Private-sector payroll jobs rose by 317,000 in January, with November and December private-sector job growth revised upward by 16,000 and 114,000, respectively. In addition, benchmark revisions added another 240,000 cumulative jobs to job growth figures over April-October of 2023, while reducing job growth through March 2023 by 307,000. In other words, job growth was softer through last March than previously reported but much stronger since then.

Oddly enough, as strong as recent job growth is now reported to be, average workweeks are even weaker. Workweeks declined enough that total hours worked (jobs times average workweeks) declined in both December and January, down a sharp -0.4% in January. To complete the trifecta of surprising data, average hourly earnings rose 0.6% in January, after gains of 0.4% in November and December. All three of these monthly gains were above the 0.3% average gains that had prevailed over the preceding six months.

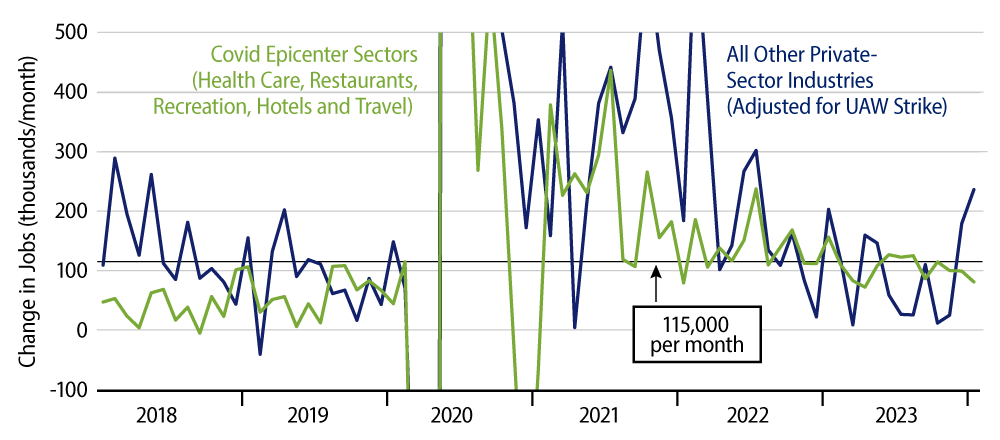

In previous posts, we have made much of the fact that 2023 had produced a string of big downward revisions to initially reported job gains. Over January-October 2023, monthly gains in private-sector jobs had been revised down an average of 55,000 per month, with every month showing a downgrade. Furthermore, steady declines in average workweeks offset most of the remaining job gains, and job growth looked to be concentrated in service sectors especially hard-hit by the Covid shutdown (health care, food service, travel, hotels and recreation). All these developments led us to believe that the labor markets were softer than what the headline job data suggested.

Well, today’s data throw a monkey wrench in that contention. The benchmark revisions for 2023 more than offset the monthly revisions previously reported. And essentially all those upward revisions occurred outside the Covid-affected sectors, so that job growth in the economy as a whole looks better than previously reported. Meanwhile, recent months’ wage data threaten to reverse a slowing trend that had been in place for two years.

It is still odd that the previously reported declines in workweeks sustained and were even intensified in today’s report. In sum, more workers are working less hours at higher wages than we previously beheld. This is redolent of Churchill’s description of “a riddle wrapped in a mystery inside an enigma.” Mr. Powell and his friends at the Fed will have to unravel all this.

From our perspective, this would seem to kill any chance of a March rate cut from the Fed. Based on today’s data alone, this is probably an understatement, but today’s news is so beyond the pale that it is wise to wait and gain some perspective before commenting further.