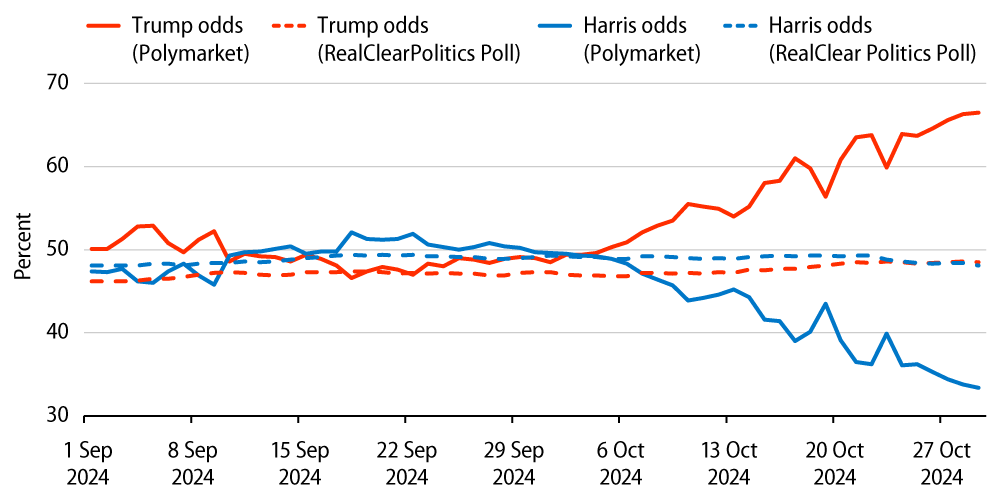

With less than a week before the US presidential election, all eyes are on the outcome with opinion polls showing a tight race between Donald Trump (Republican) and Kamala Harris (Democrat). Meanwhile, betting markets have shifted meaningfully toward a Republican sweep.

We will preface this note by mentioning that of course past performance does not predict future results, but a focus on long-term fundamental value shifts the attention to agency mortgage-backed securities (MBS).

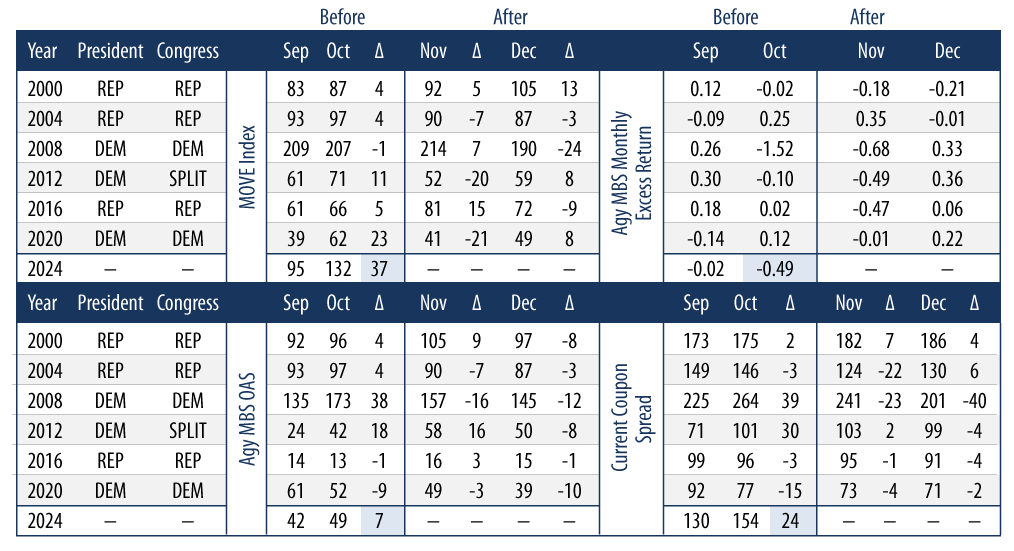

Interest rate volatility usually increases in the month prior to elections, but this year the MOVE index (Merrill’s Option Volatility Estimate), a measure of near-term implied volatility in US Treasury options, has shown the largest increase going into an election (+37 points) since inception of the index in 1988, with the index peaking at a level of 132. This is rivaled only by the volatility during the global financial crisis that coincided with the election of Barack Obama in 2008. Higher volatility has been a headwind for agency MBS, which have embedded optionality from prepayment risk. The higher levels of volatility have pressured spreads wider, in particular current coupon spreads. The monthly excess return of agency MBS is priced in for a Trump win, just like it was in 2016, but this time a month early.

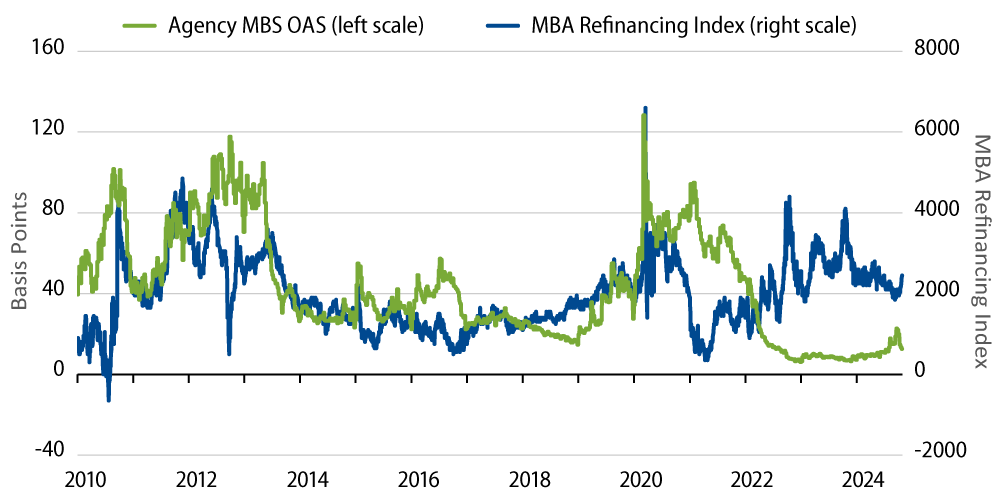

In our view, agency MBS is particularly attractive based on the fundamentals. With prevailing 30-year mortgage rates around 6.75%, only 9% of US mortgage borrowers have a higher rate. As a result, few people have an incentive to refinance, which explains why refi activity is very low relative to mortgage spread levels.

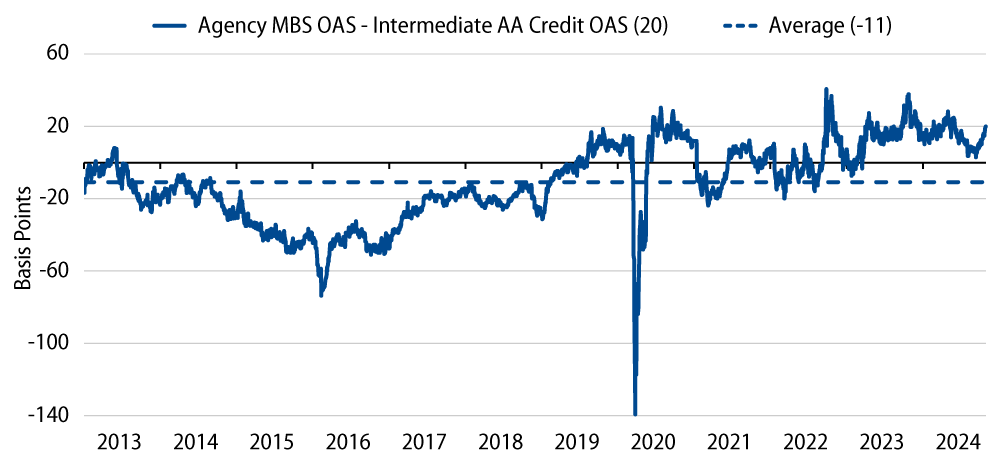

Compared to high-quality corporate bonds, agency MBS currently offers more option-adjusted spread relative to AA+ credits, in addition to diversification and liquidity benefits.

On the policy front, the US election outcomes are more straightforward. Under a Harris win, the status quo seems a reasonable expectation, while a Trump win will likely be brushed with deregulation and a rekindling of GSE reform (this refers to the government-sponsored enterprises being released from federal conservatorship). Basel III Endgame—which references the final set of reforms and regulations introduced by the Basel Committee on Banking Supervision (BCBS) to strengthen the regulation, supervision and risk management of banks—may not survive in the current form. Deregulation could allow banks to deploy much of the excess capital held in reserves over the past few years. Regarding GSE reform, an explicit guarantee of GSE MBS might be on the horizon under the Uniform MBS structure.

Given this environment, we are constructive on the agency MBS sector within our client portfolios. We are actively managing our allocations with the goal of delivering excess returns through careful subsector and security selection.