Single-family housing starts rose 3.3% in December to an annualized rate of 1.05 million per year. That brings the average level of single-family starts for the second half of 2024 (2H24) to 0.99 million units per year, down about 5% from the 1H24 average and down 9% from the 2023 level. In other words, the December gain was modest, and our take is that it represents mostly catch-up from activity levels in late summer and early fall that were restrained by the hurricanes buffeting the South.

This contention is further supported by the facts, first, that single-family starts in the South have been elevated over the last two months, and second, that even those increases leave 2H24 starts in the South about 9% below the average for 1H24.

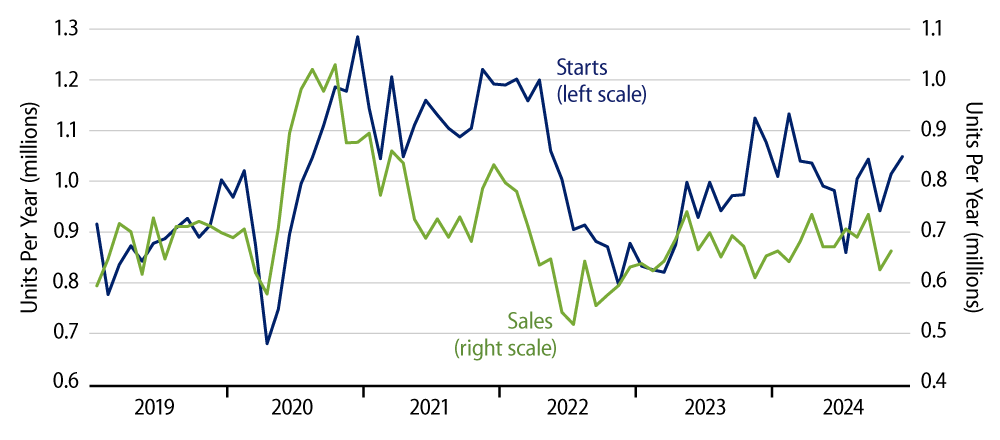

It is true that single-family homebuilding has not seen the much larger declines that we were expecting. Both nationwide and Southern single-family starts finished 2024 7% below 2023 totals, whereas we were thinking a decline of 20% was in the cards. We based that forecast on the fact that starts for the last four years have consistently come in much higher than was consistent with new-home sales rates, so that inventories of new homes have become extremely high.

Meanwhile, there is also the reality of much higher mortgage rates. Although high inventories and mortgage rates have not as yet severely weakened single-family homebuilding, activity is not increasing. And, recently, mortgages rates have ticked yet higher, rising above 7%. While homebuilding rates have held up better than expected, we still are inclined to think that high inventories—thus high carrying costs for builders—and the lack of any substantive increase in new-home sales will eventually lead to another move significantly lower in single-family home construction rates.

Multi-family starts rose a hefty 118.5% in December. This too looks to be catch-up from low rates during the hurricane months, as most of the December gain indeed occurred in the South. However, even this elevated December level left the 2H24 average for multi-family starts well below the 1H24 and 2023 levels.

Multi-family activity has clearly been weaker over the last year, with the 2024 multi-family starts total down 27.7% from the 2023 level and down 35% from the 2022 level. Even with these declines, builders are still completing 50,000 multi-family units per month, far more than we think the housing market can absorb.