Municipals Posted Positive Returns Last Week

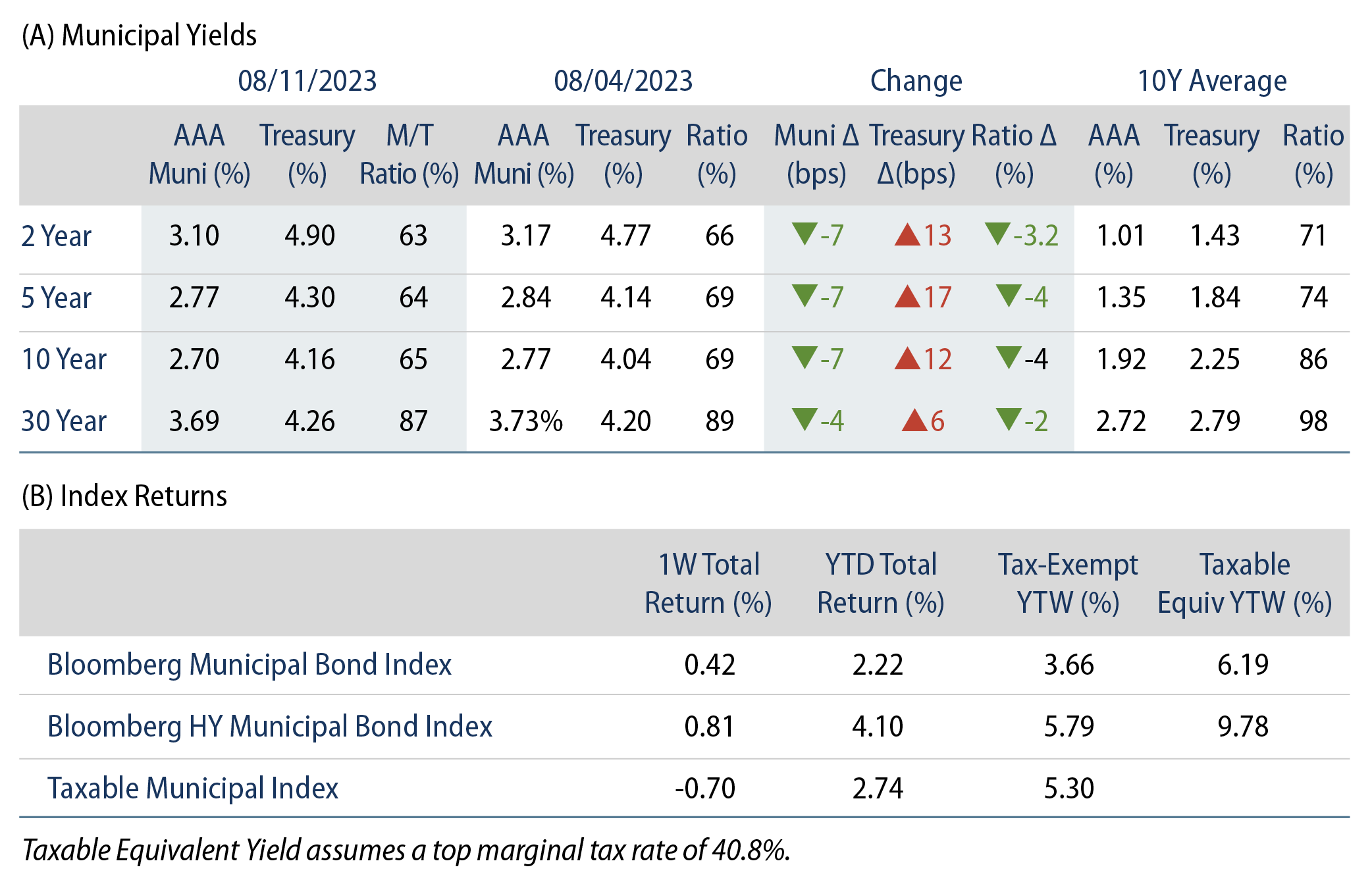

Municipals posted positive returns last week as high-grade muni yields moved lower across the curve. Technicals improved as municipal mutual funds recorded inflows. Favorable technicals supported municipal outperformance versus Treasuries, which moved higher due to higher year-over-year (YoY) headline CPI data and hawkish Fed rhetoric. The Bloomberg Municipal Index returned 0.42% during the week, the High Yield Muni Index returned 0.81% and the Taxable Muni Index returned -0.70%. This week we highlight elevated Texas Permanent School Fund (PSF) issuance which underscores supply dynamics that contribute to opportunities for active management.

Fund Inflows and Decreasing Supply Supported Market Technicals

Fund Flows: During the week ending August 9, weekly reporting municipal mutual funds recorded $278 million of net inflows, according to Lipper. Long-term funds recorded $445 million of inflows, high-yield funds recorded $94 million of inflows and intermediate funds recorded $81 million of inflows. This week’s inflows bring year-to-date (YTD) net outflows to $7.2 billion.

Supply: The muni market recorded $9 billion of new-issue volume last week, down 10% from the prior week. YTD issuance of $219 billion is down 8% YoY, with tax-exempt issuance down 2% YoY and taxable issuance down 42% YoY. This week’s calendar is expected to decline further to $6 billion. Large transactions include $694 million Dallas & Fort Worth International Airport New York Sales Tax revenue and $728 million University of California transactions.

This Week in Munis: PSF Supply Surges

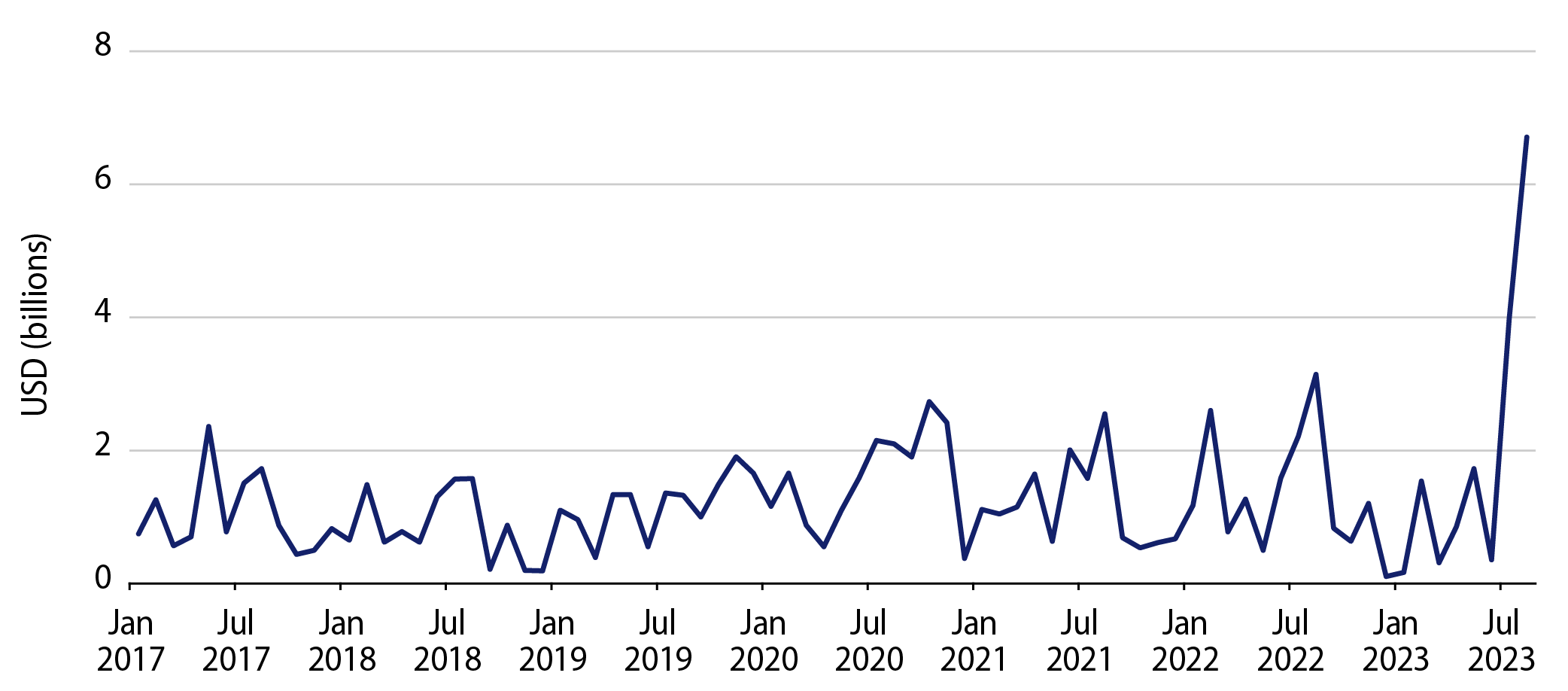

Earlier this year we highlighted the impact of the Texas PSF credit enhancement reaching its capacity limit and the subsequent capacity extension from the IRS. This summer, we have observed a significant uptick in AAA rated PSF supply, attributable to pent-up supply during the period when issuance was restricted, as well as ongoing capital needs from school districts in Texas facing growing populations.

Since the IRS expanded the PSF limit, Texas PSF supply has dramatically increased from an average of $828 million per month in the first six months of 2023 to an average of $5.3 billion per month in July and August.

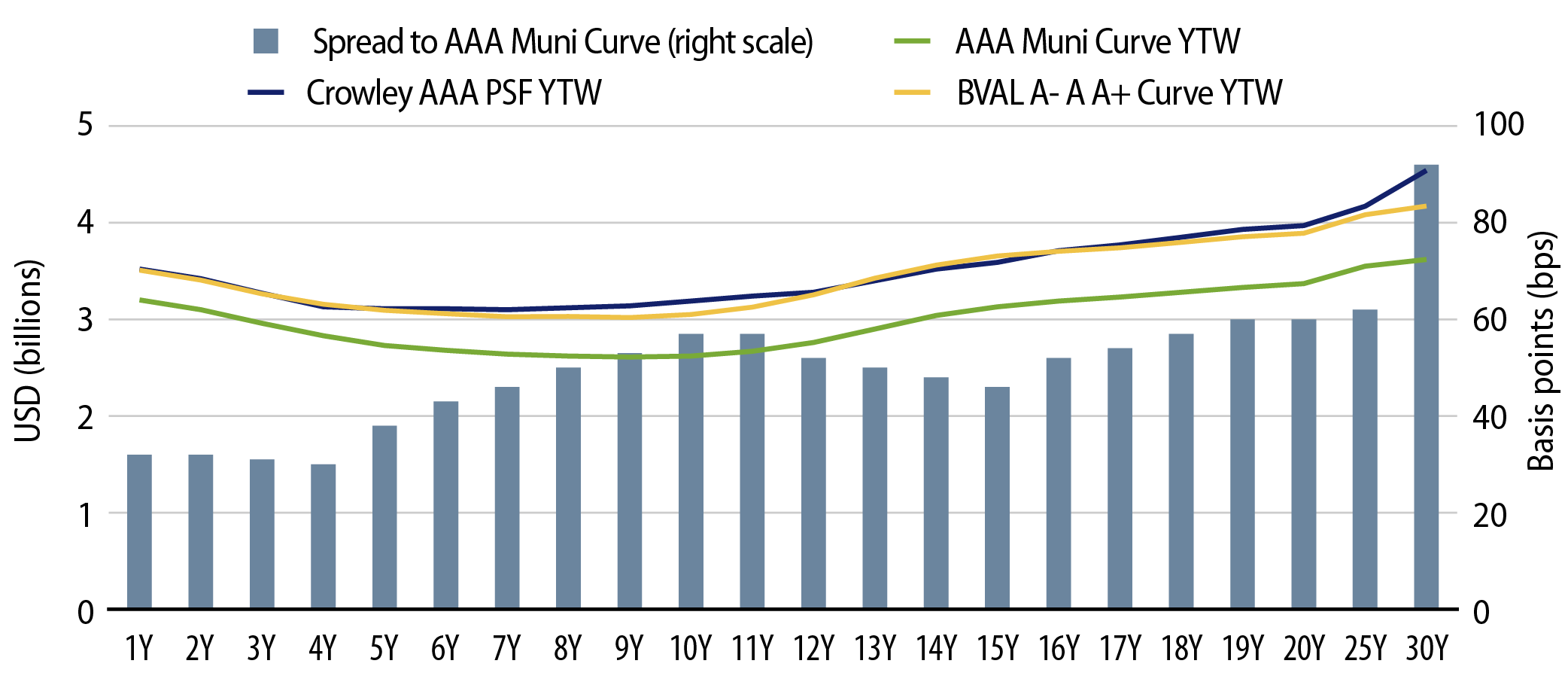

The increasing issuance observed in the Texas PSF segment underscores how supply dynamics can contribute to value opportunities in the municipal market. In recent weeks, new-issue PSF securities traded significantly higher than the comparably rated AAA yield curve. On August 4, the Crowley School District issued a PSF-enhanced deal that priced up to 4.54% in 30 years, 92 bps above the comparably rated Bloomberg AAA callable yield curve, and 37 bps higher than the Bloomberg A General Obligation yield curve.

These elevated levels of high-quality supply offer municipal investors, many of which have been challenged by relatively rich valuations at the high-quality front end of the curve, an opportunity to allocate at more attractive spread levels. Moreover, active strategies that expect long-term supply and valuations to revert closer to the PSF underlying AAA credit quality could stand to benefit from spread compression opportunities as the recent uptick in supply is fully absorbed into the market.