Real consumer spending rose a scant 0.1% in February, and this slight gain was diminished in stature even further by the fact of a -0.2% revision to the January estimate. Last month, we reported a substantial decline in consumer spending in January. The February spending total released today is even lower than the soft January spending total reported a month ago (as downward revisions to January were larger than the February gain).

Last month, we were hesitant to ascribe any substance to the January spending figure, given that December/January data are always volatile due to the ups and downs of the Christmas season. Similarly, various analysts have been wondering whether impending tariffs might affect consumer spending patterns.

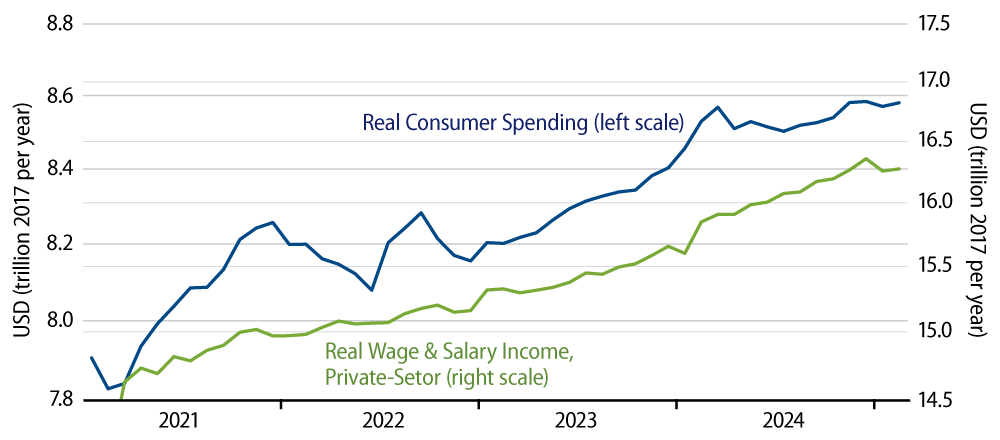

The data in hand allow for a slightly more definitive reading. There is now more evidence of a slowing in spending that actually goes back to last October. Furthermore, that softening appears to line up with a slowing in wage income growth that began in late 2024. Finally, if tariff fears were in play, one would expect consumer spending on goods to be most affected. Instead, consumer spending on services softened in recent months just as much as spending on goods. We’ll work through these details here.

First, our remarks here about ''slowing'' income growth may sound odd given that total personal income was announced today as rising 0.8% in February. Well, all the ''strength'' in that income number comes from some very large one-time increases in transfer payments to individuals, and, no, these were not from Social Security or Medicare.

According to the Commerce Department, ''other transfer payments'' rose 7.1% (non-annualized) in February due to ''tax credits for health insurance purchased through the Health Insurance Marketplace''for government social benefits. Meanwhile, transfer payments from businesses to individuals rose 16.4% (non-annualized) due to ''settlements from a domestic medical device manufacturer and a social media company.'' Whatever the actual story behind these developments, they will not be recurring. These transfer payment categories will almost surely fall back to ''normal'' levels in March, pulling down total personal income with them. So, think of that a month from now, when the income data for March appear really soft. Apart from these one-offs, private-sector wage income rose a decent 0.4% in February, but there was a substantial -0.2% revision to the January data, and PCE inflation occurred at a 0.3% rate in February. Similarly, other income sources such as proprietors’ income, rental income and interest income all saw substantial downward revisions to their January estimates alongside soft February gains.

The bottom line is that real incomes apart from transient transfer payments have been declining over recent months. You can see this in Exhibit 1 for real wage income. And we would assert that even the apparent strength in wage income in late 2024 was a one-time rebound from income losses incurred by Fall hurricanes. The softening in income lines up with a softening in consumer spending over about the same period, as you can see in Exhibit 1.

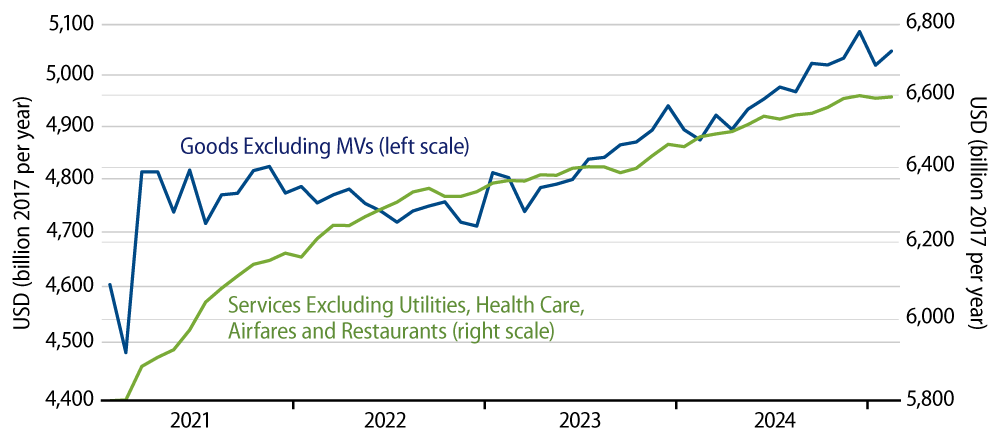

Meanwhile, as seen in Exhibit 2, said spending softening has indeed occurred for both goods and services spending. Goods spending is always more volatile than services spending, thus the ups and downs there in recent months, as goods spending rose in late 2024 with holiday purchases and replenishing of home inventories run down during the hurricanes. Still, both components have clearly downshifted together over the last three to five months.

For the record, the services spending aggregate in Exhibit 2 excludes spending on health care and at restaurants. Each of these has also softened in recent months, so the story told by the exhibits remains the same even if health care, restaurants and other components are added back to the aggregates in Exhibit 2.

As remarked in previous posts, job growth has been slowing for the last two years, and we think this is the main factor working to slow income growth in recent months. We were surprised that consumer spending held up as well as it did in 2024, given developments on the jobs and incomes side. Spending and incomes seem to have come in to better alignment recently. This signals a soft 1Q GDP number, and it also poses downside risk for the economy. It should also spur the Fed to look more kindly upon further interest rate cuts, provided, of course, that inflation and tariff fears don’t intervene to the contrary.