Private-sector payroll employment declined by -28,000 in October, and there was a massive -108,000 downward revision to the September employment estimate. That revision consisted of a -77,000 revision to August job growth and a -31,000 revision to September growth.

We state this detail to provide some context related to possible hurricane effects on the data. Hurricanes buffeted the Southeastern US in each of the last three months, and it is possible that disruptions from these events have affected the jobs data. Initial jobs tallies for August and September showed little indication of such effects, but with the huge revisions released on Friday, the possibility of such effects then—and in October—emerges.

We’ll state first that the government’s own take on hurricane effects was vague. The Bureau of Labor Statistics (BLS) noted Friday morning that establishment responses to the employment survey were lower than normal in October. However, it also noted that the responses were lower than normal in areas outside the hurricanes’ swath as well as areas affected by the hurricanes. So, it is not even clear that the below-normal survey response was fully hurricane-related.

Also, one would think that when responses to the survey are lower than normal, BLS would extrapolate the same rate of change in jobs to those establishments not responding as was observed for responding establishments. In other words, the hurricanes should reduce estimated job growth only if those establishments responding to the survey show (hurricane-related) declines in their payrolls.

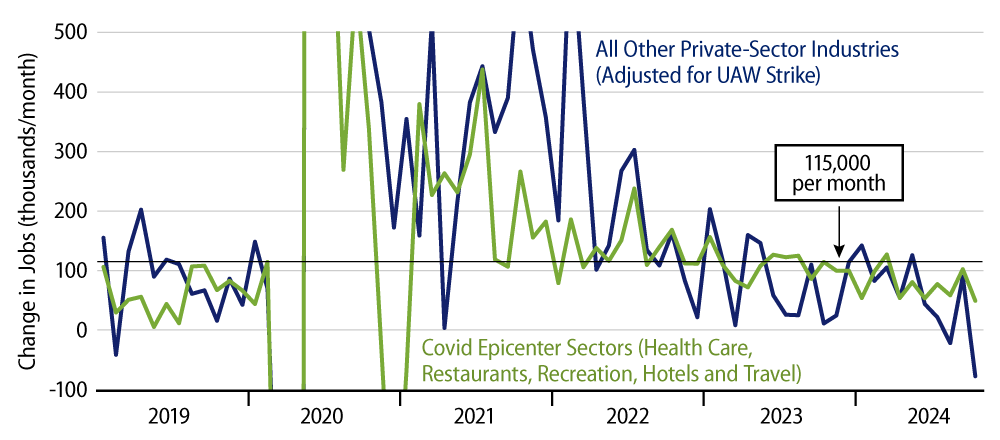

Current jobs data are summarized in the chart. Notice that job growth has slowed abruptly over the last three months (which coincides with the impact of the hurricanes). At this time, we don’t know if this slowing is wholly due to the hurricanes or reflects some substantive softening in the economy.

Notice also that the recent job growth slowing has been especially pronounced in sectors that were NOT substantially affected by the Covid shutdown four years ago. Actually, the dominant ''Covid epicenter'' sector, health care, saw continued robust job growth in October, with a +52,000 job gain then. So, private-sector employment outside health care actually declined by -90,000 in October.

Meanwhile, the -46,000 October job change in manufacturing was primarily due to a -45,000 print for transportation equipment manufacturing. This was NOT driven by motor vehicles, which lost ''only'' -6,000 jobs. Further October detail for transportation equipment is not yet available, but the big drop in jobs there was most likely in the aircraft sector, reflecting Boeing’s travails. This is not related to hurricanes, but neither is it suggestive of broad-based problems in manufacturing. Manufacturing jobs and employment have been soft for the last two years, but there does not look to have been further weakening recently.

If hurricanes are the main cause of weak job growth over the last three months, then we should see a very sharp jump in employment in November and December, when workers supposedly displaced by the hurricanes return to the job and when ''normal'' job growth elsewhere continues. That is, private-sector employment rose an average of 160,000 jobs per month through the first seven months of 2024, but has averaged growth of only 67,000 per month over the last three months.

Job growth would have to average 300,000 per month over November and December to fully offset the below-average growth of the last three months. If growth does indeed rebound that strongly in the next two months, then the assertion that recent weakness is hurricane-related would be affirmed. Anything less than that would mean some substantive slowing in job growth alongside any possible hurricane effects.

So, if hurricane impacts resulted in below-average growth from August-October, then a post-hurricane recovery should drive above-average growth. A mere return to average job growth—or a sustained below-average growth trend—would be a clear indication of substantively softer growth. Meanwhile, as the current data are inevitably vague, question marks will be addressed in the next two months.