The unprecedented closure of large swaths of the US economy related to the COVID-19 pandemic has contributed to an enormous amount of stress on tenants, property owners and lenders alike. While many market participants have focused primarily on the retail and hospitality sectors, an increasing amount of concern has been directed at the office sector. In our view, much of the concern goes beyond the near-term impact of tenants failing to pay rent during the quarantine period. Rather, it is largely centered on whether or not there will be a need for as much office space in the future and what changes will need to be made to ensure employees’ safety and comfort. In all likelihood, it will take years for these questions to be answered; however, it is not clear that those answers will be uniformly negative for office assets or for their debt and equity investors.

There are a number of factors that will determine the shape and trajectory of this critically important property type. Here we describe three of the factors that we believe will be the most significant in shaping the office of the future.

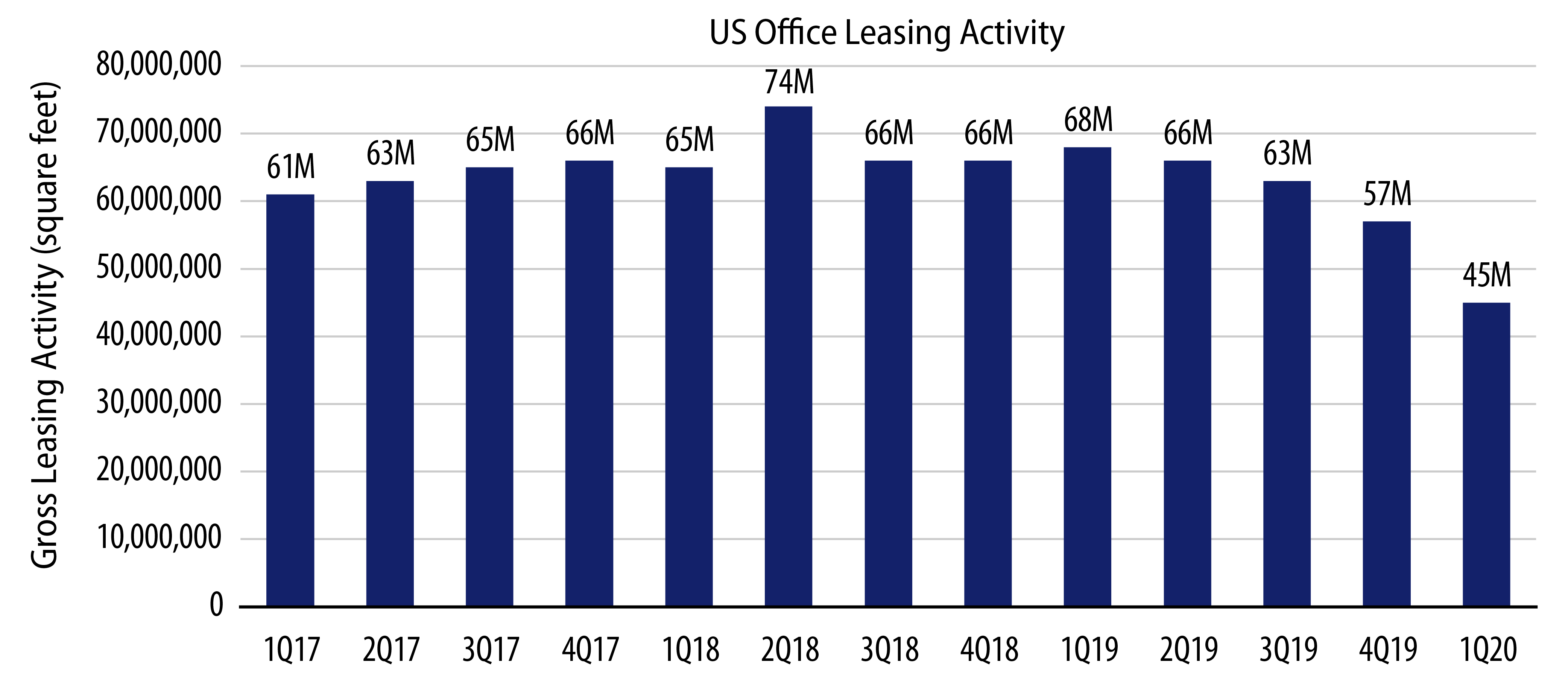

We already saw the impact of this in the first quarter when office leasing activity fell by over 30% compared to the first quarter of 2019. We expect to see additional and more severe declines over the remainder of the year. Beyond that, the trend will depend on the economic recovery, which in turn is dependent on the spread of the virus and availability of therapeutics and a vaccine, as well as the success or failure of WFH. Assuming the economy recovers over the next year or two, our view is the WFH movement will not result in a large amount of office vacancies, as we believe employee collaboration and innovation are harder to achieve in a systematic WFH environment, but clearly the sector will continue to face challenges.

At Western Asset, we have had a cautious view regarding many of these office-related assets that have been financed through the securitization market. As a result, we expect our client portfolios to be well protected from the negative impact that decentralization will have on many “trophy” assets. While the future and permanency of WFH is impossible to predict in the present moment, we think any significant shifts of the workforce out of the traditional office setting will be more than offset by the additional space required during an upcoming economic expansion and for the office of the future.