Municipals Posted Negative Returns

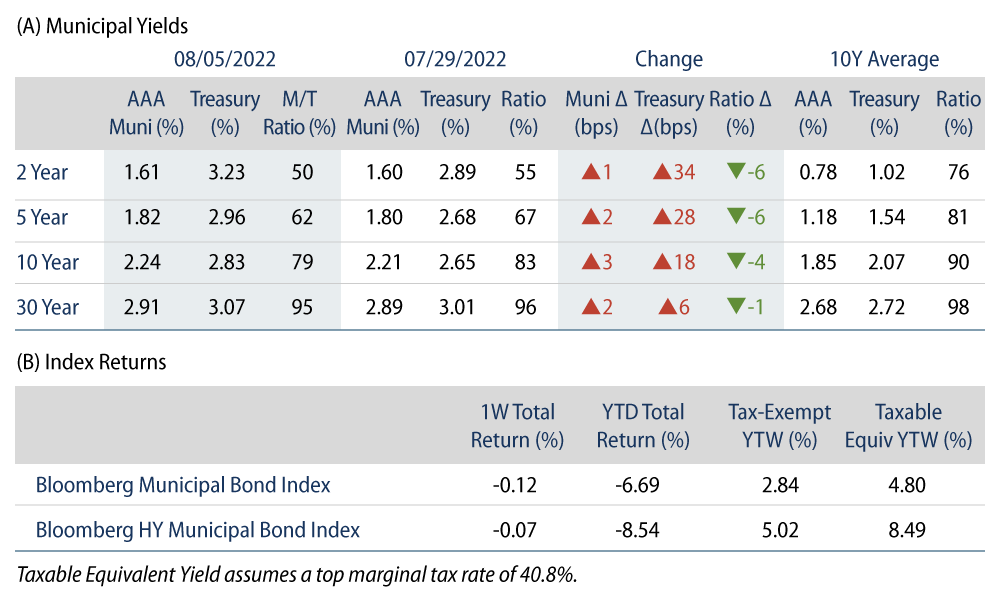

Municipals posted negative returns during the week, but outperformed the Treasury selloff that was driven by hawkish Fed comments and a favorable July jobs report. High-grade municipal yields moved 1-3 bps higher across the curve. Meanwhile, technicals continued to improve, as weekly reporting muni funds recorded inflows amid a light new-issue calendar. The Bloomberg Municipal Index returned -0.12% while the HY Muni Index returned -0.07%. This week we highlight municipal implications of the Inflation Reduction Act, which has quickly advanced through Congress last week.

Municipal Technicals Continue to Improve as Fund Flows Turn Positive

Fund Flows: During the week ending August 3, weekly reporting municipal mutual funds recorded $1.1 billion of net inflows, according to Lipper. Long-term funds recorded $1.3 billion of inflows, high-yield funds recorded $860 million of inflows and intermediate funds recorded $231 million of inflows. The week’s inflows mark the third week of inflows in the past four weeks, and decrease year to date (YTD) outflows to -$79 billion.

Supply: The muni market recorded $5 billion of new-issue volume, up from the prior week’s $2 billion calendar but still below average. Total YTD issuance of $237 billion is 9% lower than last year’s levels, with tax-exempt issuance trending 2% higher year-over-year (YoY) and taxable issuance trending 44% lower YoY. This week’s new-issue calendar is expected to pick up to $7 billion. Large transactions include $603 million Los Angeles Department of Airports and $600 million Southeast Energy Authority (Morgan Stanley Gas Pre-Pay) transactions.

This Week in Munis: Senate Passes Inflation Reduction Act, Which Avoids Key Municipal Provisions

Over the weekend the Senate passed the Inflation Reduction Act, focused on climate and health care initiatives. The reconciliation package is significantly pared back from and includes fewer municipal provisions than the $1.75 trillion Build Back Better (BBB) Act that ultimately failed to progress through Congress over the past year due to key Democratic senators’ lack of support.

Spending initiatives within the Inflation Reduction Act include $369 billion in energy and climate investments and $64 billion in Affordable Care Act (ACA) subsidies. From an energy perspective, subsidies will take effect over 10 years, funding nuclear facilities, clean hydrogen, expanding electric vehicle credits and providing $27 billion to establish a National Green Bank that can be levered to finance $500 billion of projects. The $64 billion of ACA subsidies will be funded through 2025 and will support 12 million people that could otherwise lost insurance, supporting the municipal health care sector.

There are also fewer tax provisions within the Inflation Reduction Act versus prior iterations of the Build Back Better proposal. The current legislation does not increase individual marginal tax rates, does not increase the corporate tax rate and does not address existing State and Local Tax deduction provisions. The bill plans to fund spending initiatives by closing tax loopholes and increasing tax revenue enforcement, while instituting a 15% minimum corporate tax on corporations earning more than $1 billion. All told, the proposal seeks a $300 billion net deficit reduction over 10 years.

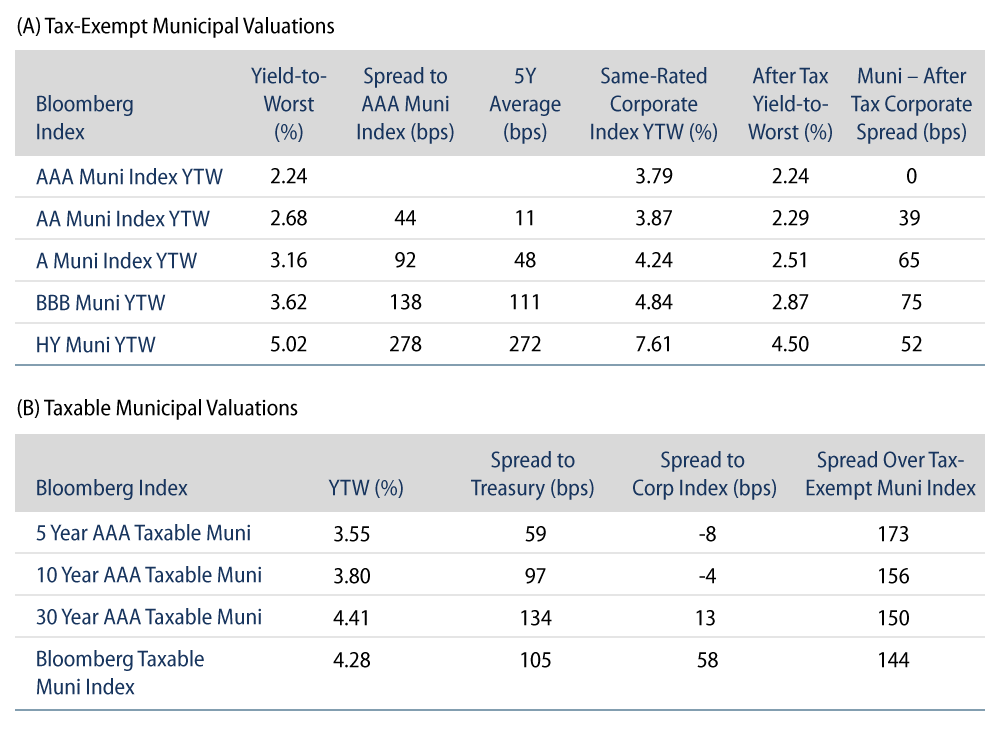

Western Asset expects the legislation to clear the House of Representatives as early as this week when the House returns from recess on Friday. Considering the lack of tax impact on high net worth individuals, Western Asset does not believe the tax provisions included will have a material impact on municipal demand. While implementing a minimum tax on corporations of 15% would increase tax rates for certain corporations, we do not believe a 15% tax rate would attract significant demand at current valuations as institutions would still achieve higher after-tax yields in other asset classes. Exhibit 1 highlights the spread of investment-grade municipals compared to like-rated taxable counterparts, which remain negative at a 15% tax rate. While we do not believe the legislation will materially impact demand, we are constructive on the fundamental support to the energy and health care sectors, as well as the incentives that drive clean infrastructure initiatives and could impact supply trends.