Consumer spending rose 0.2% in May, alongside 0.5% increases in all three major measures of household income (total personal income, disposable personal income, and private-sector wage and salary income). These gains were, of course, eclipsed by inflation, with the Personal Consumption Expenditures (PCE) price index showing a 0.6% increase and the core PCE index—the Federal Reserve’s (Fed) inflation measure of choice—showing a 0.3% rise. So, adjusting for inflation, real consumer spending declined by 0.4% in May, while real income measures declined by 0.1%.

Real incomes have been declining ever since inflation reared higher again last October. However, recent months’ declines have moderated, as good job growth has continued, and PCE inflation has moderated a bit from the October-February pace. Still, even over the last three months, real incomes are down slightly.

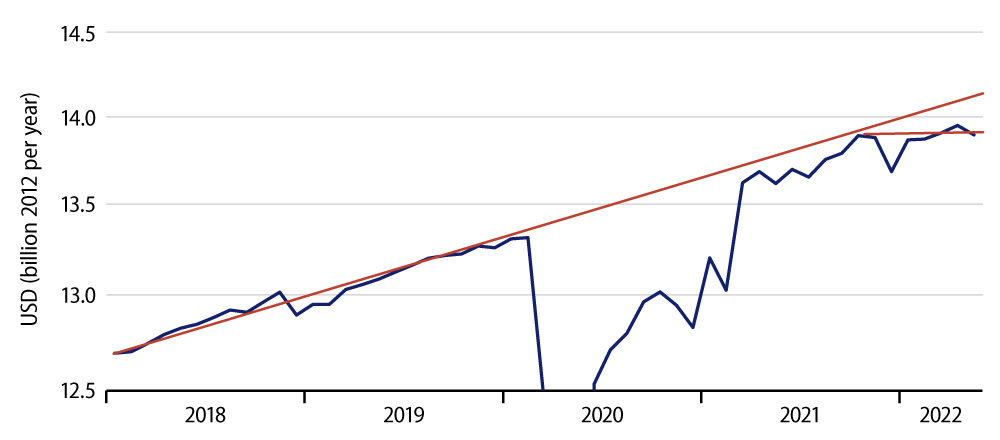

In line with the downshift in incomes, real consumer spending has gone flat. Over the seven months since October, real consumer spending has risen at only a 0.06% annualized rate, indistinguishable in the chart from a flatline (zero growth) trend.

We should point out that today’s data featured substantial downward revisions to consumer spending estimates all the way back to January. Goods spending has already been on a declining trend since March 2021. The revised data showed more pronounced declines in goods consumption over the first five months of 2022. Services spending had shown strong 6.9% growth in early-2022, thanks to ongoing recovery from Covid restrictions in various service sectors. The revisions chop that down to 4.3% through May, still respectable, but barely enough to offset the declines in goods spending.

While various analysts had proclaimed a strong consumer rebound in this expansion, we have regularly pointed out that even at its zenith last October, consumer spending had merely rebounded to pre-Covid trends. Over the last seven months, the consumer has pulled back noticeably from those pre-Covid trends.

We should concede that spending has not softened as much as incomes. Thus, despite a 3.6% annualized rate of decline in real disposable income since last October, real consumer spending has managed that 0.06% rate of increase. In other words, consumers have dipped into their savings to cope with higher prices. With the downward revisions to consumption, saving data were revised up, but not enough to completely erase this “dipping into.”

Contrary to others’ opinions, we would expect saving rates to return to their pre-Covid norms of 7.3% (from recent rates just above 5%) as consumers adapt their lifestyles and spending habits to new realities. So, unless job growth suddenly accelerates or inflation suddenly ebbs, real consumer spending is likely to decelerate further in months to come. To this end, we could add that the 0.3% reading on core PCE inflation in May was substantially lower than the 0.6% May rate shown by the core CPI.