Our base case is not for a US recession in 2022, but the risks of a mild recession are increasing as higher borrowing costs and tighter credit conditions will likely weigh on investment and consumption.

If the recession is mild, where unemployment doesn’t rise substantially and defaults don’t pick up materially, then credit spreads may not rise to levels seen in previous recessions as in 2009 or 2020. If the recession is worse, then equity multiples will likely decline further and defaults will likely rise above historical averages—both will negatively impact the returns in equity and credit markets.

With yields around 9% in below-investment-grade-credit markets, credit is looking attractive compared to equity in a slower-growth or mild-recession scenario. However, the equity of collateralized loan obligations (CLOs) may perform even better than both of those sectors if market pricing resembles those of a recession similar to the last two.

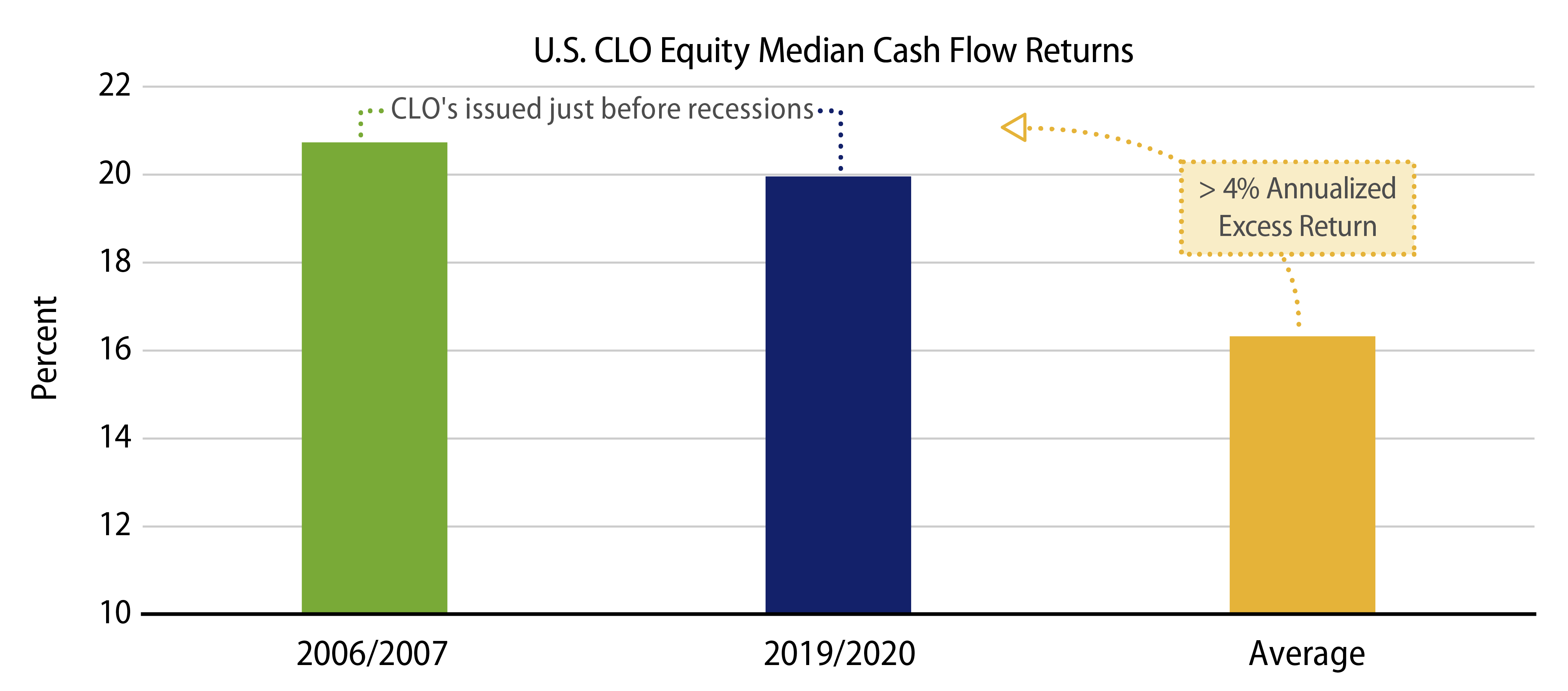

What may be counterintuitive when reviewing business cycles and the impact they have on market returns is that the equity of an actively managed CLO—which invests in bank loans—may outperform both credit and stocks should the US tip into recession. With history providing some guidance, it’s worth noting that CLOs that were originated before the last two recessions produced better returns for shareholders than in other years.

Heads I Win, Tails You Lose

Why would the equity of a CLO perform better if we head into a recession? For background, a CLO issues debt and equity securities, then the proceeds are invested in a diversified portfolio of syndicated bank loans. The bank loans provide income to pay interest and other expenses, then the remainder is distributed to equity holders. CLOs feature structural advantages that other investment vehicles don’t. They include two main sources of optionality for a CLO manager that typically enhance returns for the CLO equity holder: the option to refinance in bull markets and to reinvest in bear markets. This is akin to flipping a coin to guess the business cycle, but where both investment outcomes are positive.

When bank loan prices are falling (i.e., credit spreads are widening)—as they did during the global financial crisis and Covid-induced lockdown—a conservatively positioned CLO manager will reinvest their portfolio into higher-yielding securities. Reinvesting as spreads widen is why some CLO managers structure their portfolios conservatively at origination, as they will have several years to wait for an opportunity to swap into higher-yielding securities. On the other hand, when bank loan prices are rising (i.e., credit spreads are tightening), a CLO manager can often reduce their borrowing costs by refinancing their debt securities.

Capitalizing on the option to reinvest in bearish markets or refinance in bullish markets are two ways to increase the returns to CLO equity holders. The median manager that issued CLOs in 2006/2007 as well as in 2019/2020 locked in financing before volatility rose, then swapped into higher-yielding securities as prices declined in the respective recessions—subsequently increasing the returns to equity holders.

What Reduces CLO Equity Returns?

There are several other advantages to investing in CLOs that have historically supported attractive equity returns relative to other asset classes. These include covenants that aim to reduce default risk and, importantly, the covenants aren’t based on market prices.

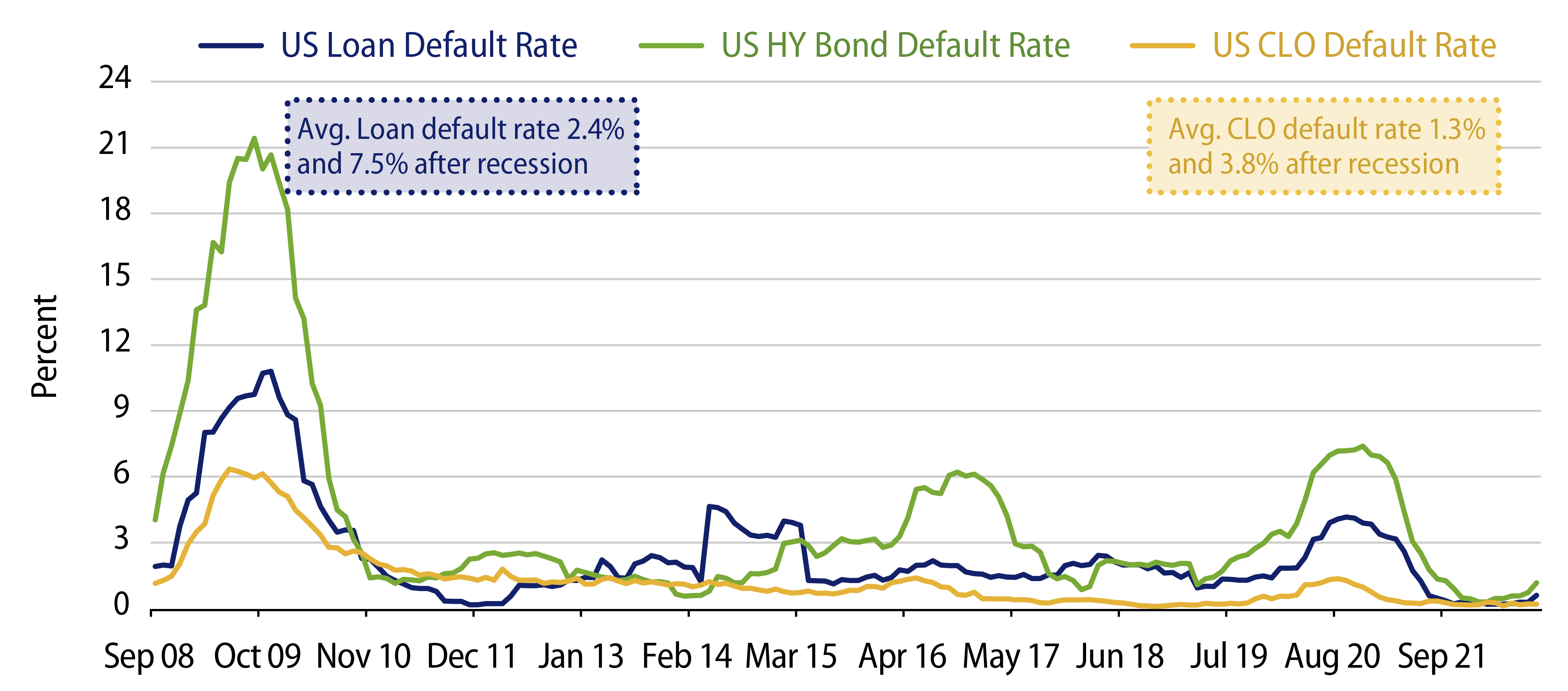

One of the most relevant risks to CLO equity returns are defaults in the underlying bank loans. As the bank loan cash flow (i.e., the CLO’s assets) are reduced when defaults happen, there is typically less available cash to distribute to equity holders, so avoiding defaults through active selection and credit research is the goal for managers.

Also, it is worth noting that covenants in CLOs typically limit the concentration in CCC and lower-rated issues. The lower-rated and riskier company limits are typically capped at 7.5% of a CLO’s holdings. For comparison, CCCs and lower-rated issues exceeded 15% in broad loan indices in 2009 (according to the Morningstar LSTA US Leveraged Loan Index). The covenants that limit CCC and lower-rated issues’ risk may help explain why defaults in CLOs were about 50% lower than defaults in the overall bank loan market for the last two recessions.

Benefits of the CLO Structure

“The investor’s chief problem—and even his worst enemy—is likely to be himself.” ~Benjamin Graham

While CLO equity may outperform other asset classes, the outsized returns accrued to investors that commit to holding the securities until the CLO matures or is called may be even greater than the historical average if the market tilts into recession.

As mentioned earlier, there are several benefits to the CLO structure that have historically led to outperformance versus other asset classes. The three main structural factors that support CLO equity outperformance are: optionality to reinvest or refinance in bear and bull markets, robust match between investment assets and financing liabilities, and covenants that aren’t based on market prices.

Based on the analysis of Cordell, Roberts and Schwert in 2021, the option to reinvest alone may explain about a third of CLO equity’s historical outperformance versus other sectors, especially for vintages before recessions. The next two structural advantages are also meaningful to CLO equity returns as they reduce the behavior risk of both the investor and the manager. In other words, these advantages help reduce the risk of the investor or manager becoming their own enemy. For example, liability financing is essentially to the term of the investment so the CLO doesn’t subject itself to the possibility of the lender changing terms when volatility rises. Also, as the capital is committed for the life of the investment, and covenants in the CLO aren’t based on market prices, the CLO manager can then focus on investment fundamentals rather than being influenced or coerced into selling assets in the portfolio due to market-price fluctuations.

All of these factors may help explain why CLO equity has historically performed better than other sectors, and even more so following the last two recessions.