Macros, Markets and Munis

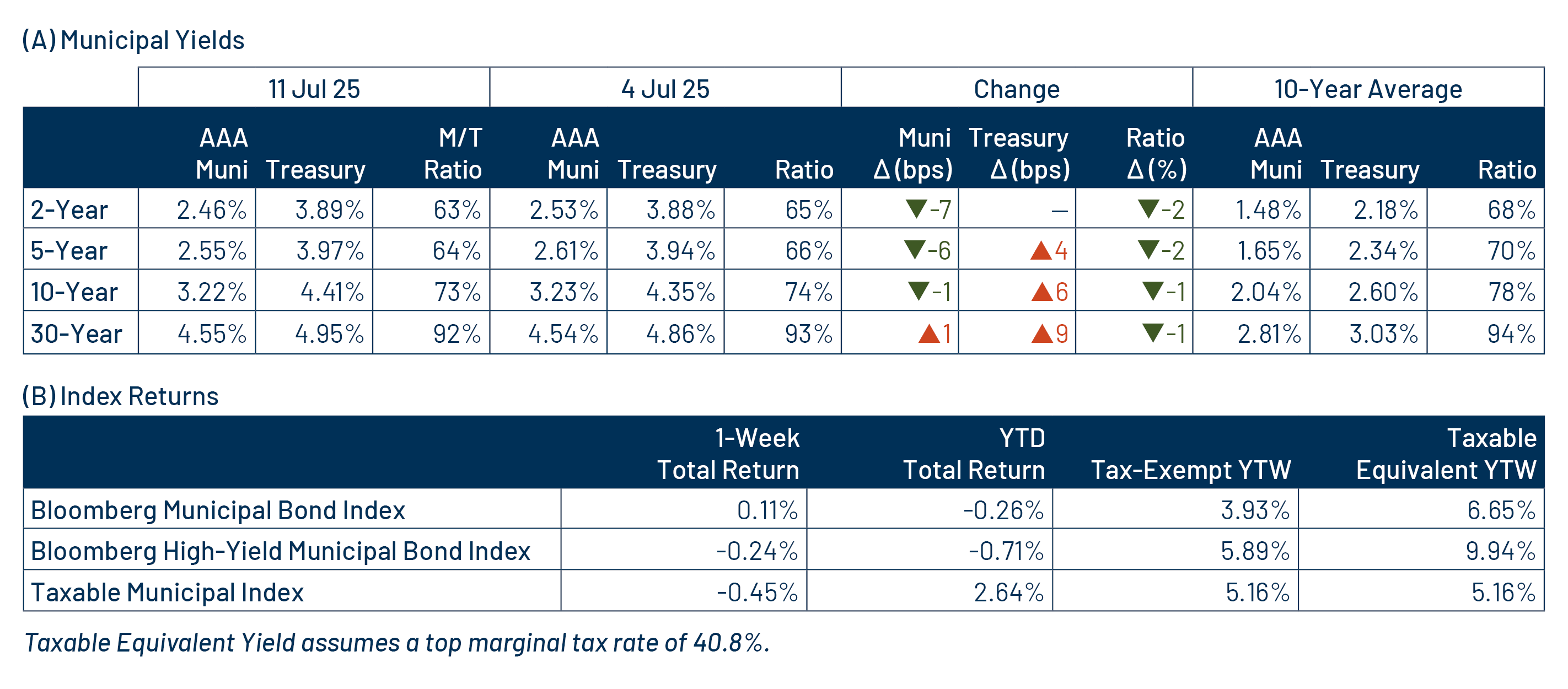

Municipals posted positive returns last week as yields moved 1-7 basis points lower across short and intermediate maturities, outperforming Treasuries which generally moved higher across the curve. Amid a light week of economic data, fixed-income volatility increased last week as tariffs and associated inflation concerns came back into focus as the original Liberation Day tariff deadlines approached. This week we highlight implications from the final “Big Beautiful Bill” legislation signed by President Trump on July 4.

Muni Issuance Rebounded to Elevated Levels

Fund Flows (up $432 million): During the week ending July 13, weekly reporting municipal mutual funds recorded $432 million of net inflows, according to Lipper. Short and short-intermediate categories recorded the majority inflows at $211 million, collectively. Long-term funds recorded $56 million of inflows, intermediate funds recorded $81 million of inflows and high-yield funds recorded $137 million of inflows. Last week’s inflows marked an 11th consecutive week of inflows and led year-to-date (YTD) inflows higher to $14 billion.

Supply (YTD supply of $305 billion; up 27% YoY): The muni market recorded $15 billion of new-issue supply last week, rebounding to elevated levels following the prior light holiday week. YTD new-issue supply of $305 billion is 27% higher than the prior year, with tax-exempt issuance up 11% and taxable issuance up 28%, respectively. This week’s calendar is expected to remain elevated at $15 billion. The largest deals include $1.4 billion New York Transportation Development Corporation and $2.4 billion New York State Thruway Authority transactions.

This Week in Munis: Big Beautiful Bill Outcomes

On July 4, President Trump signed the “Big Beautiful Tax Reconciliation” legislation, following a series of Senate amendments during the week leading up to the holiday. The bill extends key provisions of the 2017 Tax Cuts and Jobs Act (TCJA) and introduces additional measures, including increased border security and health care reform. According to CBO estimates, the legislation is expected to cost between $3.3 trillion and $3.4 trillion over the next decade. Implications for municipal investors extend across long-term tax policy and the relative value of municipal debt to credit implications stemming from funding changes.

- Permanently Extending Individual Tax Rates: Of particular interest to municipal bond investors, the legislation permanently extends the individual income tax brackets established by the 2017 TCJA, keeping the top federal marginal rate at 37%. This maintains the current value of the municipal tax exemption for top earners in the muni market.

- Increasing SALT Deduction: The bill increases the State and Local Tax (SALT) deduction cap from $10,000 to $40,000 and establishes an income limit of $250,000 for single filers and $500,000 for joint filers. While this will reduce tax liabilities for many in high-tax states, we expect the income limits to blunt the impact of the proposed relief and not materially reshape the demand profile of municipal investors. This provision is set to expire in December 2029.

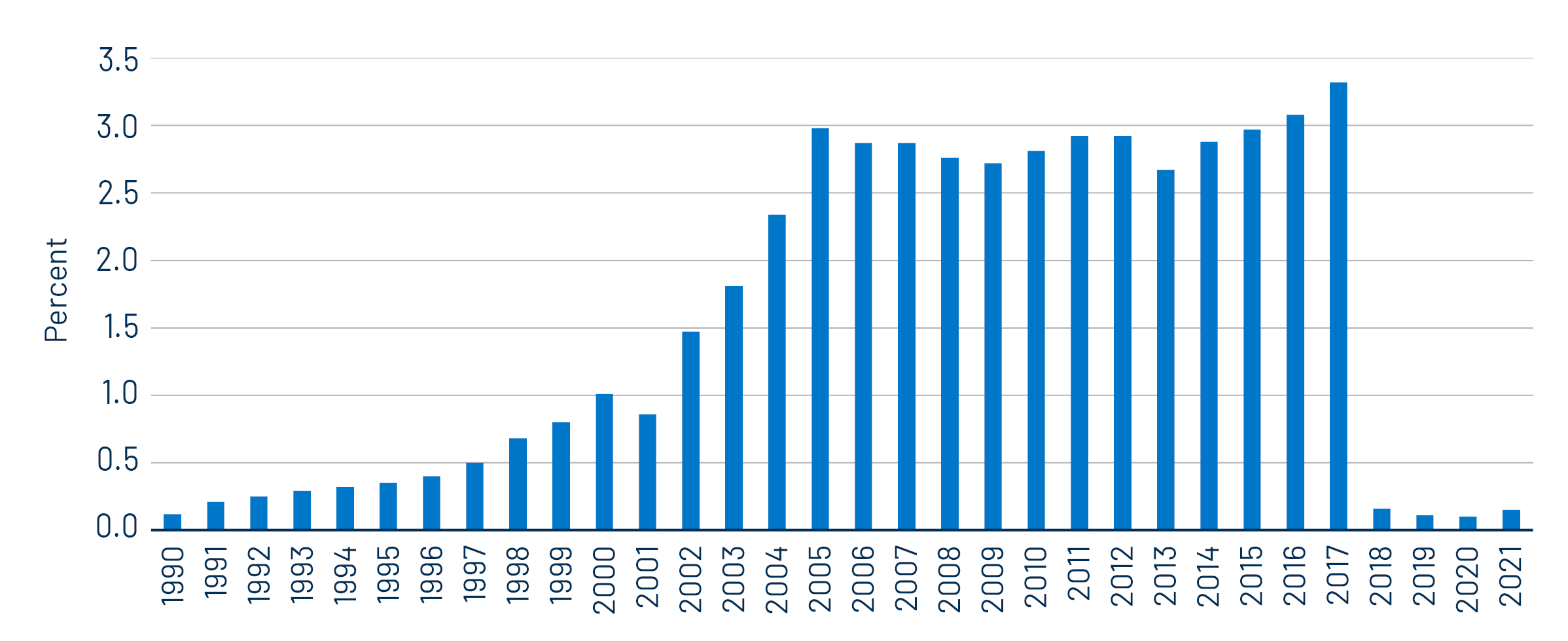

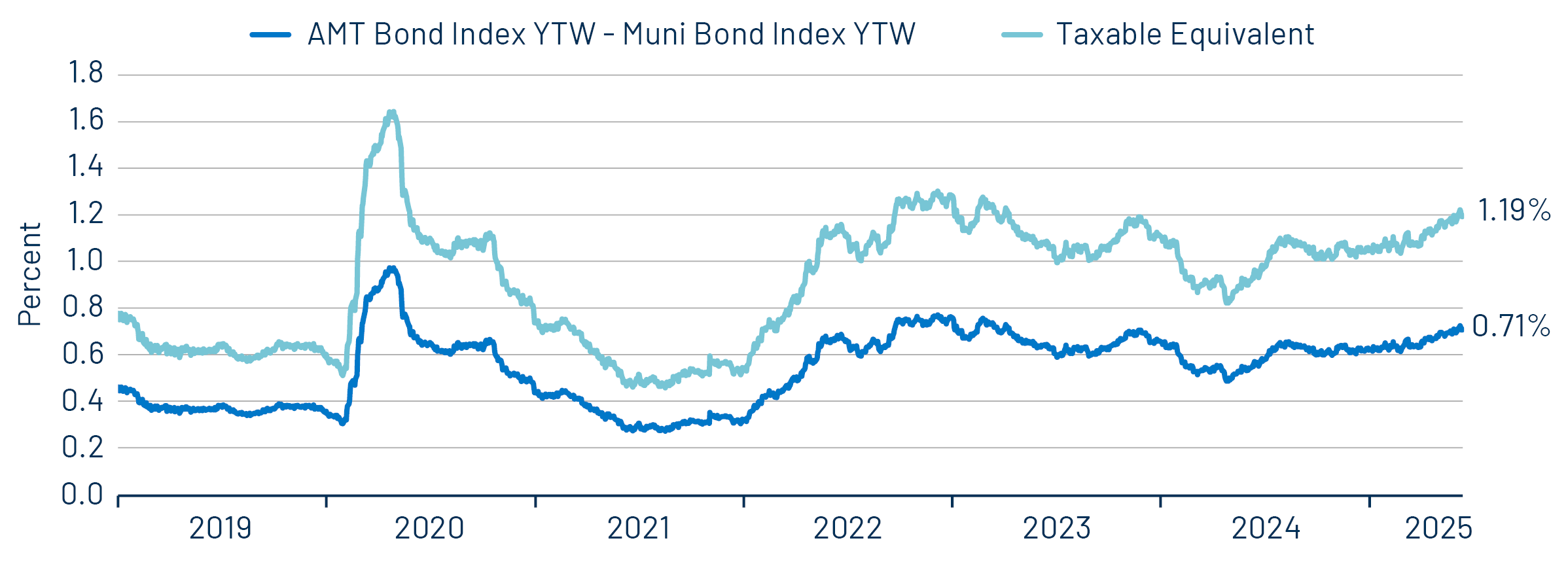

- Extending AMT Provisions: Notably, the bill permanently extends the higher Alternative Minimum Tax (AMT) exemption amounts and phase-outs established by the 2017 TCJA, which reduced the number of taxpayers subject to the AMT by 96% from over five million to 200,000. Municipal securities subject to the AMT tend to offer excess income opportunities versus non-AMT counterparts, and the extension of this provision can provide higher after-tax income opportunities for a broader base of investors not subject to the AMT.

Throughout the presidential campaign and early Trump presidency, rhetoric around lower tax rates and the potential elimination of the municipal tax exemption created uncertainty regarding the sustained value of municipal securities. Western Asset believes this uncertainty weighed on market demand, as observed following the 2022−2023 outflow cycle. Specifically, we anticipate the municipal market will contend with greater rate volatility due to expanding deficits, as well as evolving credit implications associated with federal funding reductions, particularly in the health care sector which faces lower Medicaid spending. We believe these shifting market dynamics will create opportunities for active managers to deliver risk-adjusted value to municipal investors ahead.

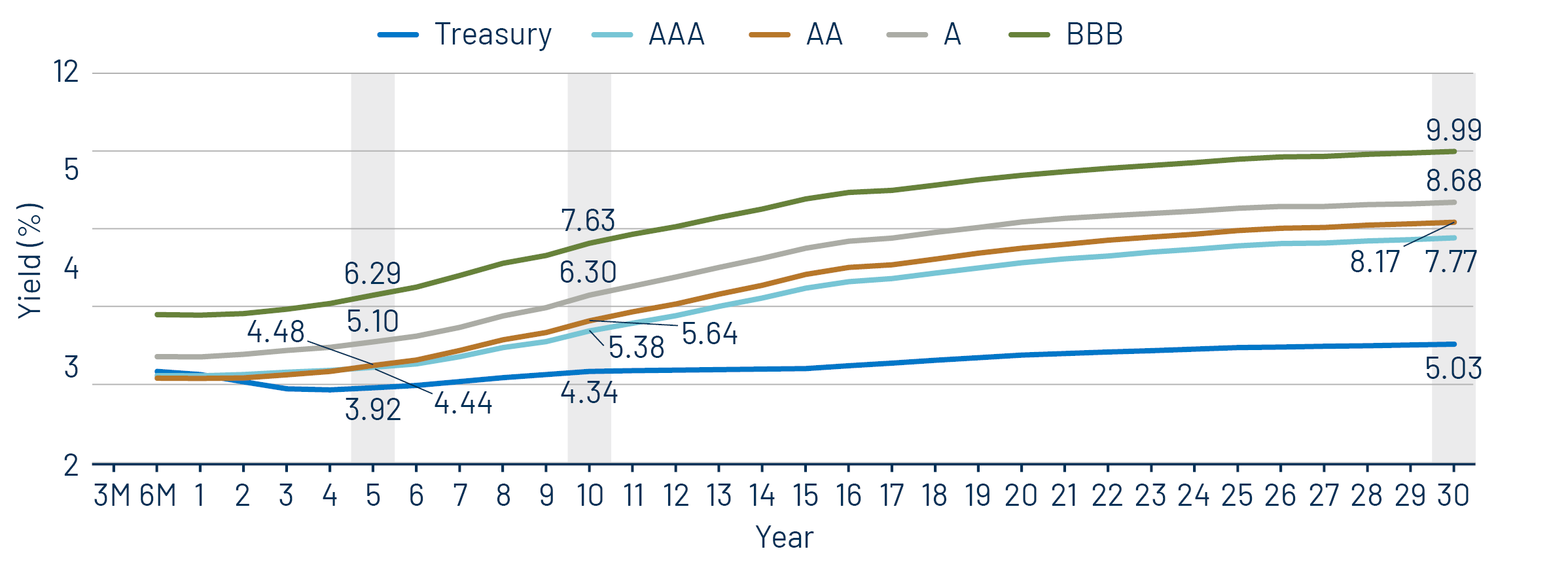

Municipal Credit Curves and Relative Value

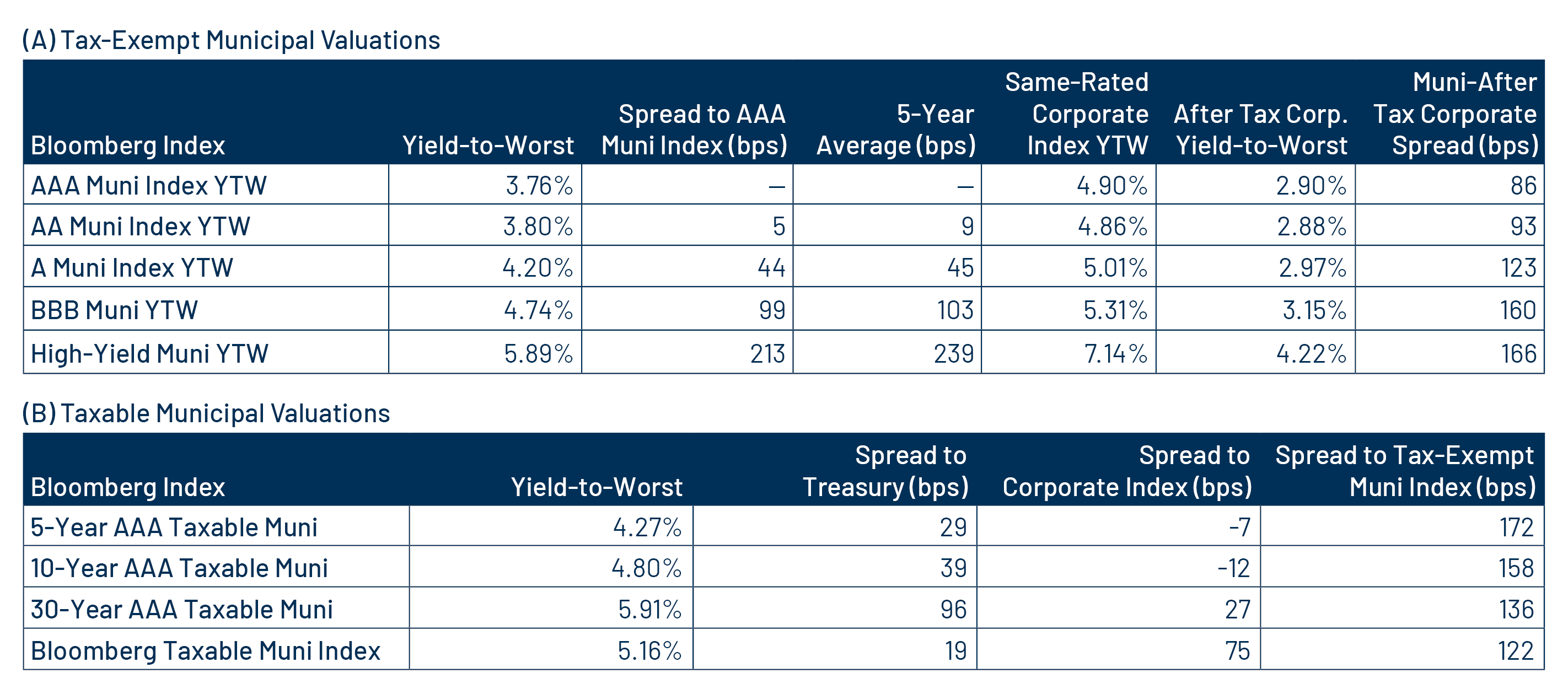

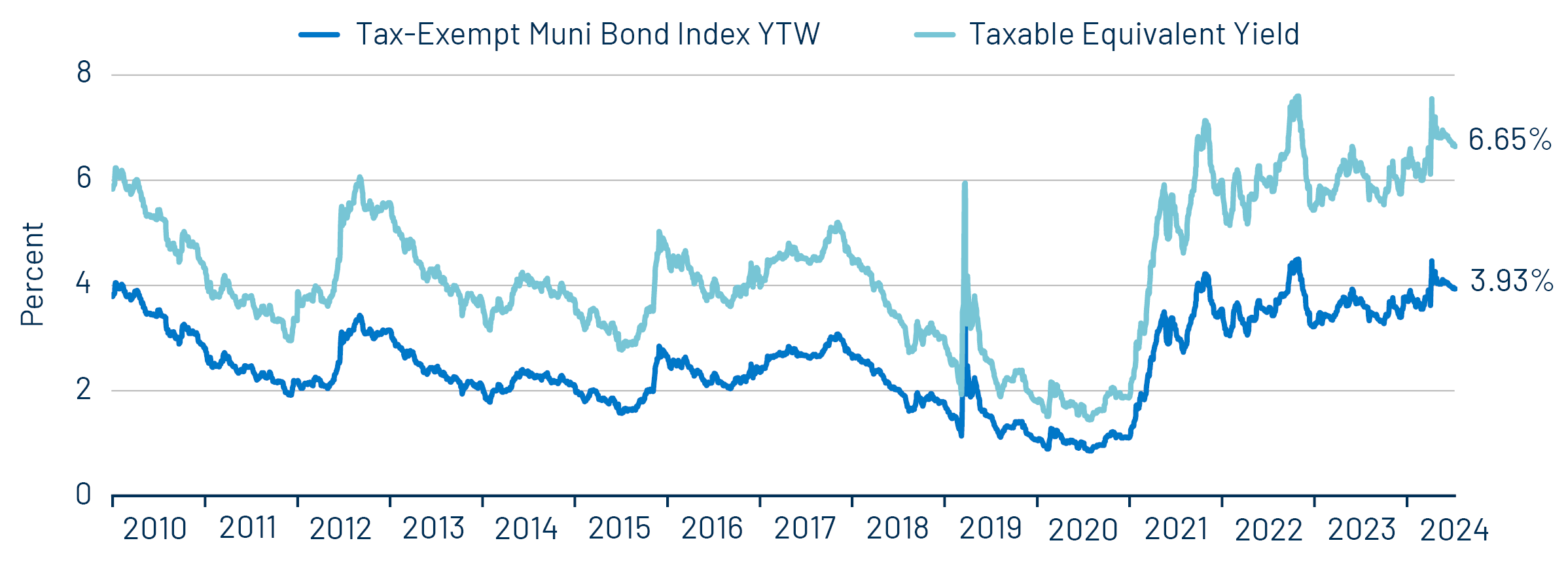

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

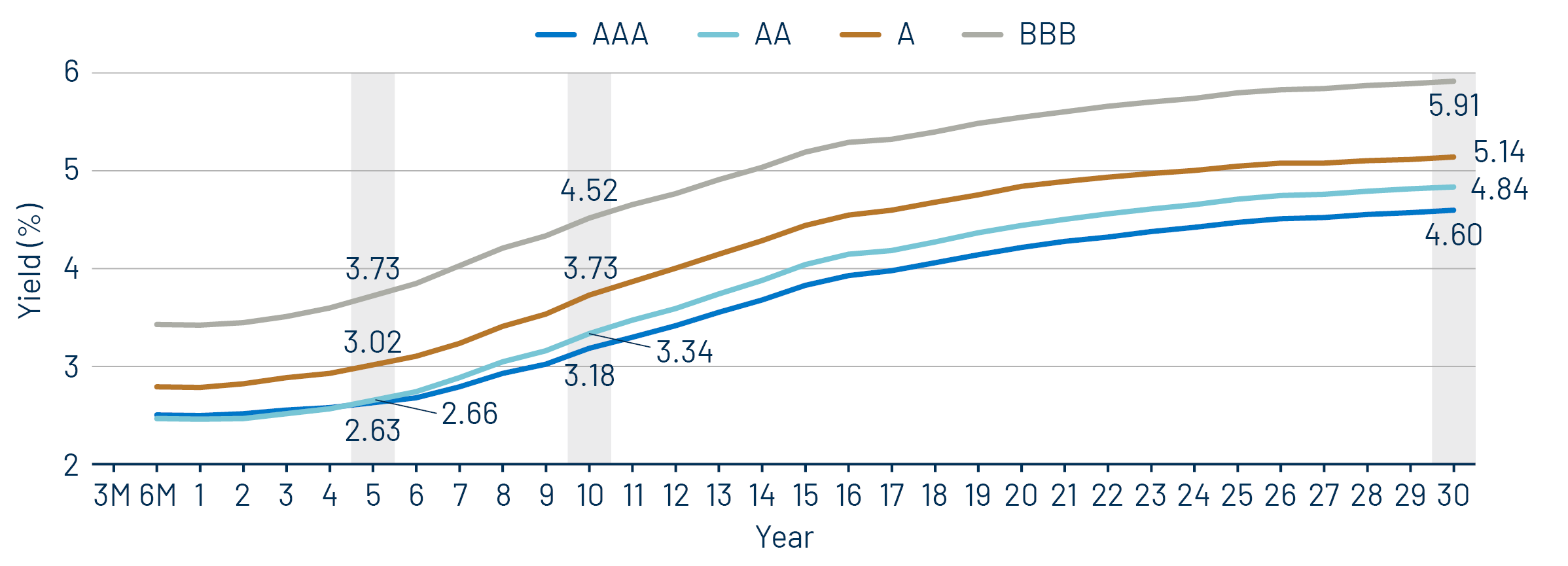

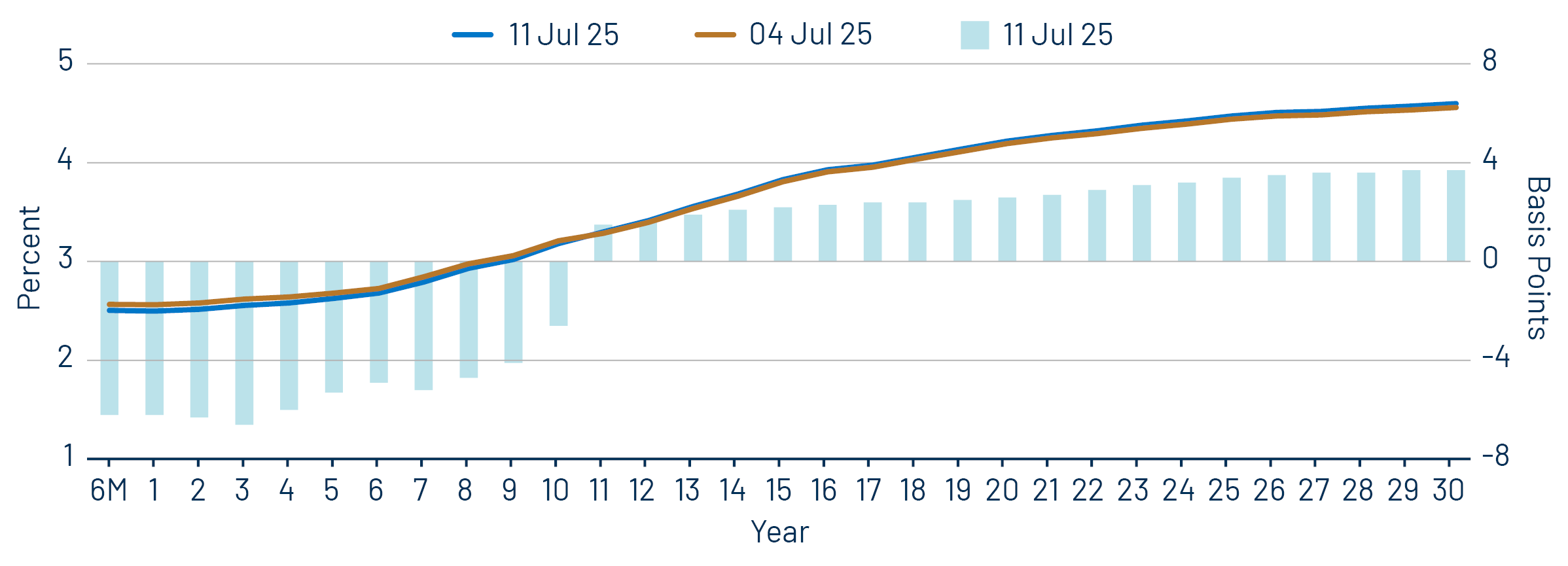

Theme #2: The AAA muni curve has steepened, offering better value in intermediate and longer maturities.

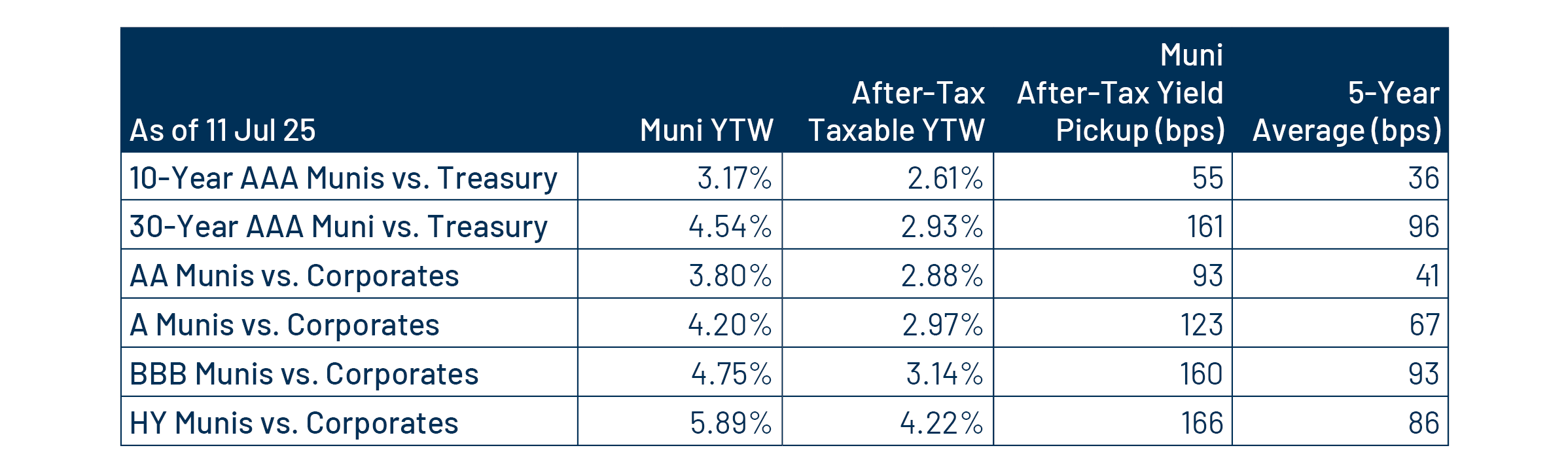

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.