During the second half of 2021 the US unemployment rate dropped from 5.9% to 3.9%, despite two major coronavirus outbreaks. At the same time, inflation has proven to be anything but “transitory.” The year-over-year change in the headline Consumer Price Index (CPI) reached 5.4% by the end of June, and increased to 7% YoY by the end of 2021. The Fed, which was vocal not so long ago about allowing inflation to run above its 2% target, has recently turned decidedly more hawkish. This has major implications for the agency mortgage-backed securities (MBS) market, which traded at all-time tight spreads during 2021.

To combat inflation, the Fed accelerated plans for monetary tightening at its December meeting. The Fed’s initial schedule for reducing asset purchases was doubled, rate-hike projections were moved forward and Federal Open Market Committee (FOMC) members began actively discussing balance-sheet normalization. Additionally, some FOMC members expressed a preference for keeping the Fed’s balance sheet primarily in US Treasuries, and more rapidly reducing paydown reinvestments in MBS. Clearly, it has now become exceedingly likely that Fed support for the agency MBS market will be sharply reduced in 2022. The implementation timeline is accelerated compared to the last major quantitative easing program (QE3) when nearly four years passed between the initial tapering of purchases in December 2013 and the beginning of balance sheet reduction in 2017.

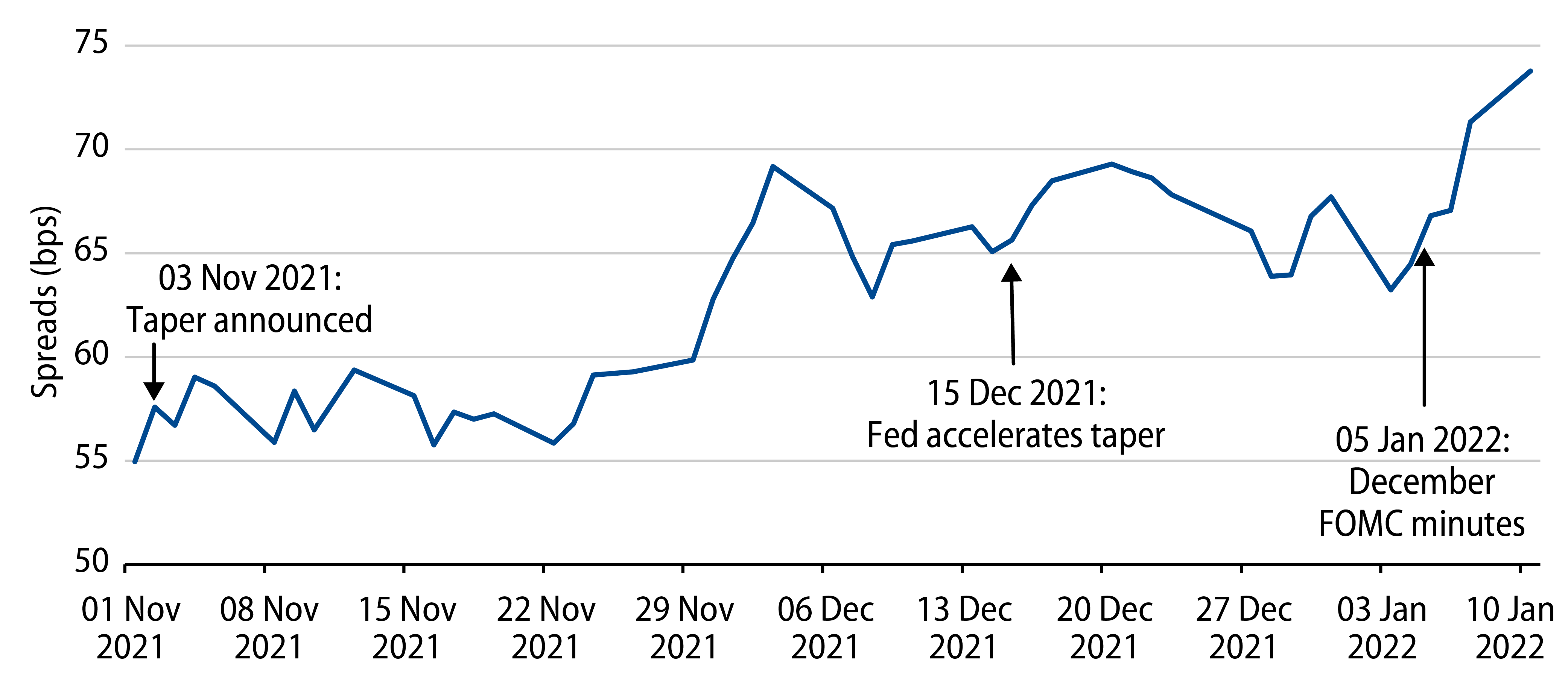

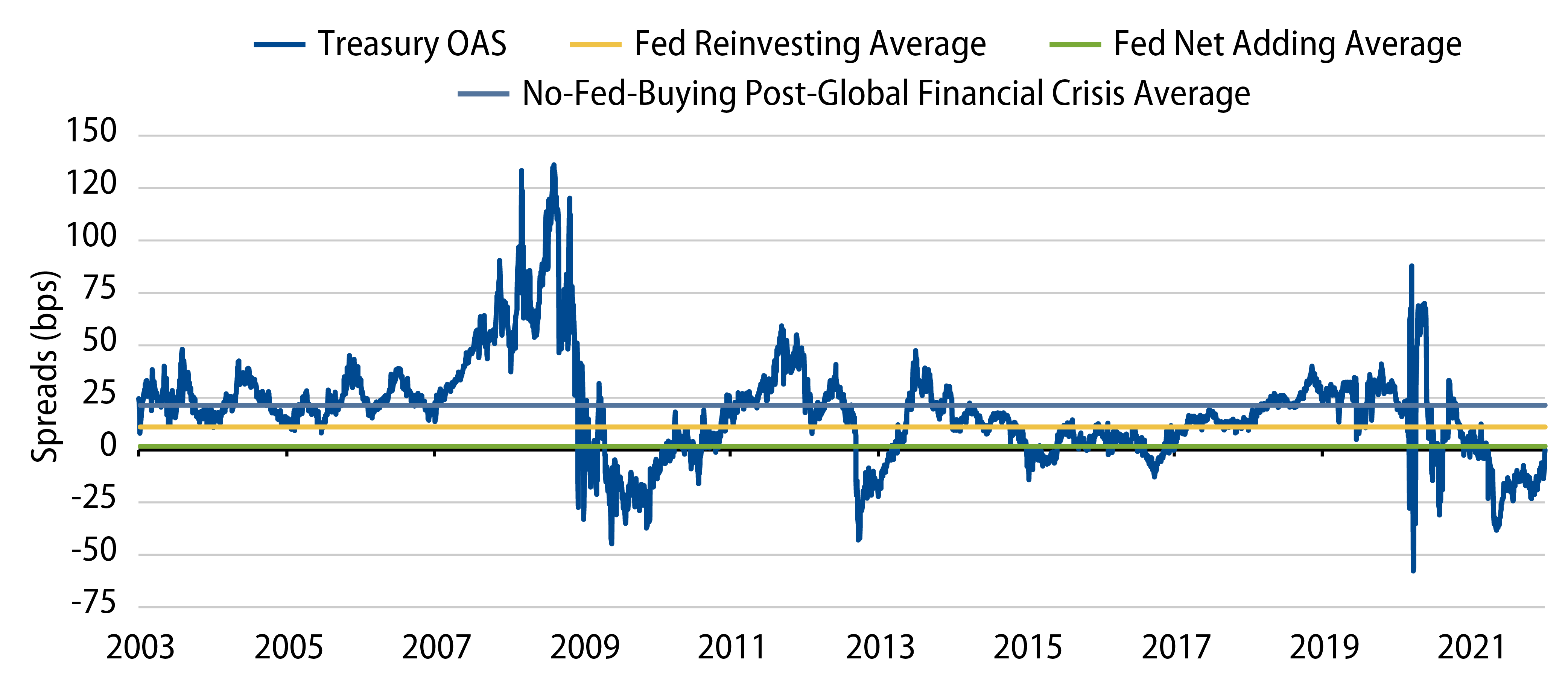

Production coupon agency MBS spreads have already reacted by widening 20 basis points (bps) from the initial taper announcement following the November 3, 2021 FOMC meeting. In spite of the recent widening, mortgages are still not compelling based on fundamentals. Spreads are currently well below pre-Covid levels and still rich compared to historical averages when the Fed was not buying MBS. In addition, the convexity profile has worsened with technology advancement in mortgage origination, increased mortgage lending capacity, higher loan sizes and elevated cash-out activity from the strong housing market.

The transition from balance sheet growth to reduction will create a challenging supply/demand environment for the sector. Projections are for the Fed to begin balance sheet reductions by the summer, decreasing agency MBS reinvestments gradually to ultimately allow for at most $30 billion to $40 billion of MBS runoff per month. Projecting prepays at current rates, that would result in the Fed reducing $500 billion of agency MBS over the next two years. If rates were to fall from these levels, resulting in an increase of prepayments, the Fed could allow even more MBS to run off its balance sheet. This not only increases the amount of supply that needs to be absorbed by the private market but also weakens the Fed’s stock effect on the MBS market. Furthermore, balance sheet reduction removes reserves from the banking system. That, in turn, could lower future bank demand for agency MBS.

Given these headwinds, we are maintaining an underweight to agency MBS across our actively managed portfolios. Security selection plays a key role in our process, and we recognize that not all MBS will be similarly affected by these policy changes. The coupons most challenged will be those the Fed has been most actively buying, primarily 30-year 2% and 2.5% MBS. These coupons currently make up over 45% of the Bloomberg MBS Index, and are the core of our underweight. We are more constructive on selected collateral stories in higher coupon MBS which offer wider spreads and more attractive convexity profiles, while in lower coupons we favor collateral with extension protection features. Additionally, we continue to focus on high quality non-agency structured product sectors for portfolio diversification and total return opportunities relative to generic agency MBS pools.