Hybrid securities issued by domestic banks and insurers have long been utilised by Australian investors looking for enhanced income from their cash and fixed-income allocations. Direct investors have been attracted to these securities due to their higher level of income and attached franking credit benefits. However, this investment strategy has rarely been followed with appreciation for the inherent investment risks or the alternative opportunities that exist.

Domestic hybrids have performed strongly in recent times, but the drivers of outperformance are not intuitively apparent. Recent seismic shifts in credit spreads globally, which represent a higher risk premium being demanded by investors above risk-free alternatives, have re-established the investment merits of a range of securities for income-hungry investors. Together with a shift in rhetoric by Australian Prudential Regulatory Authority (APRA) regarding the callability of such securities, investors are offered the chance to revisit their hybrid security allocations, and assess whether there are better risk/reward opportunities elsewhere.

Risks

The risks of investing in hybrid securities (also known as AT1 or Additional Tier 1 Securities) tend not to be fully appreciated by many investors. AT1 securities form part of an Australian bank’s “Loss Absorbing Capital” (LAC); securities that can be permanently written off in the event that the regulator deems an issuer “nonviable.”

Importantly, AT1 securities offer protection to investors higher up the capital stack, with the securities written off or converted to equity before any loss is incurred by more senior bondholders (including Tier 2 and Senior Unsecured debt holders). In addition, AT1 distributions are non-preferred and non-cumulative, meaning the bank is not obliged to pay distributions, nor make up for any missed payments. Unlike senior debt and Tier 2 debt, a non-payment of a distribution is not deemed to be a default. So, for AT1 securities there’s less of a motivation to pay distributions versus other types of bank debt mentioned here.

An additional risk borne by AT1 investors is that these securities are perpetual in nature, meaning that an issuer isn’t obliged to repay investors on a prescribed call date. Extension risk has recently been topical with APRA reminding investors they should not assume that they will get their money back at the call date. Until now, pricing has certainly reflected that assumption.

Rewards

While a material reset higher in both yields and credit spreads throughout 2022 has posed challenges for fixed-income and credit investors, it has also resulted in opportunities to access better returns moving forward.

Risk assets globally have sold off over the past 12 months, with hybrids being relatively well shielded from downward price revisions. What has been somewhat surprising is how resilient these securities have been in the context of their place in the capital structure.

Australian dollar (AUD)-denominated hybrids now trade at levels that look expensive, having outperformed in relation to both AUD Tier 2 securities and those issued by global banks, whose spreads have widened more significantly.

Domestic AT1 Versus Tier 2

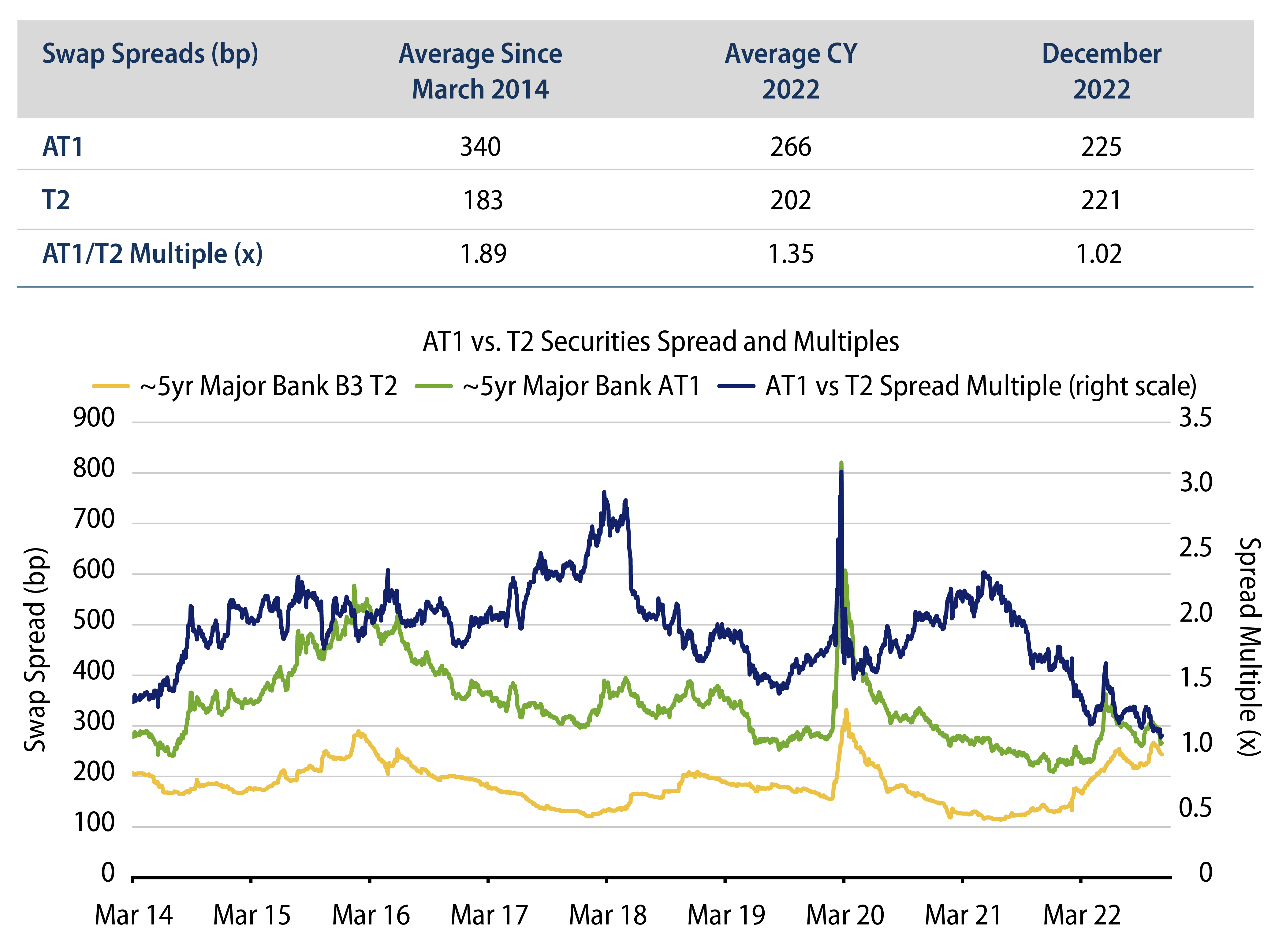

To illustrate, AT1 security spreads have averaged 340 bps since March 2014 and 266 bps over the past year, and currently sit at 225 bps. Comparatively, spreads for major bank Tier 2 securities have averaged 183 bps since March 2014 and 202 bps over the past year, and currently sit at 221 bps.

Relative to one another, AT1 spreads have traded at a historical spread multiple of 1.9 times the higher quality Tier 2 securities since March 2014 and 1.4 times the same securities over the past year. The current multiple of 1.1 times is close to historical lows. In other words, investors are getting little additional compensation for taking on greater risk by investing further down the capital structure.

Domestic AT1 Versus Global Contingent Capital

International hybrid securities have also traded cheaper (at higher yields for equivalent-rated securities) than AUD hybrids. While some of this underperformance can be partially attributed to higher extension risks being attached to offshore securities, this does not account for the wide disparity in performance. Indeed, recent APRA communications have reduced the difference in extension risk between local and offshore hybrids, as APRA has recently reinforced its stance that AUD hybrids will not be automatically called—and that it must make economic and prudential sense to do so. Given the increased extension risk for domestic issues is not reflected in current valuations, domestic securities appear particularly expensive. Global contingent capital spread multiples of AT1 securities are now trading near their highest levels.

Summary

The desirability of Australian hybrid securities versus higher-rated securities (i.e., senior and Tier 2 issues) and similarly rated securities in offshore markets has dissipated over the past 12 months. Aside from concentration risk, Australian investors holding domestic hybrid issues should remind themselves of AT1 securities’ place in the capital structure, and the limited additional return premium now available.

Active diversified fixed-income credit strategies have the ability to generate alpha above what is now a much more attractive starting yield without the need to move far out the curve or down the capital structure in a concentrated manner. Now is the time for investors in hybrids to reconsider their allocations.