On July 12, 2023 the SEC released a third round of major changes to Rule 2a-7, the regulations governing money market funds (MMFs). This is the culmination of a 15-year period of consultation and various rule iterations, first brought on by runs on prime MMFs after the Lehman bankruptcy in September 2008, and more recently following the March 2020 market crisis.

Throughout this process, the SEC’s aim has been to improve MMFs’ resilience, support the smooth functioning of markets, and mitigate taxpayers’ burden of bailing out the industry and investors during market crises. At the same time, the SEC strives to maintain MMFs’ usefulness to institutional and retail investors as cash management vehicles. Arguably, finding this balance for all MMF products and investor types continues to be elusive.

In this note, which follows our blog on the same topic from August 4, 2022, Changes are Coming to Money Market Funds (Again), we summarize the main elements of the latest reforms, while weighing in on their potential impact.

Highlights of the Rule 2a-7 Updates

- A new mandatory liquidity fee framework for institutional prime and tax-exempt MMFs designed to ensure redeeming investors’ activity does not disadvantage remaining shareholders

- Increased requirements for levels of daily and weekly liquid assets of 25% (from 10%) and 50% (from 30%), respectively, providing additional buffers for managers to better handle periods of large redemption activity

- Removal of the regulatory link between liquidity levels and funds’ use of fees and gates, neutralizing one of the key triggers to redemption activity seen during the March 2020 crisis

- New rules for periods of negative interest rates allowing retail and government constant NAV MMFs the option of moving to a valuation approach, supporting either stable or floating NAVs

- Additional reporting requirements that increase the SEC’s ability to monitor and assess Rule 2a-7 and private liquidity funds

Potential Impact of the New Rule Changes

Mandatory Liquidity Fee FrameworkInstitutional prime and tax-exempt MMFs are required to apply a mandatory liquidity fee of 1% on all redeeming shares when net redemptions during a day’s activity are more than 5% of net assets—unless the liquidity costs supporting the redemptions, including transaction and market impact costs, can in good faith be assessed as de minimis or, at less than 0.01% when applying a pro-rata vertical slice of the fund’s portfolio.

This requirement replaces the SEC’s prior swing pricing proposal and similarly, is designed to discourage first-mover advantage and slow redemptions by ensuring liquidity costs are borne by redeeming investors, while preventing remaining shareholders’ assets from being diluted by others’ activities.

Our reaction: While potentially an improvement over swing pricing, the mechanism maintains a number of the same characteristics. These include the requirement for a board-appointed administrator to assess liquidity costs using a formulaic approach, new operational complexities for fund companies and intermediaries, and the potential for investors to be wary of a new product mechanism that might carry unpredictable risks from other investors’ activities, and be as similarly opaque as swing pricing.

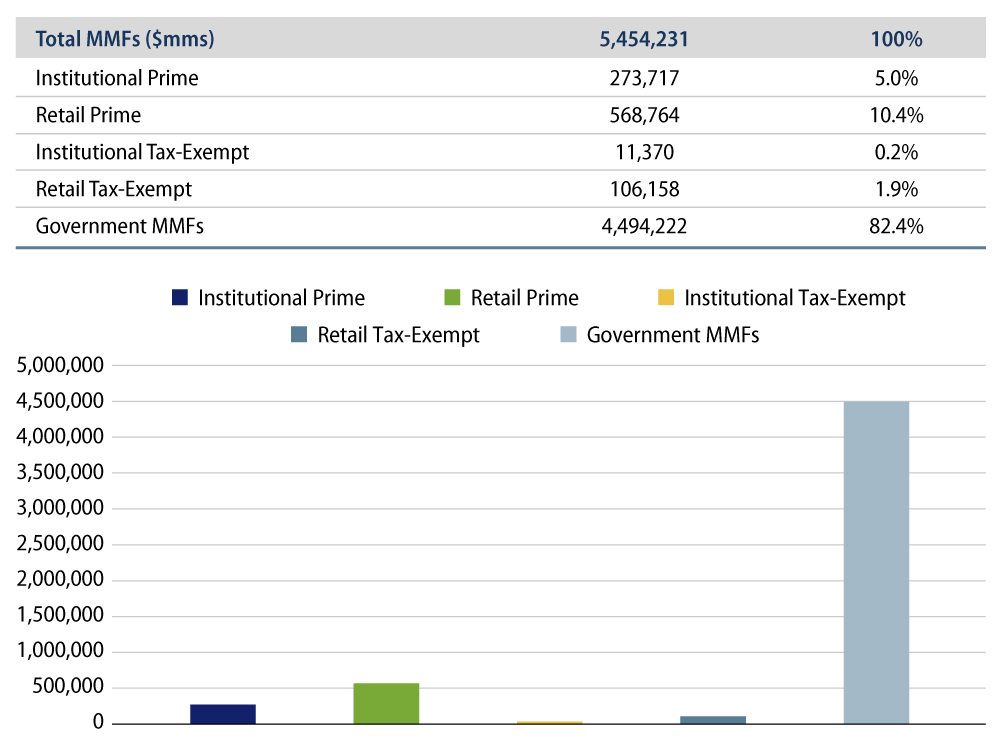

This might be the most impactful of the SEC’s latest changes to a particular MMF product category, and may reduce institutional prime MMFs’ attractiveness to investors. At the same time, institutional prime and tax-exempt MMFs combined represented just 5.2% of assets as of July 12, 2023, according to the ICI, or $285 billion of a $5.45 trillion total industry (Exhibit 1).1

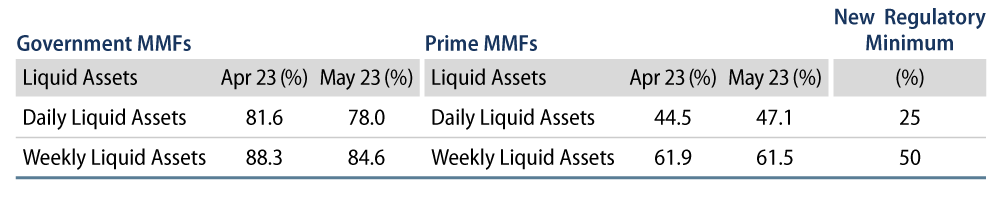

Increased Levels of Minimum Daily and Weekly LiquidityAll MMFs must now hold daily liquid assets above 25% of total assets, increased from the prior 10% requirement, while weekly liquid assets must now be a minimum of 50%, increased from 30%. This change is intended to ensure that managers have more liquidity to manage redemptions during market stress, while being able to maintain a diversified portfolio during normal conditions.

Our reaction: The new higher liquidity levels, well above those that many industry participants called for, may reduce MMFs’ ability to achieve competitive yields and compete with alternative cash management products over the market cycle, reducing their usefulness for investors, as a result.

In the short term, the impact of these higher liquidity levels will not be felt by investors as MMFs are holding levels well above the new requirements in response to the Federal Reserve’s expected policy rate path (Exhibit 2). Time will tell what the impact will be over a longer cycle.

Removal of Tie Between Fees and Gates, and Liquidity LevelsMMFs no longer have to use temporary gates or liquidity fees linked to daily and weekly liquidity levels. This set of rules was largely regarded as a trigger behind redemption activity for institutional prime MMFs during the March 2020 market crisis.

Our reaction: Industry participants will welcome this change, as it removes what was one of the key drivers behind MMF outflows during the last crisis.

Provisions for Negative Interest RatesRetail and government MMFs may now specify in their prospectus documents and other disclosures their valuation approach during periods of negative interest rates. Funds can choose to float their NAVs, or move to a process that allows an MMF to maintain a stable NAV, such as a Reverse Distribution Mechanism (RDM), which is a valuation process designed to offset negative income through share cancellation.

Our reaction: We expect this will be welcomed by industry participants, as the use of RDM represents a more pragmatic and less disruptive approach for intermediary platforms often designed to support stable, and not floating NAV MMFs.

Increased Reporting RequirementsThe rule changes also introduce a number of enhanced reporting requirements that cover a wide range of areas, including shareholder and portfolio disclosures, as well as new rules for private liquidity funds.

Reaction: While potentially increasing costs to fund managers and service providers, the industry generally supports the new changes, which are aimed to provide greater transparency and oversight.

Timeline

Following their expected publication on the Federal Register in late summer 2023, the various components of these new rules will progressively come into effect over a 12-month period ending in fall 2024.

Conclusion

Western Asset supports regulatory actions designed to promote the effective functioning of short-term markets while maintaining MMFs’ utility to short-term investors.

MMFs have proved their resilience over several decades and multiple market cycles, allowing investors access to diversified pooled investment funds that provide cash investors with same-day liquidity, capital preservation and competitive yields. While we expect the benefits of the SEC’s latest amendments to be tested over time, we remain confident that MMFs will continue their role as a key liquidity option for investors.

ENDNOTES

1. Note that Crane Data reports a higher figure for institutional prime MMFs as of July 12, 2023, approximately $640 billion. Crane reports balances for prime MMFs used by fund managers for internal and other purposes (affiliated funds’ sweep, securities lending collateral, etc.) whereas the ICI reports include MMFs that are generally available to non-affiliated investors.