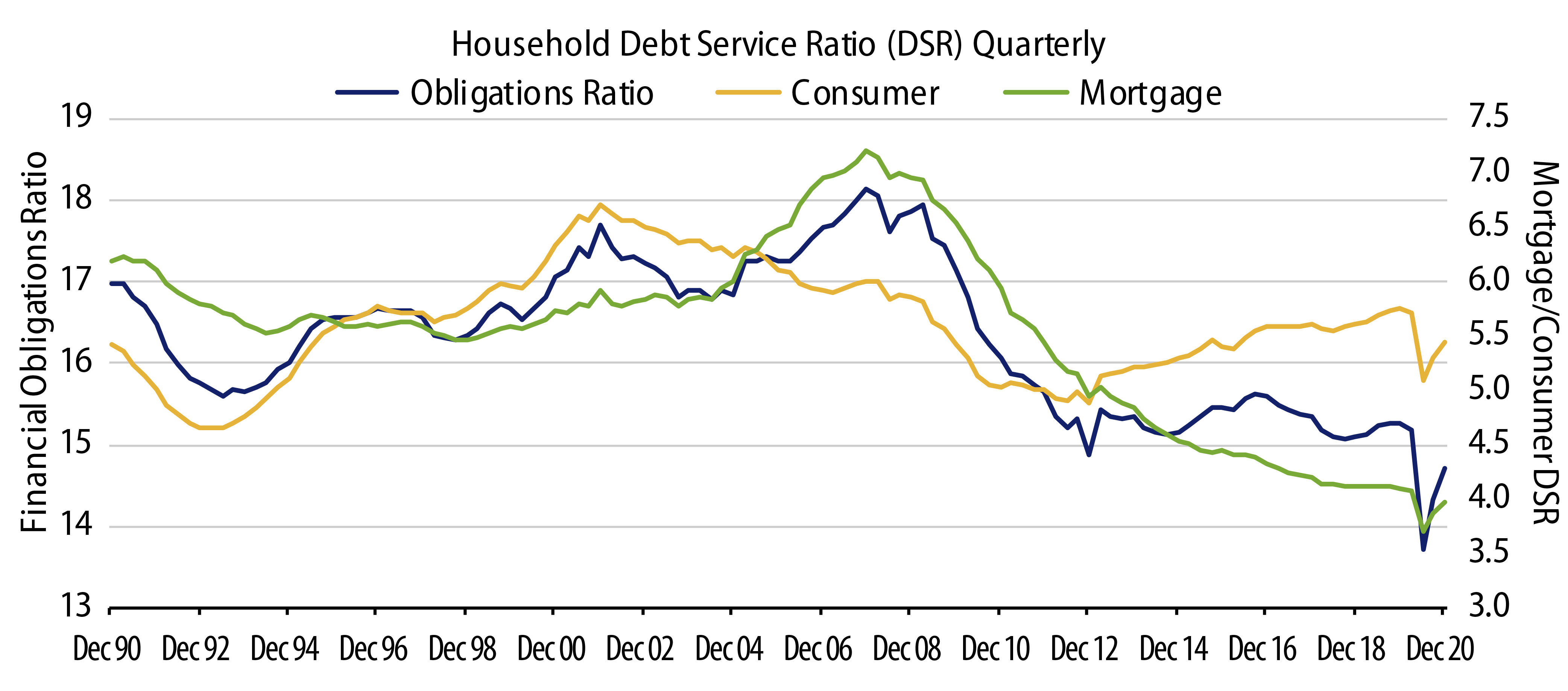

Over a year into the COVID-19 crisis and response, one of the surprising economic winners from this terrible virus has actually been the US consumer. They entered the pandemic better prepared and more resilient than before the 2008 global financial crisis to weather the shocks of the Covid-induced lockdown. Since the financial crisis, US households have made significant improvements to their balance sheets. In March 2020, the household debt burden stood at a 20-year low and savings rate at a 20-year high—thanks to declining interest rates and a rise in disposable income—supporting deleveraging despite increasing levels of consumer and mortgage debt. Exhibit 1 highlights household debt service and the financial obligations (broader measure including rent, auto lease payments, homeowner insurance and property tax payments) as a percentage of disposable personal income.

During the Covid crisis, the federal government supported the consumer with multiple rounds of direct stimulus, temporary payment suspensions for mortgages and student loans, and lenders offered generous payment deferral options. Thanks to the enormous support, this led to an increase in disposable income, coupled with a sharp decline in personal consumption as a result of widespread shutdowns that limited spending and travel, which led to massive spikes in personal savings. The personal savings rate now stands at 12.4% of disposable income, almost double the pre-pandemic level. Household debt grew 6.5%, primarily from home mortgage growth while household net worth grew 10.3% in 2020, benefiting from the sharp rise in the stock market and residential home prices. Credit card balances declined sharply by 11% in 2020 as consumers used their excess savings to pay down debt.

As vaccinations rise and restrictions ease, we would expect some of the savings and spending trends to reverse. Pent-up spending demand from high income households that typically consume a much higher share of services constrained by the pandemic and hold most of the excess savings are expected to drive consumer spending. The majority of labor market losses during Covid lockdowns were in service sectors, which affected lower- and middle-income workers disproportionately. In an economy where most of GDP and economic growth comes from spending, the contribution of consumer spending from low wage workers should be a significant driver to the recovery.

Federal government stimulus and forbearance measures over the past 12 months have supported consumer asset performance, leading to historically low delinquencies and realized losses as well as increased debt repayment rates. In addition, many lenders pulled back from higher-risk lending, narrowing underwriting criteria and restricting access to credit for those with weaker credit profiles.

As government stimulus and forbearance plans expire, loan performance of weaker and more levered borrowers is expected to deteriorate, as they remain more vulnerable to the recovery. We expect the loan performance of prime borrowers to normalize from current lows to near historical trends as these borrowers have recovered faster from the economic downturn. Our investment strategy and current holdings are concentrated mostly toward the high-quality consumer, who is better positioned to weather the recovery, steering clear of segments of the population that are more susceptible to higher unemployment and more performance volatility in securitized asset pools.