Macros, Markets and Munis

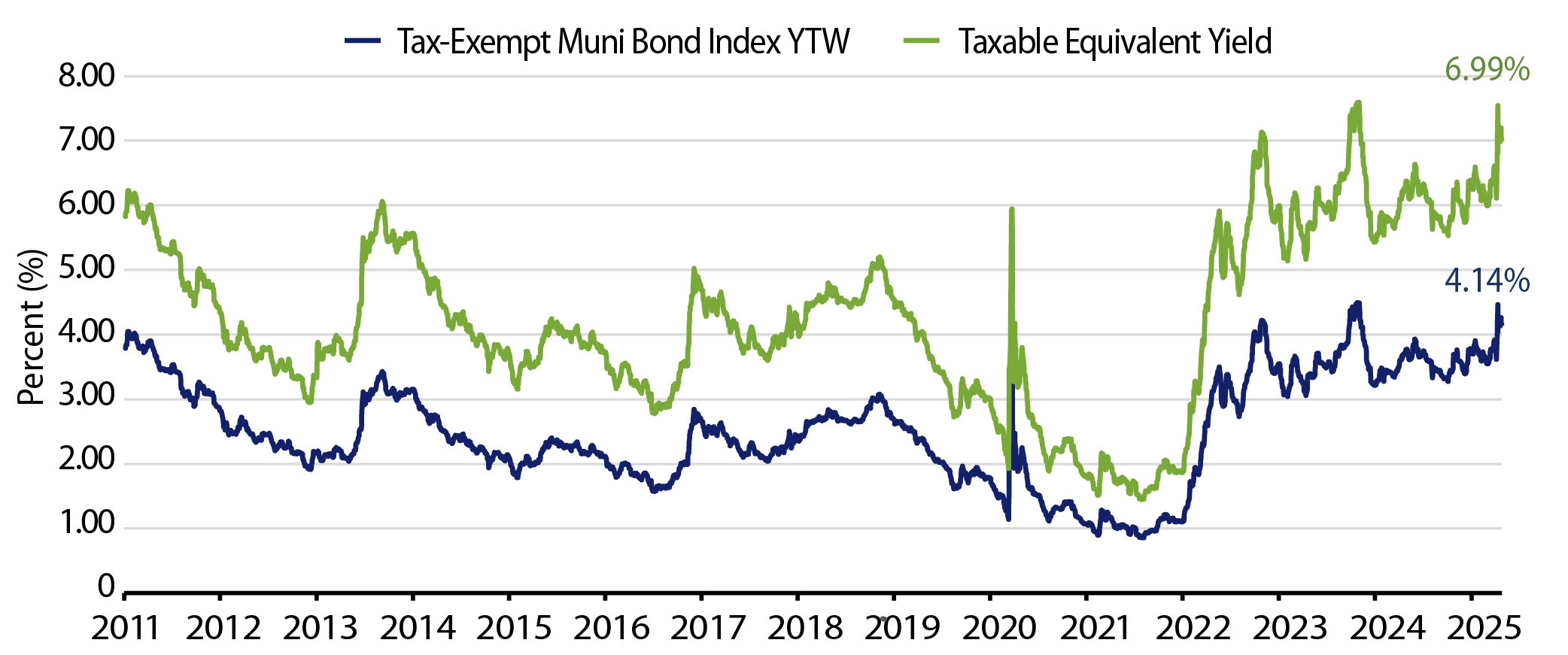

Municipals posted positive returns last week as Treasury yields moved 5-10 basis points lower across the yield curve, but munis generally underperformed as demand remained weak and supply reached the highest level of the year. Market volatility abated last week as the Trump administration continued to signal concessions from its earlier tariff proposals amid a relatively quiet week of economic data. Initial jobless claims were in line with expectations, while the University of Michigan sentiment index moved higher, beating expectations. This week we highlight evolving tax policy rhetoric that can impact municipal valuations.

Market Technicals Remained Challenged by Elevated Supply, Fund Outflows

Fund Flows (down $397 million): During the week ending April 23, weekly reporting municipal mutual funds recorded $397 million of net outflows, according to Lipper. Long-term funds recorded $1.1 billion of outflows, intermediate funds recorded $7 million of outflows and high-yield funds recorded $142 million of outflows. Last week’s outflows marked a seventh consecutive week of net outflows and led year-to-date (YTD) inflows lower to $5 billion.

Supply (YTD supply of $166 billion; up 34% YoY): The muni market recorded $16 billion of new issue supply last week, the highest weekly supply level of the year. YTD, the muni market has recorded $166 billion of new issuance, up 34% year-over-year (YoY). Tax-exempt and taxable issuance are up 33% and 45%, respectively, though tax-exempt issuance has comprised the vast majority (93%) of YTD supply. This week’s calendar is expected to remain elevated at $15 billion. The largest deals include $2 billion District of Columbia Income Tax and $994 million Los Angeles Department of Water and Power (Power System) transactions.

This Week in Munis: Tax Rhetoric Shifts

Entering 2025, expected tax policy changes were a key focus, considering the new administration and the end-of-year expiration of the individual tax reductions associated with the 2017 Tax Cuts and Jobs Act. It has been widely expected that the current tax regime would be either extended or lowered, considering the Republican majority in Congress. Surprisingly, this month it has been reported that the White House has considered increasing the top individual marginal tax rate from 37% to 40% to offset the costs of other budgetary initiatives.

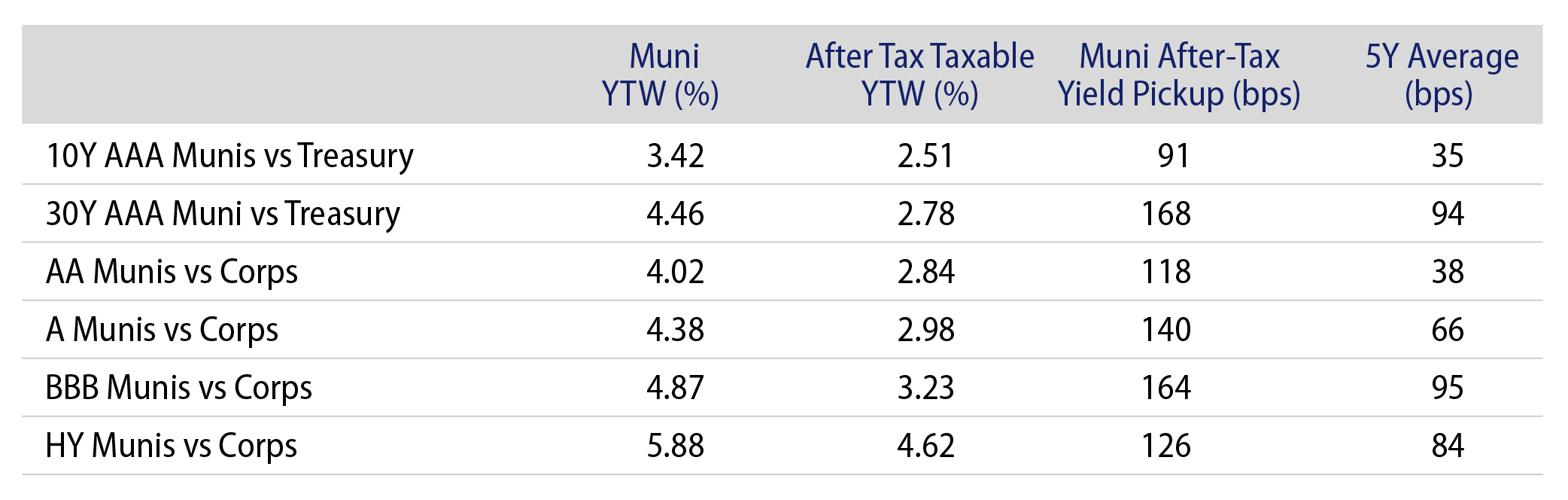

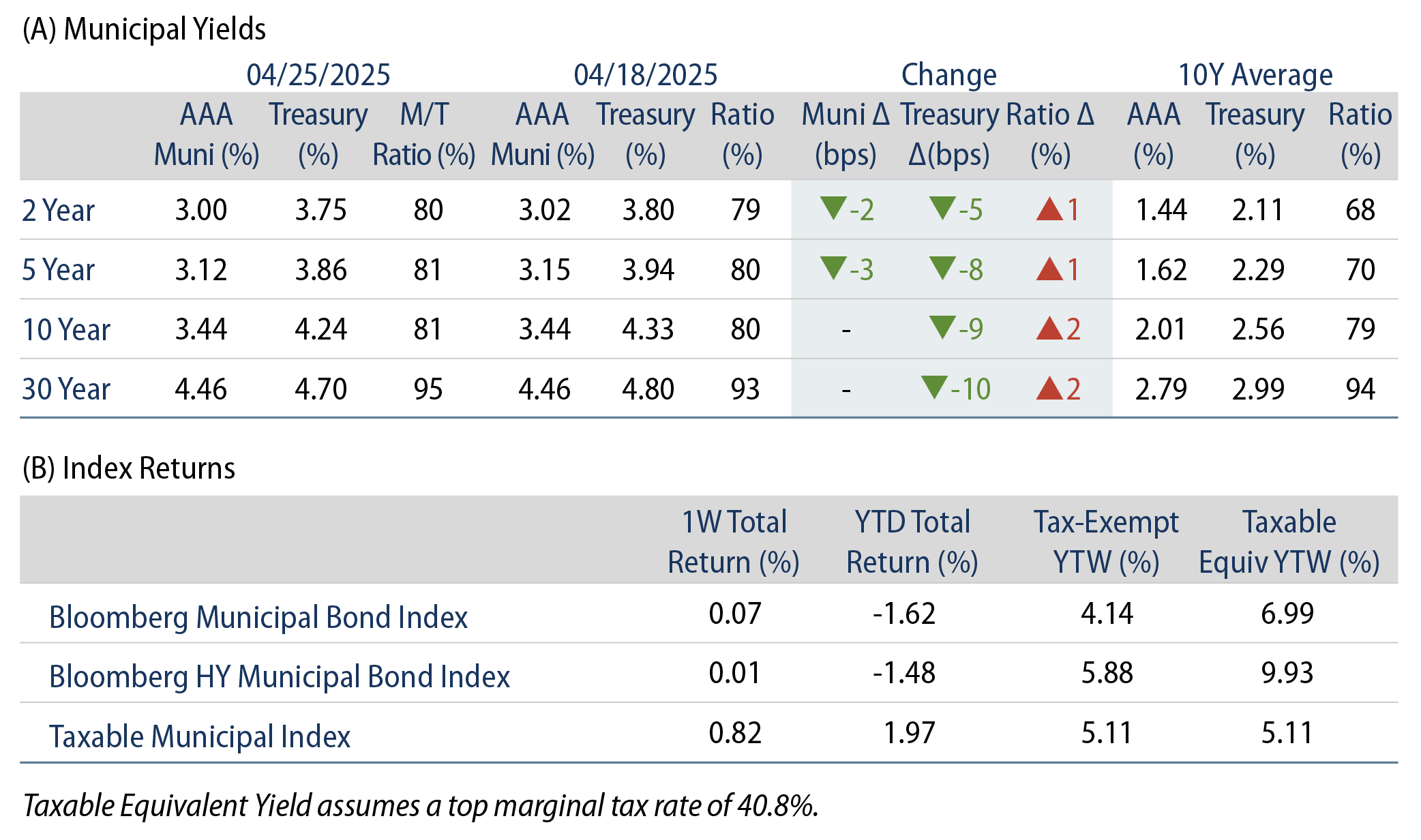

All else equal, a 3% increase to the top tax bracket would significantly impact the relative value of municipal debt. Considering a new 43.8% top marginal tax rate, the investment-grade Bloomberg Municipal Bond Index average taxable-equivalent yield-to-worst (YTW) would improve from 6.99% to 7.37%, a level that well exceeds the yield of the lowest investment-grade (BBB) corporate index.

Despite the headlines that some in the Trump administration would support higher tax rates for the highest earners, Western Asset attributes a low probability that such a measure would receive adequate congressional support to be enacted. Last week, Trump already softened the rhetoric by calling tax hikes “disruptive” and highlighting the concern of potential outmigration. However, the mere fact that rhetoric is moving away from lower tax rates (which diminish the value of the tax exemption) could lead to a positive shift in muni demand. Some attribute the YTD municipal underperformance to tax policy uncertainty. They also believe that the ultimate path of individual tax rates remaining unchanged or moving higher could contribute to a rebound in market sentiment.

Municipal Credit Curves and Relative Value

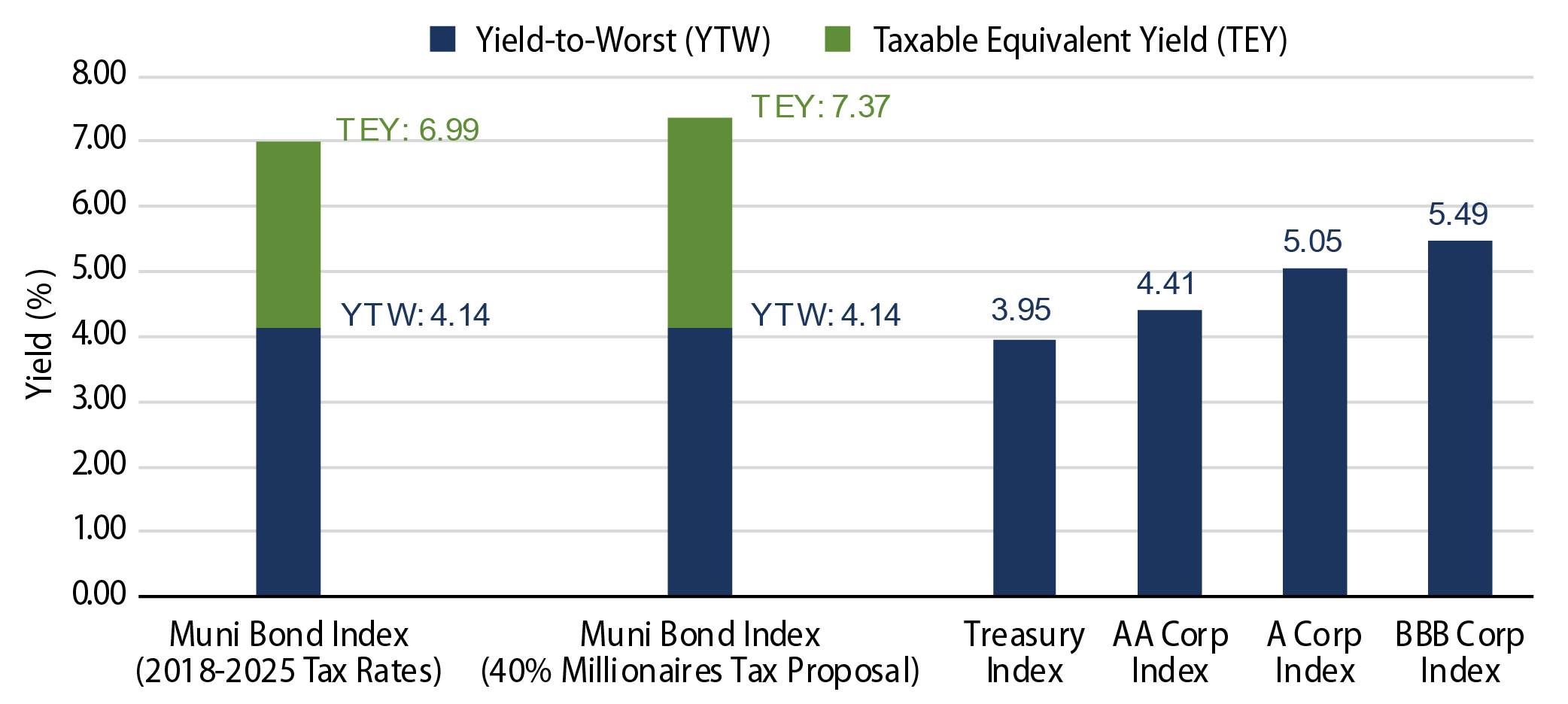

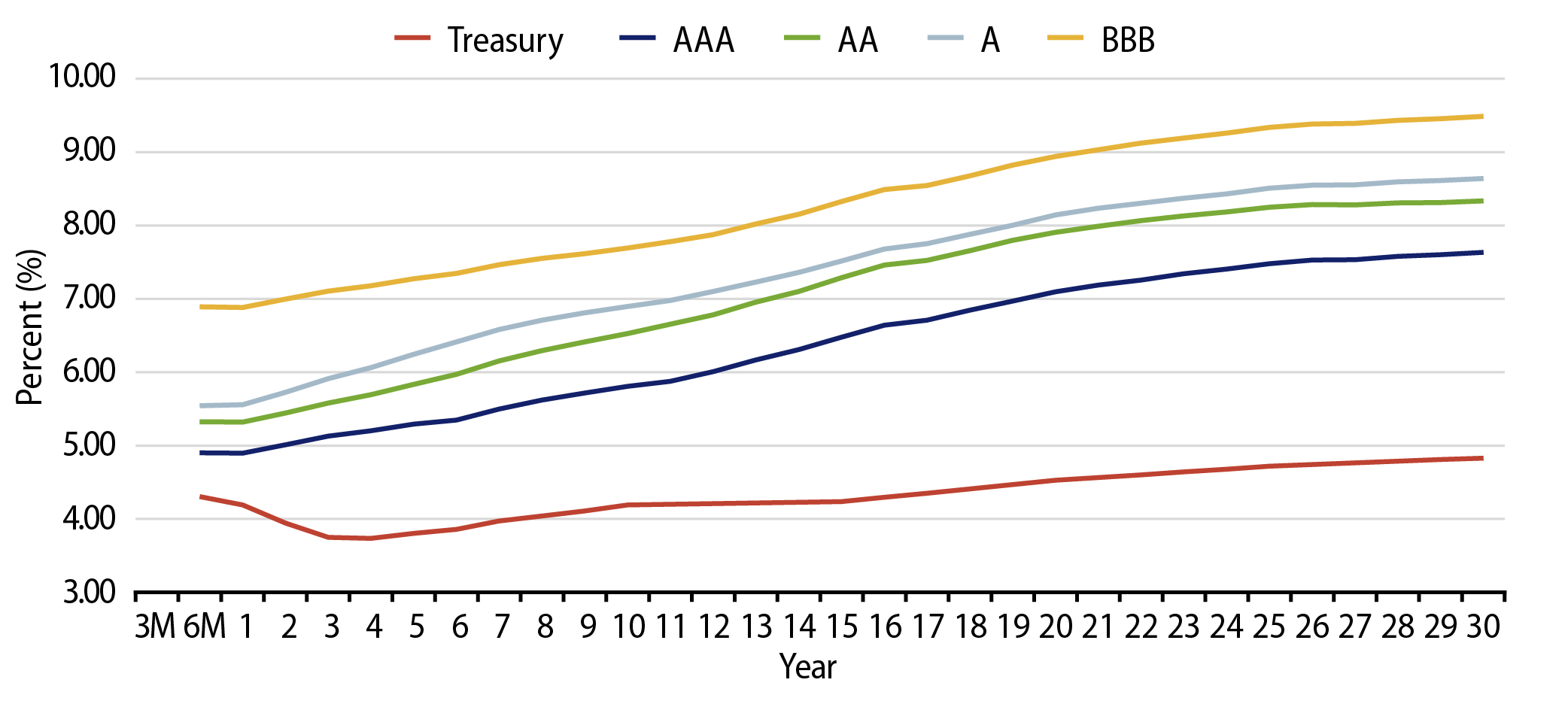

Theme #1: Municipal taxable-equivalent yields and income opportunities spiked to decade-high levels.

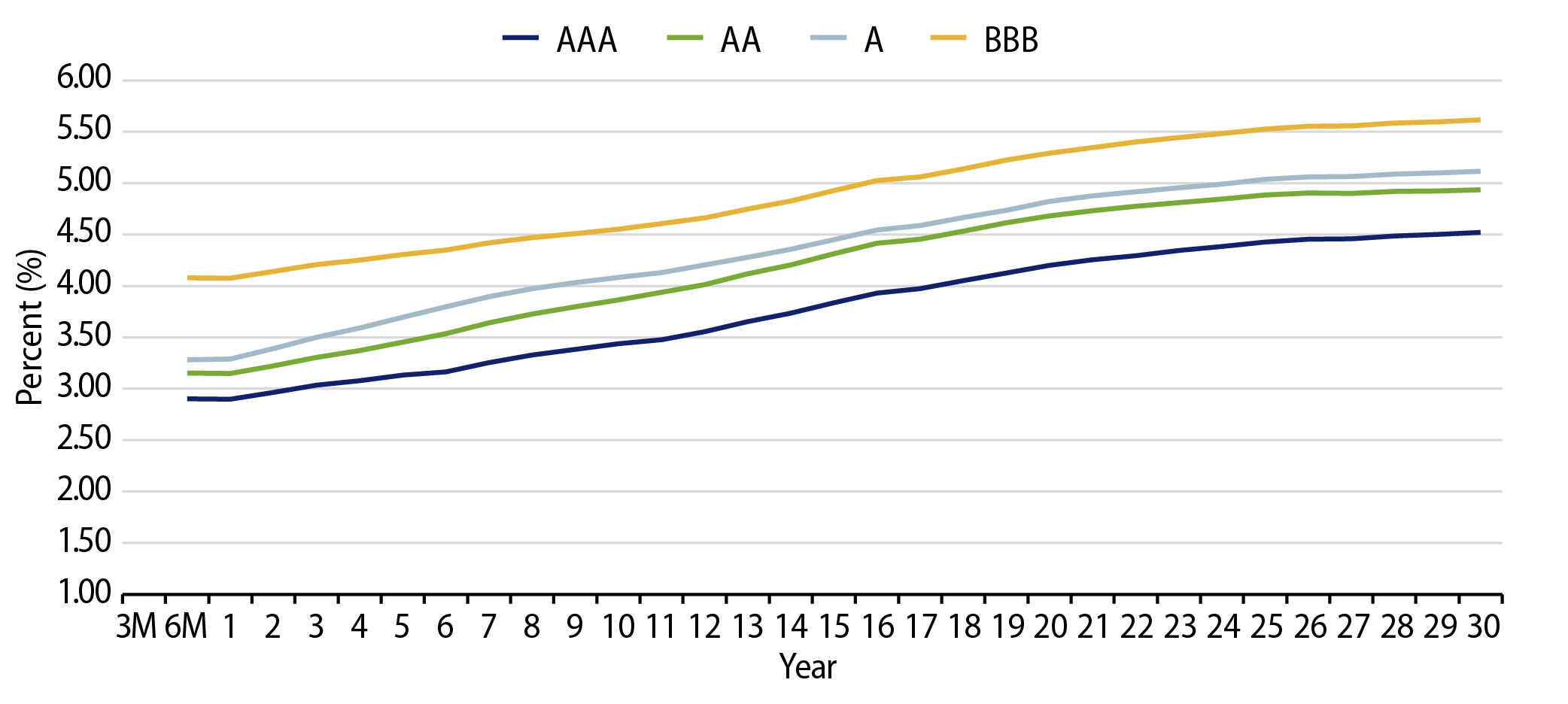

Theme #2: The muni curve has steepened, offering better value in intermediate and longer maturities.

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.