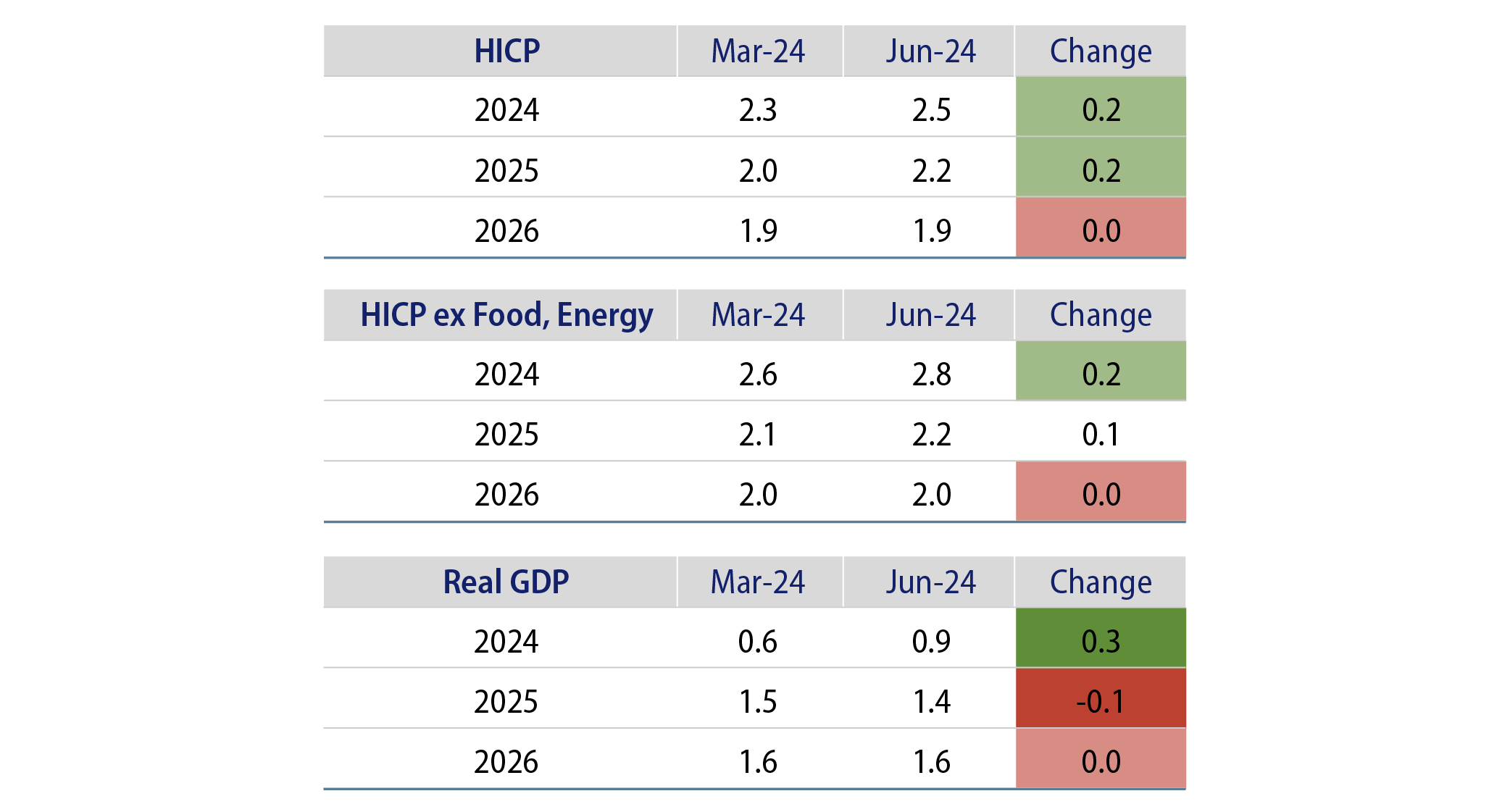

As expected, the European Central Bank (ECB) cut its main policy rate by 25 basis points to 3.75% in what was the first policy easing since 2016. Ahead of the meeting financial markets had fully priced in a reduction in June and a further 1.5 cuts before the end of this year. Members of the Governing Council, including several known hawks, had strongly indicated that a June cut was coming so the move itself offered little surprise. Instead, the focus was on the ECB staff economists’ forecasts accompanying the statement and the press conference for guidance on future rate cuts. The latest Eurosystem staff projections saw both headline inflation, as measured by the Harmonised Index of Consumer Prices (HICP), and core inflation, HICP ex food and energy, revised higher for 2024 compared to March projections (Exhibit 1).

On the justification for easing policy, the statement acknowledges that significant progress had been made on both headline and core inflation in recent quarters, and that inflation expectations had declined and remain well anchored over the forecast horizons. As such, it was considered appropriate to moderate the degree of restrictiveness. However, the ECB also acknowledges that domestic price pressures remain strong and that wage inflation is likely to remain above the ECB’s target into 2025.

Regarding the outlook, the statement reiterated the pledge to keep policy restrictive “for as long as necessary” and gave little hint as to how policy would evolve in the future other than to restate that the ECB remains data-dependent and will evaluate policy decisions on a meeting-by-meeting basis.

In the press conference, ECB President Christine Lagarde stated that in cutting rates this month the ECB is not pre-committing to a particular rate path. While the Governing Council is unwilling to pre-commit to future rate cuts or provide any form of forward guidance, the ECB retains confidence in its inflation forecast which sees inflation back to target by 4Q25. Thus, the ECB’s “confidence has increased in the path ahead.” President Lagarde noted that credit growth dynamics remain weak, and while wages were expected to fluctuate and currently remain elevated, there is evidence that corporate profits are partially absorbing the increase in labour costs from the most recent negotiated wage rounds and that forward-looking indicators point to wages declining during the remainder of this year.

Wage growth dynamics are clearly paramount for the ECB and this was a theme President Lagarde returned to in response to several questions. The key message is that the ECB needs to see additional data and requires “more evidence on the disinflation path.” In response to a question on whether the ECB was in a “dialling back” phase, President Lagarde was again noncommittal but did indicate there is a “strong likelihood” that they are.

In the absence of a more conclusive message from the ECB government, yields and the euro rose modestly. In summary, the ECB remains in data-watching mode and if wage data evolves as they expect, we foresee further policy easing in Q3 and Q4, which should lend support to euro-area bond yields.