Private sector payroll jobs rose by 118,000 in August, though that gain was substantially offset by a large, -62,000 downward revision to the July job count. Average workweeks rose very slightly, reversing July’s decline, and average hourly wages rose 0.4%, effectively reversing a gain of only 0.2% in July.

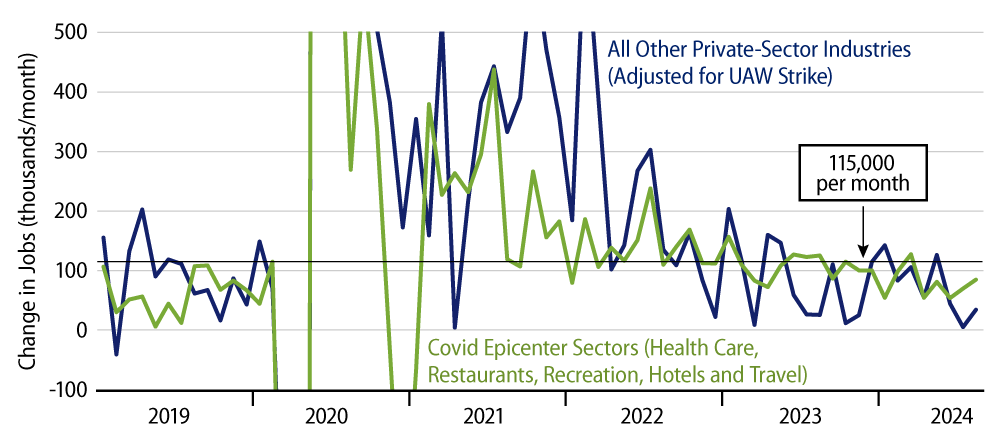

As has been increasingly the case, job gains were concentrated in a few industries, with construction adding 34,000 jobs, health care 31,000, and restaurants 30,000. The health care gain was well below its 60,000 per month average gain over the preceding 12 months. On the other side of the ledger, manufacturing shed -25,000 jobs and retail trade jobs decreased by -11,000. Other sectors generally eked out slight gains concentrated in what we call the Covid ''epicenter'' sectors as shown in Exhibit 1.

Exhibit 1 shows that job growth outside Covid epicenter sectors sharply slowed through July. The slight bounce in August mainly reflects construction jobs. While construction activity has declined recently for both residential and nonresidential sectors, construction jobs continue to steadily grow (or current data at least point to growth). Meanwhile, Covid epicenter sectors also saw slowing job growth through July, but they also got a bounce in August, thanks largely to restaurants (where activity has also recently declined).

Financial markets have widely priced in a Federal Reserve rate cut later this month. Some pundits have recently gone so far as to look for a 50-basis-point (bp) cut from the Fed. Nothing in today’s report alone would point to a 50-bp cut except, perhaps, the large downward revision to the July data.

With that revision and with only a relatively mild bounce in job growth in August, a recent downtrend in job growth is apparent, and it is conceivable that the Fed would take aggressive action to arrest this downtrend.

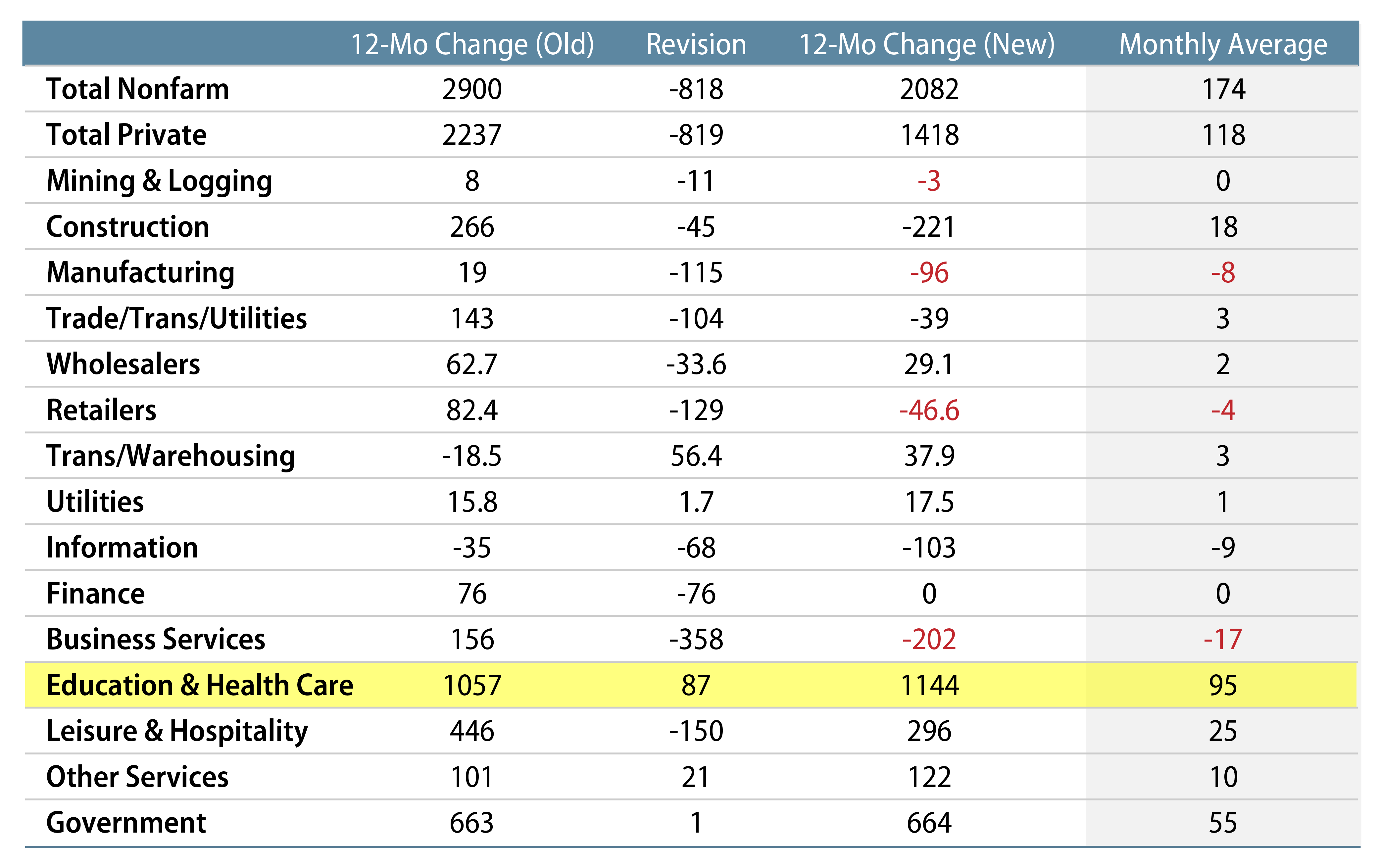

Speaking of revisions, two weeks ago, the government announced estimates of benchmark job data revisions for the period March 2023 through March 2024 that will be incorporated into official payroll data next February. Those announced revisions came to -819,000 to private-sector jobs, and those changes completely wiped out the currently reported gains in several industries. In fact, when applying those revisions to current, official data, as in Exhibit 2, average private-sector payroll job growth over the benchmark period was marked lower by -56,000 jobs per month, down to a 118,000 per month average, with the vast bulk of remaining gains occurring in health care and (private) education.

If one were to reduce the blue line in Exhibit 1 over the March 2023 to March 2024 period by 56,000 per month and allow for similar downward revisions to the months since March 2024, the job market is arguably much weaker. Keep in mind that such a markdown is not yet shown in the official data: it is only an “official” estimate of what the official data should look like come February.

Will that be enough for the Fed to move aggressively, or will it proceed cautiously? The ball is now in the Fed’s court.