The culmination of strong nominal growth, low default rates, rising equity multiples and low interest rates among other factors have fueled a surge in the supply of credit securities. As a result of this borrowing binge, total credit to the non-financial corporate sector has risen to over 100% of GDP in G20 countries in 1Q21, up from 92% in the last five years, according to the Bank of International Settlements. There is dispersion among countries and sectors, but taking note of where credit creation rises above historical trends and where it exceeds income potential can be a good predictor of undesirable outcomes when the liquidity eventually recedes. A closer look at issuance trends in the US bank loan market, which has been growing faster than other sectors, sheds some light on what the market is saying about risk.

Accelerating Supply

In US public credit markets, it’s worth noting that the bank loan market has grown by nearly 55% over the last five years, to a market capitalization of more than $1.2 trillion, according to the S&P/LSTA Index as of September 2021. Net issuance of bank loans has been growing by more than10% per year and about twice the rate of the US high-yield market. Also worth noting is that the majority of the proceeds from syndicated bank loans were used to pay equity dividends and/or for M&A activity including LBOs. The result of these issuance trends has resulted in a bank loan market that reflects more single B issuers and more covenant-lite deals, with technology industry concentrations now 5x larger than the average of other industries.

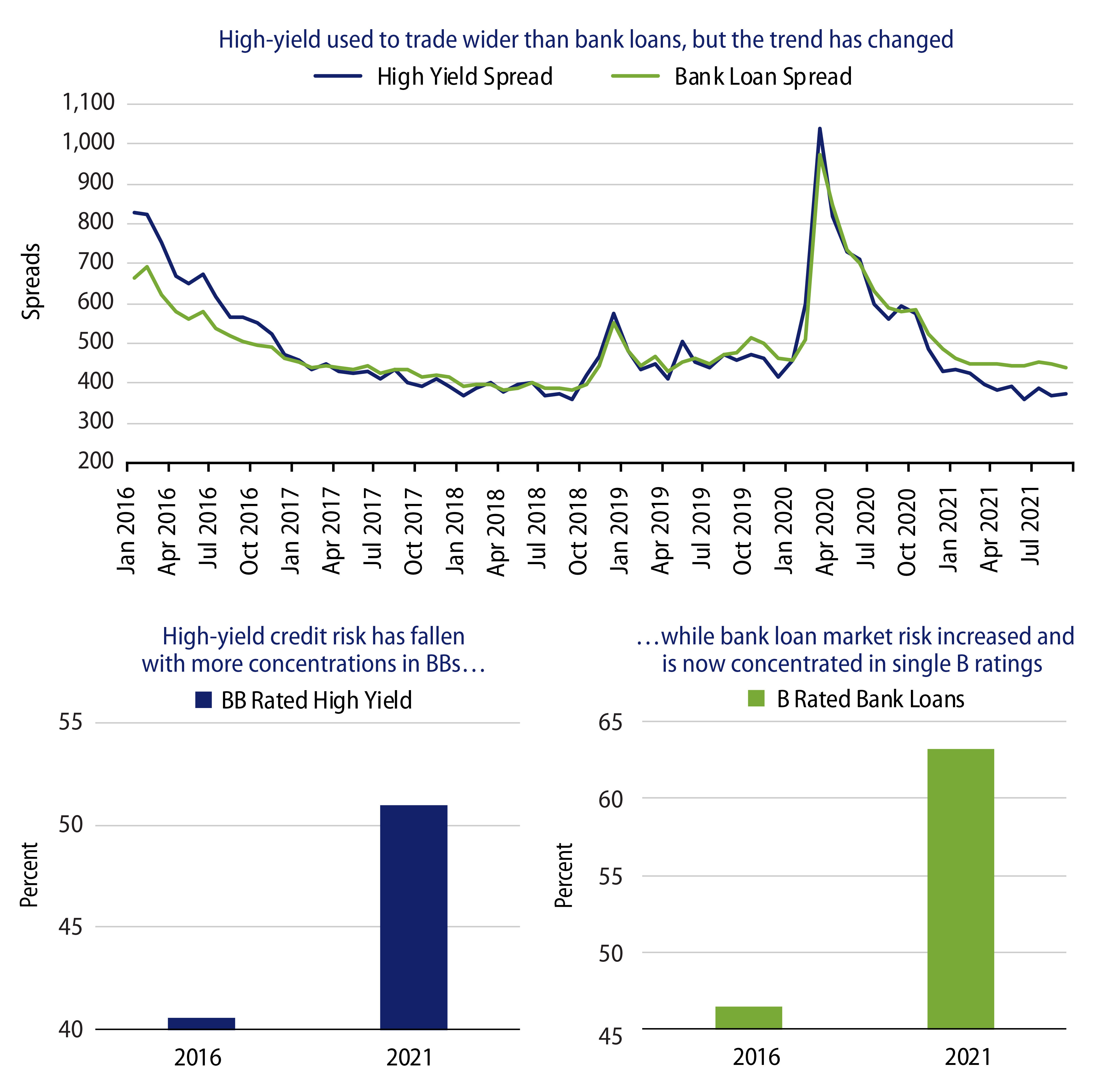

The lower credit quality of bank loans along with other factors help explain why bank loan market spreads are no longer tighter than they are for high-yield credit.

Strong Demand

While credit issuance has been robust, demand for income-producing securities has been very strong, too, given low and negative-yielding government bonds globally. Over the last year or so, demand for lower duration and floating-rate securities increased as investors are preparing for gradually higher interest rates and less central bank accommodation. For high net worth individuals or wealth managers, the rising-rate environment often results in higher allocations to bank loan funds. Interest in bank loans and floating-rate structured products, such as debt issued by collateralized loan obligations (CLOs), has also increased from large institutions. For background, much of the debt issued by a CLO is rated AAA by rating agencies as there is close to no risk of principal loss, which has been the case for the securities for decades. The high rating combined with floating-rate interest income has been in high demand by large financial institutions. Recently, the stronger demand from institutions for AAA rated floating-rate notes has enabled investment firms that originate CLOs to borrow near the lowest levels in the last decade. Concurrently, underlying bank loans that the CLOs purchase for investment income have not seen valuations return to historical lows, due in part to bank loan net issuance growing at 2x the pace of high-yield bonds. We believe the low borrowing cost for CLO debt issuance combined with somewhat elevated spreads in the bank loan market is creating a lot of attractive opportunities for CLO managers.

Risks and Opportunities

Despite the growth of debt in both the high-yield and bank loan markets, profits and equity capital have also risen. While bank loan market debt has grown faster, aggregate leverage measures for the sector have declined to the lowest levels, and interest coverage has risen to the highest levels, in over five years, according to S&P/LSTA and LCD as of June 2021. While that may sound supportive for fundamentals and relatively low credit spreads, the changes in industry concentration and capital structures suggest that bank loans could see a trend of higher volatility than in the past and lower recovery rates when liquidity recedes and defaults increase.

At Western Asset, we advocate taking an active approach to investing in bank loans, seeking long-term fundamental value through independent company research. For investors preparing for gradually rising interest rates, a more flexible approach to higher-yielding credit that includes bank loans along with high-yield could offer more attractive return potential. We also see opportunities in CLO equity and actively managed CLO debt strategies.