Today’s releases from the Commerce Department cover three aspects of consumer activity: consumer spending, personal income and consumer inflation (as per the Personal Consumption Expenditures price index, aka PCE). We’ll cover the January data for all three of these here.

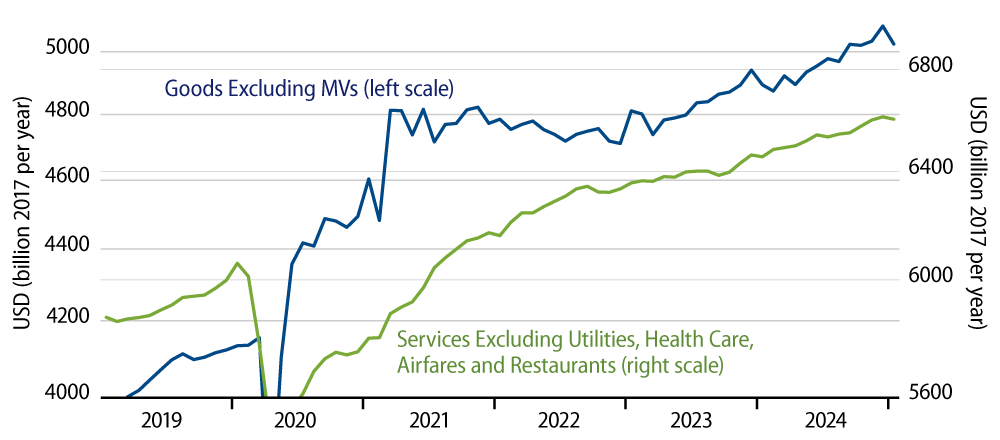

Real consumer spending is reported to have declined in January, with spending on both goods and services showing a drop. There was a very slight downward revision to December spending estimates. The goods spending decline looks to be more substantial, but as you can see in Exhibit 1, even that decline is within the range of monthly fluctuations seen in recent years.

Note that a similar-sized decline was reported for January 2024. As remarked in these posts earlier this month, January data for most economic indicators are less reliable than those for other months, partly because of variability in winter weather and partly because seasonal adjustment factors for January are ''spliced'' together with December adjustment factors for the previous year. (So, any vagaries between one year’s adjustments and the next show up in the reported growth rates for January.)

The underlying point is that while we would expect consumer spending to be slowing, it is way too early to declare victory based on the January release. There is just too much potential noise in the January data to jump on any presumed signal.

One reason to expect spending to slow is that consumption outpaced income growth throughout 2024. As a result, personal saving rates dropped from an already low 4.4% in December 2023 to a really low 3.5% in December 2024. In comparison, saving rates were generally in the 6.5% range prior to the onset of Covid.

Real personal income rose 0.6% in January, and that, coupled with the decline in spending, boosted the January saving rate back to 4.6%. That is still low. If job growth slows further in the months ahead, that would compound with low saving rates to squeeze consumers. For now, though, that is speculation, and the January spending data are but a tentative first step toward a cooling.

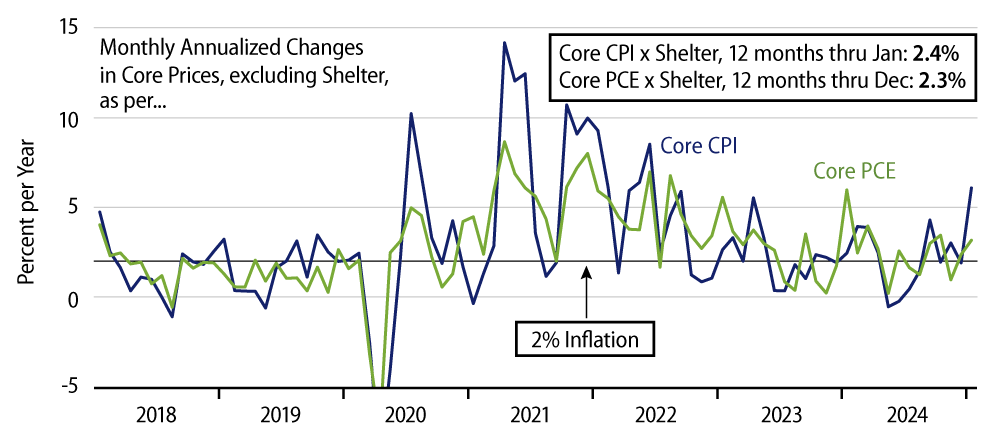

PCE inflation was elevated in January, but not as much as the Consumer Price Index (CPI). Core PCE inflation, which excludes food and energy prices, came in at an annualized rate of 3.5%, compared to 5.6% for the CPI. Excluding shelter, core PCE annualized inflation was 3.2% in January, compared to 6.1% for the CPI. Both measures showed elevated January inflation for goods—eggs, anyone?—but inflation for PCE services excluding shelter and energy was quite benign, at only a 2.7% annualized rate.

We have made a point of looking at core inflation excluding shelter because of the confoundingly elevated shelter inflation readings of the last two years. However, reported shelter inflation has declined dramatically over the last year, and has been holding recently at annualized rates around 4%, down from 6% in 2023 and 9% in 2022.

The January flare-up in inflation occurred in areas other than housing, and, again, readings were much milder for PCE services than for services within the CPI. Goods prices spiked in both measures during January, but that could well reflect delayed effects of the fall hurricanes, as well as bird-flu epidemics and other phenomena. Even with the rocky start, we still expect 2025 PCE inflation to come in within the Federal Reserve’s 2% target.