Municipals Posted Positive Returns

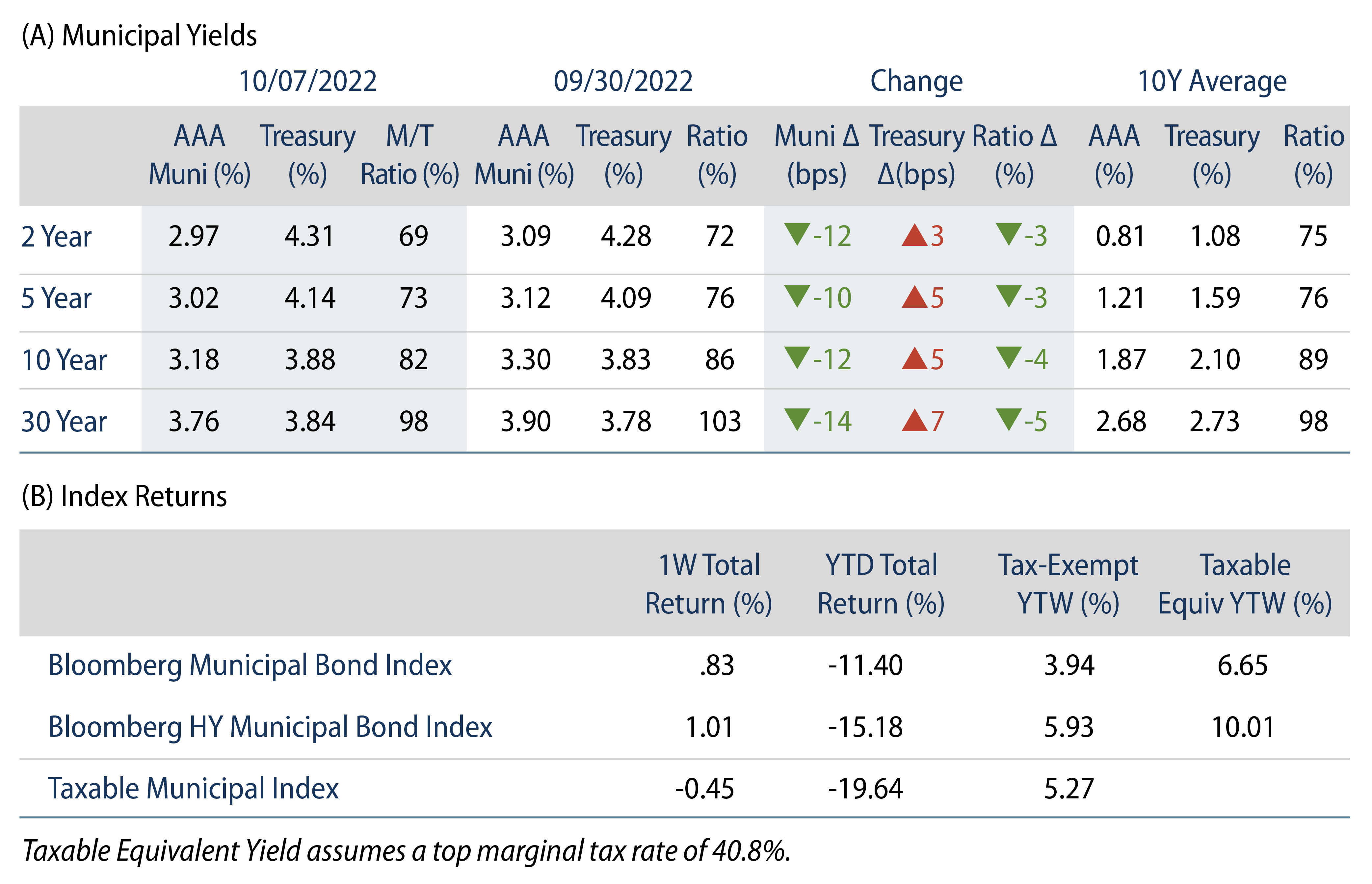

Municipals posted positive returns last week despite higher Treasury rates. High-grade municipal yields moved 10-14 bps lower across the curve. Municipals outperformed Treasuries, which reacted to strong economic data and hawkish Fed commentary. Meanwhile, municipal outflows continued amid light supply conditions. The Bloomberg Municipal Index returned 0.83% while the HY Muni Index returned 1.01%. As we enter the last quarter of a volatile year, this week we provide a third quarter recap.

Technicals Were Mixed as Municipal Fund Outflows Were Offset by Light Supply Conditions

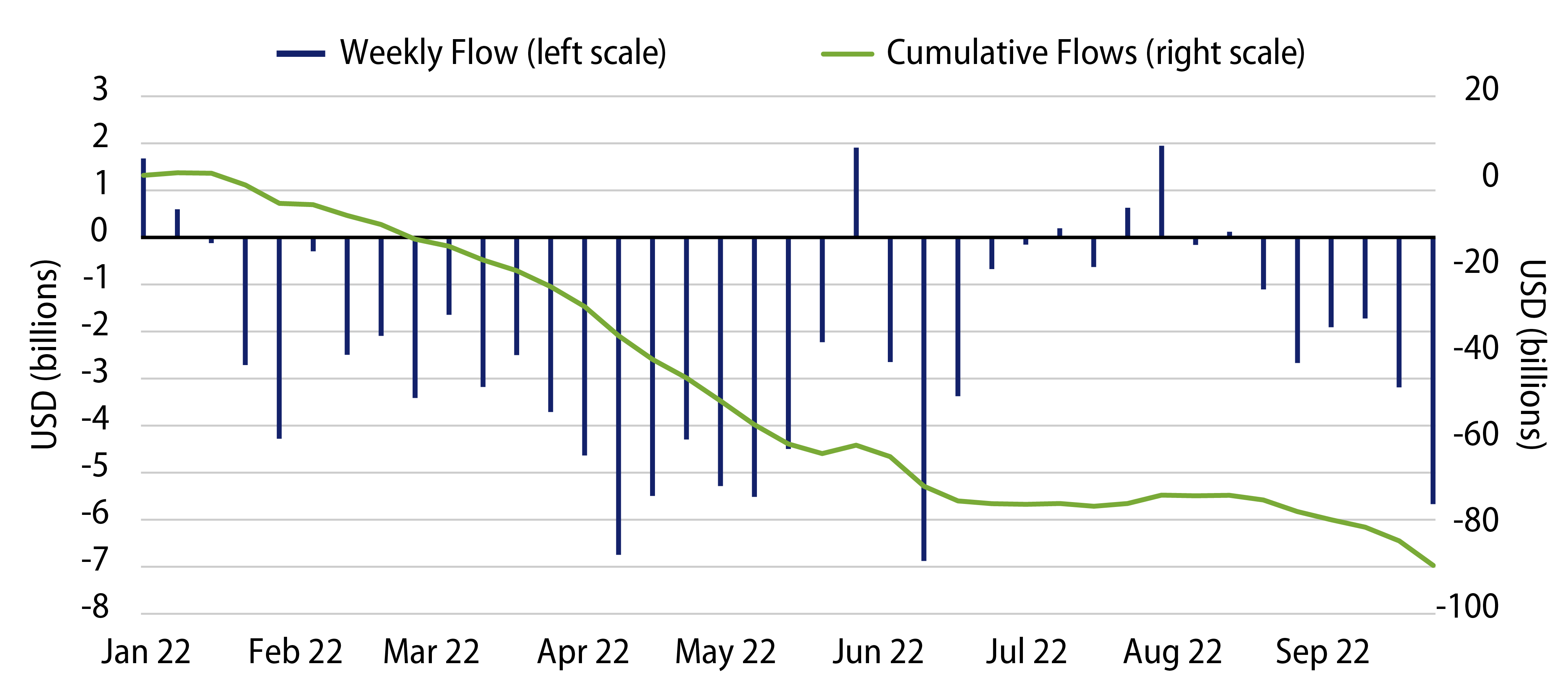

Fund Flows: During the week ending October 5, weekly reporting municipal mutual funds recorded $2.1 billion of net outflows, according to Lipper. Long-term funds recorded $1.2 billion of outflows, high-yield funds recorded $766 million of outflows and intermediate funds recorded $537 million of outflows. The week’s outflows extend year-to-date (YTD) outflows to $92 billion.

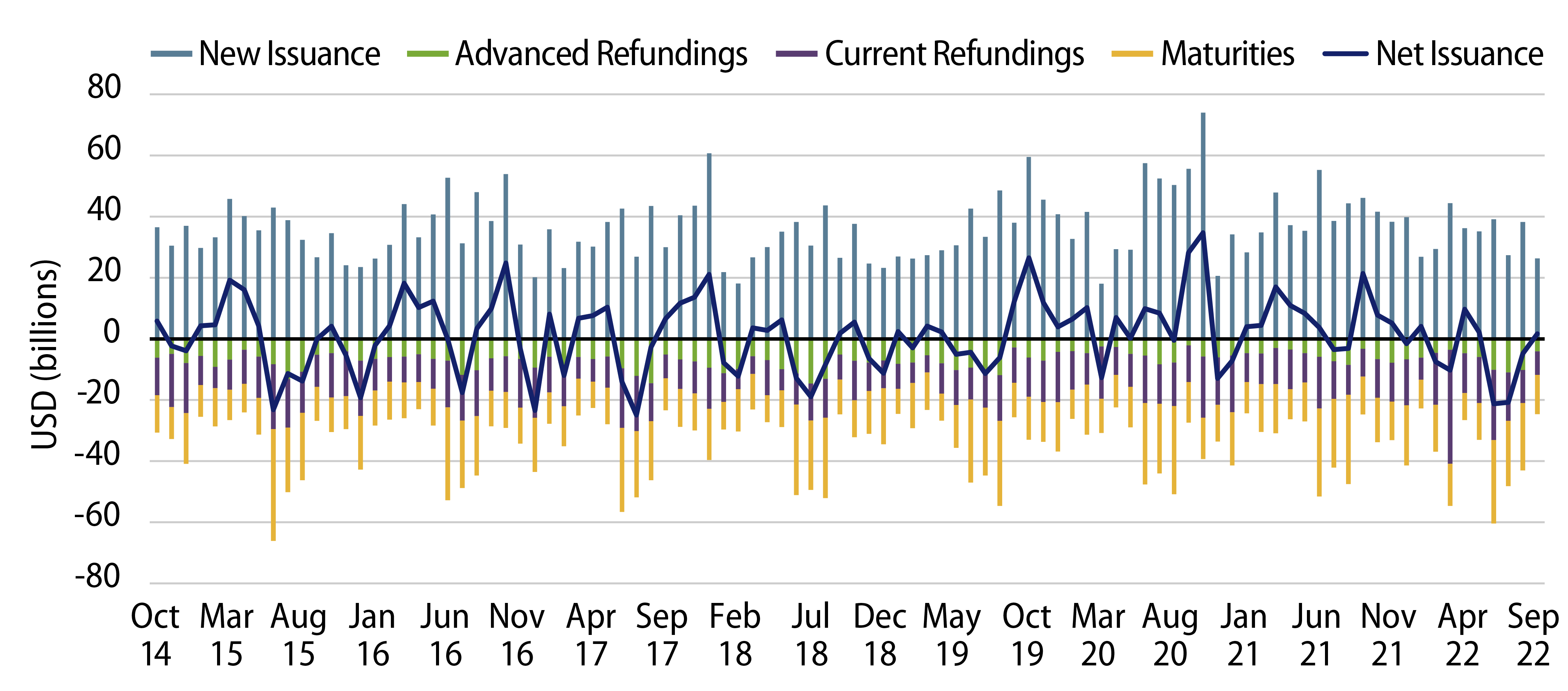

Supply: The muni market recorded $4.9 billion of new-issue volume last week, down 33% from the prior week. Total YTD issuance of $299 billion is 14% lower than last year’s levels, with tax-exempt issuance trending 3% lower year-over-year (YoY) and taxable issuance trending 48% lower YoY. This week’s new-issue calendar is expected to decline to $2 billion due to the holiday. Larger deals include $500 million New Jersey Turnpike Authority and $129 million Leander Independent School District transactions.

This Week in Munis: Third Quarter Review

3Q22 Municipal Performance Extended Historically Large Market Drawdowns: The Bloomberg Municipal Index returned -3.46% in the third quarter, resulting in YTD returns to -12.13% and contributing to the greatest drawdown since the index’s inception. The Bloomberg High Yield Index returned -4.83%. The investment-grade municipal bond index outperformed the Bloomberg U.S. Treasury Index (-4.35%) and the U.S. Corporate Index (-5.06%) during the quarter.

As we have seen in prior rate-hiking cycles, municipals outperformed other major fixed-income asset classes YTD as yields moved higher at a slower pace. We attribute this to the increasing value of the muni tax-exemption at higher nominal rates.

Market Technicals Weakened as Negative Fund Flows Overwhelmed Limited Supply Conditions: Demand for tax-exempt municipals continued to wane in the third quarter, as municipal mutual funds recorded $14 billion of net outflows during the quarter, according to ICI. Market participants were hopeful the record outflow cycle would abate as municipal fund flows fluctuated between positive and negative levels through the first half of the quarter, but fund outflows ultimately accelerated through the end of September, reaching new record highs.

Regarding supply, in a prior note we anticipated that higher nominal rates and summer holidays would contribute to lower new-issue volume, which when combined with elevated maturity activity would drive negative net new issuance. These trends were realized when total new-issue volume of $92 billion in 3Q22 was down 29% from 3Q21, contributing to a net supply of -$24 billion, compared to +$15 billion in 3Q21.

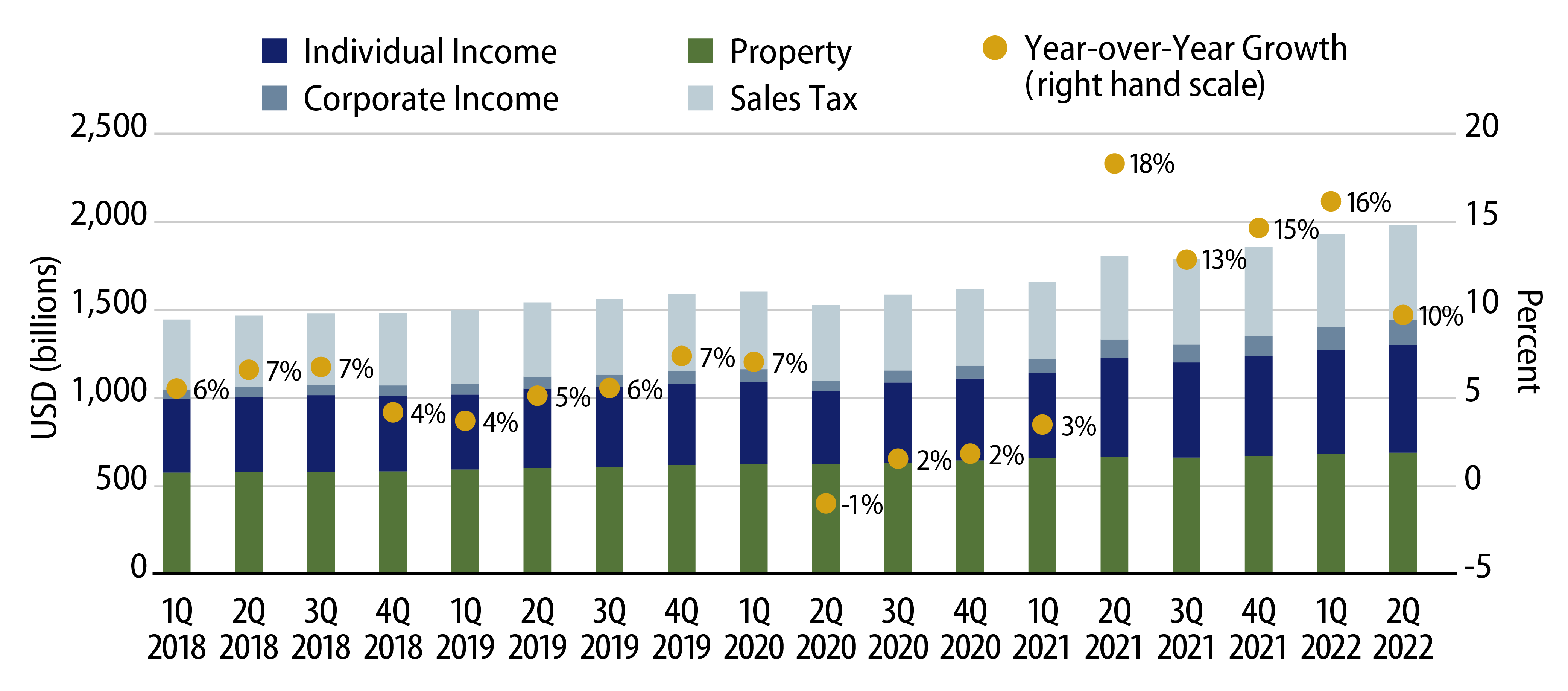

Municipal Fundamentals Continue to Improve: In September, the Census released state and local tax revenue collections for 2Q22, which continue to highlight strong YoY growth driven by favorable labor and housing conditions. Second quarter state and local tax collections were up 11% from the prior year to $532 billion. Individual income tax collections increased 12% to $203 billion, corporate income tax collections increased 29% to $55 billion, property tax collections increased 6% YoY to $124 billion, and sales tax collections increased 7% to $150 billion. Second quarter revenues tend to coincide with the fiscal year-end for many municipalities, and these strong revenue collections should bode well for upcoming financial releases.

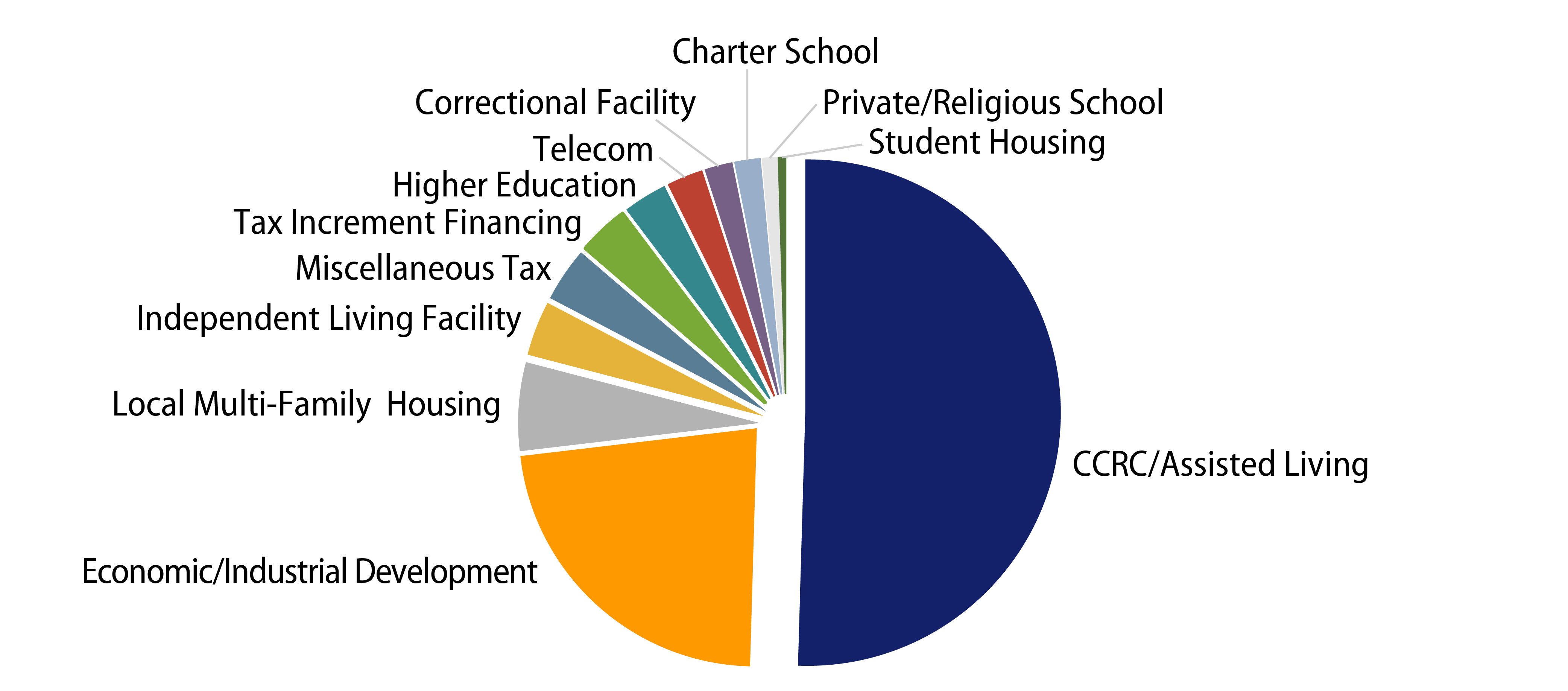

Municipal defaults remain limited and contained to select high-yield sectors. Through September 19, the municipal market recorded 30 debt service payment defaults totaling $853 million, down from the 41 defaults that totaled $1.6 billion through the first nine months of 2021. Similar to recent years, over 50% of outstanding defaulted issuance (by par value) was driven by high-yield Continuing Care and Retirement Community (CCRC) and Assisted Living sectors.

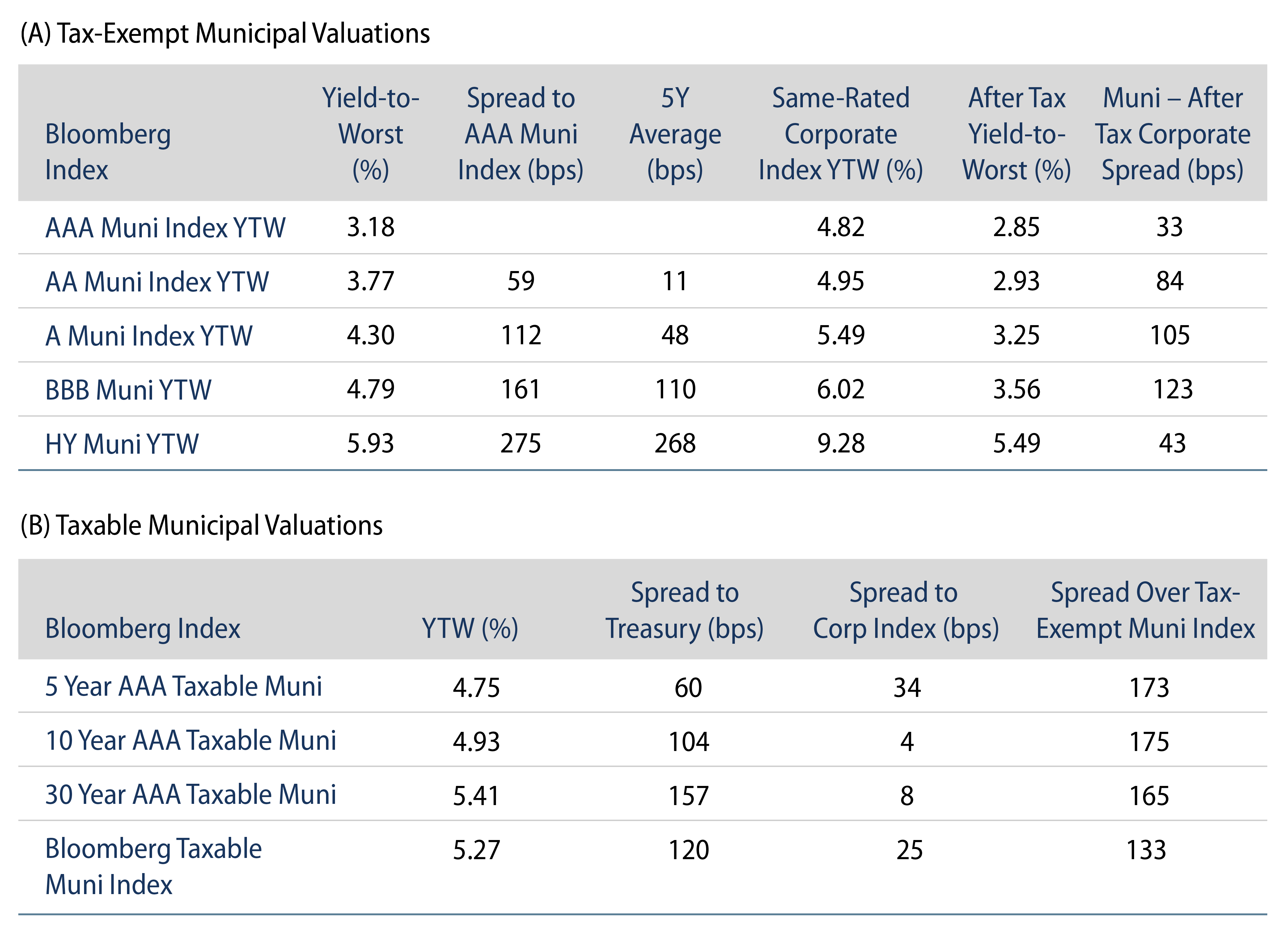

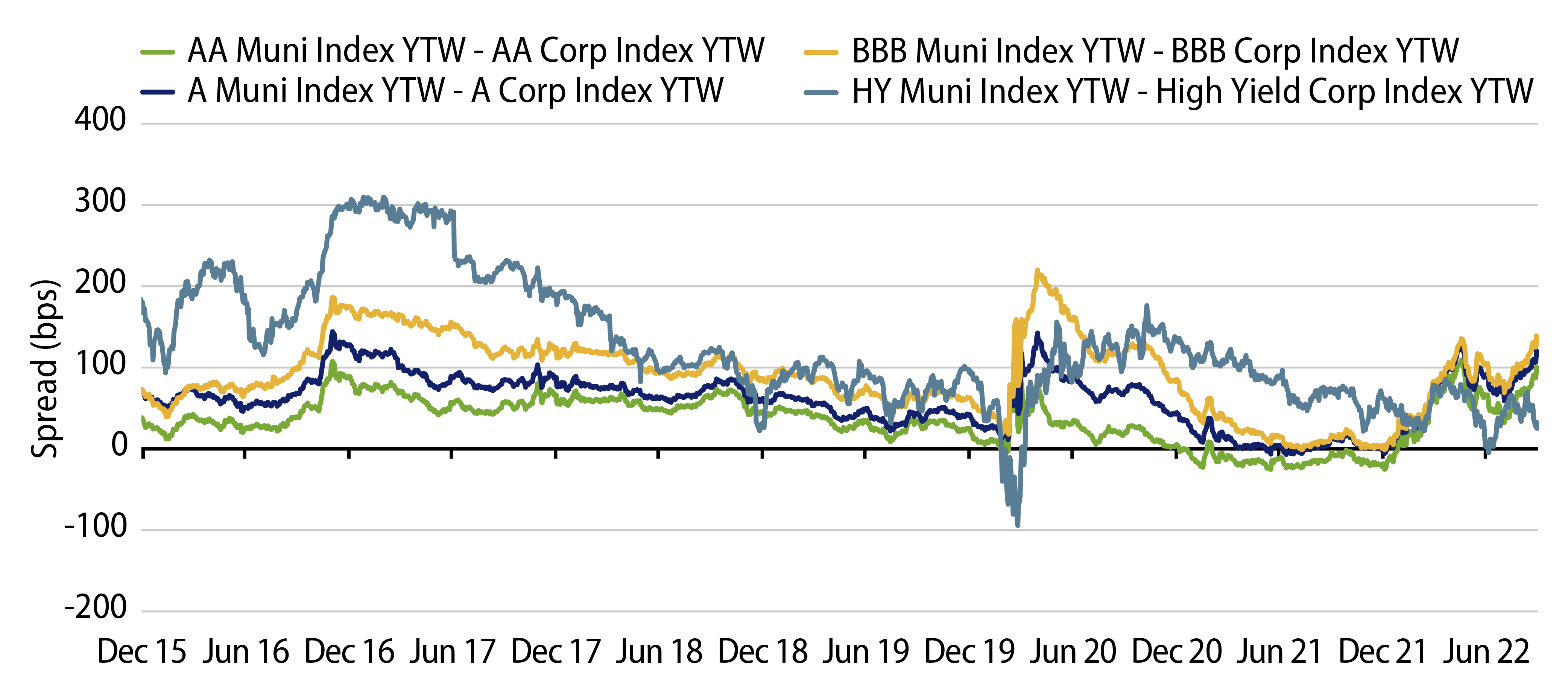

Municipal Valuations Are Attractive for Taxpayers, But Volatility Could Persist: Western Asset believes that municipals will continue to offer value for most investors subject to tax rates. Considering the highest marginal tax rate, investment-grade municipal index yields now offer 100 bps of excess after-tax spread versus comparably rated corporate credit. High-yield municipal relative value is less compelling from this perspective, with the longer duration High Yield Municipal Index offering just 30 bps relative to the High Yield Corporate Index, below historical averages.

As we begin 4Q22, we believe volatile market conditions could persist. In addition to the uncertainty around inflation, the potential for higher supply conditions as well as an increased likelihood for a hard landing could negatively impact high-yield municipal credit spreads. As such, Western Asset believes that investors are better compensated in higher grade, more liquid allocations that could better withstand volatile conditions and provide the flexibility to take advantage of outsized market weakness.