Macros, Markets and Munis

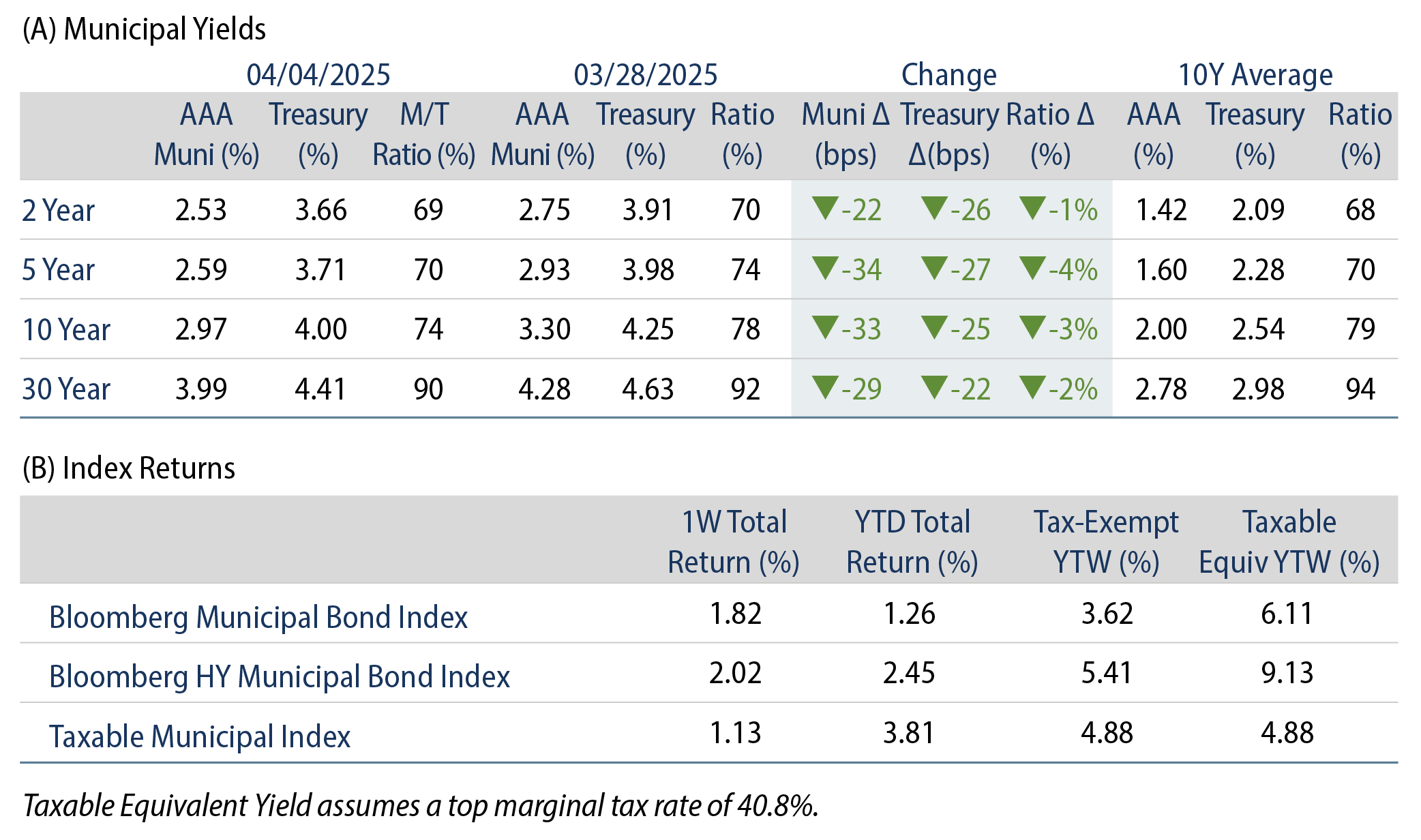

Municipals posted positive returns last week as Treasury yields fell over 20 basis points (bps) across the yield curve. Munis generally outperformed, particularly in 5- and 10-year maturities where yields moved over 30 bps lower. Market volatility and risk-off sentiment spiked following President Trump’s broad-based tariff announcement. From an economic data standpoint, nonfarm payrolls handily exceeded expectations, but the strong jobs report was muted relative to the longer-term growth concerns associated with tariff policies. Meanwhile, technicals remained challenged by elevated supply and fund outflows. This week we highlight traditionally challenged technicals observed during tax season.

Elevated Supply and Fund Outflows Persisted Ahead of Tax Day

Fund Flows (down $232 million): During the week ending April 2, weekly reporting municipal mutual funds recorded $232 million of net outflows, according to Lipper. Long-term funds recorded $364 million of outflows, intermediate funds recorded $44 million of outflows and high-yield funds recorded $96 million of outflows. Last week’s outflows marked a fourth consecutive week of net outflows amid the seasonal tax season weakness and led year-to-date (YTD) inflows lower to $10 billion.

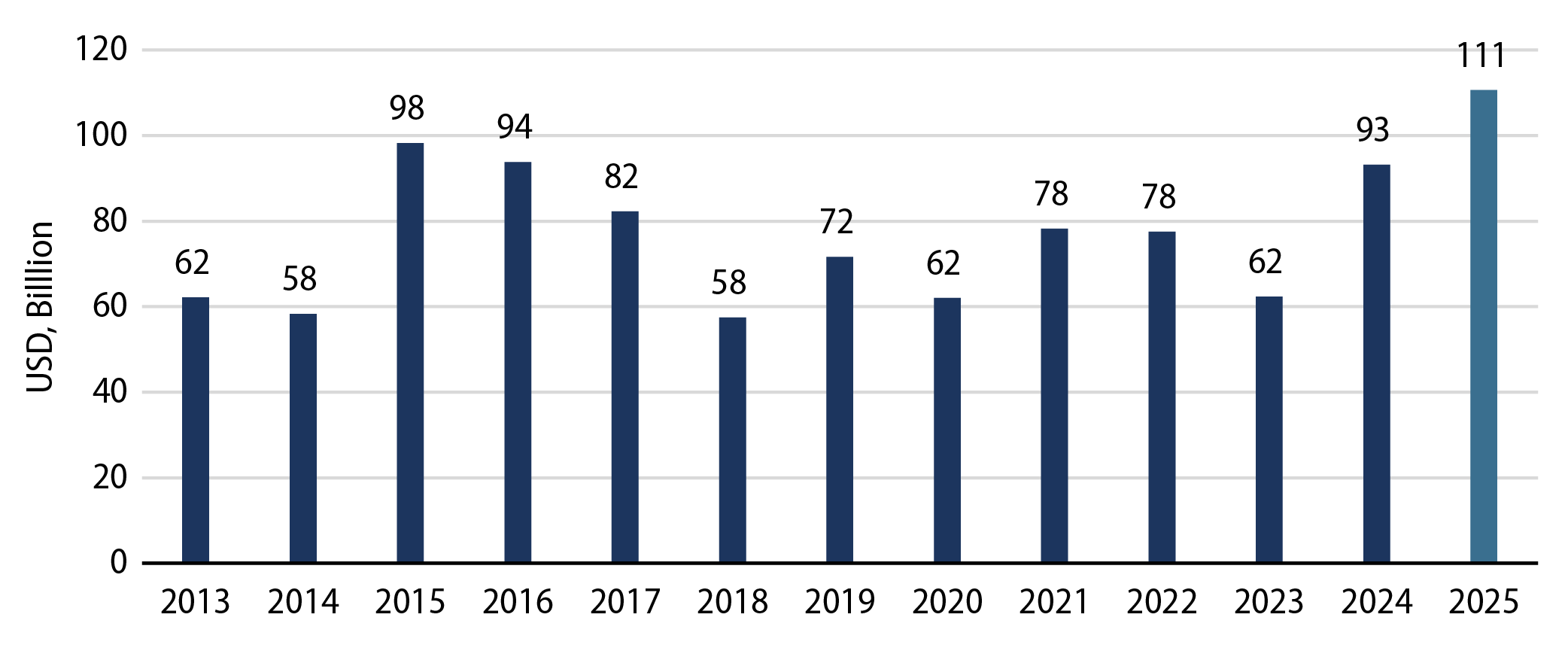

Supply (YTD supply of $134 billion; up 34% YoY): The muni market recorded $13 billion of new-issue supply last week, nearly double the prior week’s issuance. YTD, the muni market has recorded $134 billion of new issuance, up 34% year-over-year (YoY). Tax-exempt and taxable issuance are up 33% and 45% respectively, though tax-exempt issuance has comprised the vast majority (95%) of YTD supply. This week’s calendar is expected to increase and remain elevated at $12 billion. The largest deals include $1.75 billion taxable New York City General Obligations and $1.5 billion tax-exempt New York City General Obligation transactions.

This Week in Munis: Tax Season Technical Weakness

The municipal market sold off in March and returned -1.69% while most taxable fixed-income sectors posted positive returns. Historically, the weeks leading up to the April 15 tax day have been challenging for the municipal market, often due to weaker supply and demand dynamics. From 2009 to 2024, the Bloomberg Muni Bond Index returned an average -0.17% during the month of March, the second lowest average return across months.

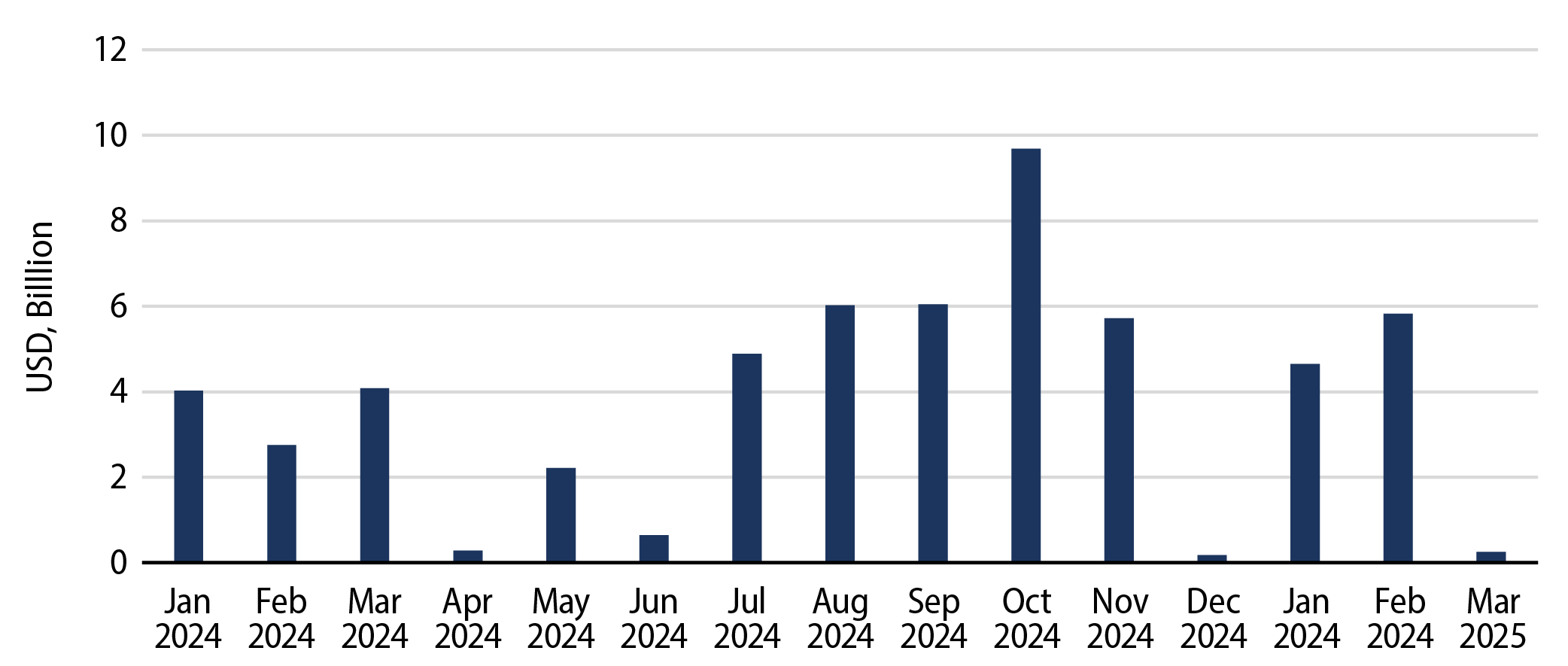

A key factor contributing to the weakened demand for municipal securities during March and April is the increasing selling activity by taxpayers that liquidate their municipal holdings to cover tax liabilities. This year, the demand for munis diminished after a period of consistent fund inflows since the start of 2024. According to Lipper, weekly and monthly reporting muni mutual funds recorded $1 billion in outflows during March. Additionally, the Investment Company Institute (ICI) weekly estimates indicated a significant drop in municipal fund inflows to $252 million in March, a sharp decline from the $4.6 billion and $5.8 billion of inflows recorded in January and February, respectively.

In addition to weaker demand conditions, municipal supply in March tends to be above average and weighs on technicals. March 2025 issuance reached $43 billion, up 15% from the prior year that ultimately represented a record year for muni issuance. The muni market has been dealing with a significant increase in supply throughout the year, with total issuance reaching $111 billion through the first quarter, a 19% increase compared to Q1 2024.

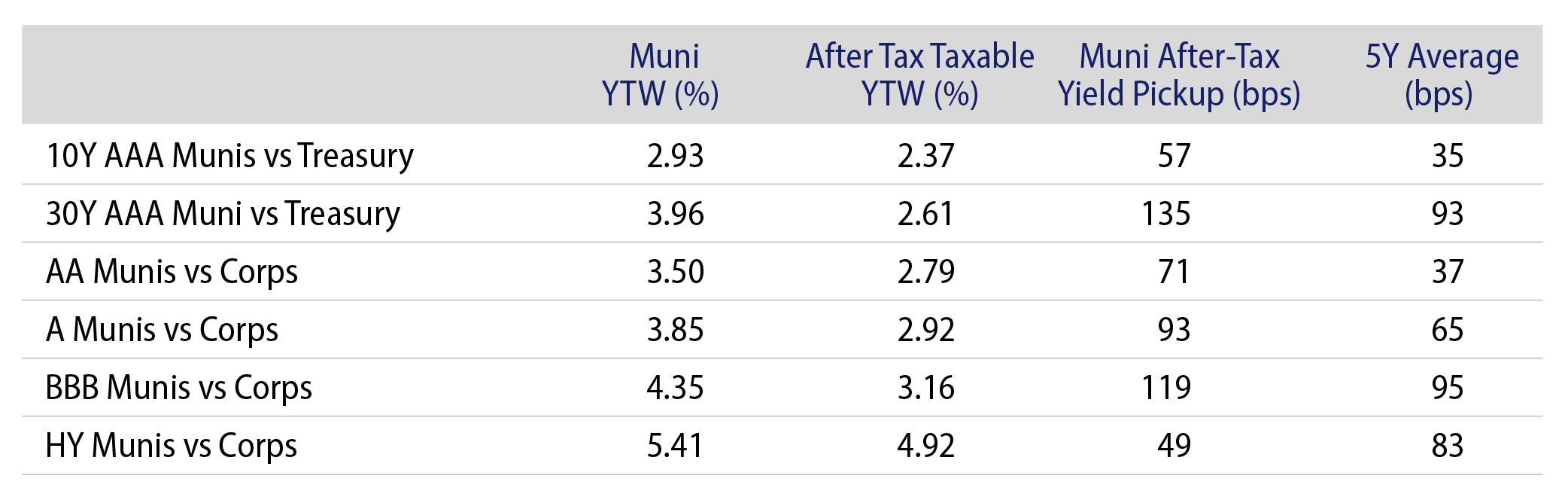

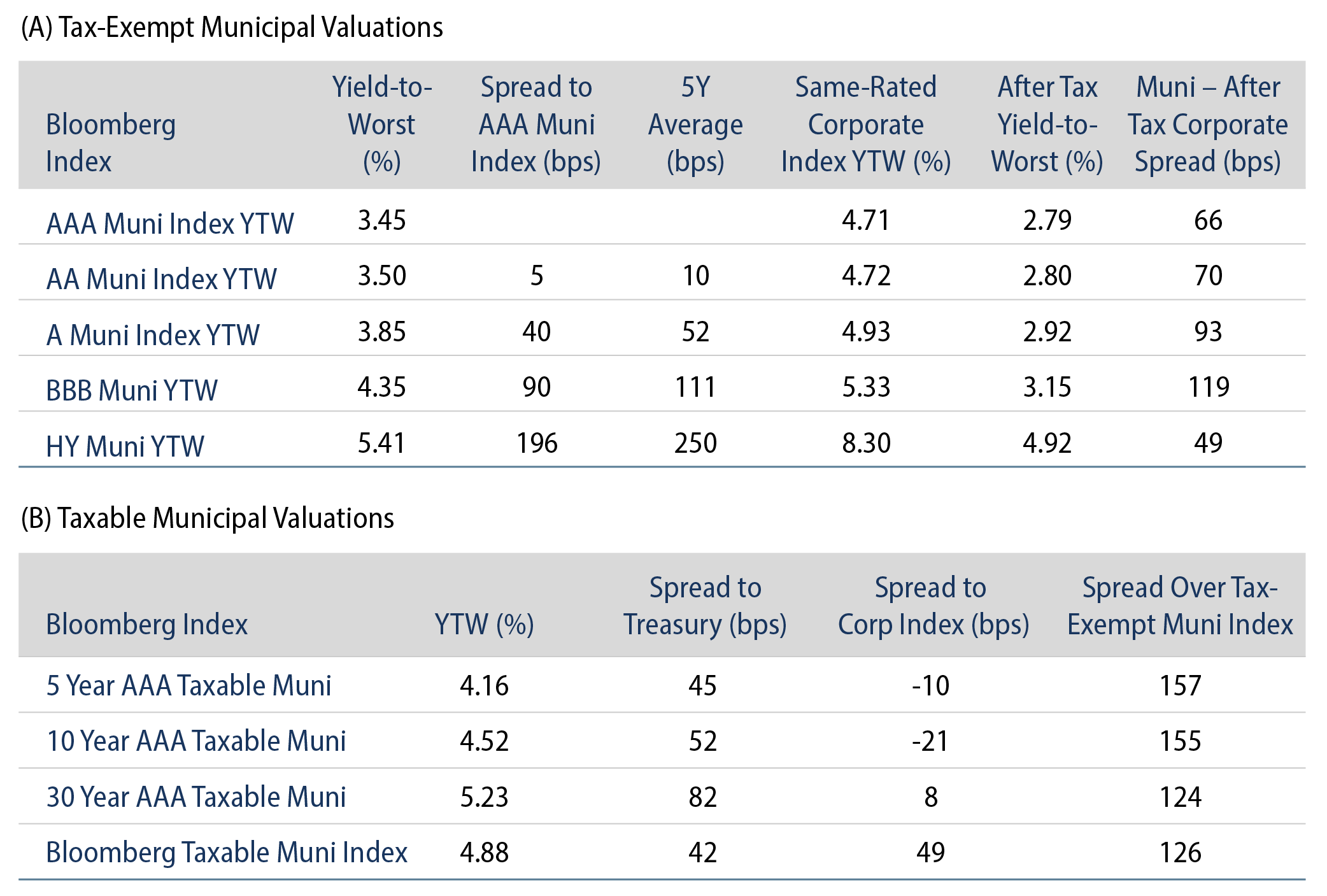

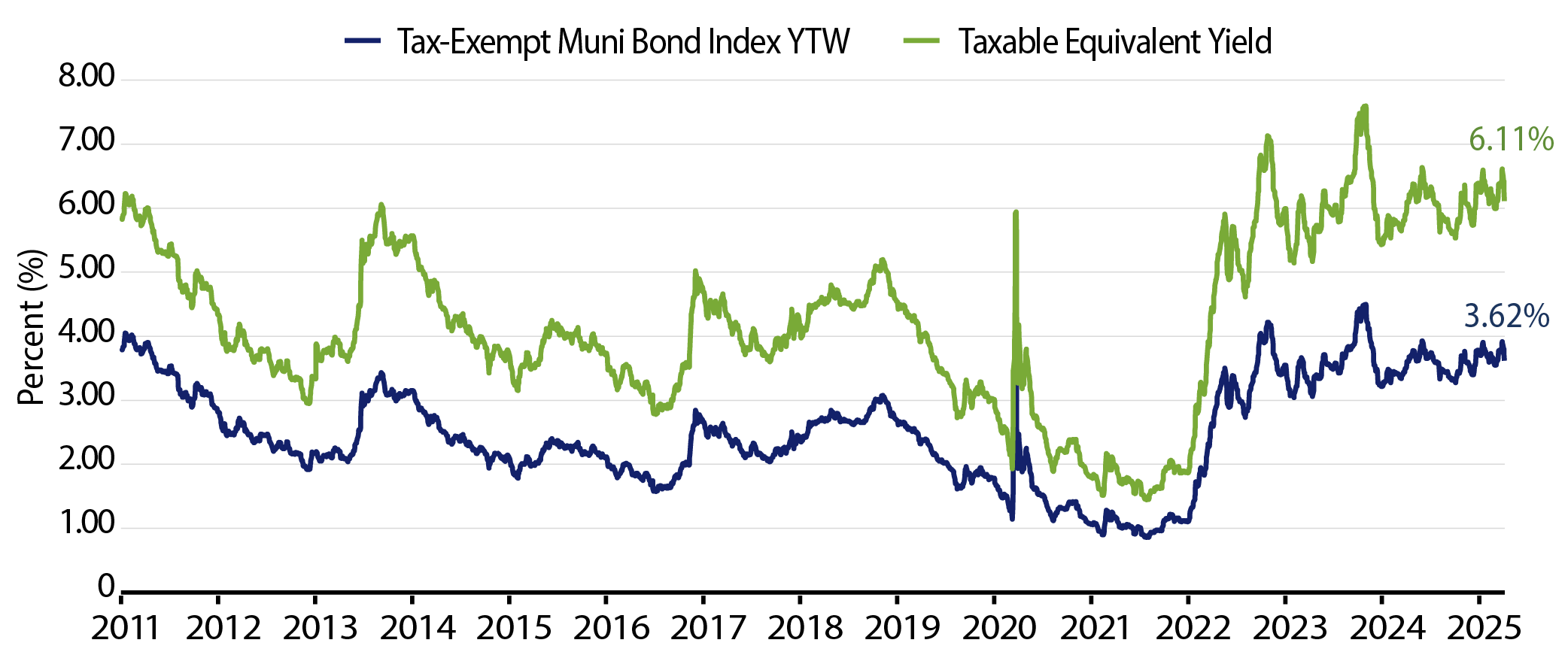

The sharp underperformance of the muni asset class in March has contributed to improved tax-exempt income and after-tax relative value opportunities. The Bloomberg Municipal Bond Index average yield-to-worst ended the year at 3.85%, up over 50 bps from the start of the year and equivalent to 6.50% on a taxable-equivalent basis when considering the highest federal income tax bracket. These improved tax-exempt income opportunities have contributed to better after-tax yield pickup versus taxable fixed-income alternatives. From our perspective, tax-exempt munis support a particularly attractive risk-adjusted value proposition considering the volatile market backdrop.

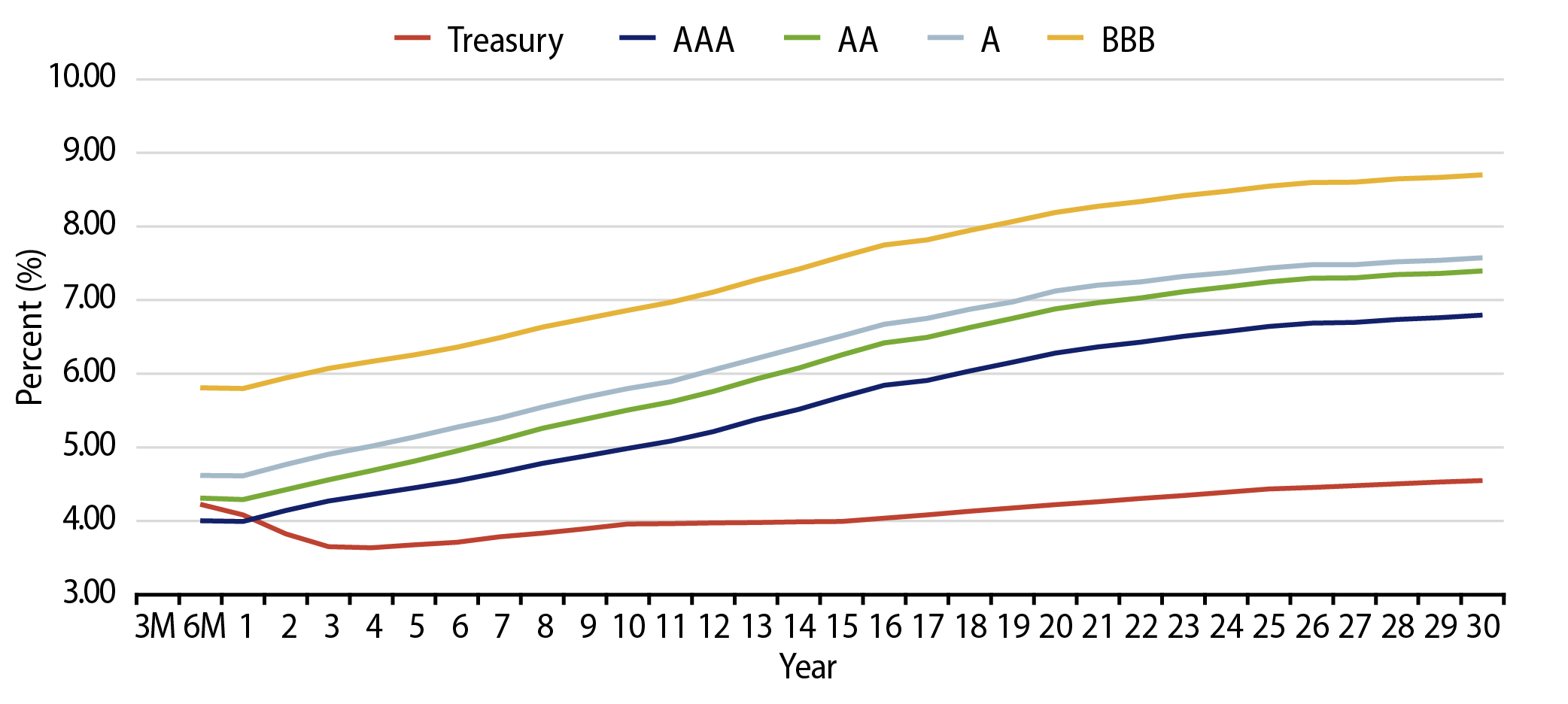

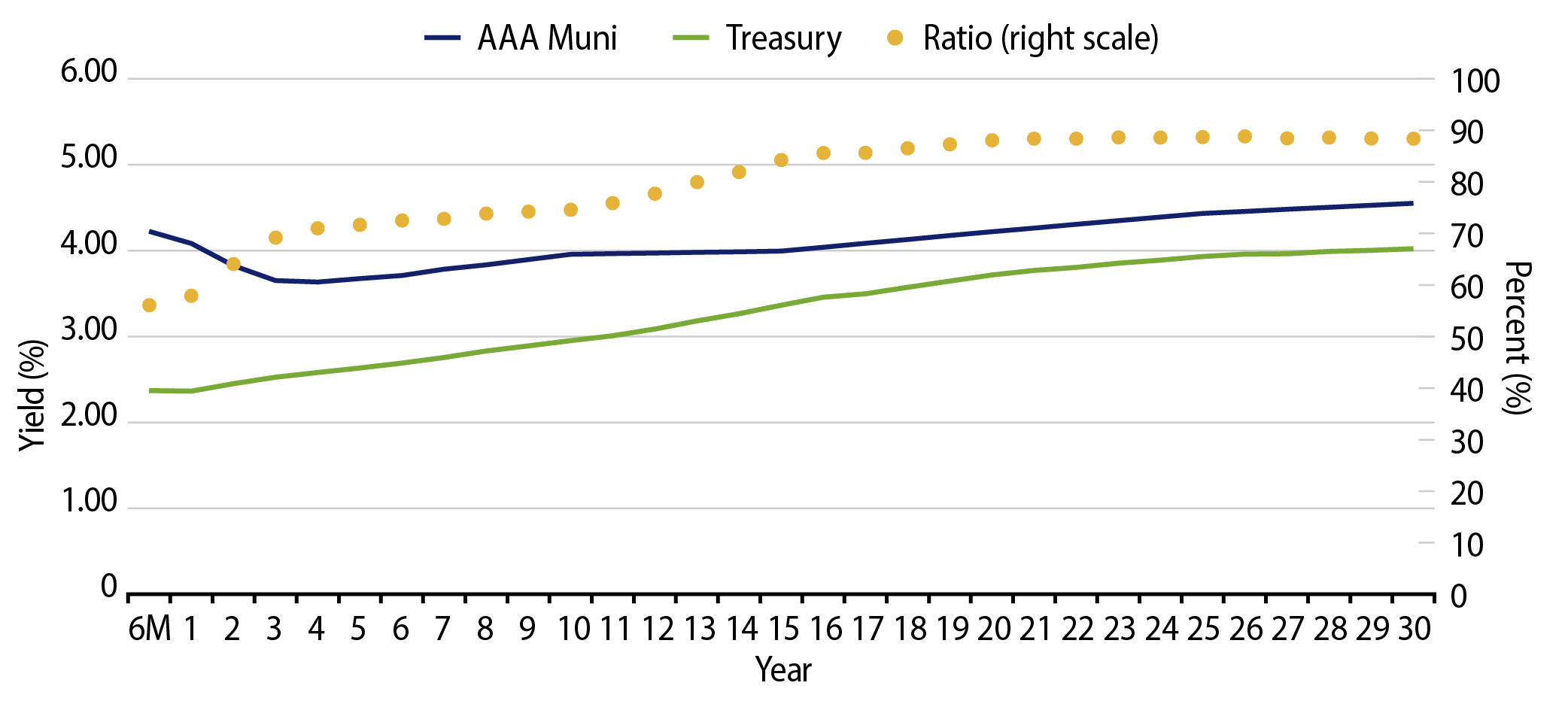

Municipal Credit Curves and Relative Value

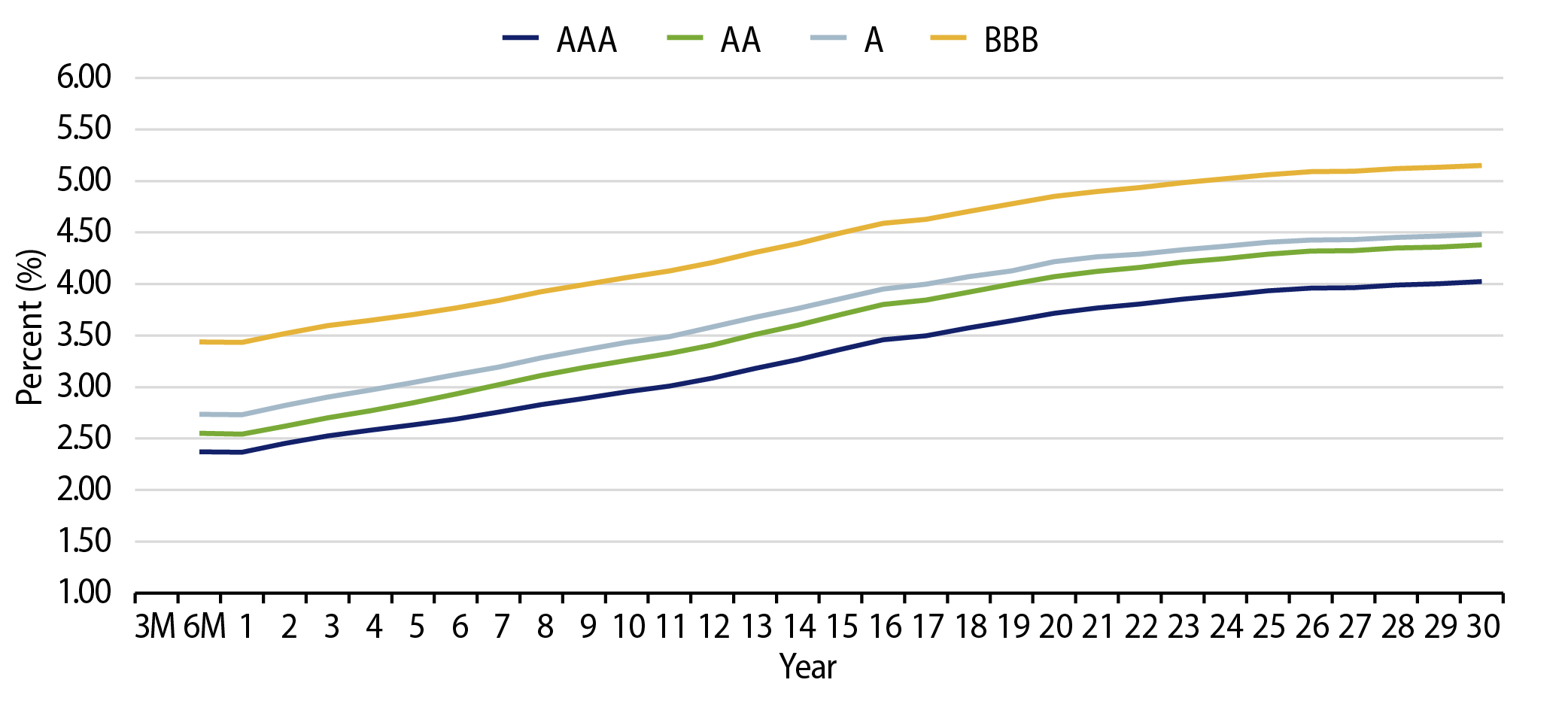

Theme #1: Municipal taxable-equivalent yields and income opportunities remain above decade averages.

Theme #2: The muni curve has steepened, offering better value in intermediate and longer maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.