In a historic move, Moody’s downgraded the US sovereign credit rating to Aa1 from AAA, assigning a stable outlook. This decision brings Moody’s in line with S&P and Fitch, which lowered their US credit ratings in 2011 and 2023, respectively. Until now, Moody’s had been the last major rating agency to maintain a perfect credit rating for the US—a status it had upheld since 1917.

The downgrade reflects Moody’s assessment that US federal debt could reach 134% of GDP by 2035, up from 98% in 2024. This concerning trajectory is premised on persistent budget deficits, forecasted at around 7% of GDP annually, which could rise to 9% by 2034. Rising interest rates have also materially increased debt servicing costs, with interest payments consuming a larger share of government revenue, which erodes the fiscal strength of the US.

Despite the downgrade, Moody’s left the US sovereign ceiling at Aaa, citing the country's institutional resilience and the central role of the US dollar in global finance—points we highlighted in a recent blog post regarding the safe-haven status of US Treasuries (USTs) and the dollar.

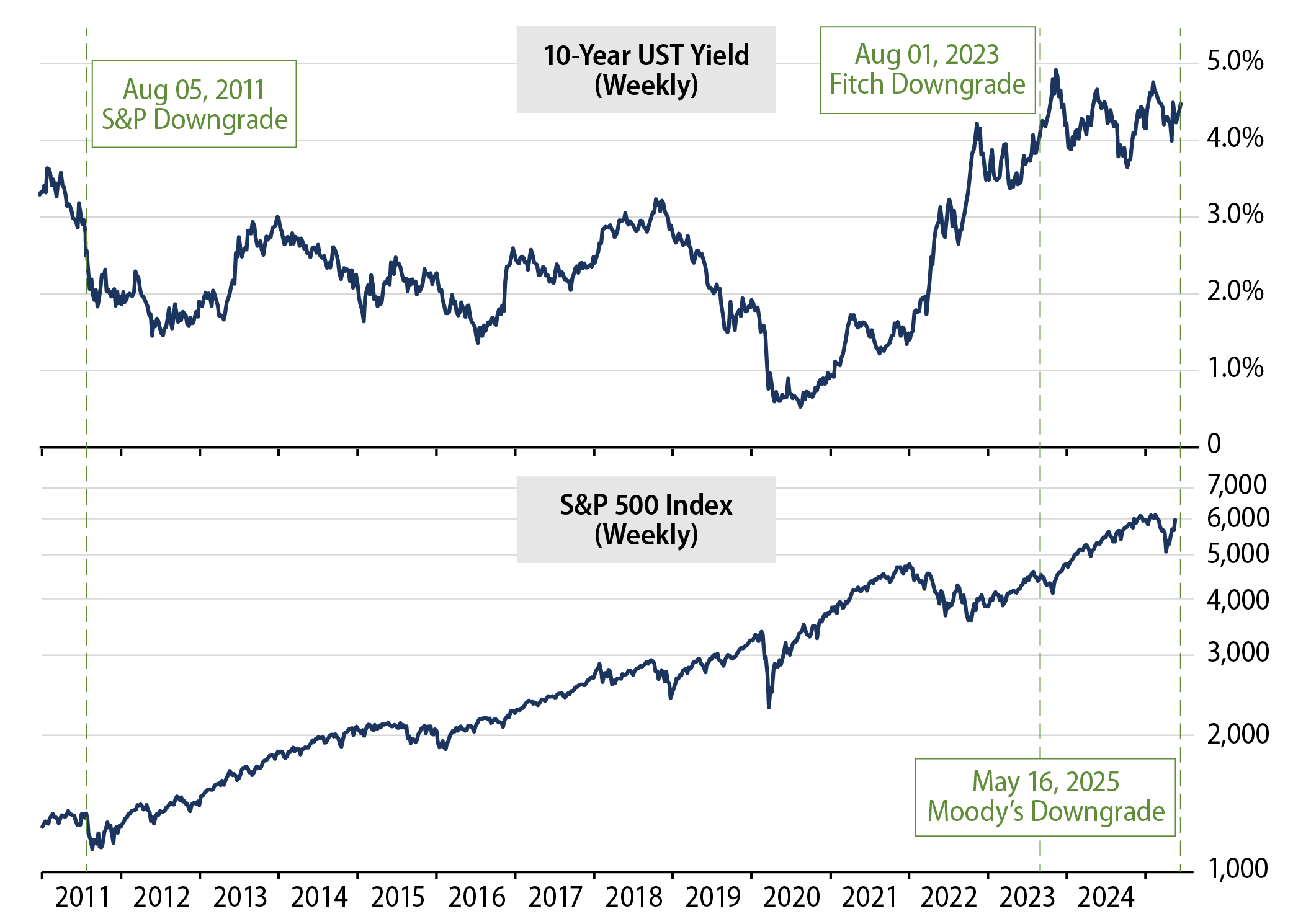

We do not expect this development to trigger the same market reaction seen during S&P’s downgrade in 2011, when the S&P 500 dropped 6.7% and the VIX surged 44% to levels not seen since the 2008 financial crisis. Back then, markets were already under strain—US equity had fallen 15% over the prior two weeks amid mounting fears over the European debt crisis, a possible US recession, and severe political dysfunction in Washington during a contentious debt ceiling debate. Interestingly, 10-year UST yields fell in a flight to safety. In contrast, recent risk-off episodes have seen yields rise, reflecting growing concerns about US trade policy, higher inflation, the possibility of a UST buyer’s strike and doubts around the sustainability of US debt.

Moody’s downgrade comes at a sensitive juncture, drawing strong parallels to the 2011 episode. Once again, Congress is mired in a prolonged standoff over the reconciliation bill, with another looming debt ceiling showdown. The estimated ''X-date''—the point at which the US government may no longer be able to meet its debt obligations—is currently projected between July and October 2025.

At the same time, markets are already on edge. Conflicting policy signals from President Trump and key cabinet members, stalled progress on deficit reduction despite recent DOGE-related spending cuts and ongoing challenges to the Federal Reserve’s independence have all contributed to mounting uncertainty—further raising the risk of higher US borrowing costs.

Should Moody’s downgrade contribute to a steeper term premium, upward pressure on US interest rates could intensify. This would likely drag on equity valuations, widen corporate credit spreads, increase mortgage rates and spur greater capital outflows from US assets—exerting additional pressure on the US dollar.

While we do not see this scenario playing out immediately, incoming economic data and fiscal developments in the weeks and months ahead will be critical to monitor.