Municipals Posted Negative Returns Last Week

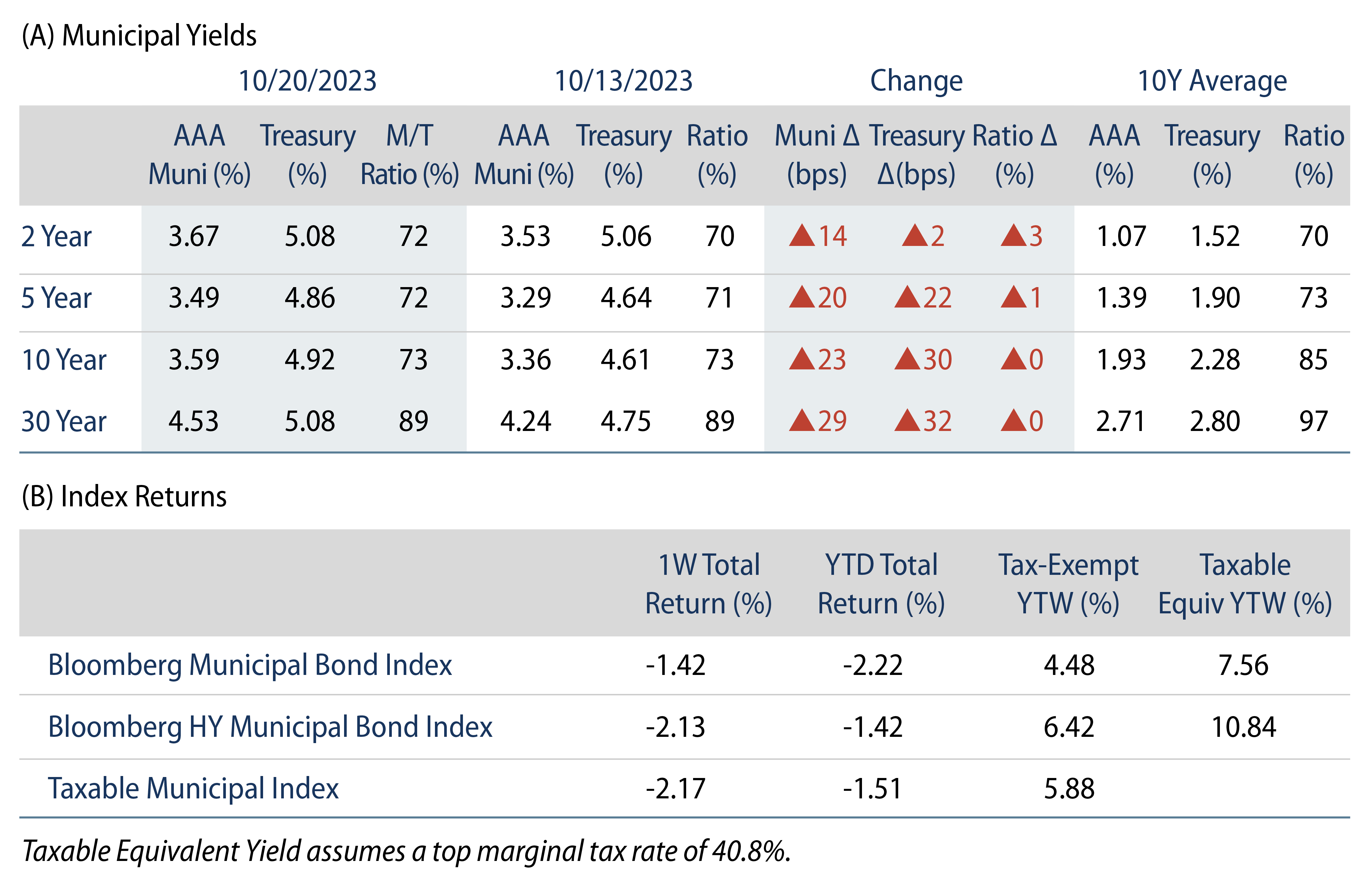

Munis posted negative returns last week as high-grade municipal yields moved higher across the yield curve in sympathy with Treasuries amid strong retail sales data that contributed to the “higher-for-longer” rates narrative. Meanwhile, technicals remained challenged amid fund outflows and elevated supply. The Bloomberg Municipal Bond Index1 returned -1.42% during the week, the Bloomberg High Yield Municipal Bond Index2 returned -2.13% and the Bloomberg Taxable Municipal Bond Index3 returned -2.17%. This week we highlight the seasonally high muni supply levels observed in October, offering investors attractive entry points.

Elevated Supply and Fund Outflows Challenged Technicals

Fund Flows: During the week ending October 18, weekly reporting municipal mutual funds recorded $297 million of net outflows, according to Lipper. Long-term funds recorded $148 million of inflows, high-yield funds recorded $190 million of outflows and intermediate funds recorded $124 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to an estimated $15 billion.

Supply: The muni market recorded $14 billion of new-issue volume last week, over double the prior week’s level, according to Bloomberg. YTD issuance of $294 billion was down 2% year-over-year (YoY), with tax-exempt issuance 4% higher and taxable issuance down 40% YoY. This week’s muni supply calendar is expected to remain elevated at $9 billion. Large transactions include $875 million New York Transportation Development Corporation and $850 million Los Angeles Unified School District transactions, according to Bloomberg.

This Week in Munis: Seasonal Supply Spike

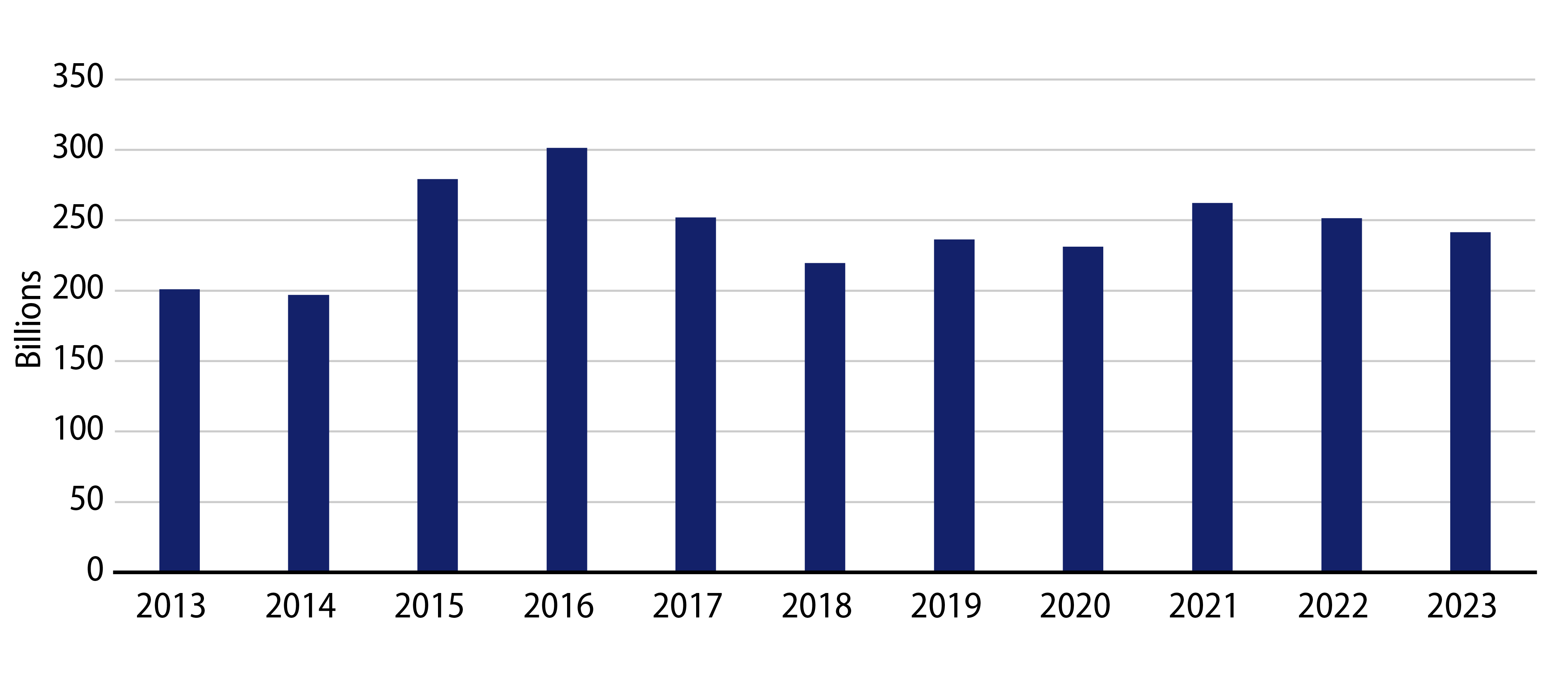

Through the first three quarters of 2023, tax-exempt municipal supply of $241 billion declined 4% YoY, following a longer-term downward trajectory. We think that while relatively low market supply levels have been supportive of overall market conditions and have potentially subdued market volatility, relatively high supply offered in October could present municipal investors with attractive entry points ahead of an expected seasonal drop-off at year-end.

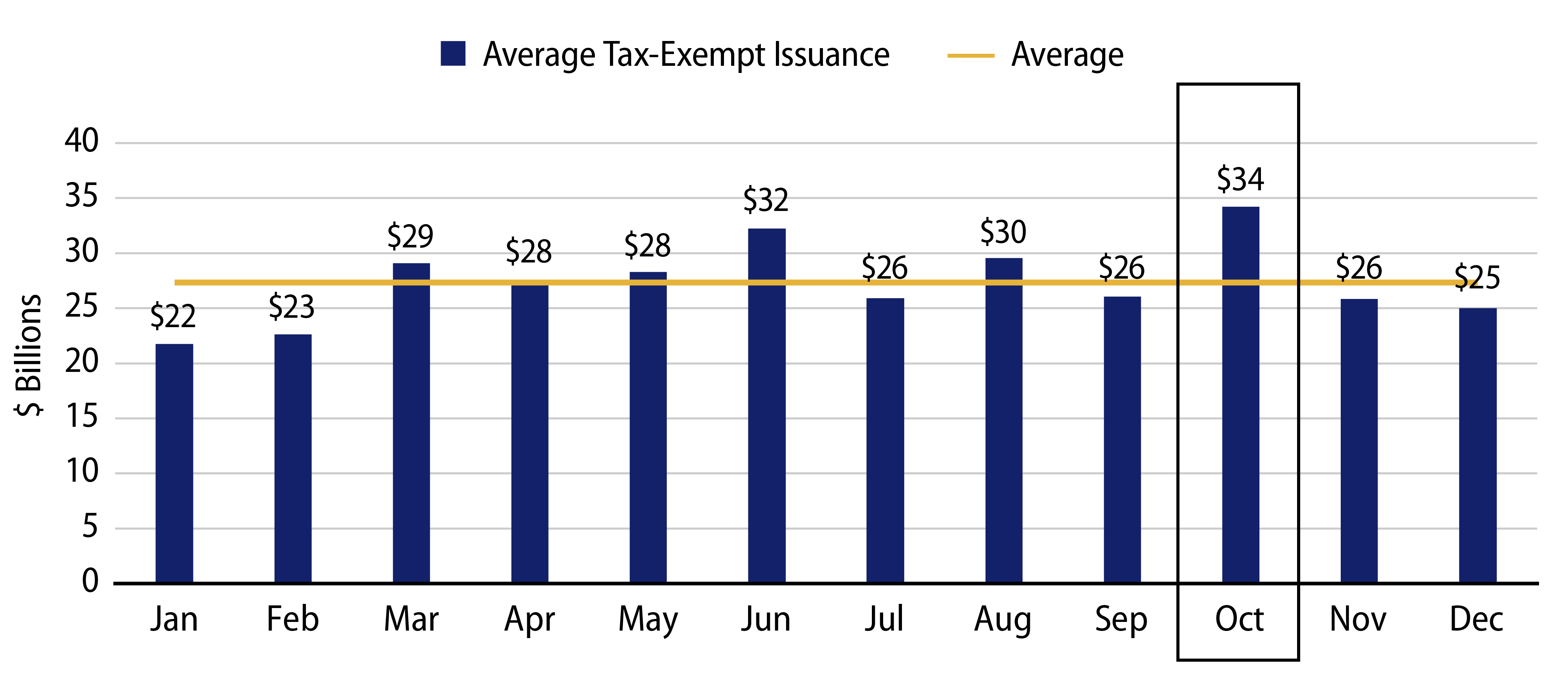

In the 10 years from 2013 to 2022, the month of October ranked highest among average tax-exempt municipal supply, as issuers sought to complete borrowing plans ahead of the winter holidays where we expect liquidity to be challenged. Following October, average tax-exempt supply typically falls to below-average levels from November to February.

Through the first three weeks of October 2023, we have observed a higher supply trend similar to previous years, with $23 billion of tax-exempt debt issued. Considering the $9 billion of issuance anticipated this week, along with two issuance days for the last week of the month, this October’s issuance could potentially provide supply levels close to the historical average.

As total tax-exempt municipal issuance has trended lower over the last decade, we believe elevated issuance could provide long-term municipal investors with favorable entry points and attractive relative value. This year’s opportunity comes along with decade-high nominal municipal yields, attractive relative value and limited municipal demand. Therefore, we believe this seasonal supply can potentially provide opportunities for those contemplating investment in the asset class.

Western Asset Key Themes for Muni Investors

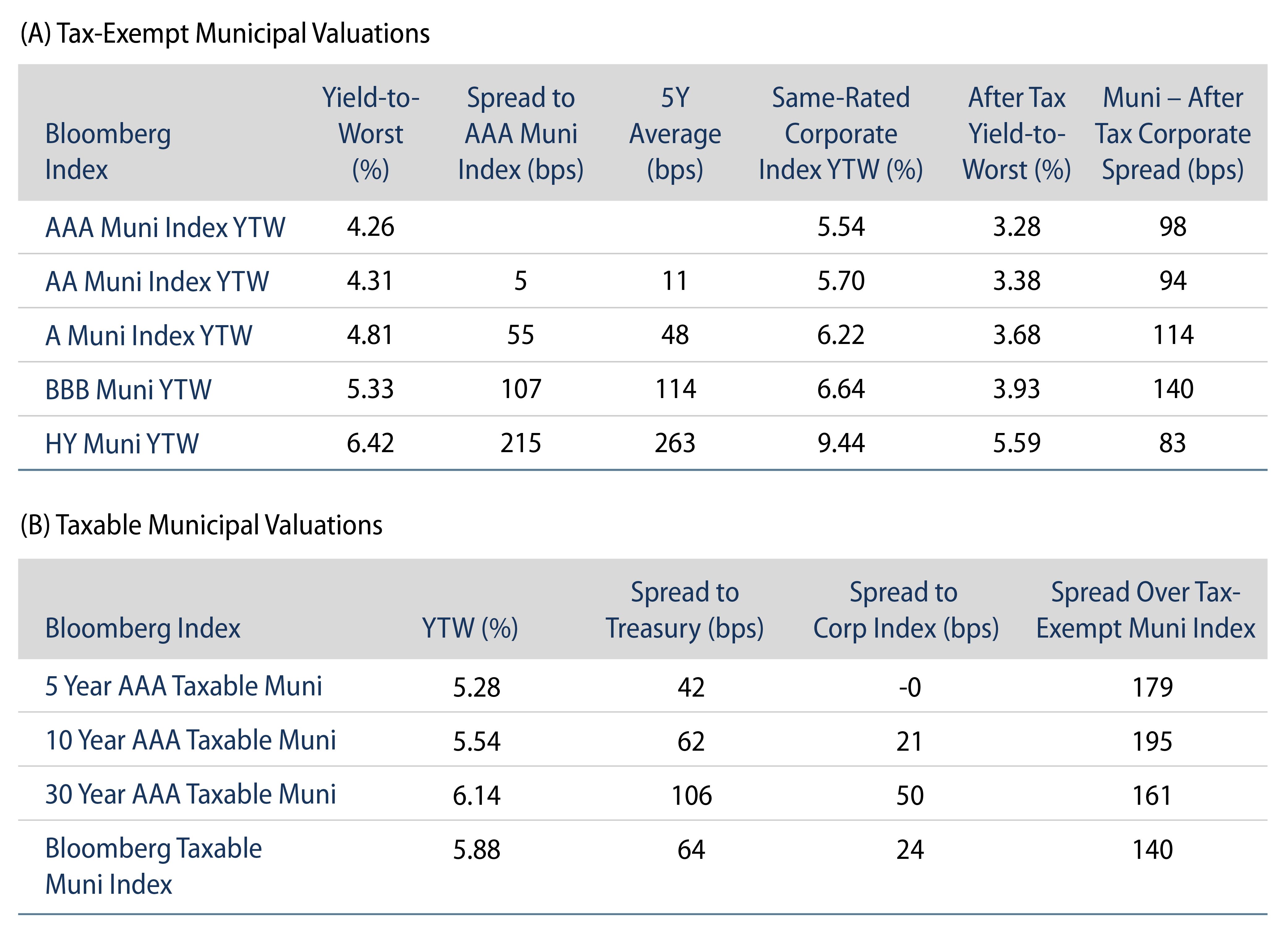

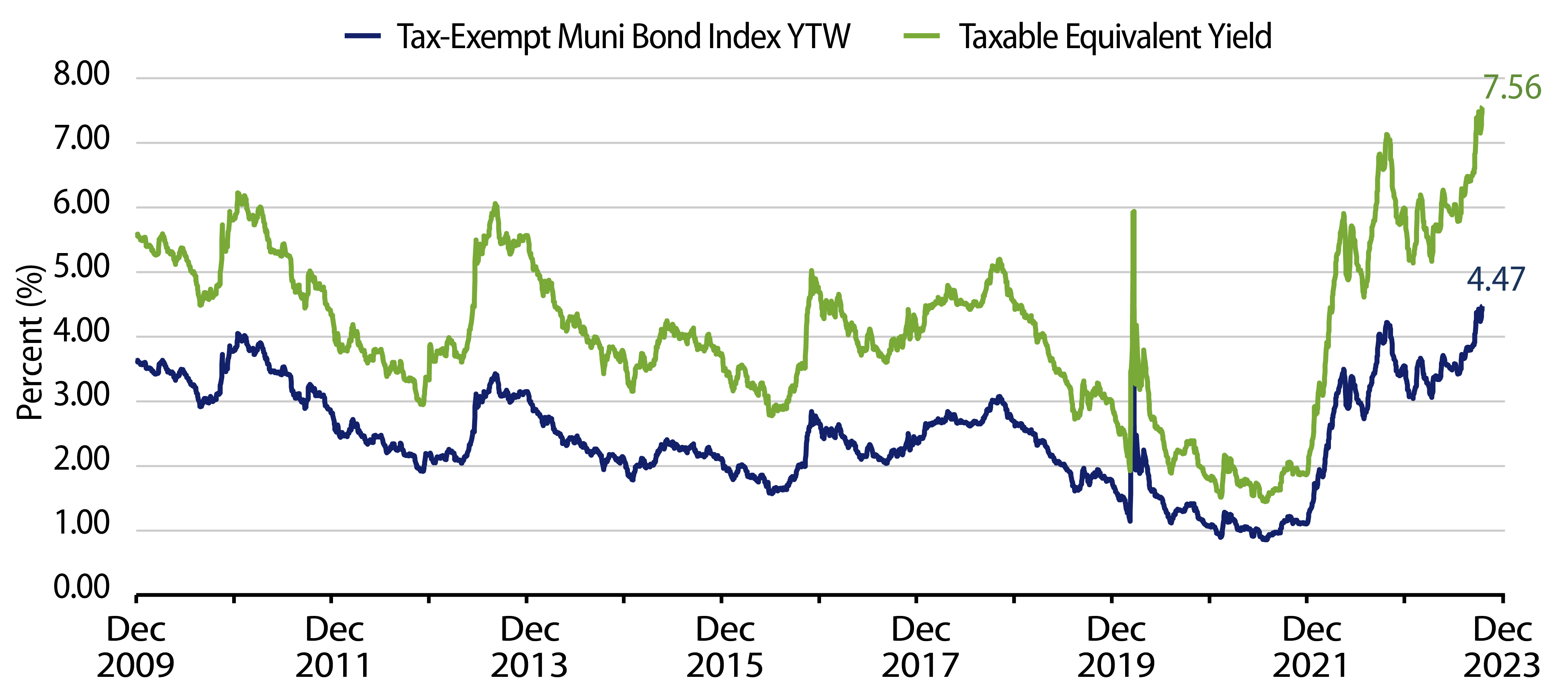

Theme #1: Municipal Index Yields and Taxable Equivalent Yields Are Above Decade Highs

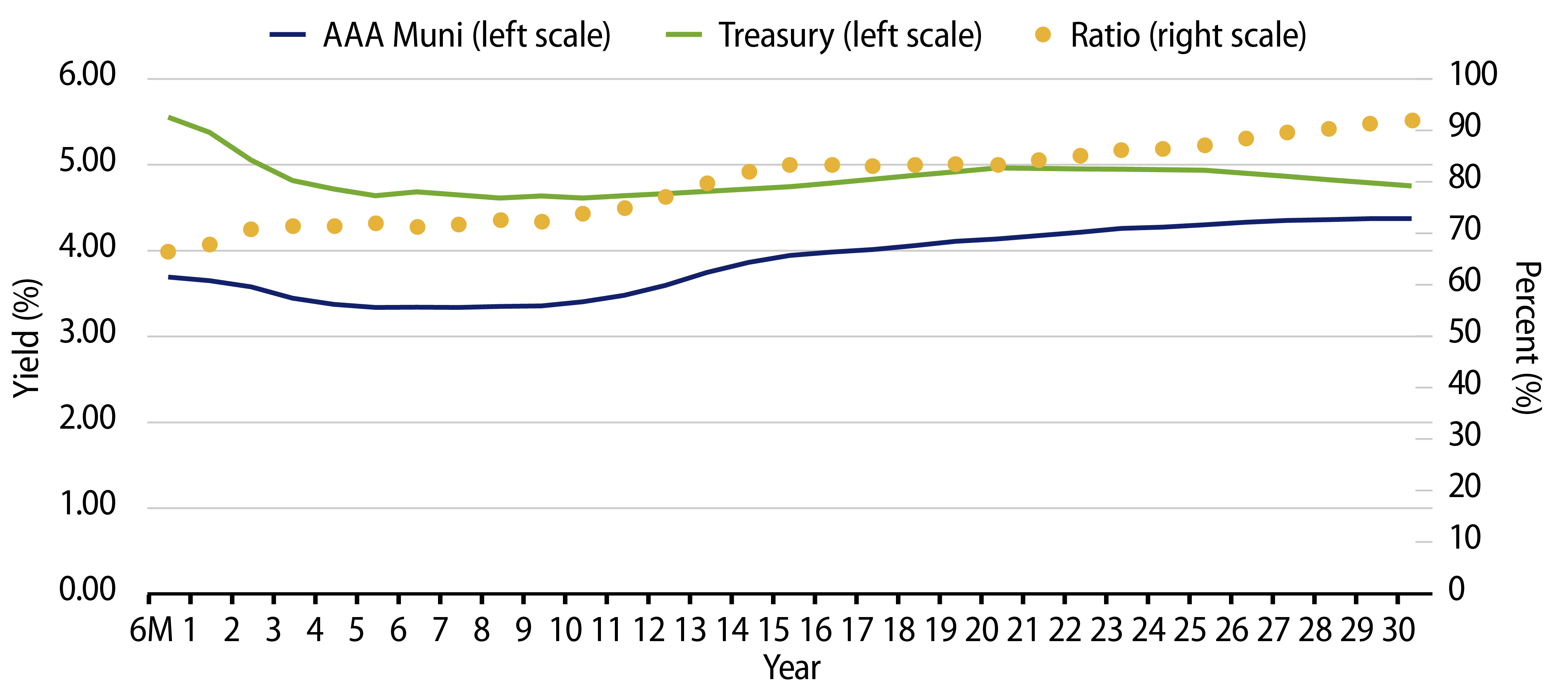

Theme #2: Inverted Yield Curve Offers Barbell Opportunities for Active Strategies

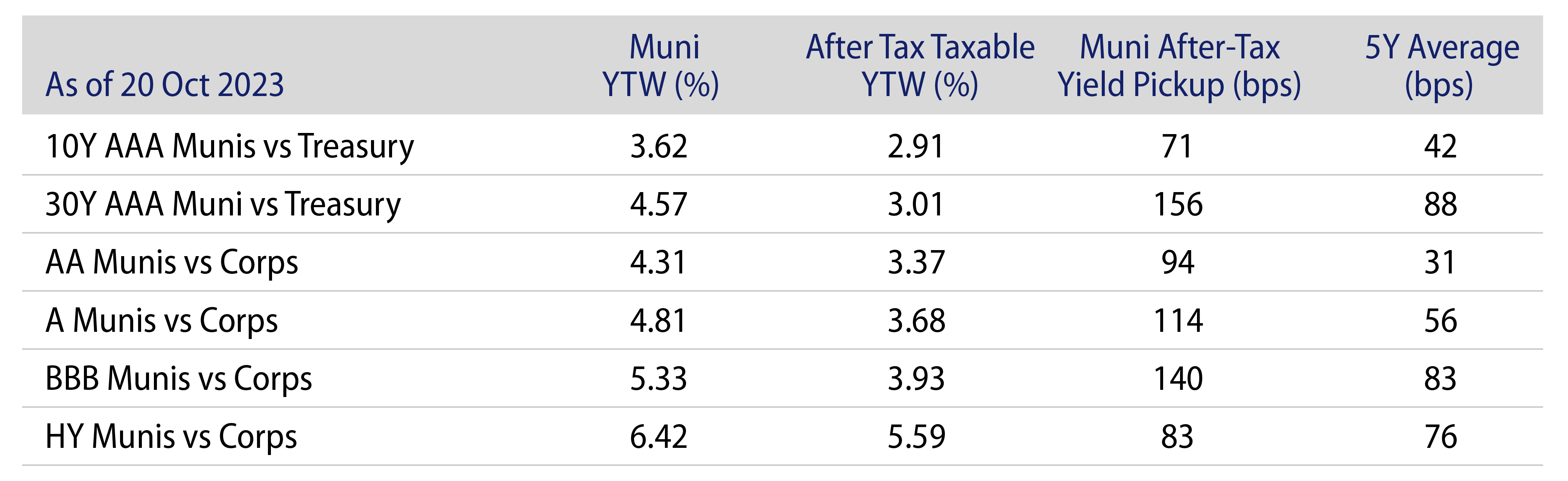

Theme #3: Munis Offer Attractive After-Tax Yield Pickup vs. Corporate Credit

ENDNOTES

2. Bloomberg High Yield Municipal Bond Index is an unmanaged index of non-investment grade municipal bonds traded in the US.

3. Bloomberg Taxable Municipal Bond Index is an unmanaged index of taxable municipal bonds traded in the US.