Macros, Markets and Munis

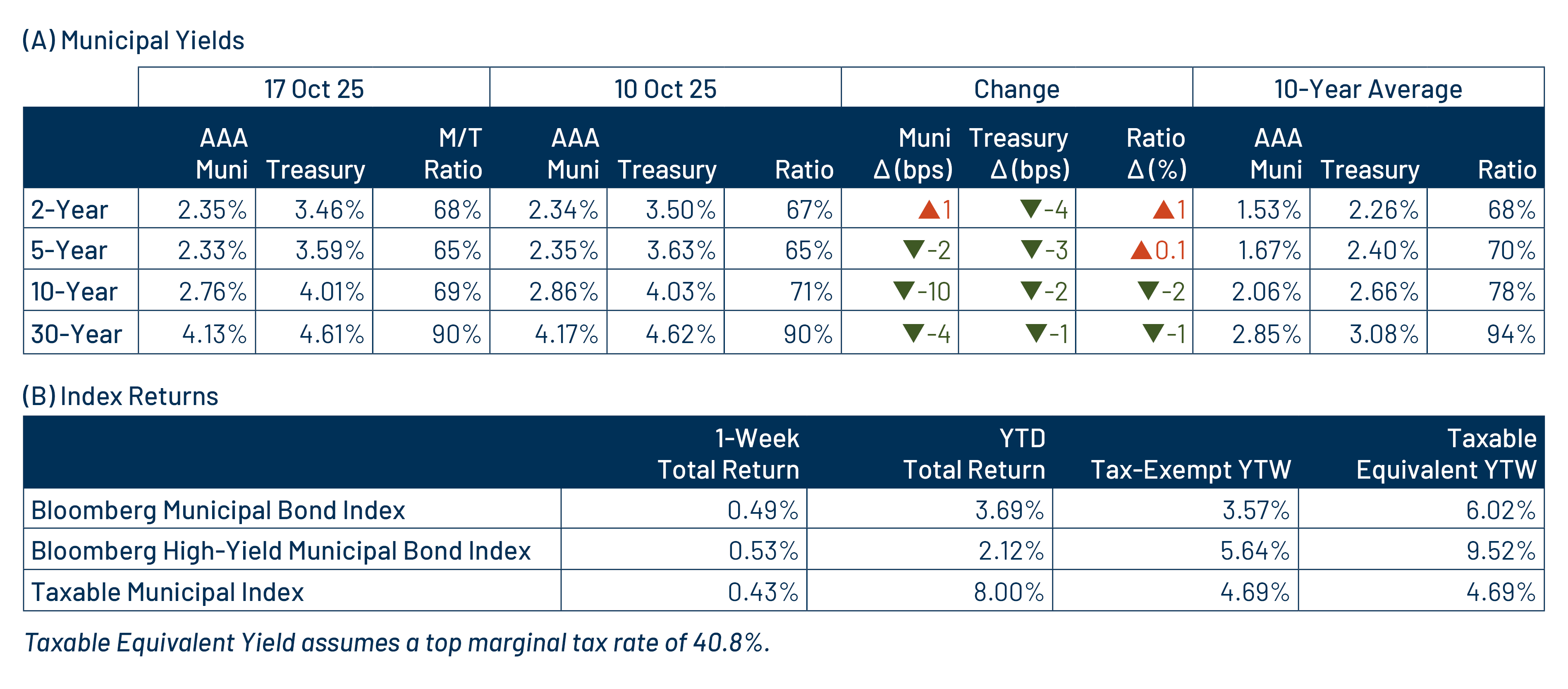

Munis posted positive returns and Treasuries moved 1-4 basis points lower across the yield curve during the week. The high-grade muni curve followed Treasuries lower and outperformed amid strengthening supply and demand technicals, with muni demand remaining positive as supply trended lower. Meanwhile, markets continued to contend with limited economic data amid the government shutdown. Federal Reserve Chair Jerome Powell signaled that the Federal Open Market Committee (FOMC) would likely cut rates in October, consistent with what’s already been priced in to the markets. As the government shutdown extends into a third week, we touch on potential implications for the muni market.

Muni Demand Remained Positive as Supply Trended Lower

Fund Flows ($678 million of net inflows): During the week ending October 15, weekly reporting municipal mutual funds recorded $678 million of net inflows, according to Lipper. Long-term funds recorded $135 million of inflows, intermediate funds recorded $226 million of inflows and the short-term category recorded $304 million of inflows. Last week’s inflows led year-to-date (YTD) inflows higher to $36 billion.

Supply (YTD supply of $465 billion; up 17% YoY): The muni market recorded $9 billion of new-issue supply last week, down 17% from the prior week. YTD new-issue supply of $465 billion is 17% higher than the prior year, with tax-exempt issuance up 18% year-over-year (YoY) and taxable issuance up 2% YoY. This week’s calendar is expected to pick up to $13 billion. The largest deals include $1.8 billion Texas Transportation Commission and $1.5 billion New Jersey Transportation Trust transactions.

This Week in Munis: Federal Shutdown

The federal government shutdown has entered its third week, and ongoing debate around government spending has increased scrutiny of the municipal bond market that benefits from federal spending to varying degrees across sectors. While the immediate effects of the current federal government shutdown appear limited for most municipal issuers, the longer-term implications could be more pronounced across different sectors and issuers.

State and local general obligation issuers comprise the majority of the municipal market and remain well positioned to weather short-term federal funding uncertainty. These issuers typically benefit from broad and autonomous taxing authority across income, sales, and property taxes. States and localities also benefit from financial flexibility to delay or defer expenditures if needed, providing a buffer against short-term disruptions. State and local government credit health remains in a strong position, with tax collections near record highs and reserves elevated by historical standards. These robust fundamentals should help mitigate any marginal impacts from reduced federal contributions to programs such as Medicaid, the Infrastructure Investment and Jobs Act or the Inflation Reduction Act.

Certain revenue-backed sectors, including health care, higher education and not-for-profit entities, face greater potential revenue volatility due to their direct or indirect dependence on federal funding. These sectors have drawn more attention amid political discourse surrounding the future of government support. Health care systems, for instance, could be significantly affected by potential cuts to Medicaid or the Affordable Care Act, both of which have been key points in current federal budget negotiations. Similarly, higher education institutions are vulnerable to reductions in research and grant funding, potential changes to endowment tax policies, and future potential international enrollment limitations.

The diverging impacts highlight the importance of selective and diligent credit analysis in municipal portfolios. For sectors more reliant on federal funding, Western Asset is focusing on issuers with strong reserves, diversified revenue streams and proactive management teams capable of adapting to evolving fiscal conditions. In addition, for municipal securities backed by federal lease payments, we are placing increased scrutiny on the essentiality of the underlying asset, as well as the stability and reliability of lease agreements and user fees. Ultimately, the degree of credit volatility will depend on whether federal funding reductions flow down to the state, local or issuer level. At this stage, the broad-based impact appears limited. However, long-term impacts of what may come from an ultimate resolution of the current budget stalemate could alter the trajectory for select issuers.

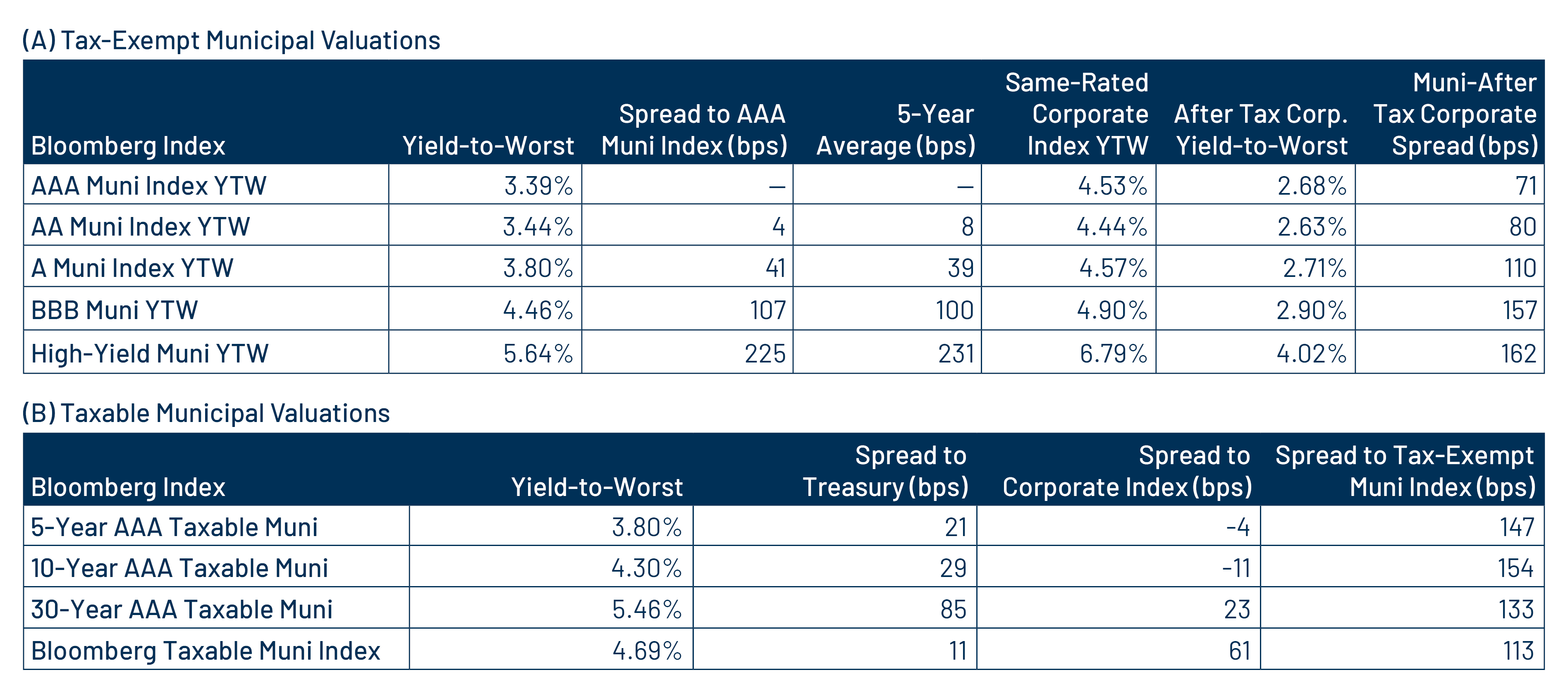

Municipal Credit Curves and Relative Value

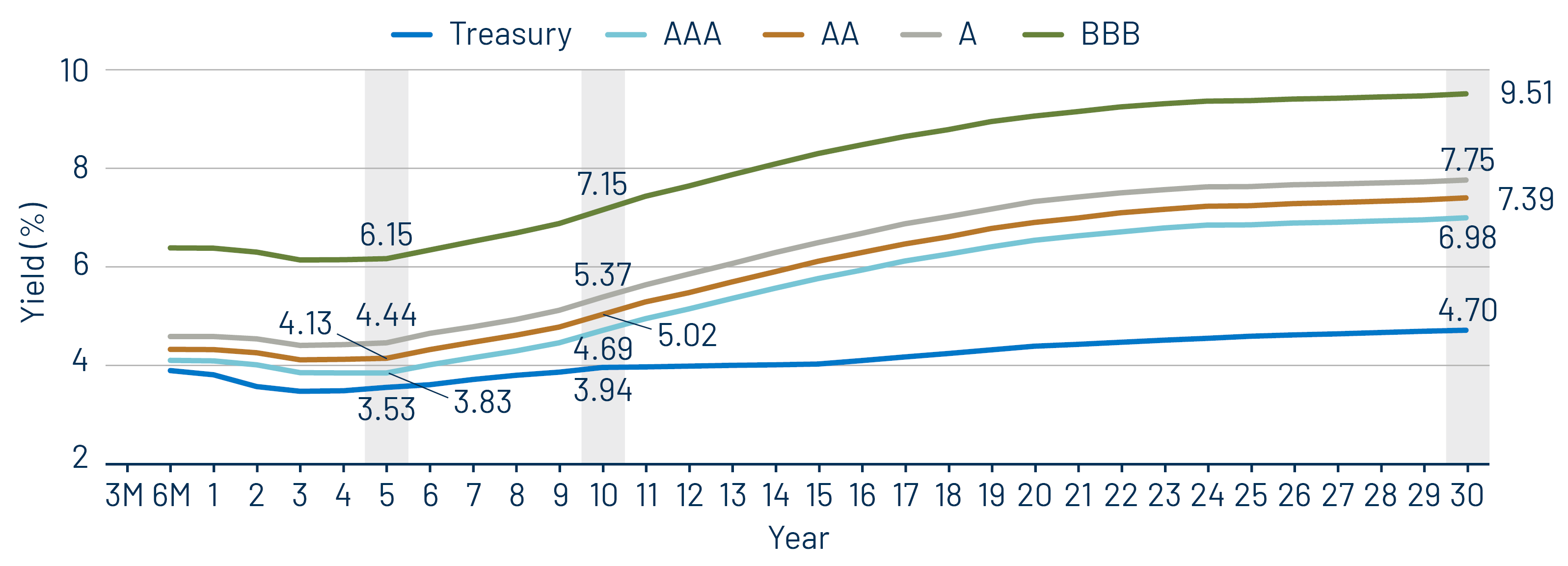

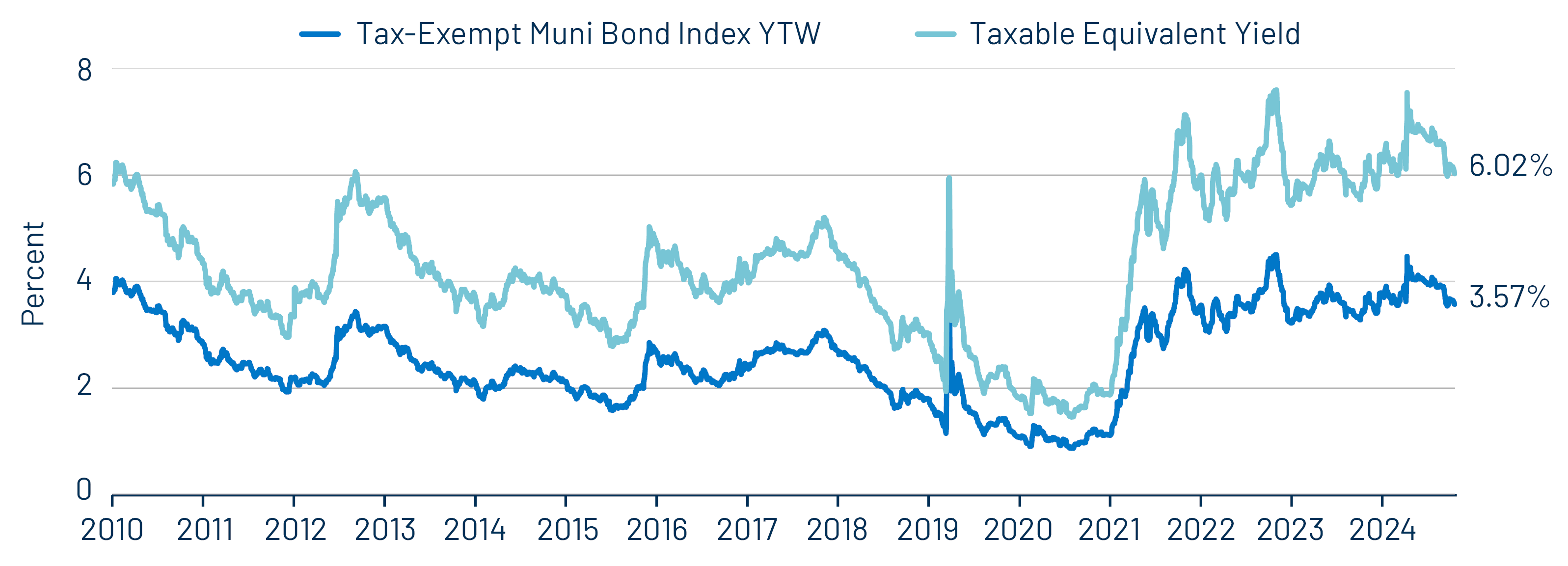

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

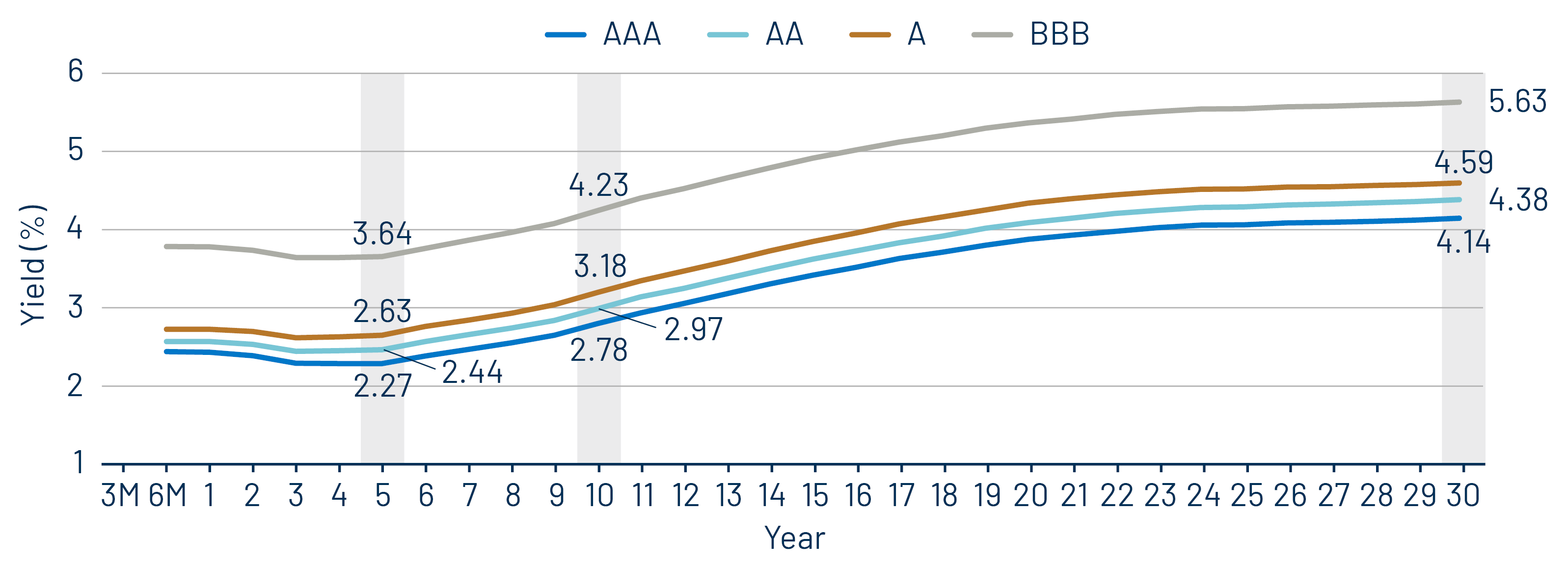

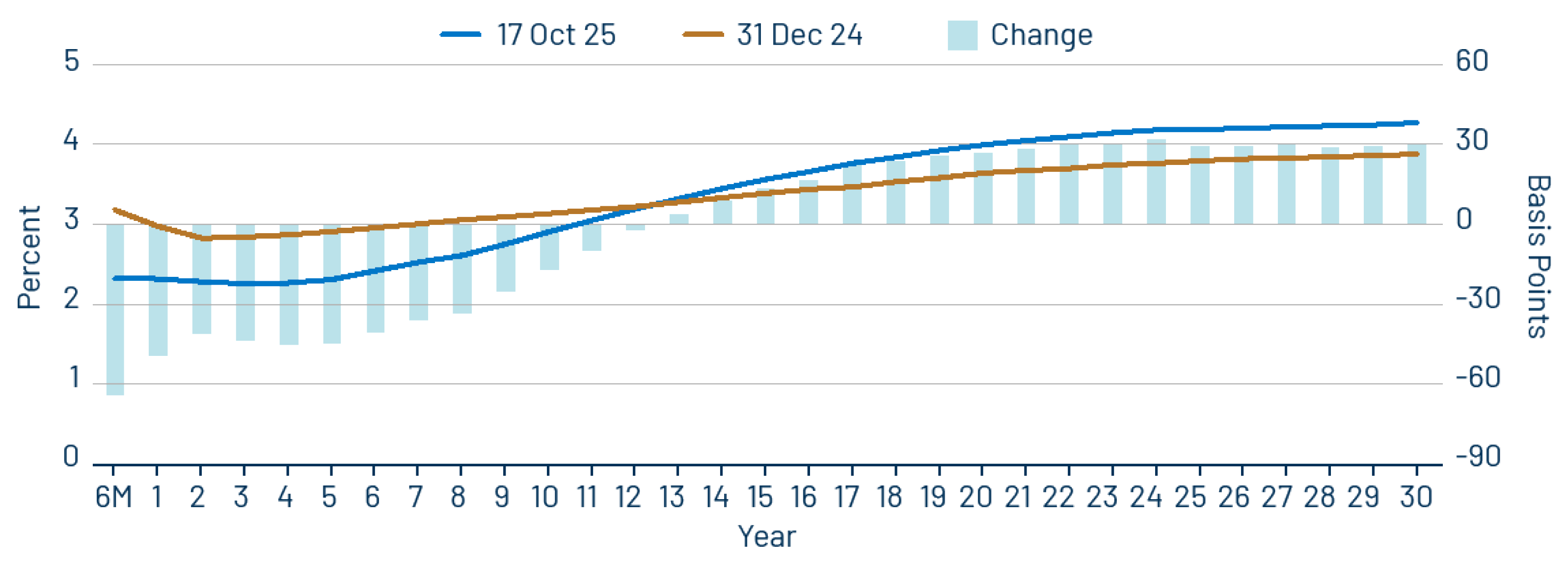

Theme #2: The AAA muni curve has steepened this year, offering better value in intermediate and longer maturities.

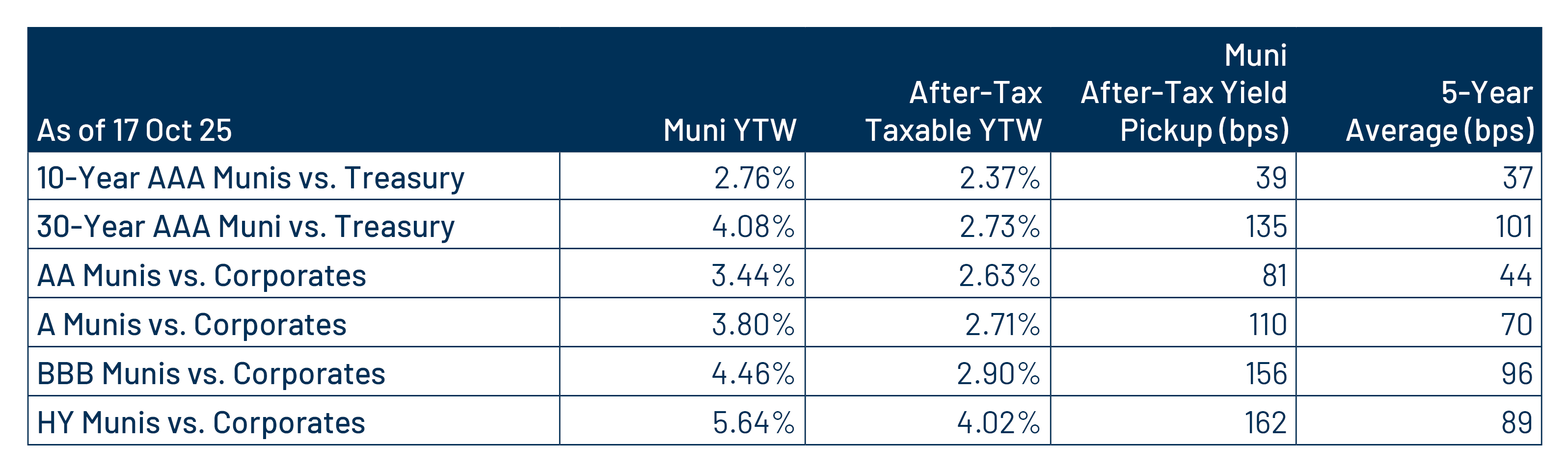

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.