KEY TAKEAWAYS

- As global vaccination rates improve, a return to more “normal” economic activity appears likely.

- With most DM central banks contemplating the removal of accommodative policy, they will have to balance the effects of too much inflation and still insufficient employment.

- We believe global growth will downshift from present levels but remain firm.

- As the global recovery blossoms and Covid recedes as a frontline worry, EM economies and currencies should rapidly recover.

- Thoughtfully selected higher-yielding fixed-income securities should outperform US Treasury and DM sovereign bonds.

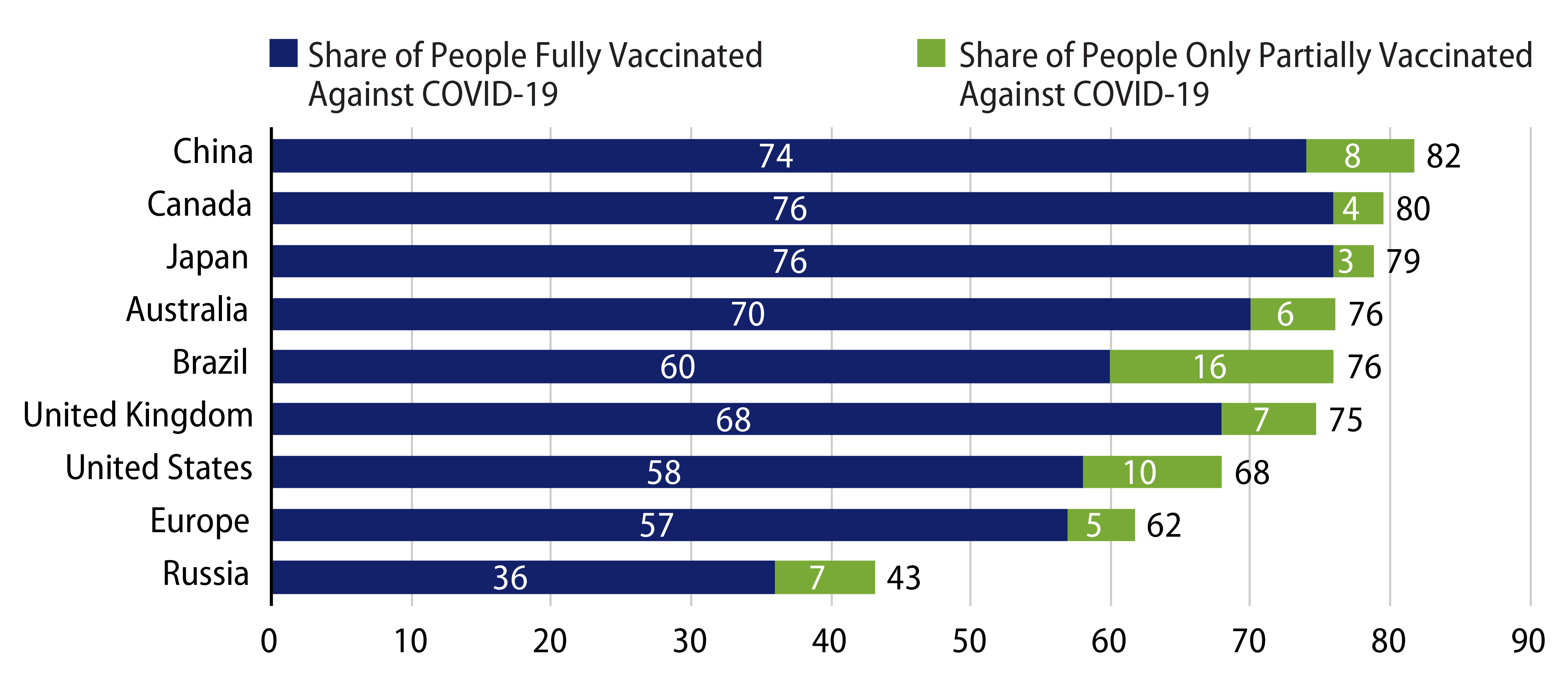

Pandemic panic and fear remain a constant source of health anxiety. The omicron variant is the latest example of this, with new travel restrictions already being enacted in response. And yet, learning to live with Covid will be the major theme for 2022. Even as we end the current year with continuing and renewed restraints—lockdowns, shut-ins, travel restrictions, etc.—these will fade as an acceptable societal response to the persistence of this virus. As vaccination rates inexorably improve around the globe (Exhibit 1), a return to more “normal” economic activity appears in prospect. Large segments of the global population will emerge from being shut in—and the sources of both supply and demand will be largely increased.

With the tailwind of fiscal policy waning rapidly, developed market (DM) central banks will have to be extraordinarily judicious in removing monetary accommodation. Each country will have its own unique circumstances. But broadly speaking, they will have to walk a tightrope between too much inflation and still insufficient employment. The economic carnage of the pandemic has been immense. The interruption of supply chains has caused gigantic relative price shifts and shortages. Gauging the improvement in employment rates while suffering through blistering inflation readings will test DM central bankers’ mettle. As growth returns to pre-Covid trend lines, rates will be gradually raised, but our view is that policy caution is warranted and will be exercised.

Presently, the markets have taken the inflation bait as proof positive that an accelerated and persistent Federal Reserve (Fed) tightening campaign is in the offing. The completion of Fed tapering and six 25 basis point rate hikes are expected by the end of 2023. This expectation for an accelerated timeline for tightening in the US has helped elevate the dollar and, combined with China’s current economic soft patch, has put pressure on emerging markets (EM). EM countries haven’t helped themselves recently either. Turkey’s currency and other markets have seen volatility that is truly unsettling. Russia has anxiety over the Ukraine back in its focus, and in Mexico, AMLO has spooked investors over the potential politicization of their central bank. As investors brace for the widely expected elevated inflation prints of the next few months, expectations of Fed hiking continue to accelerate. In essence, global financial markets are in thrall of the Fed. But while that path is not implausible, should that level of fear really constitute the base case?

In this regard, we view the reappointment of Jerome Powell as Fed Chair and the appointment of Lael Brainard as Vice Chair as a very strong signal that the Fed’s new policy framework, which emphasizes the attainment of both trend inflation rates and full employment across broad segments of the population, will be the guiding principle for monetary policy over the coming year. The near-term inflation picture is daunting, but the healing process toward full employment in the US will take time. The distinction between tapering and raising interest rates will be strongly reinforced. Tapering may be accelerated, but the bar of full employment for raising rates will stay any rate hikes until well into 2022, if not 2023. Our strongly held view is that the front end of the US Treasury curve is too deep relative to our expectations for growth, inflation or the Fed’s reaction function.

Interestingly, the path ahead for EM central banks may prove less challenging. The challenge of Covid, the fear of Fed tapering and the inflationary surge of higher commodity prices (particularly food costs) has caused anticipatory tightening to have already begun in earnest. As previously noted, fears of a pronounced Chinese slowdown are also weighing on EM assets. Higher US rates combined with weaker global growth evokes memories of 2018, which was very difficult for this asset class. Our view is that global growth will downshift from present levels but remain firm. We also believe that Chinese policymakers will begin to stimulate in very short order, and that supply chains will come back reasonably swiftly. Most importantly, our view is that the improvement in vaccination rates will reopen the economies of many EM countries.

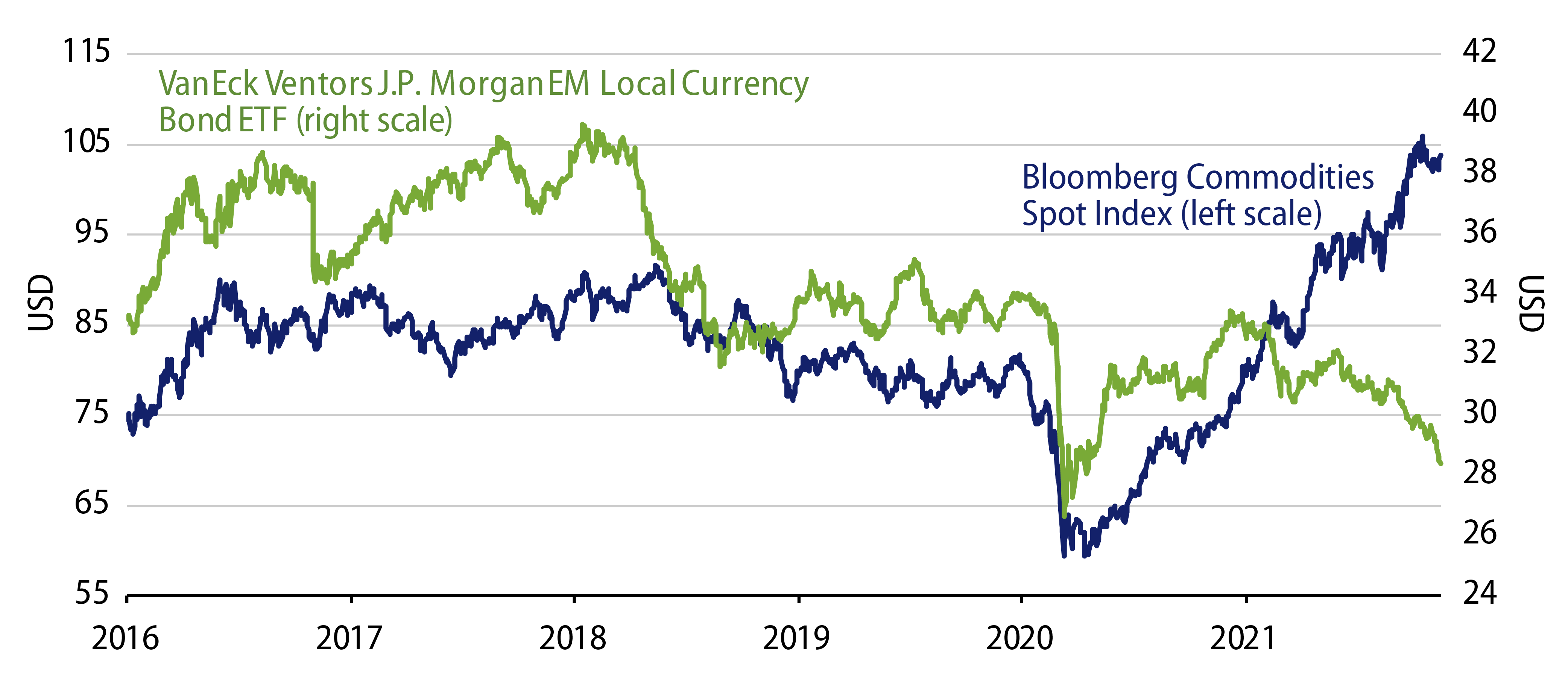

The enormous disconnect between EM fixed-income valuations and the current level of global growth commodity prices can be seen in Exhibit 2. Historically, broad-based commodity prices are a coincident indicator of global growth. As can be seen in the graph, the level of EM local currency debt has moved in virtual lockstep with commodity prices and by extension, global growth. Weak growth and low DM interest rates in 2016 were followed by a strong bounce and Fed tightening in 2018, and then the relapse and recovery of 2020. EM local currency debt moved in lockstep until this year. Currently, the real yield differential between EM and DM rates stands at 15-year wides. As the global recovery blossoms and Covid recedes as a frontline worry, EM economies and currencies should rapidly recover. We believe investors will increasingly look to EM for substantial yield improvement over historically low DM yields.

The key component of our portfolio construction is our reliance on a substantial yield advantage over our benchmarks or targets. This strategy is designed to benefit from the long but, we believe, successful slog toward a less Covid-ridden and more “normal” economic environment. We have never been through such a pandemic. Similarly, we have never had to exit from one. Policy experimentation on both the monetary and fiscal fronts has been extraordinary. The tailwinds of the Covid reopening, along with broken supply chains, has caused huge price shocks. Humility is warranted when trying to see through such an impenetrable haze, and we’re continually re-evaluating the landscape of the Covid crisis—as we’re doing again now given the very recent news of the omicron variant. But our strongest conviction is that the war against Covid will be won. Policymakers will strive mightily to keep the global economy on course. In this vein, the benefit of thoughtfully selected higher-yielding fixed-income securities should outperform US Treasury and DM sovereign bonds.