Municipals Posted Positive Performance as Yields Moved Lower

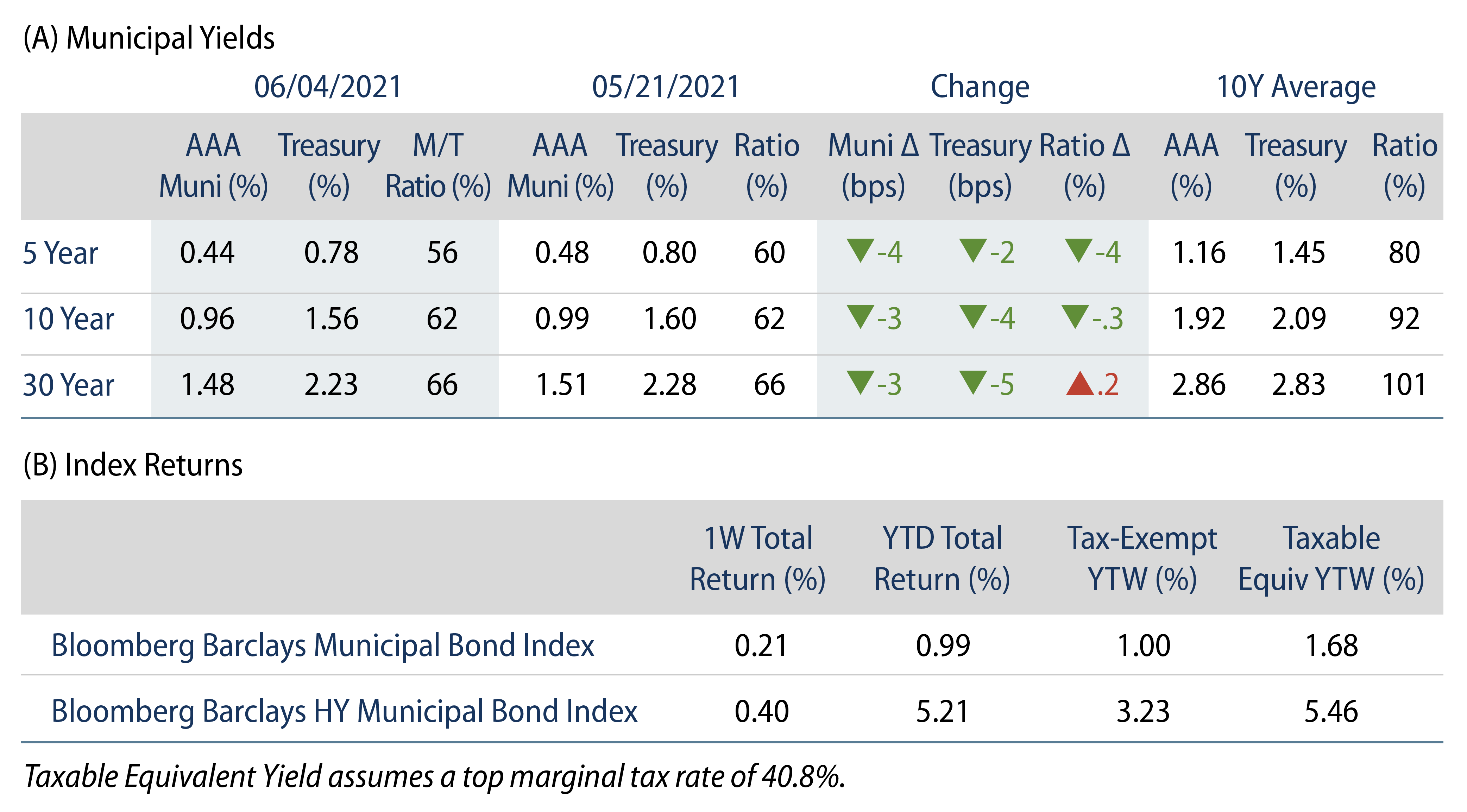

Municipals posted positive performance as yields moved lower during the week, supported by the rally in Treasury rates and strong supply and demand technicals. Municipals generally outperformed Treasuries, with Municipal/Treasury ratios declining in short and intermediate maturities. The Bloomberg Barclays Municipal Index returned 0.21 % while the HY Muni Index returned 0.40%. This week, as state and local governments continue to progress through budget season, we explore the outlook for the local general obligation (Local GO) sector.

Supply and Demand Technicals Remained Strong During the Holiday-Shortened Week

Fund Flows: During the week ending June 2, municipal mutual funds recorded $997 million of net inflows. Long-term funds recorded $565 million of inflows, high-yield funds recorded $372 million of inflows and intermediate funds recorded $97 million of inflows. Net inflows year to date (YTD) continued at a record pace, reaching $49.7 billion.

Supply: The muni market recorded $5.9 billion of new-issue volume during the holiday-shortened week. Total issuance YTD of $182 billion is 20% higher from last year’s levels, with tax-exempt issuance trending 19% higher year-over-year and taxable issuance 23% higher. This week’s new-issue calendar is expected to more than double, with an expected $12.7 billion of new issuance. The largest deals include $2.7 billion taxable Kaiser Permanente and $1.1 billion state of Georgia transactions.

This Week in Munis: Looking at Locals

As state and local governments continue to progress through budget season, this week we explore the outlook for the Local GO sector, the largest municipal sector by number of issuers. Local GO credit benefited from a sound fiscal position going into the pandemic, and revenues were largely unimpaired from the effects of the pandemic’s economic disruptions.

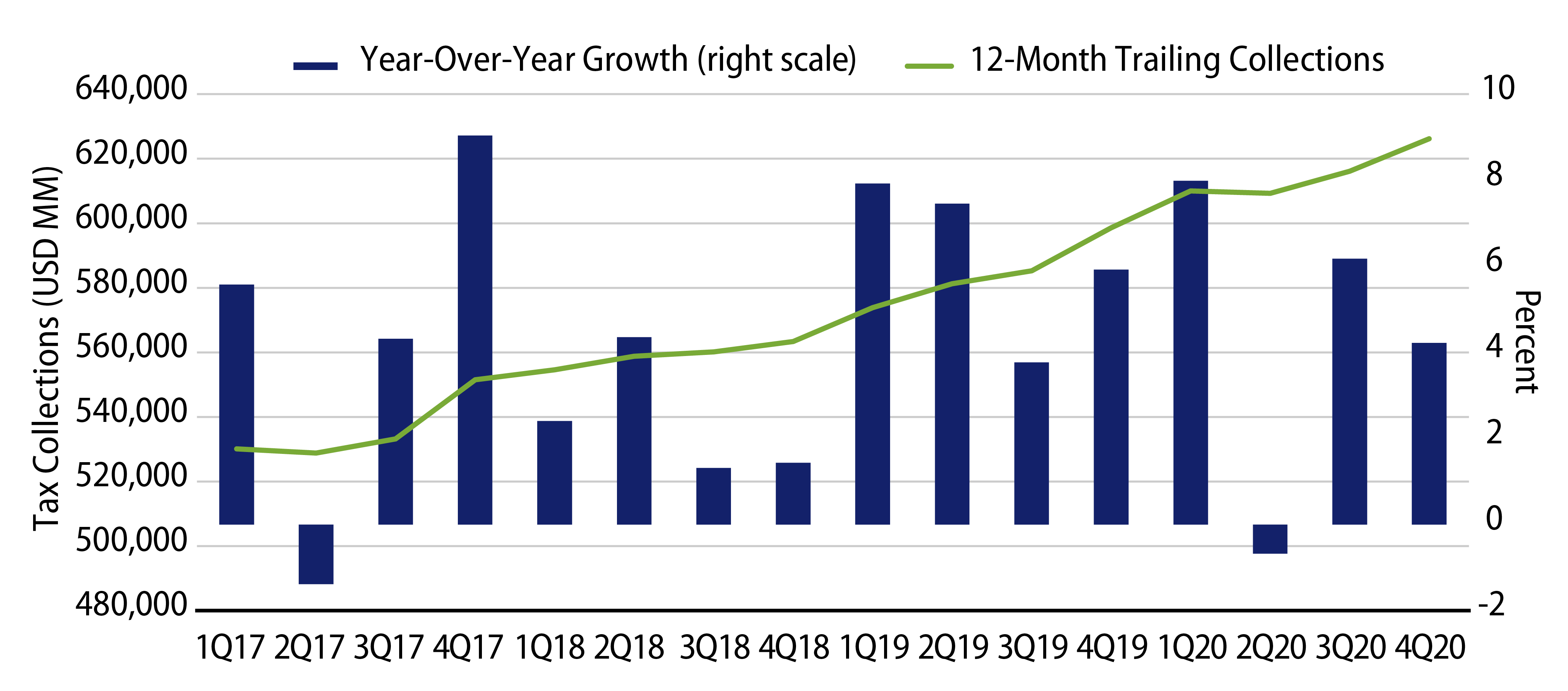

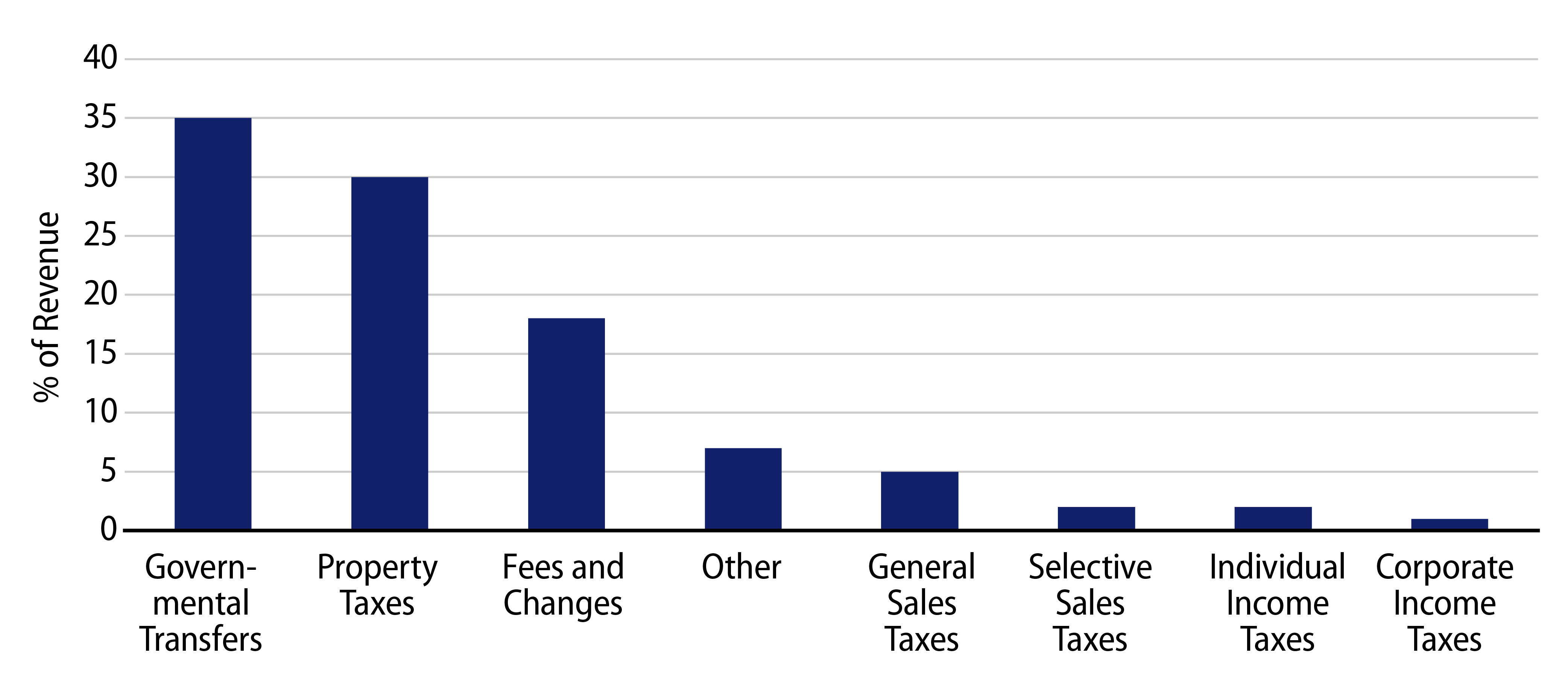

While local government revenues are traditionally characterized by property tax collections, which have remained resilient throughout the pandemic due to the improving housing market (Exhibit 1), the primary sources of local government revenues are downstream transfers from federal and state governments, representing 35% of local tax collections (Exhibit 2).

Considering the scope of unemployment, uncertainty around tax collections and the potential for austerity at the state level, these downstream intergovernmental transfers were vulnerable during the depth of the pandemic. However, the massive federal stimulus measures that followed not only supported economic activity and tax collections, but allocated more than $500 billion of direct federal support to state and local governments. This intervention was critical to support downstream revenues as local government expenditures are largely essential and fixed (e.g., education, safety, debt repayment and pension obligations), leaving limited discretion to cure substantial revenue shortfalls.

While we expect that a vaccine-driven return to normalcy will suppress most remaining volatility in the sector and ultimately improve local government credit metrics, not all local governments were on equal footing entering the pandemic, and we expect there will continue to be intermittent pockets of credit pressure within the sector due to outsized dependence on vulnerable economic sectors, existing or developing structural revenue/expenditure imbalances, or unusually large fixed costs such as outsized pension obligations.

From a valuation perspective, we believe investors have already “priced in” the fiscal picture of well managed locals and the cushioning effects of federal support early on in the pandemic, which limited relative value opportunities in the sector. As a result, Western Asset remains underweight the Local GO sector. However, we believe the pandemic-related drawdowns and subsequent unprecedented governmental support have offered an opportunity to reassess risk-adjusted relative value at the issuer level. As we continue to see evidence of local municipalities move from projected deficits to surpluses, we are focusing on localities that utilize new-found capital to address long-term structural issues rather than fund non-essential short-term benefits.