This blog post is the result of a collaboration between Research Analysts Liam Lynch (mortgage and consumer credit) and Michael Kim (high-yield credit).

Who Will Win: Builders or Buyers; Millennials or Boomers?

“Always forward, never backward!” is a common mantra these days as we embark on another year filled with a variety of uncertainties around the world. It’s been almost two years since the global COVID-19 pandemic began and while many things have changed in the economy, a strong US housing industry seems to have remained a constant. Looking forward to the housing landscape of 2022 it appears much as it did at the start of 2021, with a few extra wildcards thrown in the mix. In the coming year, we expect to see a number of past themes continue: aging Millennials and Baby Boomers, housing-supply constraints, building material price fluctuations and homebuyers’ continued desire for more space. The 2022 wildcards include mortgage rates, housing alternatives and affordability pressures. Even with all of these factors contributing to the US housing landscape, the expectation is for another year of positive price appreciation, albeit at a slower pace than the record gains seen during 2021. So, as we begin 2022, we are clearly carrying with us many of the same fundamentals from last year.

On the Move: Millennials and Boomers Retreat From Cities

For a number of years now it appears that both the Millennial and Baby Boomer cohorts have been relied upon as influencers for various economic trends, and we expect this year will be no different. Baby Boomers, perhaps more than any other consumer group, have been major beneficiaries of the home price appreciation seen over the past few years. What’s more, as the pandemic continues we’ve seen older members of the workforce participate in what has been termed the “Great Retirement.” This is exemplified by many Boomers opting out of the workforce and embarking on their retirements. With large home-equity gains and a shortage of existing homes for sale, these Boomers are able to pick up stakes and add even more fuel to what has been a hot sellers’ market. One crosswind, however, facing equity-rich Boomers, is the lack of available housing as they attempt to downsize into their golden years. The desire to scale back has seen Boomers migrate away from city centers and into less urban areas in search of more affordable homes.

On the other end of the housing spectrum are Millennials, those who were born during the 1980s and into the first half of the 1990s. Historically, this cohort has been late to form households compared to their predecessors. Joining the workforce around the time of the Great Recession (2007-2009), Millennials gained economic freedom at a more gradual pace and were reluctant to take on homeownership, but those trends have changed over the past few years. In conjunction with the “Great Retirement” taking place at the senior end of the workforce spectrum, Millennials who are still early in their careers are driving the “Great Resignation.” Opting for opportunities that allow them more flexibility and a better work/life balance, these first-time homebuyers have also been migrating away from city centers to form their households. As the pandemic has afforded them the advantage to exploit the work-from-home trend to relocate, only time will tell if a paradigm shift has in fact taken hold of the American workforce (and if it will continue). A major headwind also facing Millennials is the difficulty in trying to find existing or newly built homes to purchase.

Challenges Abound: Supply/Demand Imbalances and Construction

The pandemic has helped bring to the forefront the housing supply/demand imbalance that has been brewing in the background of the US housing industry ever since the Great Recession. The underproduction of new entry-level homes over the past 15 years combined with the aforementioned demographic tailwinds has created an imbalance only further magnified by pandemic-driven shifts in consumer preferences. Freddie Mac estimates that the housing supply at the end of 2020 was 3.8 million units short of the level required to match long-term demand, a 52% increase in shortage from 2018, which is likely to grow further over the near-term. Supply constraints are a major factor causing the housing shortage, which is prevalent across the entire spectrum of the housing market—in new construction, re-sales and the rental markets. While we saw a surge in demand for homes through the pandemic, supply constraints have pressured inventory availability for both new and existing homes. The supply of existing homes (measured in months) fell to a record low at the beginning of 2021 and held steady at depressed levels all year. With the last reading of 1.8 months, the current sales pace for December 2021 reached a new all-time low and is well below the 6- to 7-month supply level that is considered a healthy balance between supply and demand.

Labor and material shortages have been preventing homebuilders from meeting increased buyer demand, and as construction cycle times continue to lengthen some builders are citing year-over-year (YoY) time to completion increases of four to six weeks. Some homebuilders have also intentionally reduced their sales pace, scaled back on incentives and raised selling prices to more than cover the 19% YoY increase in construction costs. One extreme example of higher input costs was the rise in lumber pricing during 2020 and early 2021, having more than tripled from pre-pandemic levels and directly raised the price of a new single-family home by nearly $30,000 on average. Uneven supply-chain disruptions have also introduced unpredictable delays to the production cycle, with builders citing a wide range of categories in short supply. Recent examples include garage doors, windows, paint, HVAC condensers and flexible ducts and cabinets. The status of global supply-chain pressures and volatility in material prices will be central themes for the housing industry in 2022.

Low inventory levels of single-family homes coupled with rising home prices have frustrated many potential homebuyers, creating more demand for single-family rentals as an alternative choice for housing. Heading into 2022, the “single family built for rent” model is the fastest growing housing category in the country and will be topical in the context of affordability. Built for rent represents only 6% of all homes being constructed but has the potential to grow meaningfully over the next few years due to strong support by institutional investors, private equity, single family REITs and even public homebuilders. It is notable that single family rent growth has mirrored the for-sale housing market, with CoreLogic reporting national rents increasing 10.9% YoY as of October 2021. The built for rent model is an especially interesting theme to keep an eye on throughout 2022.

Affordability Under Siege: Mortgage Rates, Wages and the Housing Shortage

Perhaps one of the more interesting themes to unfold during 2022 will be the path of mortgage rates and their impact on overall housing affordability. Mortgage rates have remained at historical lows for more than a year, which has helped fuel the strong housing industry. In part, mortgage rates have been low due to the Fed’s open market purchases which have already been tapered starting in November 2021 and are expected to stop in March 2022. With the prospect of rising interest rates during 2022 we could see first-time homebuyers impacted and demand from that group weaken.

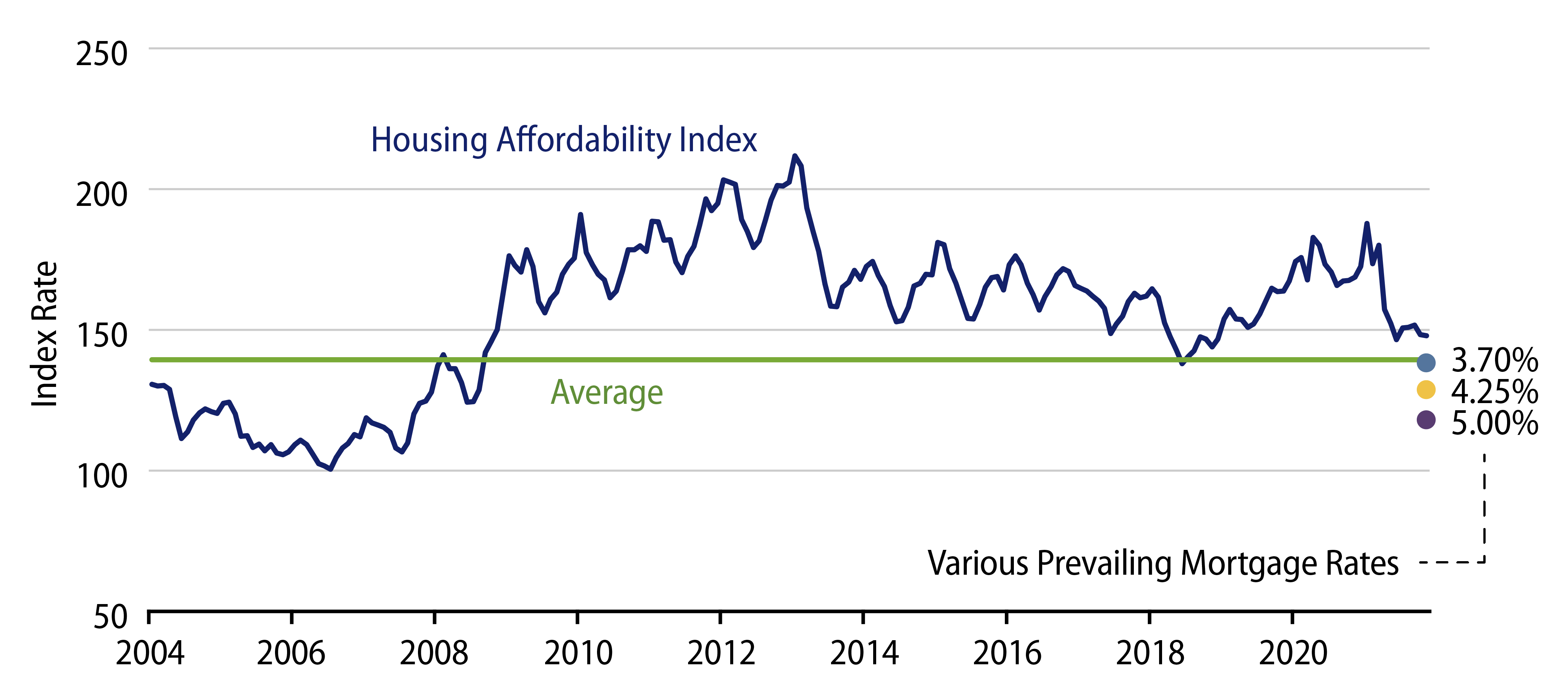

Another factor that drove strong housing demand was the high level of wage growth in 2021. While the median family income in the US over the past two years is skewed due to various federal assistance programs, the level of income today is higher compared to levels of income pre-pandemic, which is certainly a positive tailwind for buyers. Although wage growth is expected to decelerate in 2022, gradual wage growth could be a theme to pay attention to as a way for housing demand to remain robust. Using the median US home price of $362,000 and assuming the prescribed down payment of 15% with an overall debt-to-income ratio of 25%, based on current median income levels, affordable housing starts to move out of reach as mortgage rates near 5%. As rates are expected to rise this year, many indicators suggest traditional mortgage rates will range from high 3% to low 4%; currently they are at 3.7%. Exhibit 1 illustrates the Housing Affordability Index since 2004, when the prevailing mortgage rates generally ranged between 3.7% and 5.0%.

Last but certainly not least, we expect to see the political arena weigh in as well. The Biden administration is expected to introduce more supply-side policies to address the housing shortage and alleviate pricing pressures across the housing market. Additionally, on the demand side we see the Biden administration pushing for higher levels of homeownership. We have already witnessed them ramping up pressure on lenders to make more loans to underserved community members.

The Year Ahead

While the US housing market is never lacking for economic uncertainties, as we start the third year of the pandemic, we see even more unknowns than usual as the market recovers from Covid-driven imbalances. Some of the housing challenges set to persist this year include: rising mortgage rates, backed-up supply chains and frustrating construction projects, just to name a few. One thing is certain, however: the 2022 US housing market is bound to be exciting. While 2022’s pace of home price appreciation is not expected to reach the historic highs seen last year, we believe more signs are pointing to a year of solid price growth and continued limited overall housing supply.