Municipals Rallied Last Week

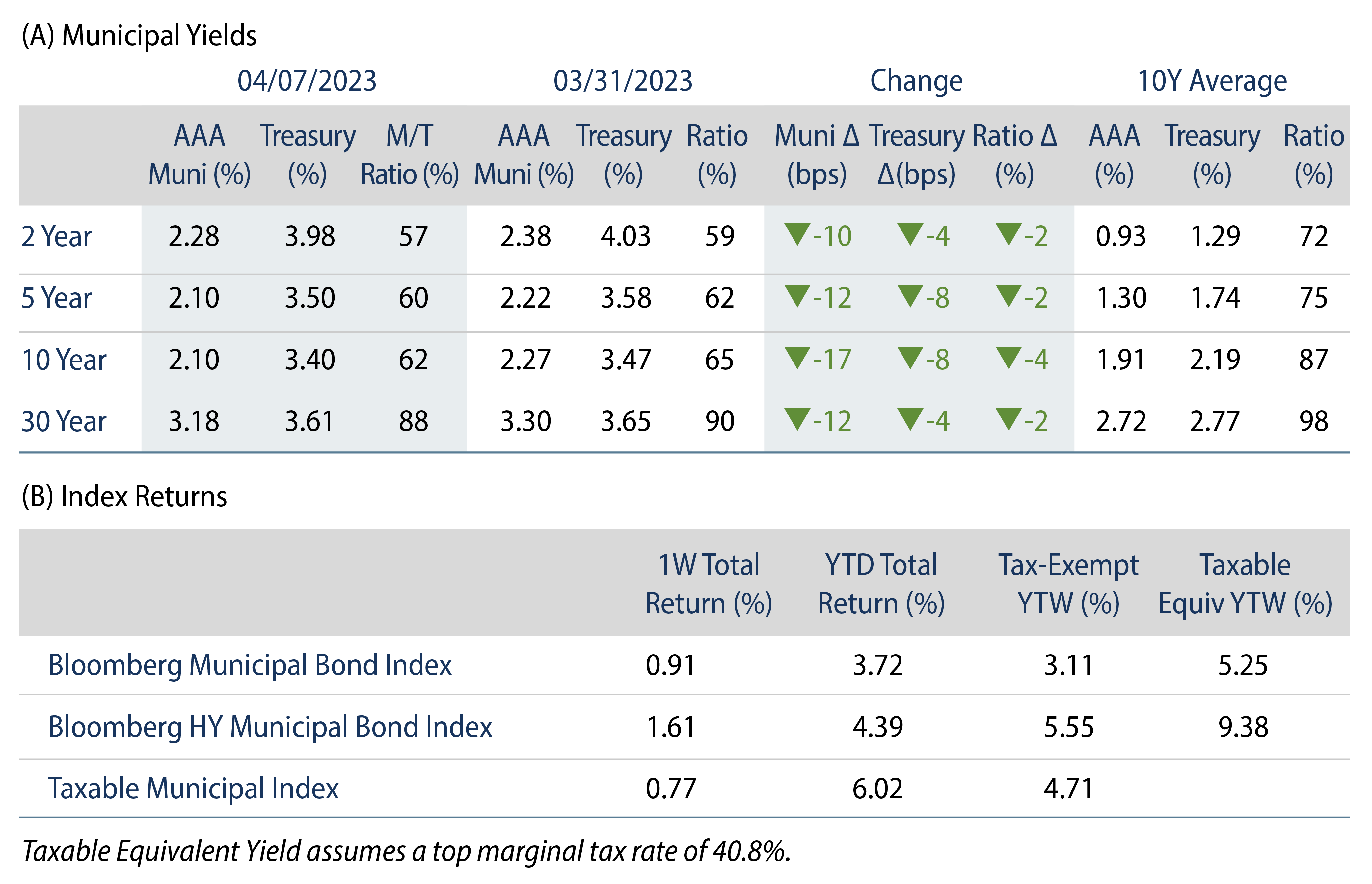

Municipals posted positive returns for a fourth consecutive week. Munis outperformed Treasuries, which declined due to lower than expected job openings, March jobless claims coming in worse than expected and a slowdown in average hourly earnings. The Bloomberg Municipal Index returned 0.91% during the week, the High Yield Muni Index returned 1.61% and the Taxable Muni Index returned -0.77%. This week we highlight Census Bureau population estimates that were released at the end of last month.

Market Technicals Were Steady With Limited Supply, Modest Outflows

Fund Flows: During the week ending April 5, weekly reporting municipal mutual funds recorded $92 million of net outflows, according to Lipper. Long-term funds recorded $399 million of inflows, high-yield funds recorded $148 million of inflows and intermediate funds recorded $200 million of outflows. This week’s outflows extend year-to-date (YTD) net outflows to $1.6 billion.

Supply: The muni market recorded $8 billion of new-issue volume last week, up 41% from the prior week. YTD issuance of $83 billion is down 17% year-over year (YoY), with tax-exempt issuance down 14% YoY and taxable issuance down 34% YoY. This week’s calendar is expected to decrease to $6 billion. Large transactions include $467 million State Public Works Board of the State of California and $456 million Black Belt Energy Gas District transactions.

This Week in Munis: 2022 Population Data Underscores Long-Term Trends and Pandemic Flight

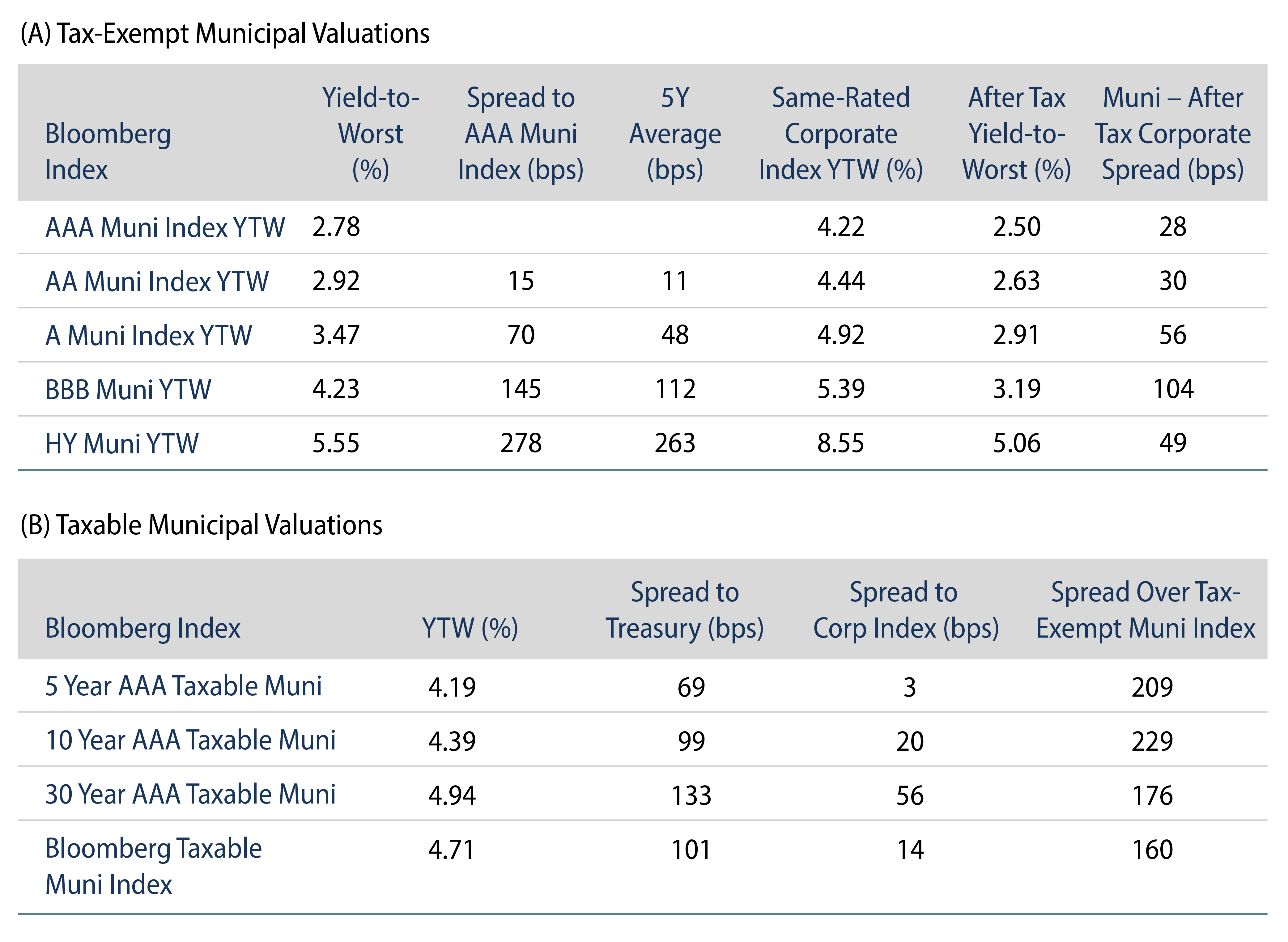

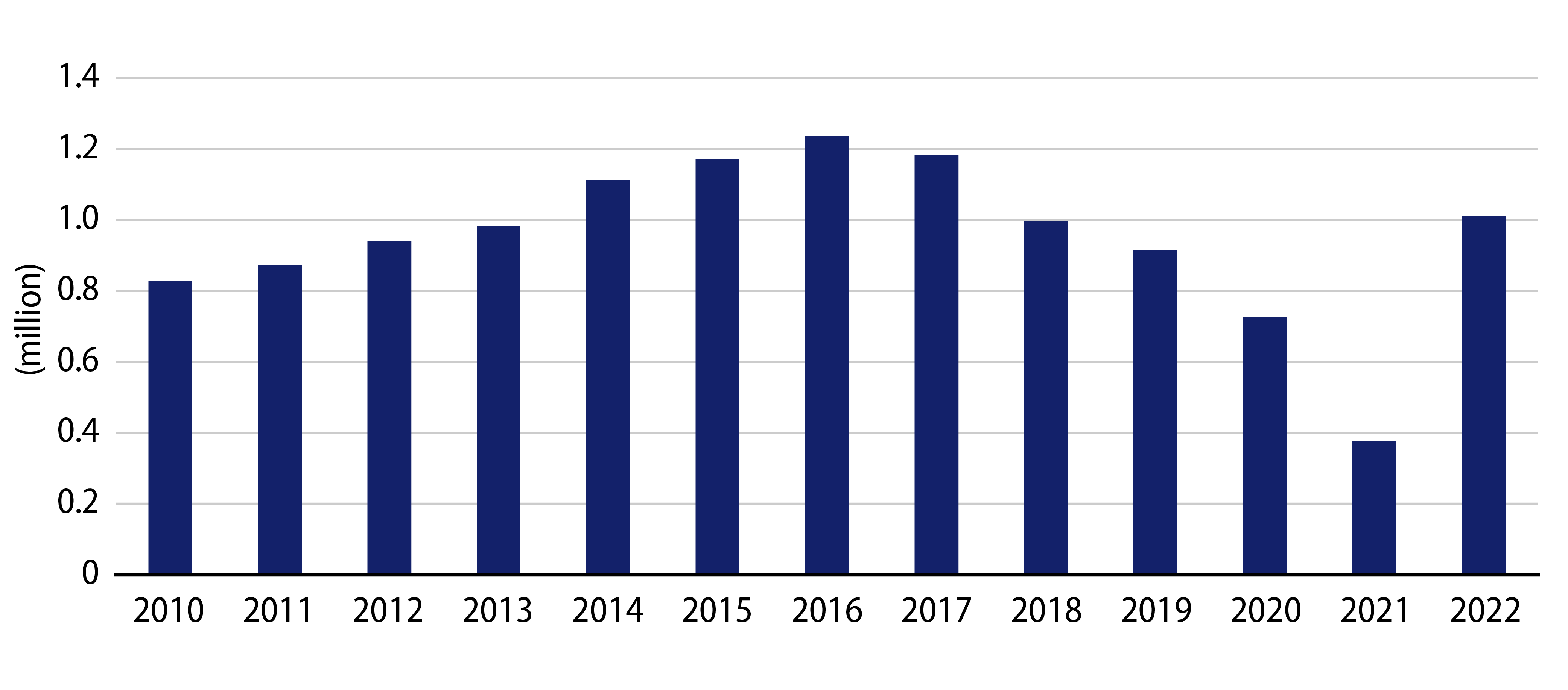

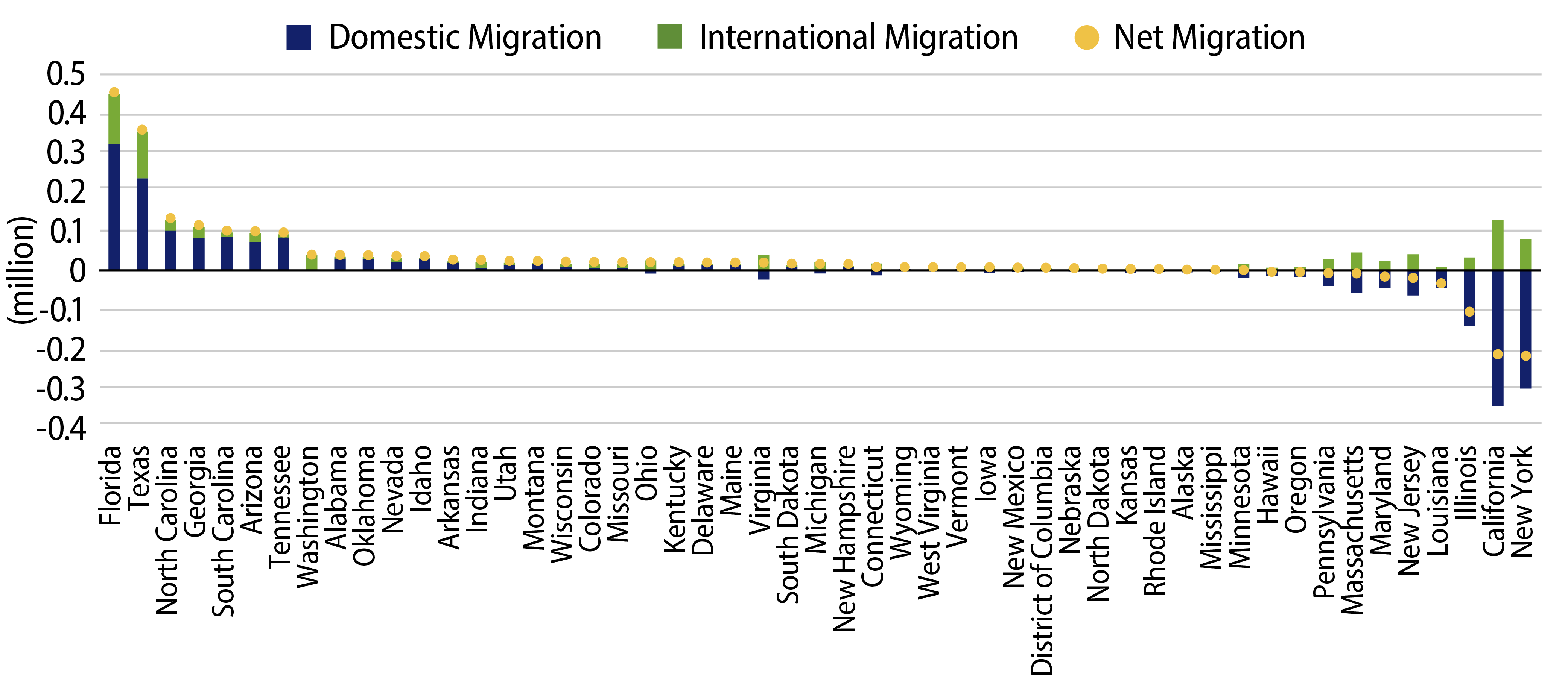

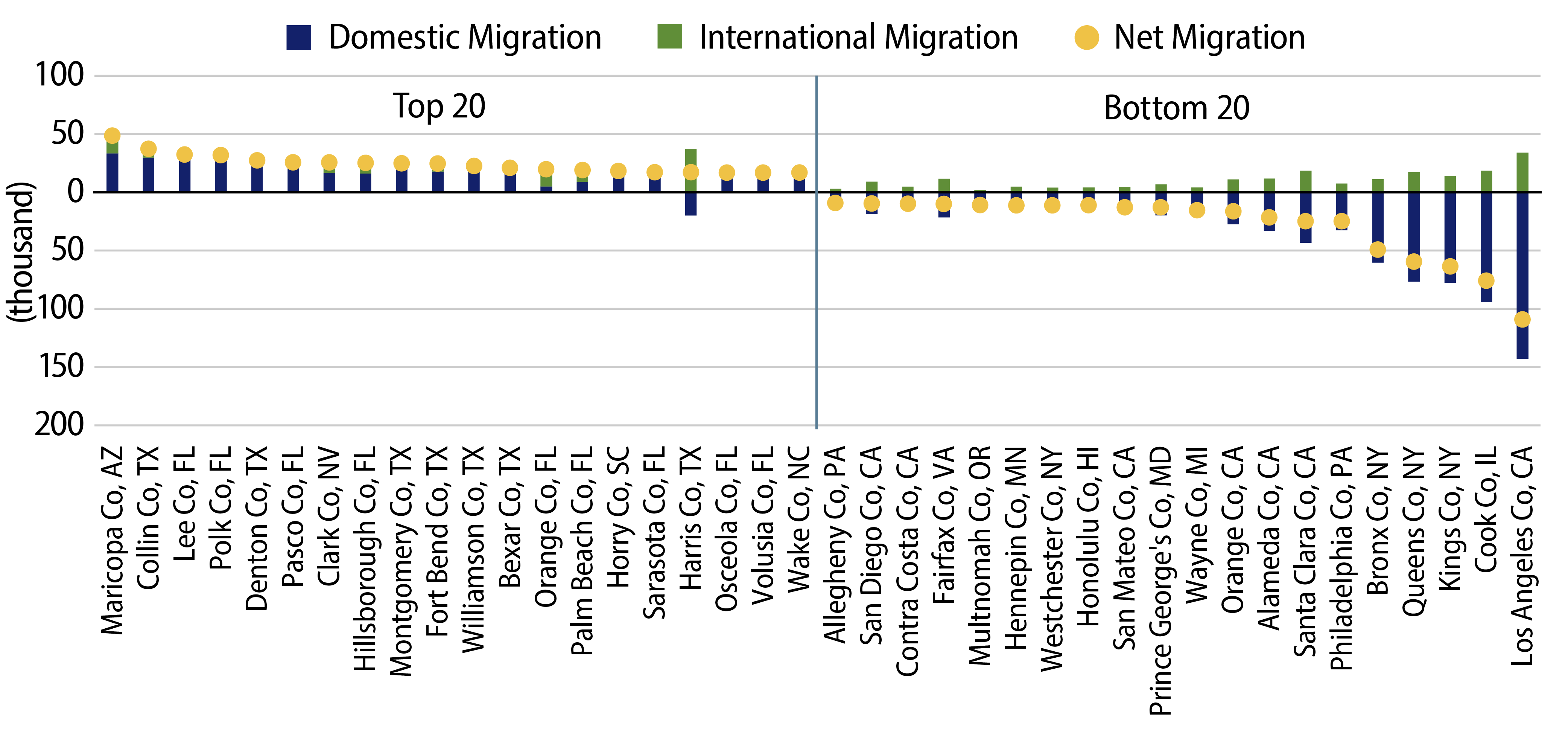

The Census Bureau released its July 2022 population estimates at the end of March. Population trends help inform the potential growth or decline of a municipality tax base, a key component of municipal credit quality. The state and county data released highlights a continuation of the long-term trend to the southeast and the northwest US. The data also reflects a pick-up in international migration, which has approached pre-pandemic highs and offset domestic outmigration pressures in certain regions.

At the state level, Florida, Idaho, South Carolina and Texas observed the percentage population YoY gains of 1.9%, 1.8%, 1.7% and 1.6%, respectively. These gains were at the expense of New York and Illinois, which declined 0.8% and 0.9% due to elevated net domestic outmigration, potentially reflecting a demographic flight away from states with a higher cost of living.

At the county level, Maricopa County, AZ, was the largest beneficiary of net migration in 2022, as the county garnered an estimated 49,000 new residents. Meanwhile, 16 counties in Florida and Texas rounded out the top 20 counties with the highest number of new residents. Los Angeles, CA, Cook County, IL (home of Chicago), and outer boroughs of New York recorded the largest levels of outmigration during the year through July 2022. While the New York, Chicago and Los Angeles metropolitan areas have been challenged by net outmigration in recent years, these tax bases continue to be supported by wealth levels that are well in excess of national averages.

While this 2022 data provides insight into some of the population movement toward the tail end of the pandemic, we recognize that the YoY population trends during the pandemic have been quite volatile. We expect next year’s population figure to deliver more credible color on longer-term trends as metropolitan economies continue to reopen and more corporations institute return-to-office policies.