Both headline and core Consumer Price Indices (CPI) rose 0.3% in December, with the headline rate annualizing to 3.7% and the core to 3.8%. Both increases were somewhat higher than the October and November readings, which had come in at 2.8% and 3.5%, respectively, for core inflation and much lower for headline inflation, thanks to declining gasoline prices then.

Gasoline prices were up a slight 0.1% in December, and overall energy prices rose 0.4%, thanks to an increase in utilities prices. Food prices continued to rise in the 0.2%-0.3% range, after logging much sharper gains in 2021 and 2022.

As for prices other than food and energy, so-called core commodity prices were unchanged in December, after having declined in each of the six preceding months, and this was the main factor pushing up core inflation relative to preceding months’ readings. Services prices decelerated very slightly, thanks largely to a similarly very slight slowing in reported shelter costs.

Federal Reserve (Fed) Chair Jerome Powell has mentioned at various times that shelter prices are reported with a lag. While home sales prices have been flat since mid-2022 and while market rents are reported to be flat or falling, the government’s estimates of shelter prices are still rising fairly rapidly, at a 5% annualized rate for renters’ rents and at a nearly 6% annualized rate for so-called homeowner rents (the “rental value” that homeowners derive from residing in their abodes). While this is down from double-digit annualized gains reported a year ago, it was thought that by now, the government’s reported estimates of shelter costs would be more in line with perceived market realities. That has not been the case.

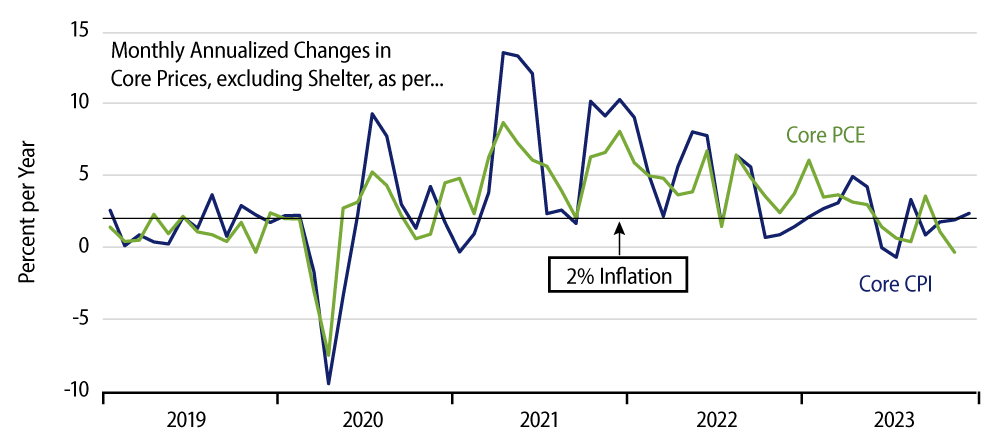

Outside of shelter, core prices remain well behaved. The chart shows annualized monthly inflation rates for core inflation excluding shelter, both for the CPI and for the Personal Consumption Expenditures (PCE) index that the Fed actually targets. As you can see, while the December CPI print was somewhat above the readings for the three previous months, it still came in at 2.3% annualized, only slightly above the Fed’s stated 2.0% inflation target.

Even with the somewhat higher December print, the average annualized inflation rate for core CPI excluding shelter over the last seven months is only 1.3%—way BELOW target. Meanwhile, core PCE inflation ex-shelter has been coming in even lower lately. Even if it rises in December at the same rate as for the CPI, core CPE would still show an average annualized rate of increase of only 1.1% over the last seven months.

Probably the best perspective for today’s inflation data is that CPI inflation in December came in somewhat above recent months’ readings, but still way below what we were seeing a year ago and, all things considered, at rates reasonably close to the Fed’s targets. We need to see reported shelter prices come in at much lower rates than what current prints indicate. Who knows what it will take to accomplish that? However, the rest of the inflation picture has improved markedly in the last year, and December data were only slightly elevated relative to the stellar performance of the preceding six months.