Data for August released today by the U.S. Census Bureau indicated that permits for new housing rose 2.0% for single-family units and 15.8% for multi-family units, while actual housing starts declined -4.3% for single-family and -26.3% for multi-family. The details within the report are every bit as chaotic as the mix of rising permits and falling starts would suggest. We’ll try to make sense of things here.

For single-family construction, starts had been running ahead of permits since December 2022, as builders strove to work down backlogs of permitted but unstarted units. So, today’s data mostly indicate single-family permits and starts moving back in line with each other.

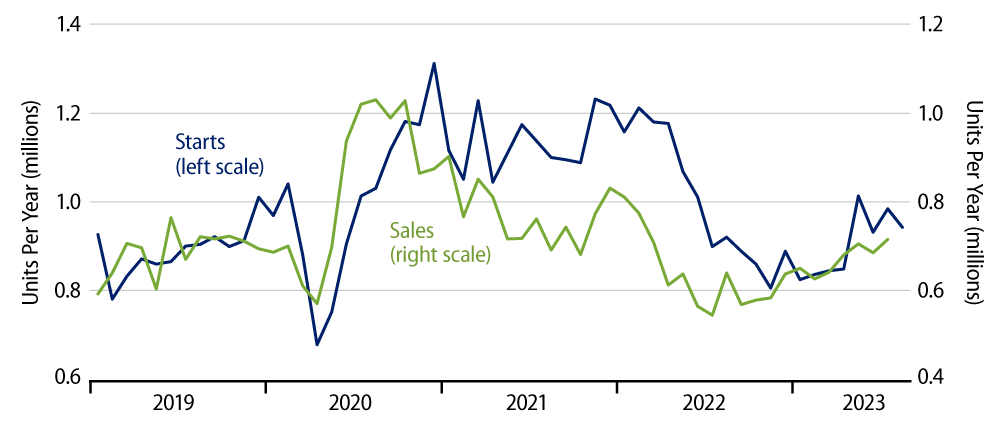

We have been flummoxed by the stabilization in single-family homebuilding in recent months. With inventories of new single-family homes already very high relative to sales rates, and with higher mortgage interest rates depressing demand, we thought single-family homebuilding would fall sharply further this year. Instead, we saw a spike up in single-family starts in May that held through the early summer.

Then again, mortgage rates pulled back early this year, and declining home-sales prices also helped improve affordability somewhat, perhaps contributing to the mid-year stabilization. Well, mortgage rates have since bounced above 7%, and home-sales prices have bounced as well. We’d like to assert that today’s data indicate single-family starts beginning to pull back again, but with the data so chaotic, it is much too early to forcefully make that claim.

This is especially true given how mixed the regional starts data were in today’s release, with essentially all the August drop in single-family starts occurring in the West, and starts in the South actually bouncing. It will take further data to determine whether the recent declines in national single-family starts are for real or merely fluctuations around a stable level. Upcoming new-home sales data will be especially instructive.

Conditions are very different in multi-family housing. There, permits have been running above starts throughout the last four years. Both have been trending down this year, but their divergent behavior in August widens the gulf between them.

Despite the decline in multi-family starts this year, there remains a huge overhang of multi-family units under construction and soon to come to market. At the height of the housing bubble in 2005, there were 450,000 multi-family units under construction. Presently, despite a slower rate of population growth than 18 years ago, there are over 1,000,000 multi-family units under construction. Similarly large overhangs exist in all regions.

A very sharp decline in multi-family construction over the next two years appears inevitable. The sector is much smaller than single-family homebuilding, so such a drop won’t take as big a bite out of economic growth as would a similar plunge in single-family. However, all those soon-to-be completed multi-family units will be competing for occupants with single-family homes. Despite the better data of recent months, we think the homebuilding market is in for rough sledding.