Municipals Continued to Rally Last Week

Municipals continued to rally, as high-grade municipal yields moved 16-20 bps lower last week. Throughout the week, municipals steadily outperformed Treasuries, which moved lower on Thursday’s Consumer Price Index (CPI) report that reinforced inflation has continued to ease. Headline CPI fell 6.5% year-over-year (YoY), in line with the consensus and increasing expectations that the Federal Reserve (Fed) would slow hikes to 25 bps. Meanwhile, muni mutual fund flows turned positive. The Bloomberg Municipal Index returned 1.15%, the HY Muni Index returned 2.07% and the Taxable Muni Index returned 1.11%. This week we provide context on key drivers of the “January Effect” supporting year-to-date (YTD) muni outperformance.

Municipal Mutual Fund Flows Turn Positive

Fund Flows: During the week ending January 11, Lipper weekly reporting municipal mutual funds recorded $2.0 billion of net inflows. Long-term funds recorded $361 million of inflows, high-yield funds recorded $788 million of inflows and intermediate funds recorded $1.4 billion of inflows. Through the first two weeks of the year, YTD outflows stand at $4.8 billion.

Supply: The muni market recorded $4.5 billion of new-issue volume last week, up from the prior week. YTD issuance stands at $5.8 billion, 93% of which is tax-exempt. Despite the holiday, issuance is expected to pick up to $10 billion this week. Large transactions include $700 million Tennessee Energy Acquisition Corporation and $696 million Main Street Natural Gas transactions.

This Week in Munis: January Effect

This week’s municipal outperformance is a signal that the “January Effect” is in full swing. The January Effect in the muni market is characterized by low supply, elevated reinvestment from seasonally high January 1 coupon payments and market relief from potential reinvestment associated with year-end tax-selling.

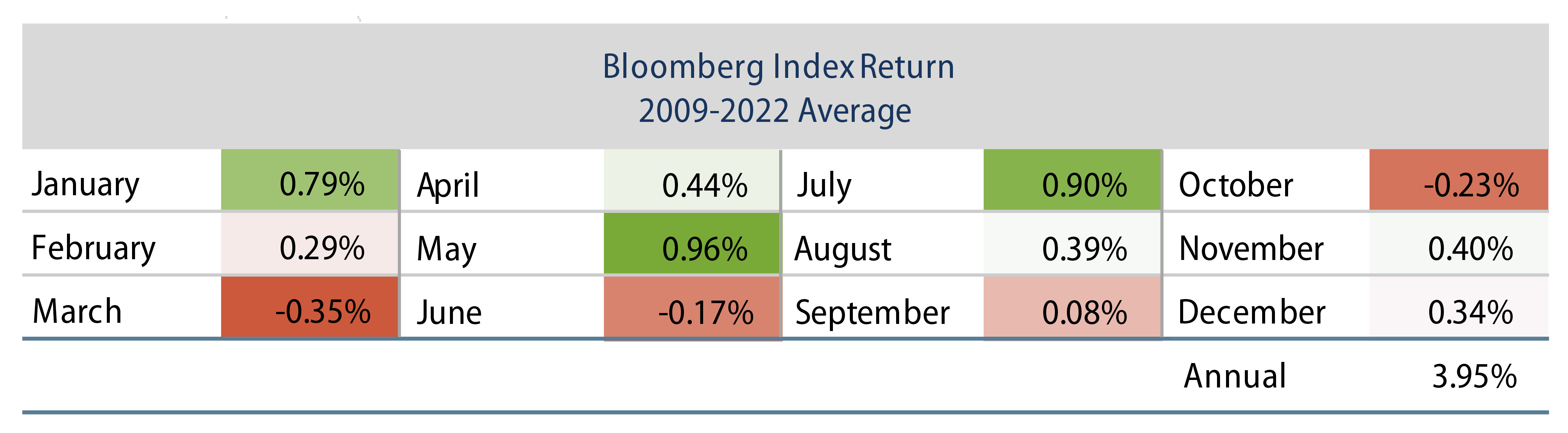

The month of January ranked as the lowest supply month in 11 of the last 14 calendar years, and ranked second lowest in the other three years. January long-term issuance averaged $16 billion since 2009, and comprised 4.0% of annual new-issue volume. The strong technicals in the month have contributed to above-average municipal index performance. The average January return of 0.79% ranked as the third highest month of returns from 2009, just shy of May and July average returns of 0.96% and 0.90%, respectively.

Following significant negative municipal returns last year, we expect that a portion of the heavy tax loss selling that occurred last year was put back to work, and was a partial driver to the $2.0 billion of weekly municipal fund flows observed last week. In addition to signs of demand returning to the marketplace, elevated coupon payments early this month estimated at $17 billion, which are often reinvested in the market and further support muni demand.

So far, January issuance has been very limited at $6 billion. However, considering the $10 billion expected calendar this week, we anticipate that we might see above-average January issuance this year. Still, we believe that any marginally higher issuance would be quickly overwhelmed by the higher demand driven by the early-month coupons and improved fixed-income market sentiment as inflation continues to show signs of stabilizing. As highlighted in last week’s outlook, we anticipate a supportive technical backdrop in 2023, and this year’s January Effect represents a start of this trend.