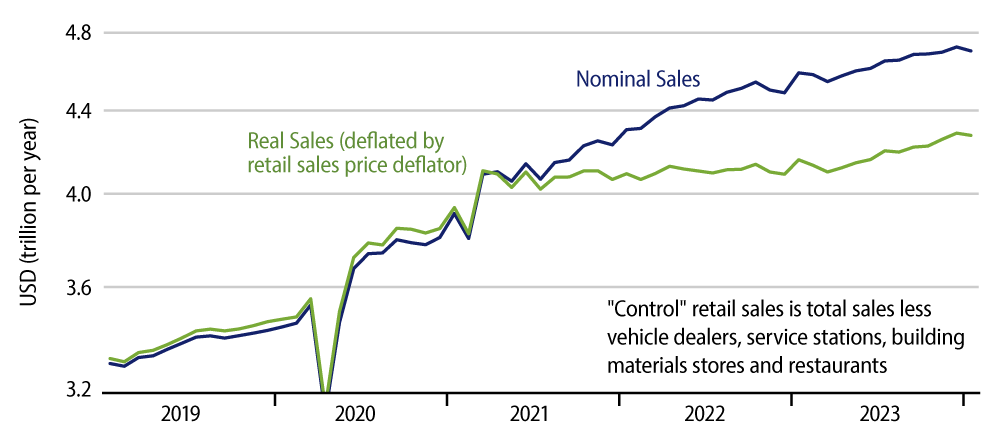

Census Bureau data for January retail sales released today showed a -0.8% decline in total sales and a -0.5% revision to the sales estimate for December. A closely watched “control” measure of sales excludes sales for car dealers, building material stores, gas stations and restaurants, partly because of the extreme volatility of these sectors’ sales and partly in order to focus on more consumer-oriented retail sectors. That control measure showed a -0.4% decline in January as well as a -0.4% revision to December sales.

These declines in nominal sales were partly diminished by the fact that retail prices declined in both months. Also, data for this time of year are especially seasonally volatile, as variations in the ups and downs of holiday shopping—way up in November and December, way down in January and February—can wreak havoc with seasonal adjustment practices and, thus, with seasonally adjusted data.

The best way to read the January data is that the reported sales declines come on the heels of much better sales reading for the preceding six months. Maybe the spending spree that began in July indeed began to sputter in January. Or, maybe the reported January declines are just a seasonal blip, with November/December sales strength overstated and January softness overstated.

We won’t know which is the case for a while yet, as February data could be just as seasonally “tainted” as the sales readings for the last three months. Sorry if we are sounding overly circumspect, but that is the state of the data at this time of year, both for the soft sales readings released today and the stronger inflation and jobs readings released earlier this month. Bond markets sold off on the inflation and job releases, and they are rallying now on the sales data. Maybe the markets are responding wisely, maybe they are just chasing their tail. Again, it will take a while to figure out which is the accurate depiction.

It is the case that January sales were reported as declining at most store types. The declines were especially notable for building material stores, electronics stores and online (nonstore) vendors. Building material stores’ sales had been mostly flat in preceding months and are reported as dropping substantially in January. Electronics and online had been two of the strongest sectors in late 2023, such that their reported January declines are all the more interesting. Maybe these sectors’ fortunes began to soften in January, or maybe today’s news is just misleading data.

This question is an important one, but, again, we won’t know the answer to it for a while yet. As always—and especially at this time of year—one month does not make a trend, but every change in trend has to start somewhere.