Municipals Posted Negative Returns Last Week

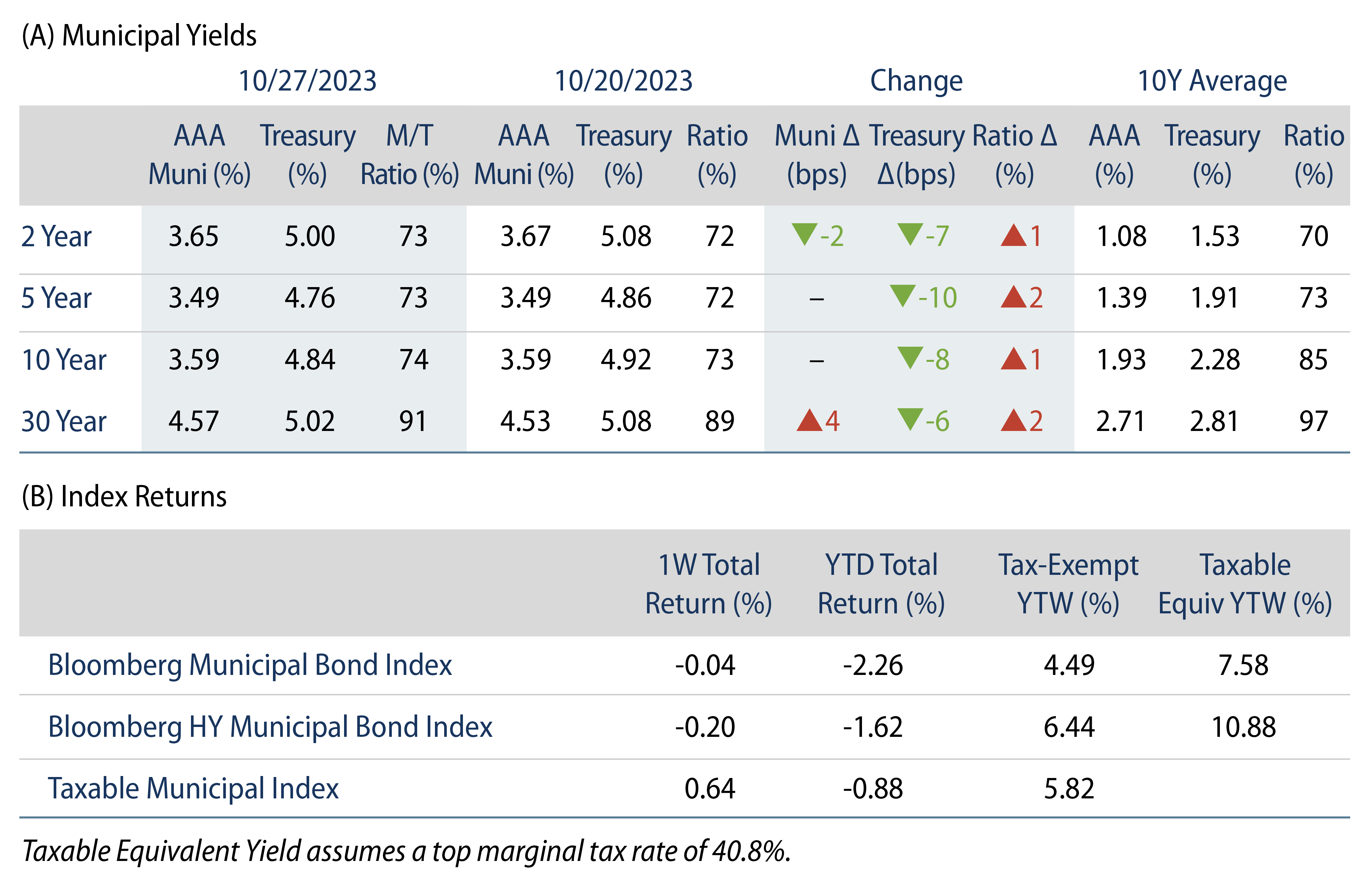

Munis posted negative returns last week and underperformed Treasuries, which moved lower across the yield curve. The high-grade muni curve steepened, moving 4 bps higher in long maturities and 2 bps lower in short maturities. Meanwhile, technicals remained weak amid fund outflows and elevated supply. The Bloomberg Municipal Bond Index1 returned -0.04% during the week, the Bloomberg High Yield Municipal Bond Index2 returned -0.20% and the Bloomberg Taxable Municipal Bond Index3 returned 0.64%. This week we highlight the impact Treasury rate volatility can have on the municipal market.

Muni Technicals Remained Weak Amid Fund Outflows, Elevated Supply

Fund Flows: During the week ending October 25, weekly reporting municipal mutual funds recorded $935 million of net outflows, according to Lipper. Long-term funds recorded $522 million of outflows, high-yield funds recorded $364 million of outflows and intermediate funds recorded $94 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to an estimated $16 billion.

Supply: The muni market recorded $13 billion of new-issue volume last week, 3% above the prior week’s level. YTD issuance of $306 billion is down 2% year-over-year (YoY), with tax-exempt issuance 4% higher and taxable issuance down 38% YoY. This week’s calendar is expected to drop to $3 billion. Large transactions include $433 million Black Belt Energy District and $400 million Massachusetts Development Financing Agency transactions.

This Week in Munis: Muni Volatility

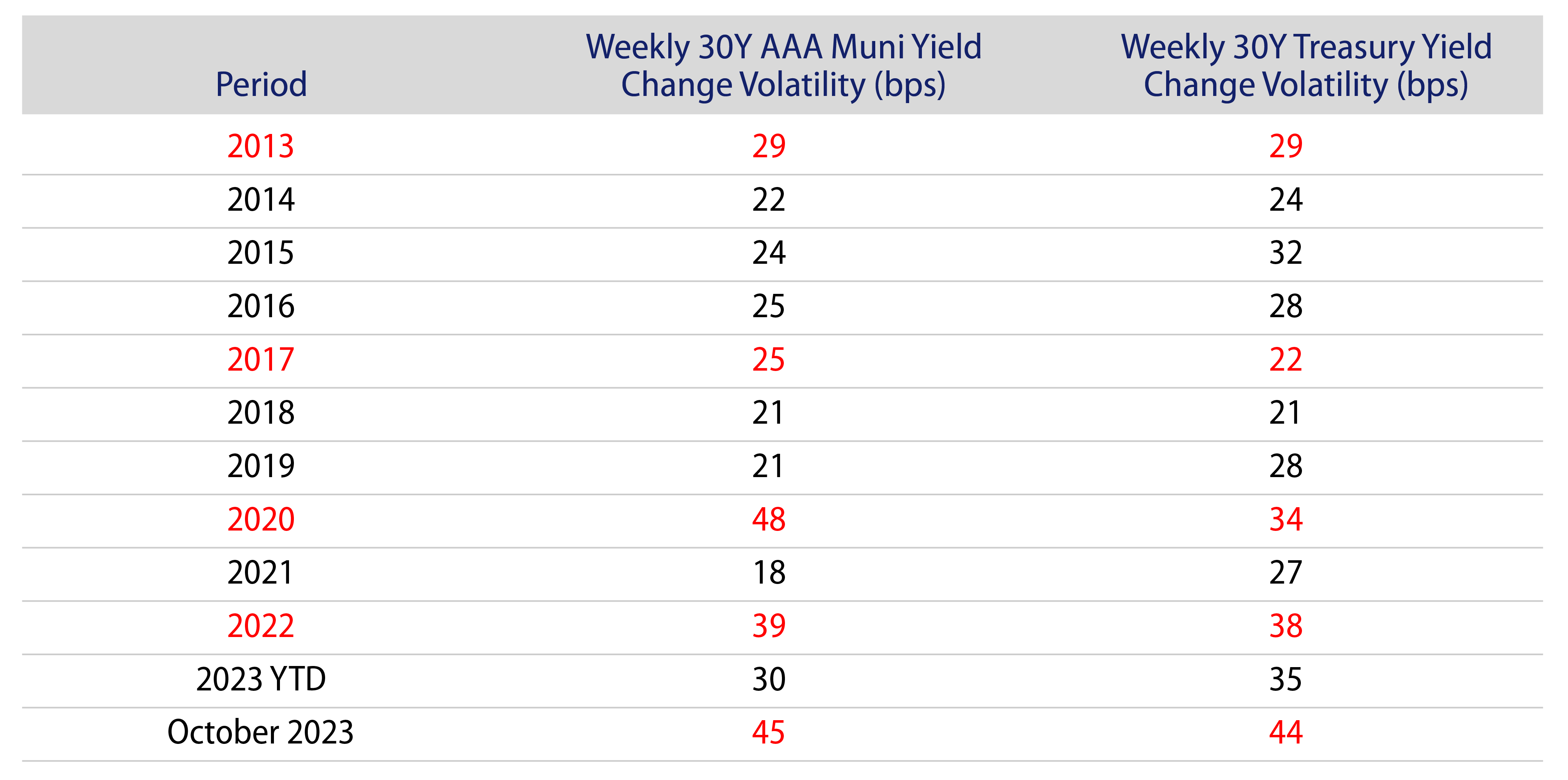

Over longer-term periods, the volatility of AAA muni yield changes has been lower than Treasury changes, contributing to the risk-adjusted appeal of munis. Over the 10 years from September 2013 to September 2023, the average 30-year AAA muni rate volatility of 27 bps was below the Treasury rate volatility of 29 bps. Despite the lower longer-term volatility profile, municipal yields have experienced isolated bouts of higher volatility than Treasuries over the past decade, including the 2013 Taper Tantrum, 2016 elections, the 2020 pandemic credit concerns and the 2022 rate-hike cycle. So far this month, municipal yield volatility has exceeded Treasury rate volatility.

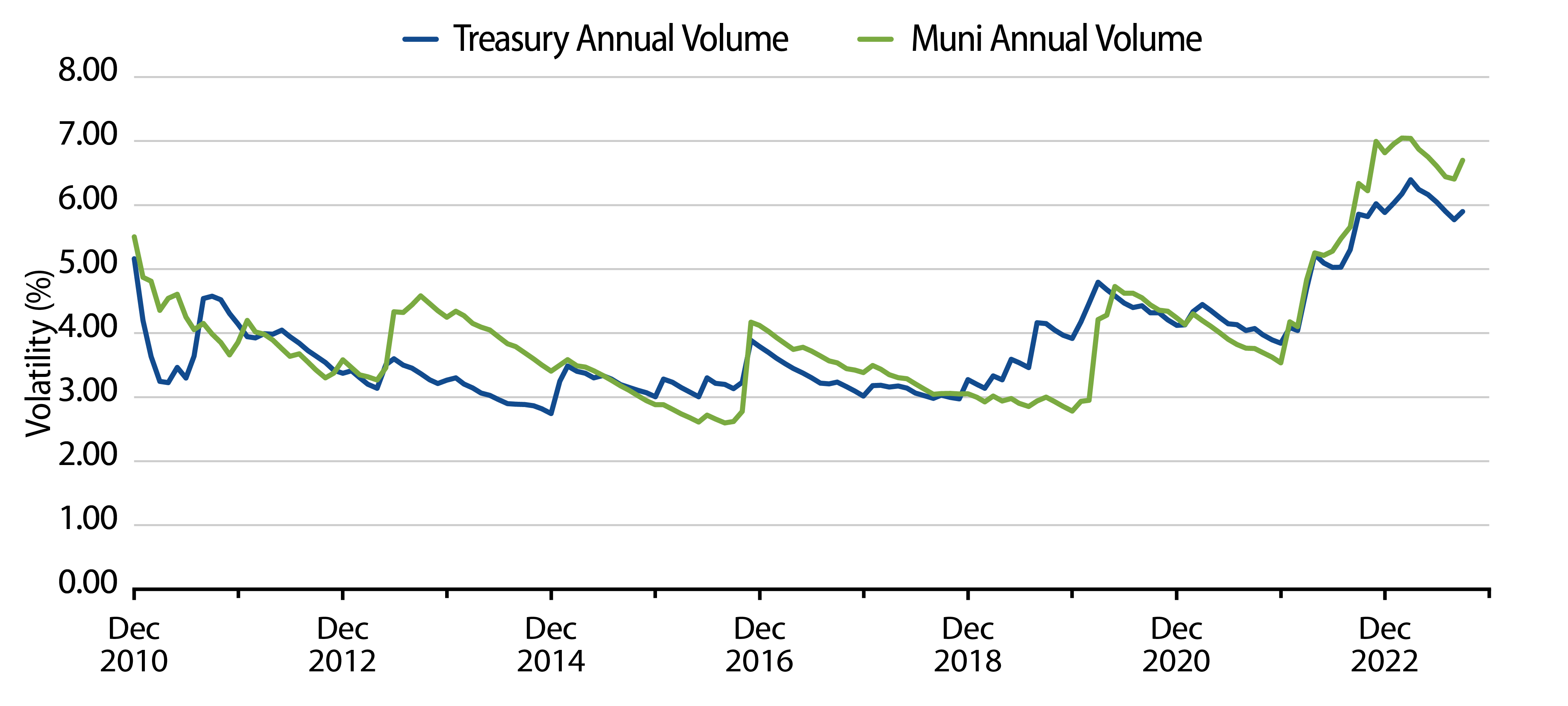

Considering that volatility from an index perspective can capture impacts of credit and structural factors of the broader municipal market beyond the highest quality municipal segment. Most recently, annualized municipal return volatility has exceeded Treasury volatility since May 2022, when considering the Bloomberg Municipal Index and the Bloomberg Treasury Index. Previous periods where muni return volatility exceeded Treasury return volatility included the rate volatility associated with the 2013 Taper Tantrum and the 2016 presidential elections when the long-term value of munis was questioned under a potential lower-tax-rate regime.

Western Asset views the recent municipal volatility as more aligned to the rate volatility that took place during the Taper Tantrum in 2013. As muni volatility sharply spiked from May 2013 to September 2013, the Bloomberg Municipal Bond Index returned -3.01%, underperforming the U.S. Treasury Index return of 1.00%. When municipal volatility subsided, munis observed favorable risk-adjusted outcomes. From September 2013 to September 2016, the Bloomberg Municipal Bond Index returned 5.54% on an annualized basis, outperforming the Bloomberg Treasury Index return of 3.37%.

As growth and inflation continue to trend lower, Western Asset expects municipals’ volatility to return to a longer-term trend level lower than that of Treasuries. We expect the potential for lower volatility could improve market liquidity, and be supportive of longer-term risk-adjusted performance, as offered over the past decade.

Western Asset Key Themes for Muni Investors

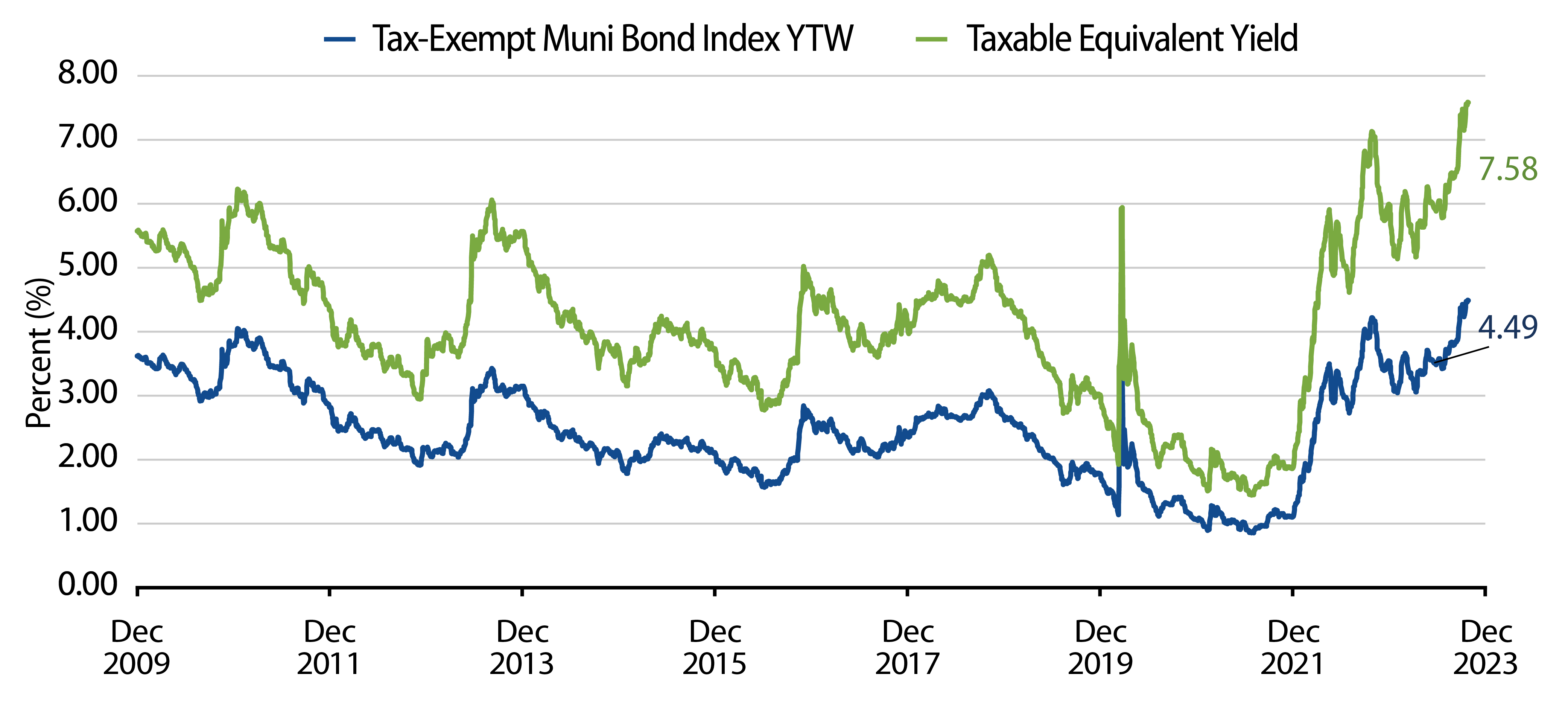

Theme #1: Municipal index yields and taxable equivalent yields are above decade highs.

Theme #2: The inverted yield curve offers opportunities in short and long maturities.

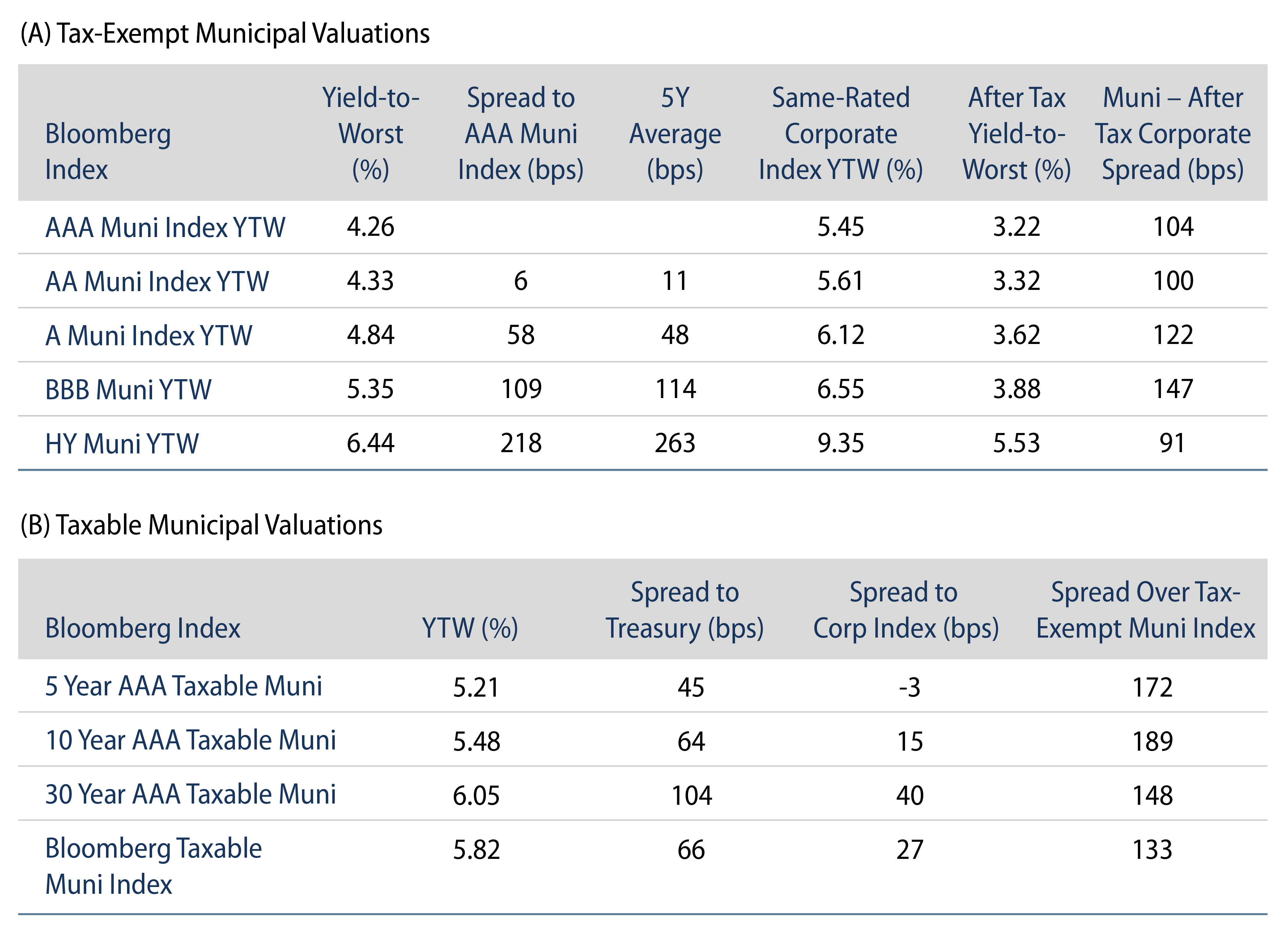

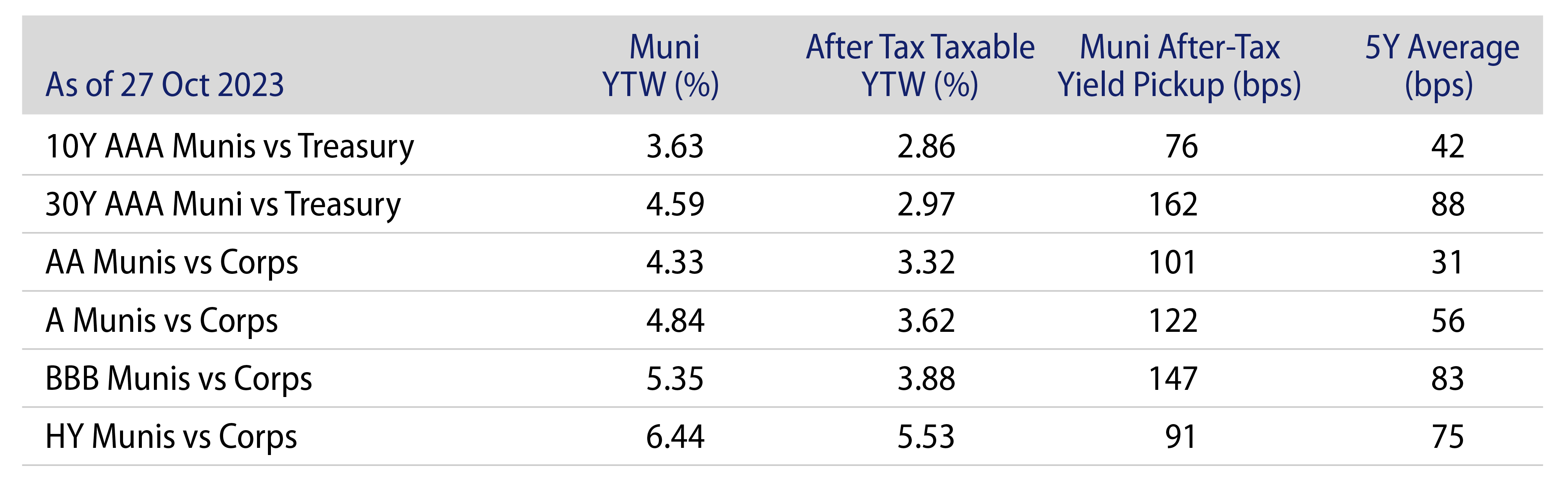

Theme #3: Munis offer attractive after-tax yield pickup vs. corporate credit.

ENDNOTES

1. Bloomberg Municipal Bond Index is an unmanaged index of municipal bonds traded in the US.

2. Bloomberg High Yield Municipal Bond Index is an unmanaged index of non-investment grade municipal bonds traded in the US.

3. Bloomberg Taxable Municipal Bond Index is an unmanaged index of taxable municipal bonds traded in the US.