The Bureau of Labor Statistics (BLS) today announced that Consumer Price Index (CPI) inflation in June came in at 0.2% for both the headline and core (excluding food and energy) aggregates. Those monthly rates annualize to 2.2% and 1.9% per year rates, respectively.

Yes, these are right in the Fed’s target range, though, first, one month doesn’t make a trend, and second, the Fed actually targets the Personal Consumption Expenditure (PCE) price index, for which we won’t get June data until July 28. Still, having at least one month’s data come in favorably is better than a kick in the head, and the financial markets today are acting accordingly.

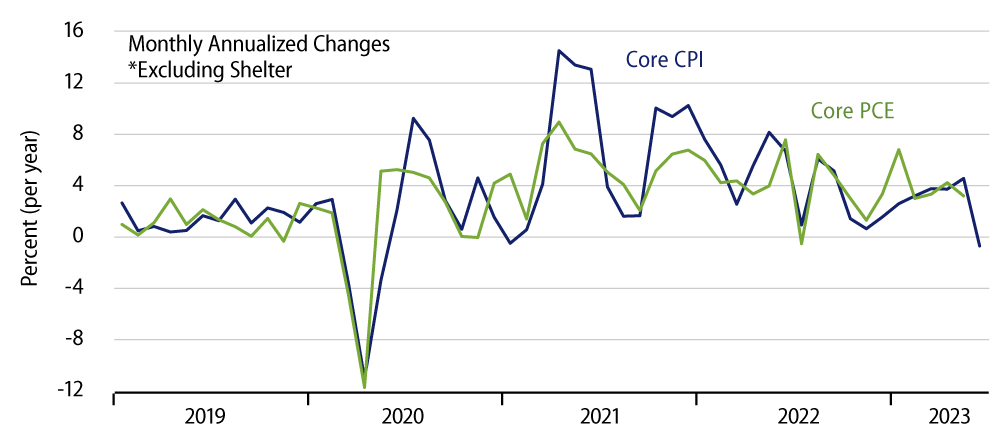

The inflation data actually look even better than the “headline” figures touted above. That is, excluding shelter, core inflation was negative in June for both goods and services. The chart shows how core CPI and PCE inflation would look were shelter prices excluded.

Why exclude shelter? Simply because the data there are known to be “old,” obsolete actually. BLS’s data collection methods result in reported shelter prices reflecting market conditions some time in the past. Thus, US home prices peaked in May 2022 and have been declining pretty steadily since then, and rental costs appear to have moved similarly. Yet, the reported shelter prices in both the CPI and PCE indices remained at double-digit (annualized monthly) rates through December 2022 and have since decelerated to only about a 6% annual rate since then.

The Fed’s Mr. Powell himself has acknowledged this crimp in the inflation data. Our perception is that the Fed itself is monitoring prices net of shelter, so that the negative readings for both goods and services prices on this basis are welcome news, assuming that the PCE data come in similarly later this month.

It is hard to find any disappointing readings in today’s report. Used car prices rose very sharply in April and May, at 4.4% non-annualized rates in both months. They declined by “only” -0.5% in June. Still, with carmakers furiously churning out new vehicles ahead of the model-year changeover and with new car inventories rising accordingly, it would not be surprising to see used car prices drop more sharply in the months ahead.

Elsewhere, sporting event prices rose 5.5% non-annualized in June. However, they had declined by -14.7% in the preceding three months, so this was more a reversion to mean than an acceleration. Outside these sectors, the only real disappointment was the aforementioned lack of reported progress on shelter inflation.

Once again, one month’s data do not constitute victory over inflation. As you can see in the chart, similarly beneficent readings last July proved merely to be a flash in the pan. We do see more indication of declining inflation trends now than was the case a year ago, but it will take further data to confirm this perception. The ball is now in the Fed’s court as to whether today’s data—and other economic indications—are sufficient cause to continue its pause.