Bond Wars: The Battle of Alpha and Beta

Executive Summary

- With global equities moving to new highs, global bond yields declining and broad market volatility skimming record lows, we believe the beta decision for investors is now more critical than ever before.

- Alpha generation through active management of global fixed-income will be the key driver of broad portfolio performance going forward.

- It is vitally important that investors work with an asset manager that has experience striking the right balance between growth and defensive strategies within their investment portfolios.

According to recent flow data, investors continue to embrace asset classes that exhibit equity-like behavior given their perceived propensity to generate the highest returns. But with global equities moving to new highs, global bond yields declining and broad market volatility skimming record lows, we believe the beta (i.e., the volatility of different asset classes) decision for investors is now more critical than ever before.

In our view, investment return expectations across asset classes are now much more uncertain than in the recent past due to the rise of more varied and non-quantifiable risks. We therefore caution investors to avoid being lulled into a false sense of complacency by this artificially low volatility environment and by the force of seemingly attractive returns offered by asset classes that carry misunderstood or under-acknowledged risks.

At Western Asset, we believe that as a market’s complexity grows and risks become more opaque, the need for investment solutions with greater defensive characteristics as well as the value of active portfolio management likewise continue to grow.

Central Bank Policy: The Phantom Menace

Portfolio construction is a complex and intricate process that requires a deep familiarity with asset classes, an appreciation of the importance of the beta decision, and a keen understanding of the market drivers that are expected to generate alpha (i.e., returns in excess of benchmarks).

In general, most advisors spend an inordinate amount of time focusing on the “growth” segment of the asset class spectrum, namely equities. Within this space, they adhere to a range of philosophies which emphasize a quality or dividend focus, or a small capitalization bias as advocated by Gene Fama and Ken French. However, we find that they spend an insufficient amount of time on the “defensive” segment of the asset class spectrum, namely fixed-income. The reasons for this are understandable.

Global central bank monetary policy since the global financial crisis (GFC) has disrupted natural market forces and engendered a dynamic of increasingly lower global bond yields and asymmetric risks for broad fixed-income beta that continues unabated. Moreover, this collective policy norm has supported returns for those who held passive exposures to any assets, including defensive allocations.

Advisors wishing to steer clear of the gravitational pull of lower yields are right to question an allocation to fixed-income and may be compelled to stay out of the market altogether. For instance, some advisors in the Australian market have been looking for alternative sources of income through a “bondification” of equities or by assuming illiquidity (and conversion) risk in hybrids, while others are moving to cash and term deposits.

We believe that investors should be aware of the broader portfolio implications of these allocation decisions, given that such alternatives fail to provide the benefits offered by traditional bonds: diversification and “ballast” (i.e., they can appreciate in value during periods when equity markets are under stress).

A strong argument can also be made that the return potential offered by bonds or fixed-income in general is greater than what meets the eye. Indeed, the global bond market has evolved considerably over the last 20 years; investors now have a much richer universe of investment opportunities across a number of regions, sectors and even currency-denominations (with differing return outcomes) from which to choose.

In our view, alpha generation through active management of global fixed-income will be the key driver of broad portfolio performance going forward, as long as investors are aware of the proportionality of risks they are taking by including this asset class into their investment mix.1

Beta Strikes Back

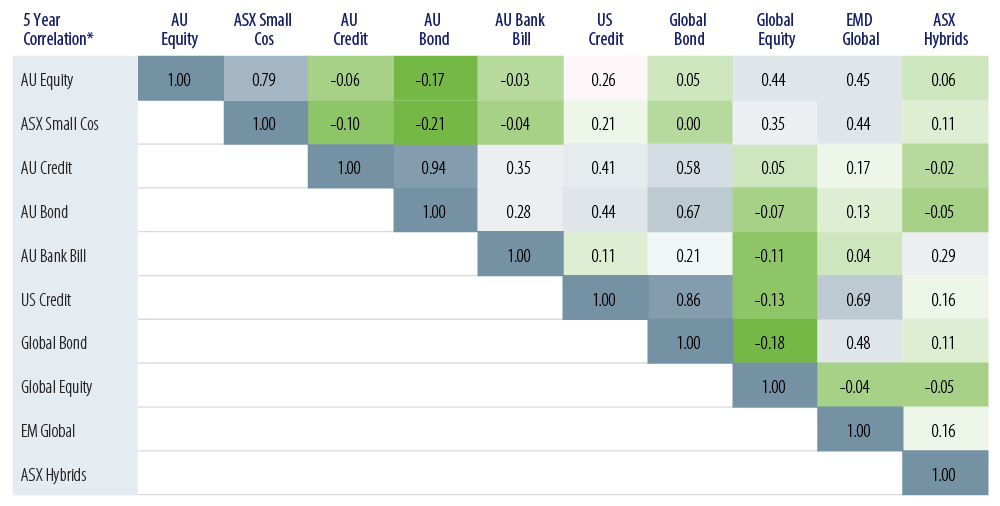

In general, the beta or volatility risk associated with the asset allocation decision should center on two areas of analysis: historical asset class correlations and a forward-looking assessment of the drivers of market risk—the latter in particular will shape your asset class return expectations.

Correlation analysis is relatively straightforward as it entails running basic calculations over different time periods. This helps to produce some insight on the past relationship between asset classes, especially during risk-on and risk-off periods.

Forward-looking assessments, by their very nature, are much harder to make given the inherent difficulties of trying to quantify unknowable or qualitative risks. However, if there is a determination that the main drivers of risk over a specific time horizon will be more macro-oriented (e.g., faster interest rate normalization by global central banks) than credit-oriented (e.g., a sudden default spike in the high-yield market) then this view can help serve as a first cut toward quantifying asset class return outcomes and, ultimately, aid in the investor’s beta decision.

For instance, one view that we regularly encounter is that credit is highly correlated to equities. With the steady decline of credit as a proportion of the Australian bond benchmark, few investors have sought to replace this through an active Australian credit beta allocation.

Now it is true that some higher-beta segments of global credit markets can display high correlations to risk assets. However, if we look at Australia, the credit market has a short duration profile (relative to global markets), is dominated by high-grade issuers and historically defaults have been exceptionally rare.

While we agree an allocation to Australian credit is unlikely to provide the strong capital appreciation in a period of stress that we would anticipate from a pure government bond allocation, adding Australian credit—as highlighted in Exhibit 1—can improve the diversification profile of the overall portfolio without raising the risk of generating material negative returns. Similarly, those with an Australian small cap bias in the growth component of their investment portfolios would benefit strongly from the defensive attributes of Australian bonds, and those with a global equity tilt would benefit from a larger allocation to global bonds.

A New Hope: Improving Diversification with Defensive Assets

*AU Equity is represented by the returns of the ASX 200 Index; AU Property = ASX Property Index, AU Credit = UBS Credit 0+ Index, AU Bond = UBS Composite 0+ Index, AU Bank Bill = UBS Bank Bill Index, US Credit = Barclays US Aggregate Total Return (USD Unhedged) Index, Global Bond = Barclays Global Aggregate Total Return (AUD Hedged) Index, EM Global = JPMorgan EMBI Global Index (USD Unhedged)

Return of the Alpha

Just as important as the beta decision is knowing where your alpha will be coming from (e.g., US or global) and the sources of that alpha.

The appeal of today’s global bond market is that it can be sliced and diced into customized solutions with differing degrees of beta and alpha contributions and differing sources of alpha (e.g., macro or credit-oriented or both). This is because fixed-income solutions can be country-specific, regional or global, linked to a standard or customized benchmarked, or managed in an unconstrained (i.e., non-benchmark aware) fashion.

For instance, unconstrained and alternative fixed-income strategies typically seek to provide many of the benefits offered by actively managed benchmark strategies, including capital preservation, liquidity and diversification. However, unconstrained strategies are afforded much greater investment and risk management flexibility within their mandates to achieve their objectives and, therefore, have the propensity to generate returns during both bullish and bearish environments for bonds.

Looking at the conceptual graphic in Exhibit 2, you can see that the greater the degree for active management, the greater the potential degree of alpha contribution.

Balancing the Force: Alpha/Beta by Investment Approach

The alpha and beta attributions for traditional active, unconstrained and Liquid Alternative strategies are Western Asset’s estimates. Based on multiple regressions of returns of representative domestic and global strategies. They do not reflect actual attributions in the future.

Using a real-life example in the benchmarked arena, our Legg Mason Western Asset Global Bond Fund has posted an alpha contribution of 28% of the Fund’s 7.4% p.a. total return (AUD hedged) over the past five years. The Fund achieved its excess return objective, importantly doing so while retaining high liquidity and the defensive attributes of the sector.

In the unconstrained investing arena, our Legg Mason Western Asset Macro Opportunities Bond Fund—the Firm’s most flexible fixed-income solution—has posted an alpha contribution of 53% of the 10.9% p.a. total return (AUD hedged) generated over the same time period.

Looking at the alpha sources of these strategies we would note that both strategies have extracted alpha from a diverse range of sources. The Global Bond Fund has generated 74% of its alpha through strategic decisions over duration and yield-curve positioning, country and currency allocation, while bottom-up decisions regarding sector allocation and security selection have contributed 26% of the alpha over the past five years.

Given its flexibility, the Legg Mason Western Asset Macro Opportunities Fund does not have a benchmark and we therefore assess the total return contribution to understand the drivers of return. Over the past five years, close to 50% of the total return can be attributed to macro decisions across duration, yield curve and FX, while the remaining 50% has been sourced from spread sectors based on a bottom-up sector view.

Selecting Your Jedi

The beta decision would not be complete without the final touch: the choice of asset manager. In our view, investors would be well served to select a manager such as Western Asset that has the global scale and scope to exploit today’s much richer investment universe and a strong long-term track record in managing both benchmarked and unconstrained strategies.

As markets now face unprecedented challenges from the low-yield, low-volatility environment, it is more important than ever that investors work with an asset manager that has experience striking the right balance between growth and defensive strategies within their investment portfolios. In a galaxy of shifting global macro conditions and broad market risk, understanding what goes into your beta decision and knowing your alpha sources are key to exploiting the best investment opportunities available.

Endnotes

- For more information, please see our white paper by Robert Abad on Global Investing: The Price You Might Pay for Going Passive.

- Returns that cannot be explained by major benchmarks through statistical regression. For more information, please see our white paper by Joseph Filicetti, Macro Opportunities: A Flexible Approach to Macro Investing.