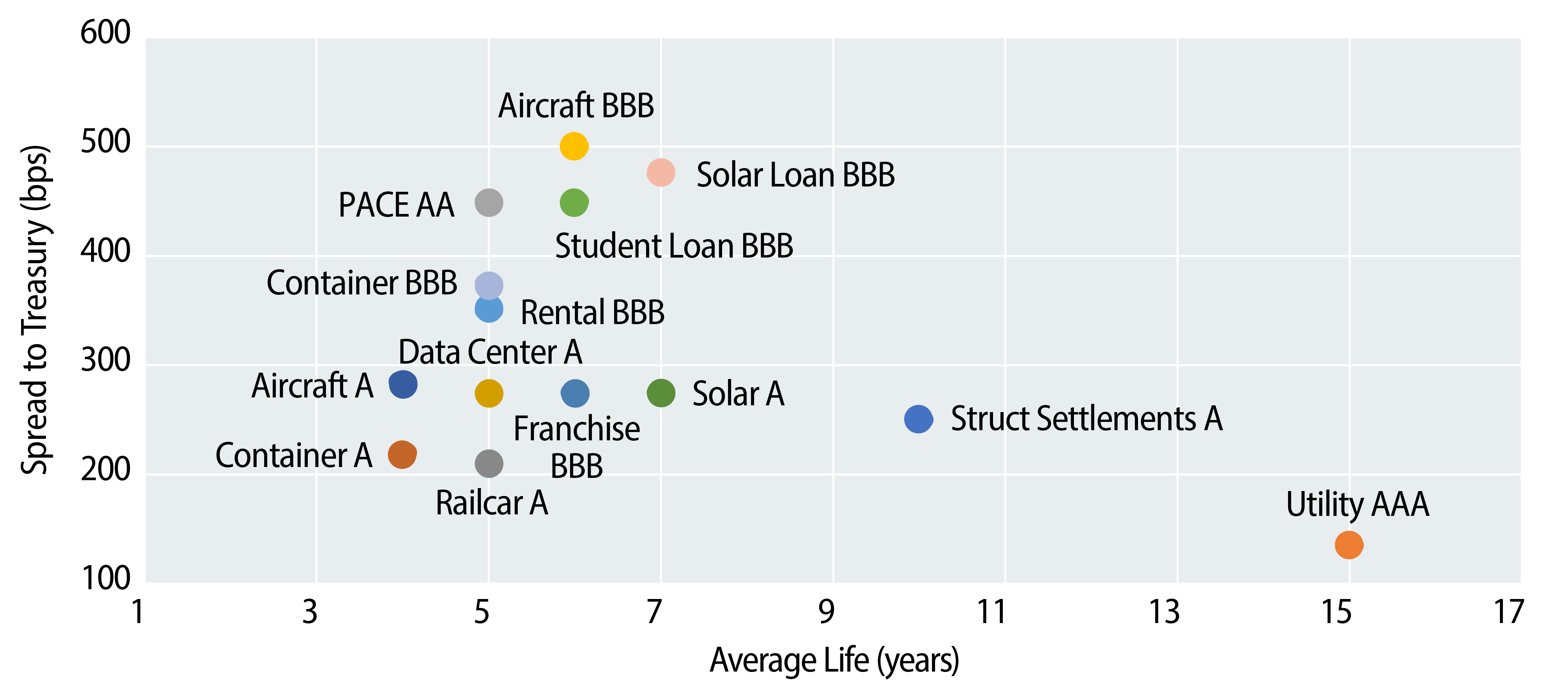

Non-traditional asset-backed securities (ABS) asset classes can be a compelling addition to insurance portfolios as they have generally provided significant yield advantages versus both traditional ABS and corporate peers. Adding ABS can provide risk diversification and be a more capital-efficient solution to manage insurance portfolios than using investment-grade corporates alone. Non-traditional ABS receive favorable regulatory treatment due to desirable deal structures. On average, non-traditional ABS asset classes currently provide a spread pickup of 130 bps over single A rated investment-grade corporates (as of May 2023). Over the past five years, except during the pandemic, that differential was about 60 bps.

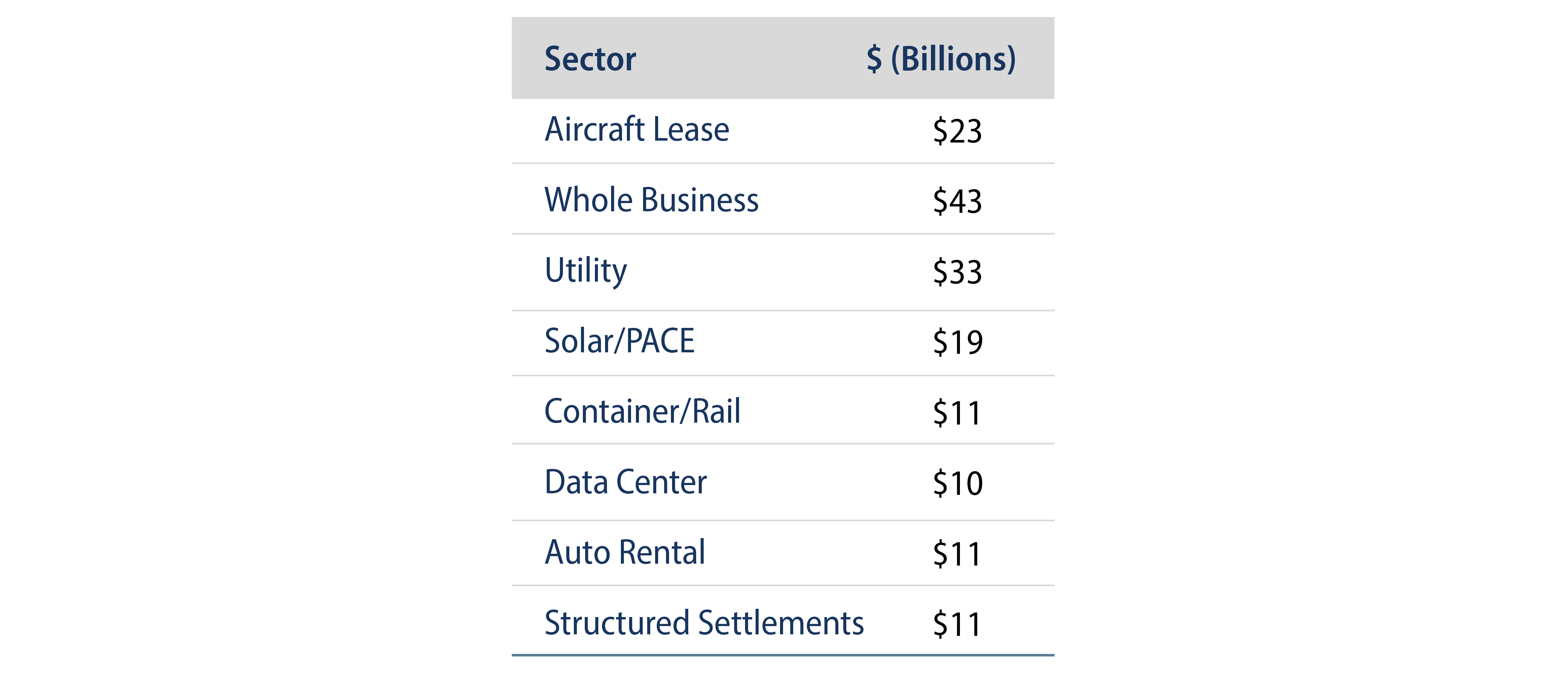

The ABS market has $770 billion of issues outstanding, with about $230 million in annual new issuance. Traditional ABS consumer asset classes generally include credit cards, auto loans and student loans. These make up about 80% of annual new issuance. Non-traditional asset classes represent a diverse set of underlying assets, with issuers that tap the market on a less programmatic basis than traditional asset classes. What’s more, non-traditional asset classes make up more than 20% of total annual issuance, doubling in proportion in less than 10 years. Non-traditional ABS asset classes are smaller and diverse, with structures that are more simplified and have more robust investor protections following the global financial crisis, and have built enough collateral loss history. There is enough information symmetry available to help investors properly analyze and make investment decisions. Commonly traded assets that back such deals include shipping containers, railcars, commercial aircraft, franchise royalties and data centers, and less-common types such as music royalties, legal receivables and tax liens.

Deals are generally 144a registered, broadly placed and have adequate liquidity. Private placement issuance has grown meaningfully the last few years and can provide entry to select asset classes not available in the 144a market. ESG issuance in ABS has grown materially in the past few years and can provide attractive solutions to insurance ESG demand. $42 billion of labelled ESG issuance since 2014 (22% of total securitized ESG since then) has been issued in ABS sectors such as solar, PACE* and railcar—mostly Green designated, and all in non-traditional asset classes.

Non-traditional ABS can offer yield and diversification, desirable especially in a volatile economic environment. Non-traditional ABS can act as an inflation hedge given that asset values such as container, railcar and aircraft can rise with inflation. Risks underlying non-traditional ABS asset classes are more correlated to business cycles, but less so correlated to corporate and mortgage markets, and not generally correlated to equities. The types of risks represented in non-traditional collateral are diverse, for example, restaurant sales, industrial production and travel demand. In addition, robust structural protections can reduce variability of asset-level risk to senior-most tranches. As such, non-traditional ABS deals have generally lower cash flow variability than mortgages and many deal structures de-lever over time. They can be an attractive diversifier away from corporate credit, which is an essential sector for many insurance investment strategies. The ABS sector has also shown stable loss performance over time. Over the past 30 years, less than 3% of ABS tranches ever issued have experienced a principal loss. ABS sectors also provide expansive term offerings to fit investors’ desired term exposure.

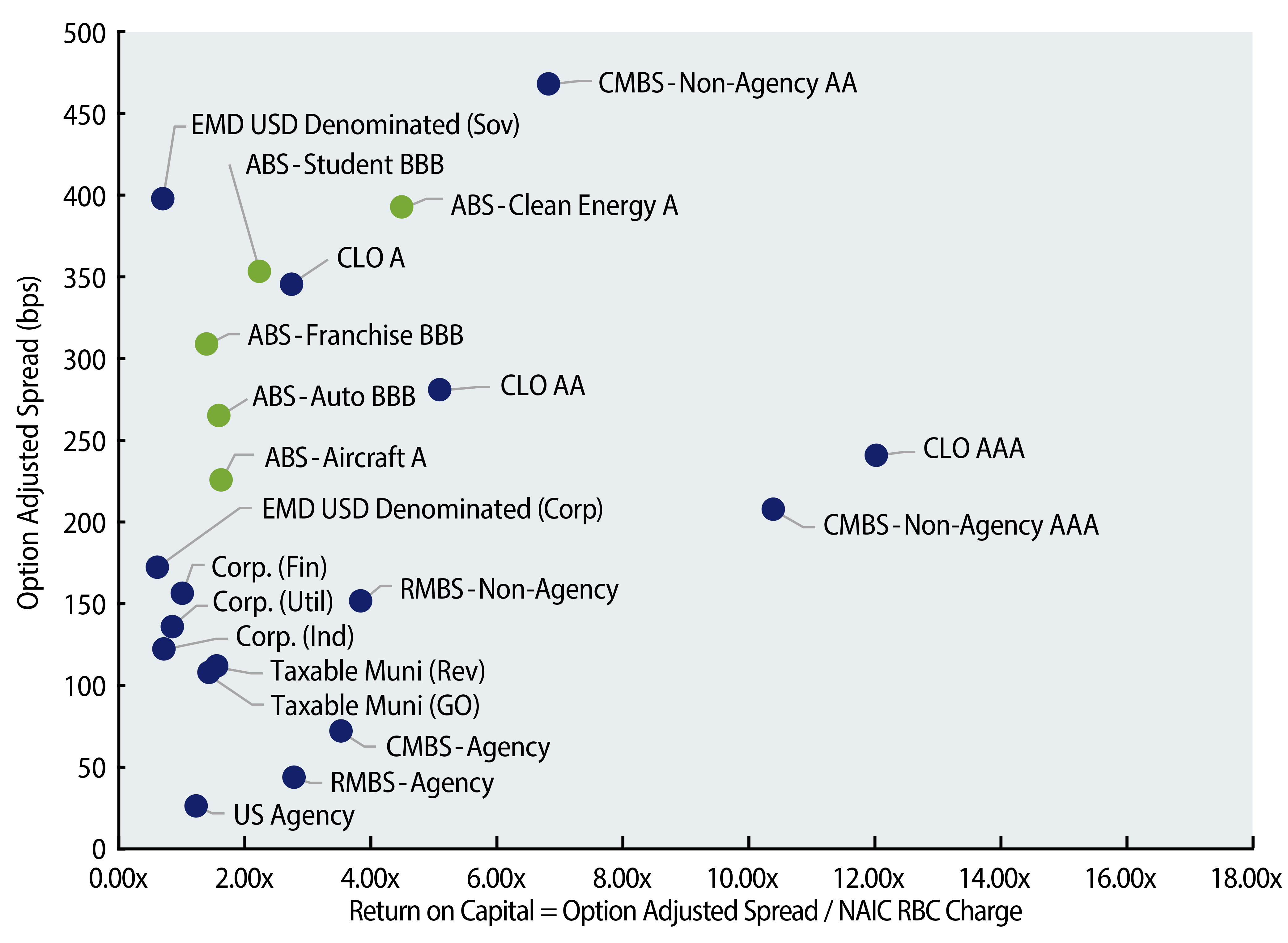

Many ABS sectors are capital-efficient for both P&C and Life insurance companies (P&C is depicted in Exhibit 3), as they offer considerable spread pickup versus traditional corporate sectors and select mortgage sectors.

In conclusion, adding non-traditional ABS sectors to insurance portfolios can provide diversified sources of return. Non-traditional ABS are less correlated with other credit sectors, and generally receive more favorable regulatory treatment due to strong structural protections that afford it higher ratings.

ENDNOTES

*Property Assessed Clean Energy programs