Private-sector payroll jobs rose by 167,000 in April, with a slight -15,000 revision to March payrolls, according to data released today by the U.S. Department of Labor. Average workweeks declined one-tenth of an hour, and average hourly wages rose by 0.2%. Within the household survey, civilian employment rose by just 25,000 jobs.

Early financial market comments on the release referred to a ''weak'' jobs report. This is not really true with respect to the headline payroll gains, +167,000 being a satisfactory gain. Any “weakness” in the data was in the ancillary indicators, hours worked and wages, as well as the household survey gains.

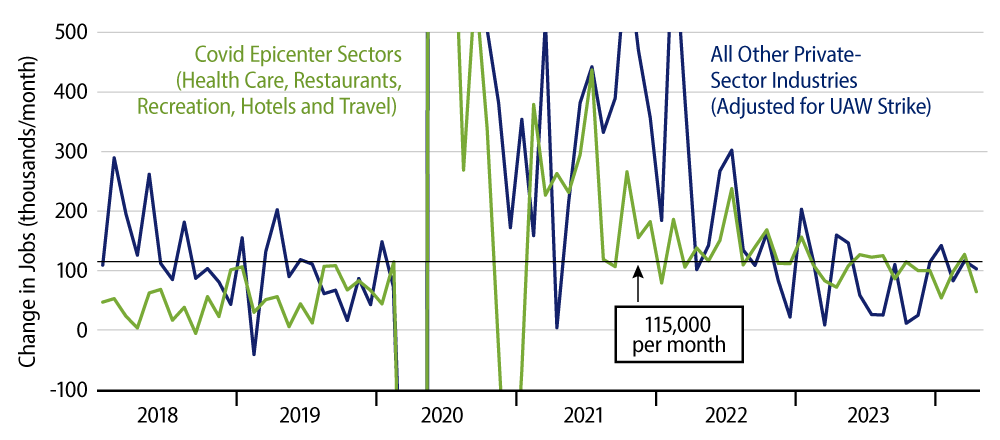

Within payroll jobs, gains in Covid-decimated sectors declined a bit in April. In the rest of the economy, job gains remained decent, well above the pace of late-2023, as you can see in the chart. For the Covid sectors, the more tepid job gains might be an indication that these sectors are finally getting back to pre-pandemic staffing levels. As always, one can’t put too much emphasis on a single month’s data.

For the rest of the economy, while job gains were good, the decline in workweeks means that total hours worked actually declined in April, at least according to the data. Total hours worked have been fluctuating wildly in recent months, declining about half of the time and rising at a good clip the other half. On average, total hours worked are rising at a rate right around the 1.5% growth per year seen prior to Covid.

After a disappointing report on 1Q24 employment costs earlier this week, the hourly wage data today points more squarely to a disinflationary trend. The April wage gains annualize to a rate of 2.4% per year, and hourly wages have grown at an annualized rate of only 2.8% over the last three months. The Federal Reserve has indicated that wage growth around 3.5% is consistent with their inflation target, so this recent news has got to be encouraging to them. It certainly is cooler wage growth than seen a few months ago.

The meager employment gains within the household survey are a puzzle. They are a continuation of the experience of the last year, wherein household survey gains have averaged only 52,000 per month, compared to 234,000 monthly gains in total nonfarm payroll jobs.

The household survey counts workers, while the payroll survey counts jobs, and it may be that the faster growth in payroll jobs reflects more workers holding down two or more gigs. Or, it may be that the Department of Labor is under-counting population growth, so that the same change in employment rates means less household survey jobs. Or, one or both of the surveys might be wrong. It is the case that unemployment has risen to 3.8%, up from 3.4% a year ago, so the slower job growth in the household survey is reflecting at least something.

In any case, the breadth of today’s data is once again consistent with declining inflation. Also, the declines in workweeks and softer wage growth suggest little or no growth in wage incomes in April, which may be a restraint on consumer spending. These threads come after hotter readings in previous months, so caution is warranted. Still, the news provides a lift to the bond markets. It doesn’t signal any actual weakness, but it does portray a much cooler labor market than some folks were alleging previously.