Municipal Weakness Accelerated Last Week

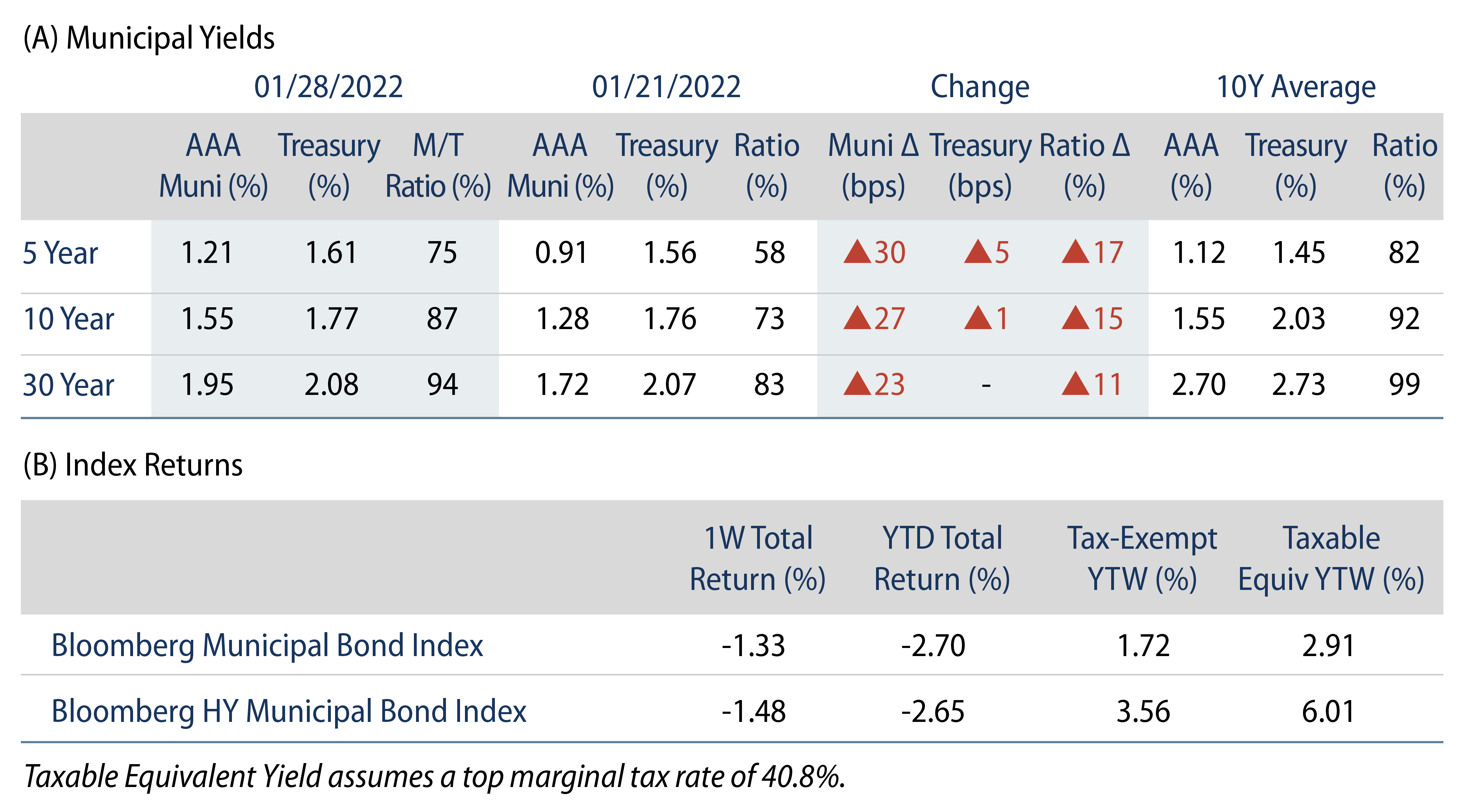

US municipals posted negative returns and underperformed Treasuries as Municipal/Treasury ratios reverted closer to longer-term averages. High-grade municipal yields moved 23-30 bps higher across the curve. Technicals softened as municipal outflows extended into a second week. The Bloomberg Municipal Index returned -1.33%, while the HY Muni Index returned -1.48%. This week we highlight implications of the end of a record inflow cycle observed from the spring of 2020.

Technicals Weaken as Fund Outflows Accelerate

Fund Flows: During the week ending January 26, municipal mutual funds recorded $1.4 billion of net outflows, according to Lipper. Long-term funds recorded $760 million of outflows, high-yield funds recorded $454 million of outflows and intermediate funds recorded $158 million of outflows. Municipal fund flows year to date (YTD) are now negative at $1.1 billion.

Supply: The muni market recorded $8 billion of new-issue volume last week, in line with the prior week. Total YTD issuance of $28 billion is 50% higher from last year’s levels, with tax-exempt issuance trending 84% higher year-over-year (YoY) and taxable issuance trending 21% lower YoY. This week’s new-issue calendar is expected to increase to $9 billion. Largest deals include $908 million Rayburn Country Securitization LLC and $651 million New York Triborough Bridge and Tunnel Authority transactions.

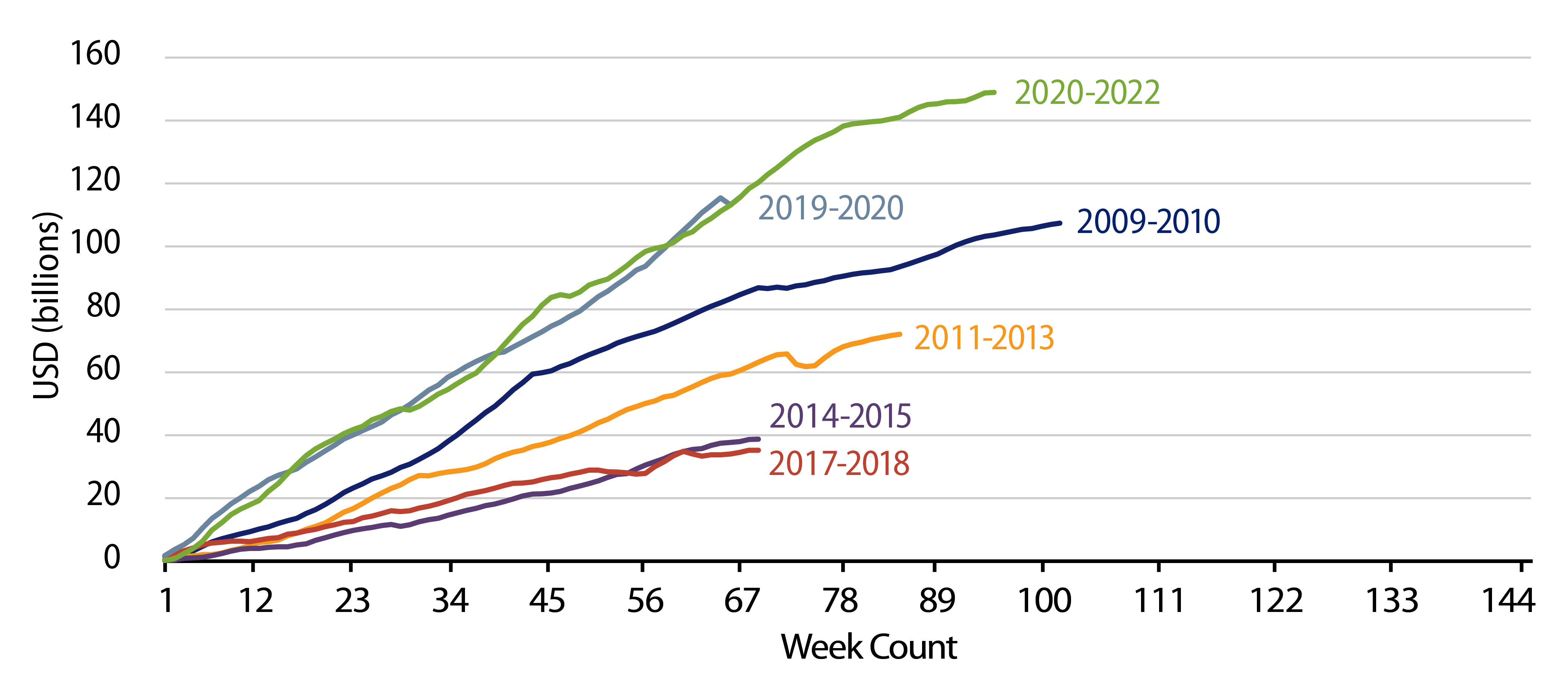

This Week in Munis—End of a Record Demand Cycle

The municipal mutual fund outflows observed over the last two weeks ended a record positive demand cycle that was observed since the pandemic-driven drawdowns. According to ICI data, from April 29, 2020 to January 12, 2022 municipal mutual funds recorded 86 weeks of net inflows (over 88 weeks), totaling $149 billion. The municipal mutual fund demand well surpassed the prior record observed in 2019-2020, which spanned 60 consecutive weeks and totaled $115 billion. According to Lipper, the General and Insured Category collected the most assets over this period followed by high-yield municipal mutual funds.

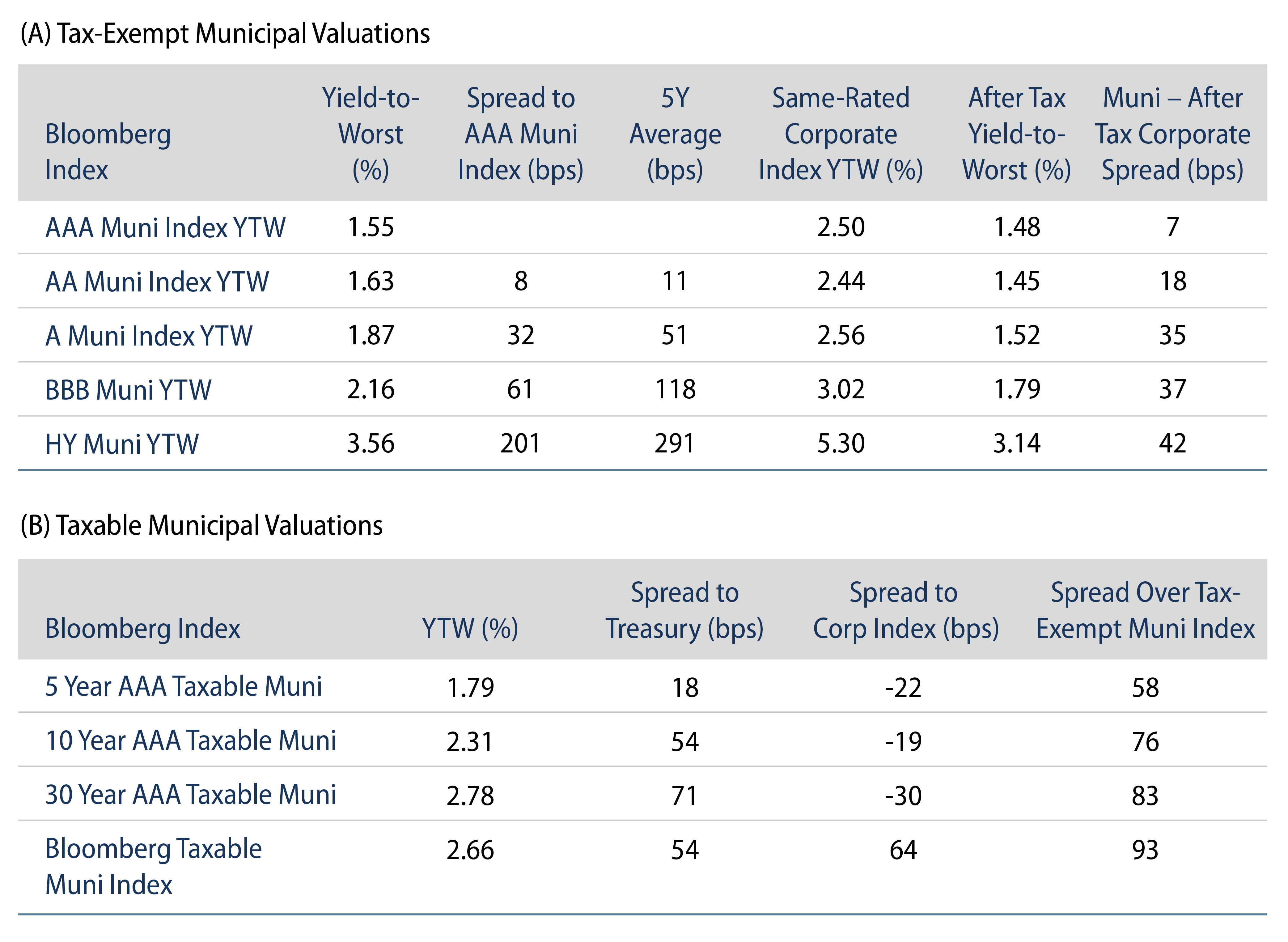

Notably, the robust demand for munis persisted during a period of elevated interest-rate volatility that challenged most other fixed-income asset class returns in 2021. A combination of improved fundamentals that alleviated pandemic-driven credit concerns, along with expectations of higher tax rates, increased the relative value proposition and attracted investors to the asset class. Entering 2022, this relative value proposition was simply less attractive as spreads narrowed to post-global financial crisis (GFC) lows. Considering the starting point of relatively rich valuations, municipal demand quickly softened amid the most recent bout of inflation-driven market volatility as weekly reporting municipal mutual funds recorded approximately $2 billion of net outflows over the past two weeks, according to Lipper.

Over the last decade, the municipal market has become increasingly sensitive to mutual fund demand, considering mutual fund assets have comprised a greater share of market activity. From September 2008 to September 2021, assets under management (AUM) for muni mutual funds increased over 2.5x to $1.1 trillion. Brokers and dealers, who have historically served as primary intermediaries of market volatility prior to the GFC, reduced municipal inventories by over 80% to $12 billion during this period. Other market intermediaries such as banks and insurance companies have also stepped away from the tax-exempt market more recently as corporate tax rates declined from 35% to 21% in 2017. As a result of this market evolution, liquidity seekers often outnumber liquidity providers in times of volatility, which could quickly present opportunities as tax-exempt yields can move significantly higher (as they have this week) when fund demand declines. Western Asset believes that active management of liquidity is essential in navigating these market dynamics to achieve our objectives of providing long-term risk-adjusted returns for our clients.