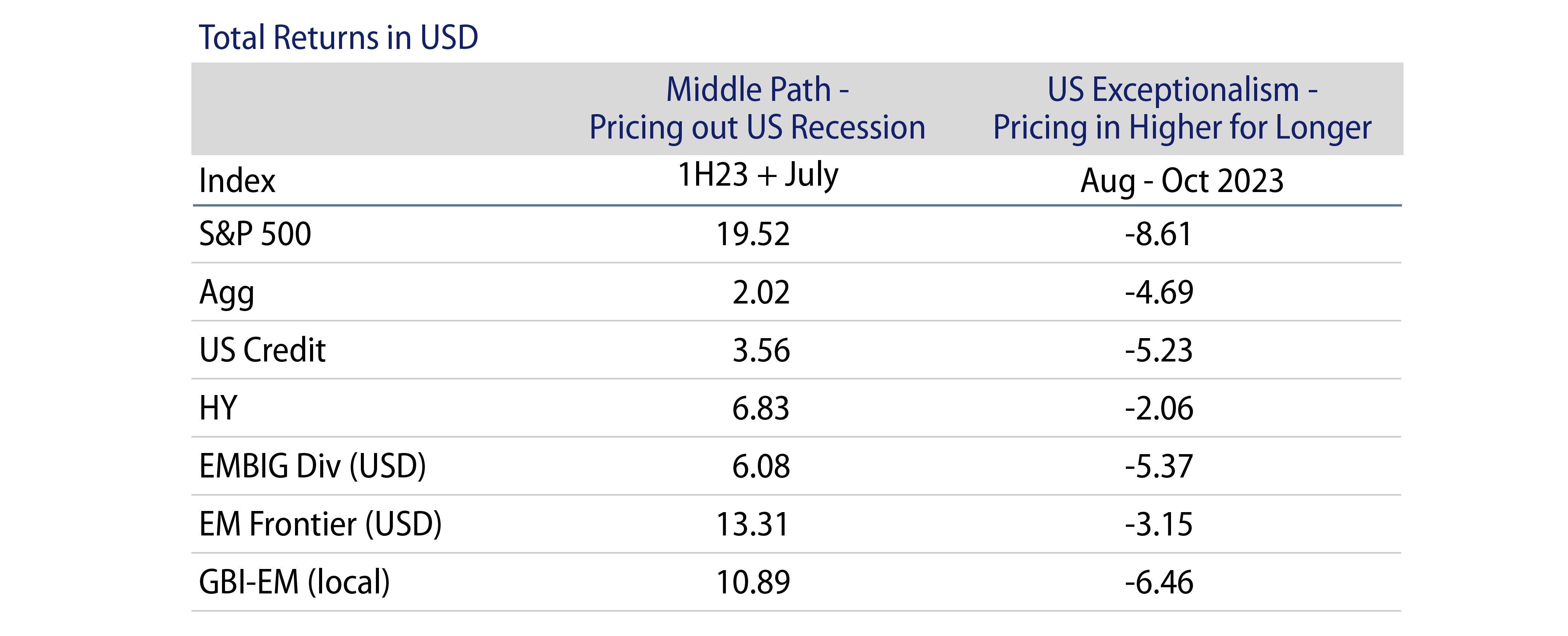

At Western Asset, we’ve been steadfast in our view that emerging markets (EM) would benefit from a backdrop of subdued growth and inflation in the US, and a generally benign global economic environment. During the initial seven months of the year, EM assets performed well as investors discounted the likelihood of a US recession. However, more recently, EM market sentiment has taken a turn for the worse as investors have begun to consider the possibility of stronger US growth compared to the rest of the world and a prolonged period of higher interest rates. This concern, combined with uncertainties about the ability of the US to manage its high deficit and debt burdens under such conditions, led to a spike in US Treasury (UST) yields. This, in turn, disrupted the expected monetary easing cycle in Brazil and Chile and delayed the first rate cut in Mexico. Indonesia and the Philippines also raised interest rates preemptively to support their currencies. In short, the notion of US exceptionalism significantly affected EM valuations (Exhibit 1).

EM Valuations—A Tale of Two Expectations

In the past week, the US Treasury’s announcement of a reduction in the supply of longer-dated USTs and weaker-than-expected US labor and manufacturing data have reinforced two of our key takeaways:

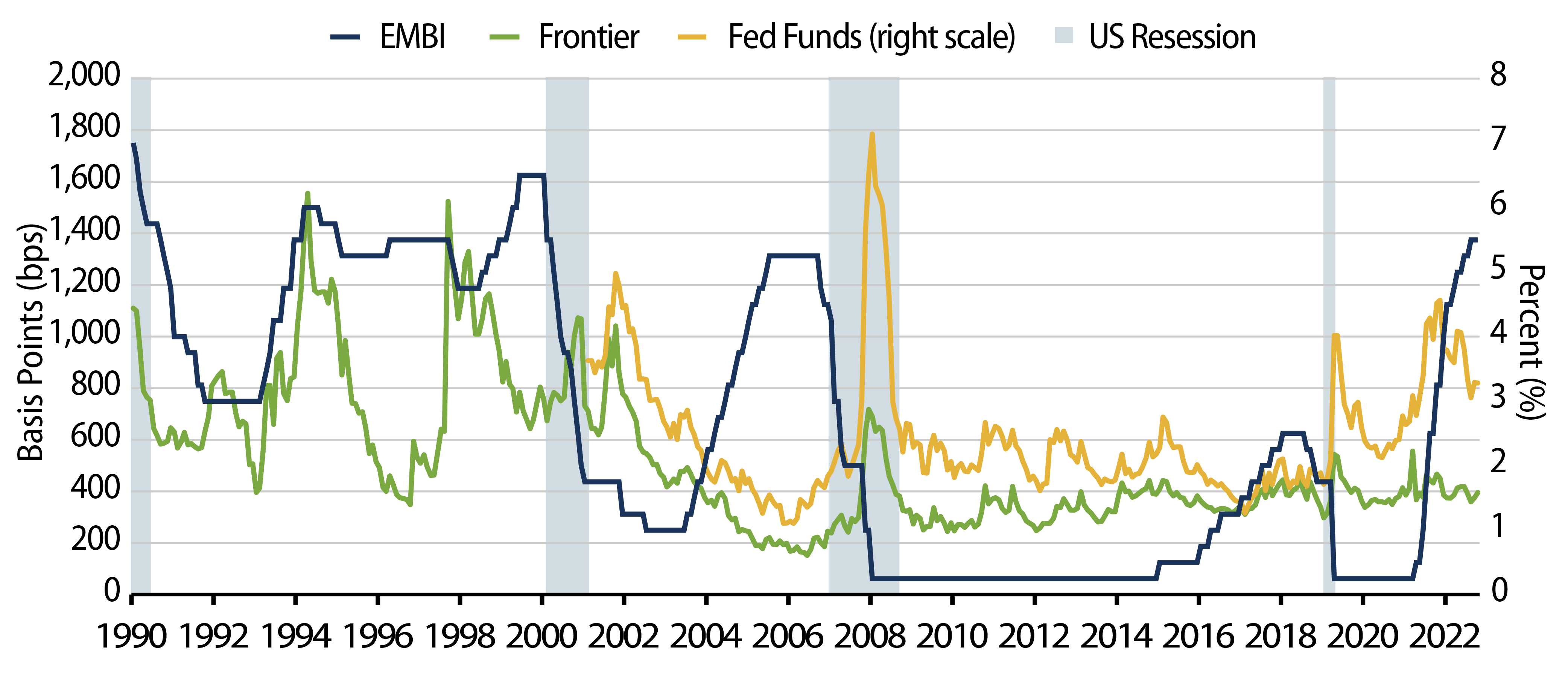

- A likelihood of a soft-landing scenario in the US has now increased, which should ease the extreme upward pressure on UST yields and create a more favorable environment for EM. Historically, US recessions have typically delivered a one-two punch of slower growth and capital flight for a number of EM countries. When confronted with these difficult situations, EM policymakers found themselves compelled to tighten monetary and fiscal policies rather than implementing counter-cyclical measures to offset the impact of external economic shocks. This approach, especially for the more fragile EM countries, further constrained policymakers’ ability to effectively manage the dual challenges of mounting debt-servicing costs and exchange-rate pressures leading to deteriorating sovereign credit metrics, a surge in sovereign spreads and limited access to external capital markets (Exhibit 2).

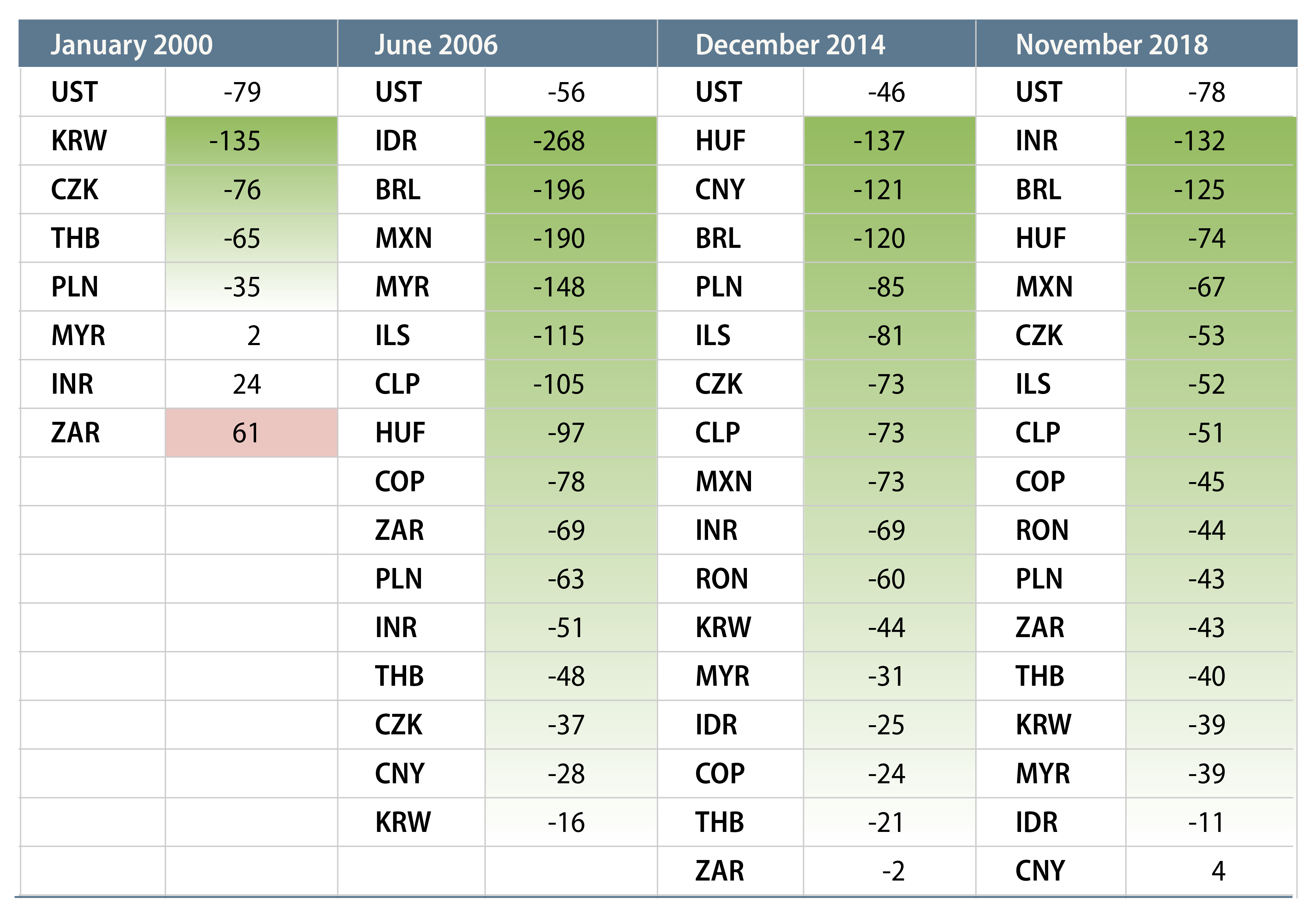

- Recent statements from Fed Chair Jerome Powell and other Fed governors, signaling a more restrained approach to monetary policy due to the observable slowdown in US growth and inflation, strengthen our conviction that the Fed is now on hold; this is highly supportive for EM local markets. It’s important to highlight that EM local markets have historically exhibited strong performance in the months following the conclusion of Fed tightening cycles.

While we have consistently maintained a constructive outlook for EM, we remain vigilant, recognizing the potential for unanticipated events and fears that can suddenly grip broader market sentiment. For instance, in the upcoming months, market participants will be closely monitoring political developments, starting with presidential elections in Argentina later this month, followed by 14 other pivotal elections. That stated, we see US macro conditions and interest-rate dynamics aligning with our expectations and a Fed that appears to be adopting a more cautious stance on policy tightening. We believe all of these factors lead us to the conclusion that EM, particularly local market debt, is now well-positioned, “primed and ready.”