Tax-Exempt Municipals Posted Positive Returns for a Third Consecutive Week

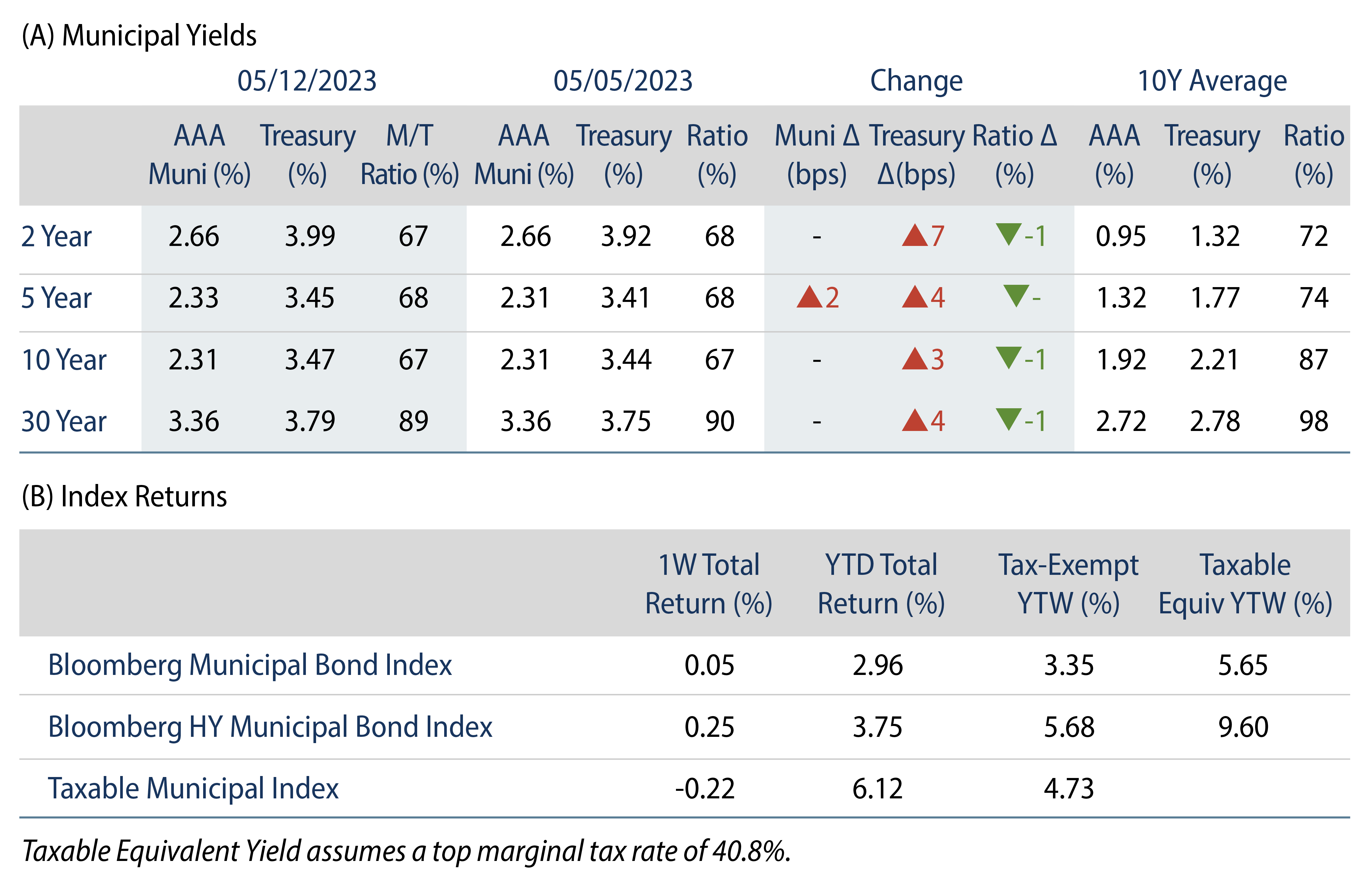

Municipals posted positive returns last week as high-grade yields were steady across the yield curve. Munis outperformed Treasuries, which moved higher. Treasury yields were supported early in the week by lower than expected CPI and PPI data, but yields ultimately moved higher Friday following challenged University of Michigan consumer sentiment data. Technicals were soft amid above-average supply conditions and mutual fund outflows. The Bloomberg Municipal Index returned 0.05% during the week, the High Yield Muni Index returned 0.25% and the Taxable Muni Index returned -0.22%. This week we highlight the scope of banking sector muni liquidations associated with regional bank challenges.

Higher Supply, Fund Outflows Continue to Challenge Technicals

Fund Flows: During the week ending May 10, weekly reporting municipal mutual funds recorded $102 million of net outflows, according to Lipper. Long-term funds recorded $341 million of inflows, high-yield funds recorded $71 million of inflows and intermediate funds recorded $175 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to $5.6 billion.

Supply: The muni market recorded $9 billion of new-issue volume last week, up 58% from the prior week. YTD issuance of $121 billion is down 14% year-over year (YoY), with tax-exempt issuance down 8% YoY and taxable issuance down 44% YoY. This week’s calendar is expected to drop to $5 billion. Large transactions include $616 million Virginia College Building Authority and $277 million California Housing Financing Agency transactions.

This Week in Munis: Bank Selling

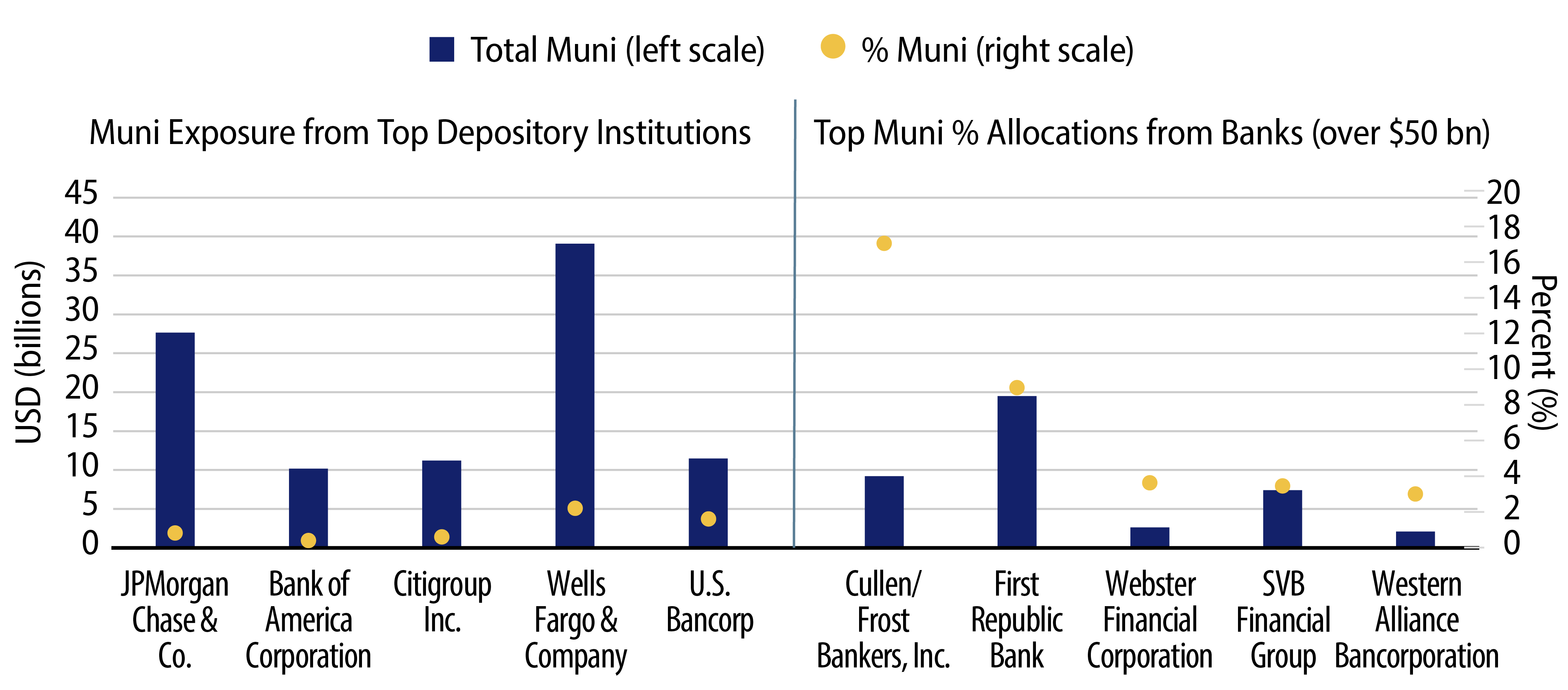

Since banking sector challenges began in March, a key concern for the municipal market was the potential for elevated selling of municipal assets from regional banks compelled to de-risk due to deposit flight. Following the FDIC takeovers of both Silicon Valley Bank and Signature Bank, as well as the JPMorgan acquisition of First Republic earlier this month, we have seen early-stage selling in the muni market.

Regional banks have greater allocations to municipal bonds on their balance sheets versus some of the larger depository institutions, according to FDIC call report data. The top depository institutions by assets, JPMorgan, Bank of America and Citigroup, held less than 1% of total assets in municipal securities. Regional banks, which tend to take more interest-rate risk, have allocated at times over 17% of their asset allocation to municipals. As JPMorgan consolidates First Republic’s assets within its risk targets, we expect to see a wind-down of legacy First Republic municipal assets. First Republic’s $19.5 billion municipal allocation represented 10% of the company’s balance sheet, compared to JP Morgan’s $27 billion of municipal assets which comprise 0.8% of JP Morgan’s asset base.

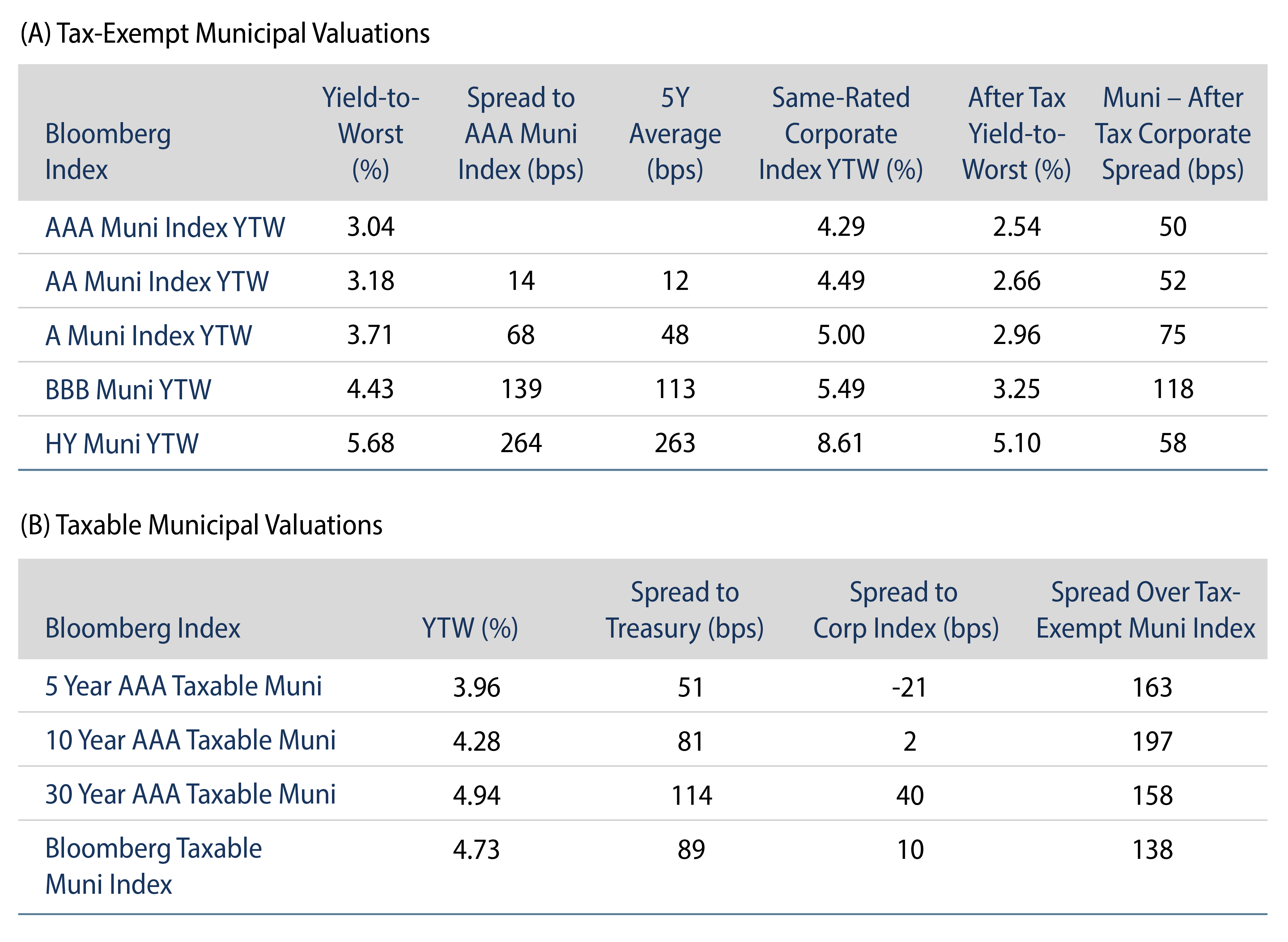

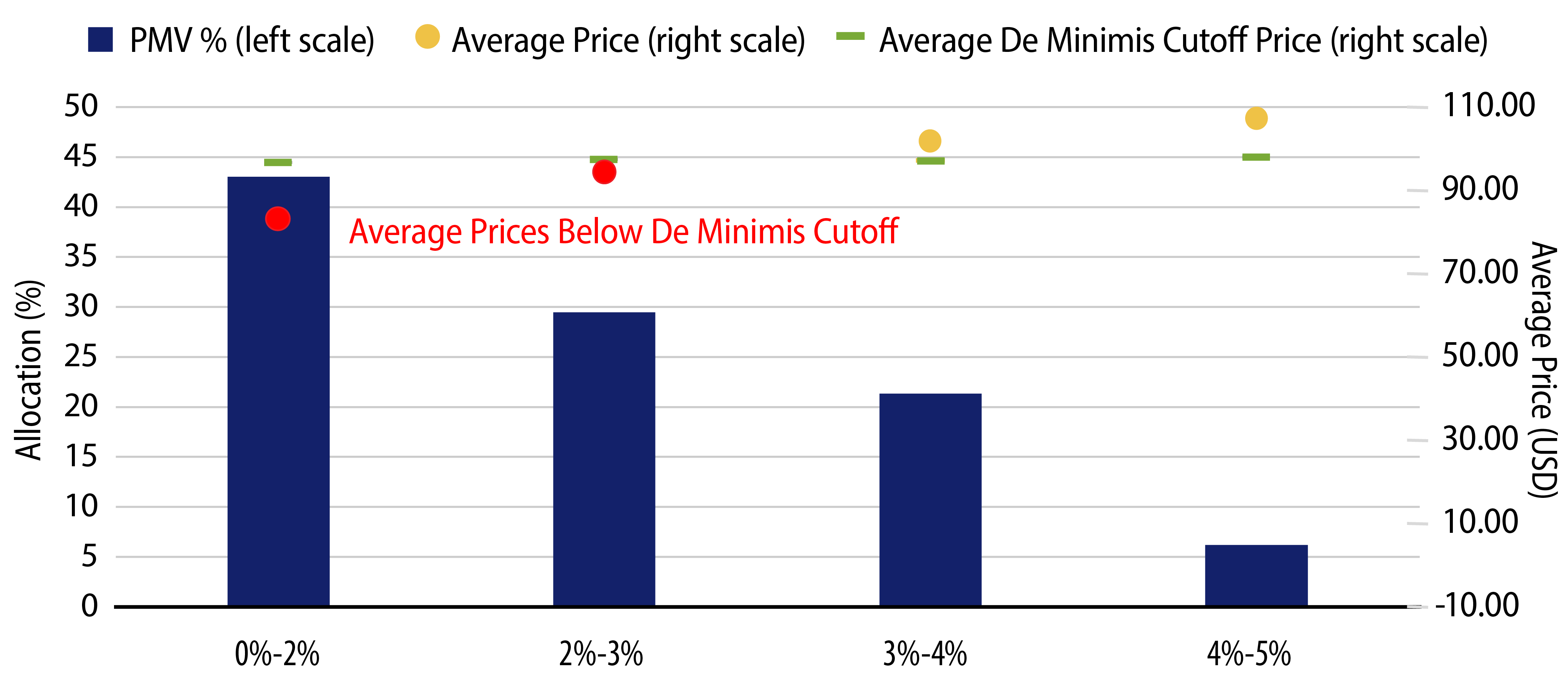

Meanwhile, the FDIC liquidation of Silicon Valley Bank’s $7 billion of municipal assets that began last month will likely continue into the summer. SVB’s muni allocation was primarily concentrated in high-grade tax-exempt assets, with over 70% of municipal securities allocated to coupons of 3% or less. These lower-coupon securities are more susceptible to steeper discounts in the higher rate environment. According to the de minimis tax rule, if the price of the bond falls below the de minimis price cutoff, a municipal bond’s accretion can be fully taxed at the ordinary income rate.

For individual investors that can face a top marginal tax rate of 40.8%, the tax impact of prices falling below the de minimis tax cutoff can be material, which could limit the liquidity for these securities. For an institution such as a bank or insurance company with a marginal tax rate of 21%, the impact of the de minimis rule is less material and could present opportunities for these entities if retail demand sidesteps these structures.

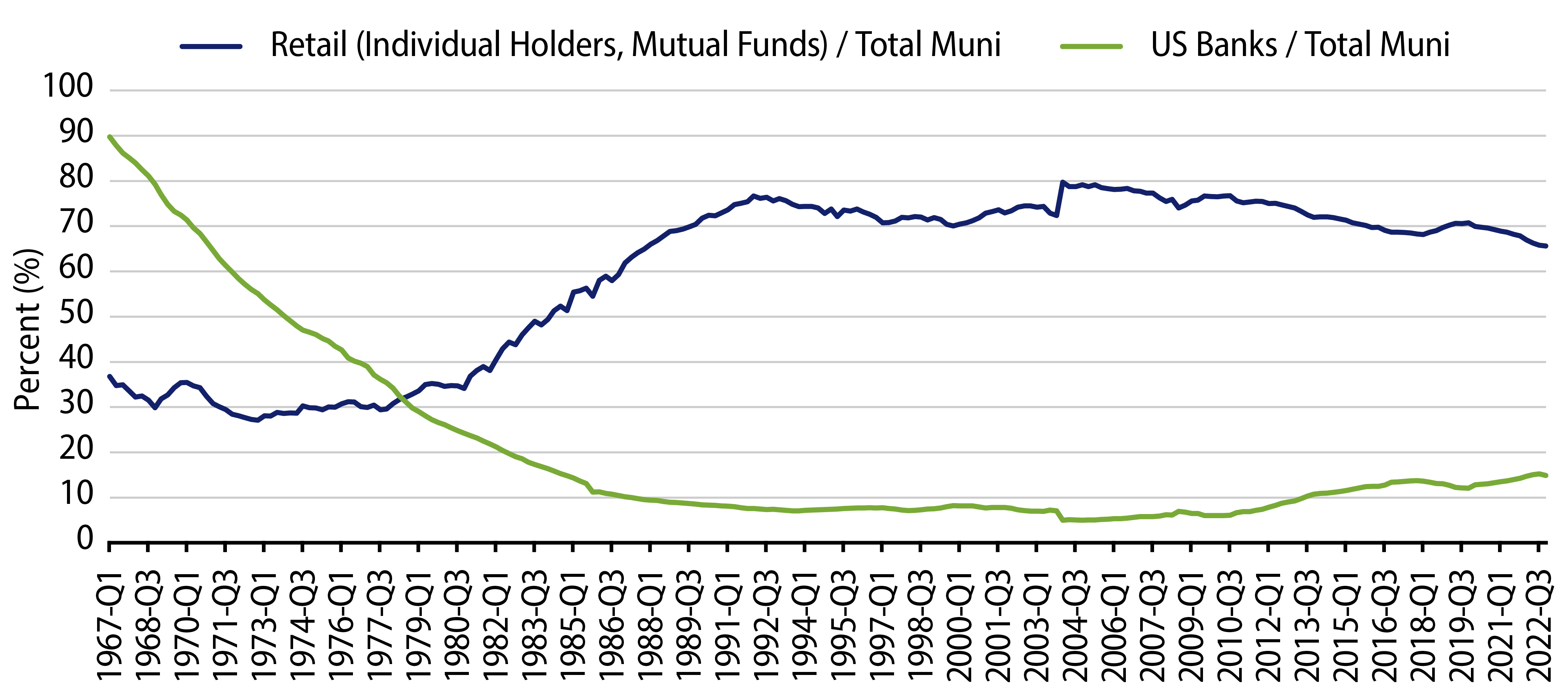

While the size of the municipal allocations that will be liquidated is significant, Western Asset anticipates wind-downs to be orderly and generally well received into strengthening market technicals. We anticipate that more than $1 billion of taxable supply was well absorbed in the taxable municipal market in recent weeks, which is contending with supply that is down 40% YoY. Meanwhile, given the anticipated seasonally low summer new-issue supply, elevated principal redemptions should provide an opportunity for orderly unwinds of the tax-exempt allocations. While we do not anticipate bank sector selling to cause outsized volatility in the near term, less bank ownership of municipal assets will likely lead to fewer marginal liquidity providers, which could exacerbate future bouts of volatility in the municipal market.