Today’s data releases from the Bureau of Economic Analysis (BEA) within the Commerce Department covered February data for consumer spending, personal income and the Personal Consumption Expenditure (PCE) measure of consumer inflation that is the Fed’s target inflation indicator. We’ll cover each in turn here.

Consumer spending data were a mixed bag. Total real consumption declined by -0.1% in February, with both goods and services spending declining. However, the goods spending decline came fully in motor vehicles activity, which bounces wildly from month to month. Also, the sharp January gain in goods consumption announced a month ago was revised substantially upward. On the other side of the ledger, services spending was revised noticeably lower (but not as much as goods spending was revised higher).

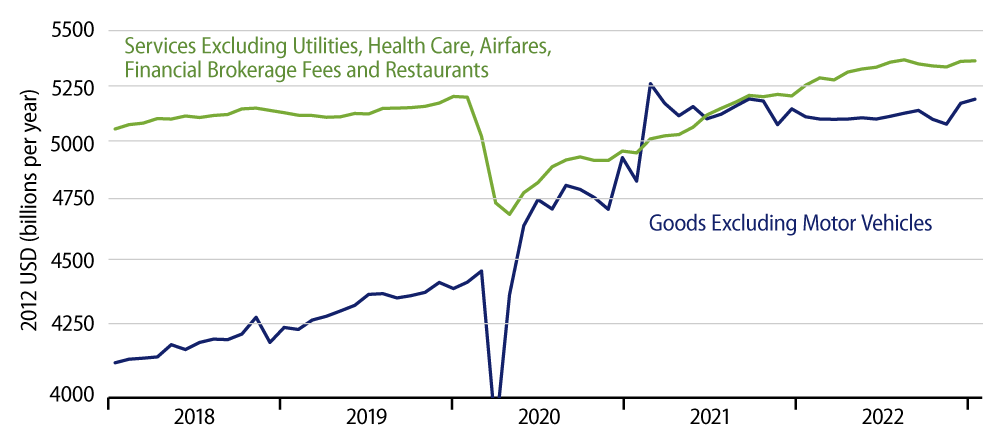

The chart shows goods and services spending, net of particularly volatile components. You can see a bounce in “core” goods spending over the last two months. Is that a meaningful improvement or merely an offset of understated goods spending data in November/December? An excellent question. We favor the offset explanation, but it will take softer goods spending data in March and after for that explanation to gain currency.

Meanwhile, “core” services spending now looks flat for the last five months, after it had provided the bulk of consumption gains through most of 2021 and early-2022. As for the components excluded from our chart, again, vehicles spending was reported down in February, utilities spending remained depressed (relatively warm winter weather means less use of heaters), and restaurant spending pulled back in February from a weather-boosted level in January. Health care spending is accounting for most/all of service spending gains registered in recent months.

So, yes, a mixed bag indeed for consumption. We believe the consumer is in the process of substantially downshifting spending growth, but there is enough “chaff” in recent data for reasonable folks to argue differently.

As for personal incomes, despite the vaunted job growth numbers of the last two months, real wage incomes were essentially flat, declining 0.02% in January and rising 0.06% in February. Job gains were offset by declining workweeks and meager wage gains, so that total income gains did not meaningfully outpace inflation. This is one reason among many that we believe the underlying trend for consumer spending is slowing.

As for inflation, the PCE index provided something in the way of good news, coming in for February at slower rates than what the CPI had registered. Headline and core PCE inflation measures came in at 3.2% and 3.7%, respectively, in February. As Fed Chair Powell has continually noted, shelter inflation in the official data is being overstated, thanks to technical lags in the price collection processes. Net of shelter, we estimate core PCE inflation to have been at a 2.5% rate in February. Granted, this is above the Fed’s targets, but it is a moderation from what we had seen in previous months and an indication of ongoing progress on the inflation-reduction front.