Municipals Posted Positive Returns Last Week

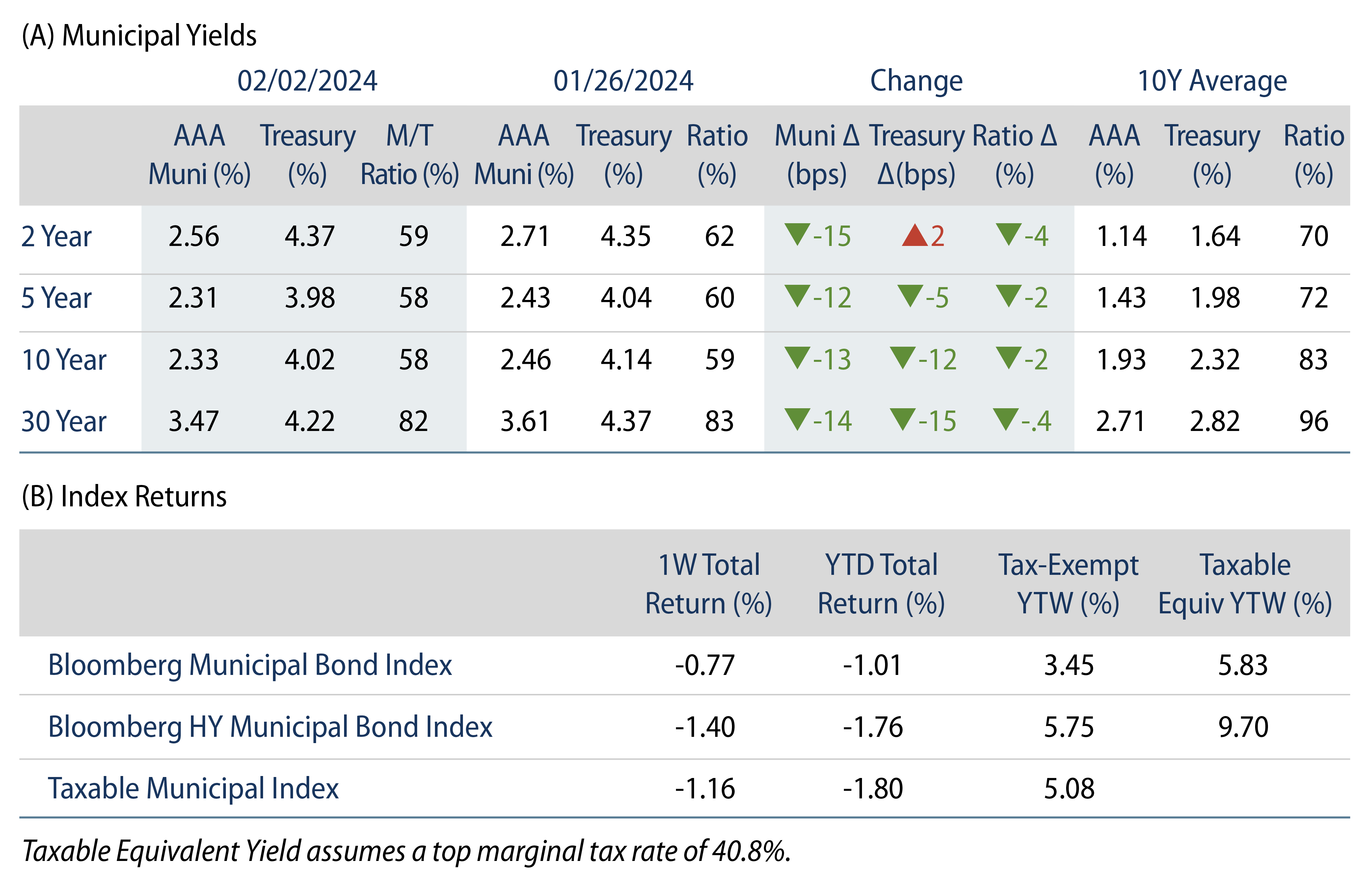

Munis posted positive returns and outperformed Treasuries last week, as yields moved lower despite a stronger-than-expected payrolls report. Market technicals improved with municipal mutual funds recording inflows amid lighter supply conditions. The Bloomberg Municipal Index returned 0.94% during the week, the High Yield Muni Index returned 1.57% and the Taxable Muni Index returned 1.34%. This week we highlight active versus passive muni fund performance and the structural benefit of active management within the muni market.

Muni Technicals Strengthened on Lower Supply, Fund Inflows

Fund Flows: During the week ending January 31, weekly reporting municipal mutual funds recorded $1.5 billion of net inflows, according to Lipper. Long-term funds recorded $1.5 billion of inflows, high-yield funds recorded $626 million of inflows and intermediate funds recorded $95 million of inflows. Short-term funds posted outflows of $25 million. This week marks the fourth consecutive week of inflows and led year-to-date (YTD) net mutual fund inflows higher to $2 billion.

Supply: The muni market recorded $6 billion of new-issue volume last week, down 35% from the prior week. YTD issuance of $35 billion is 50% higher from last year’s level, with tax-exempt issuance up 58% and taxable issuance up 16% year-over year. This week’s calendar is expected increase to $8 billion. The largest deals include $1 billion New York Transition Finance Authority and $540 million Commonwealth of Massachusetts transactions.

This Week in Munis: Active Management Often Outperforms

Low absolute yields over the past decade have heightened the allure of passive municipal mutual funds. From 2013-2023, passive muni mutual funds garnered $103 billion of inflows or nearly nine times starting 2013 AUM levels, according to Morningstar. Over the same period, active municipal funds collected a comparable $105 billion of net inflows, though representing just 18% of 10-year growth.

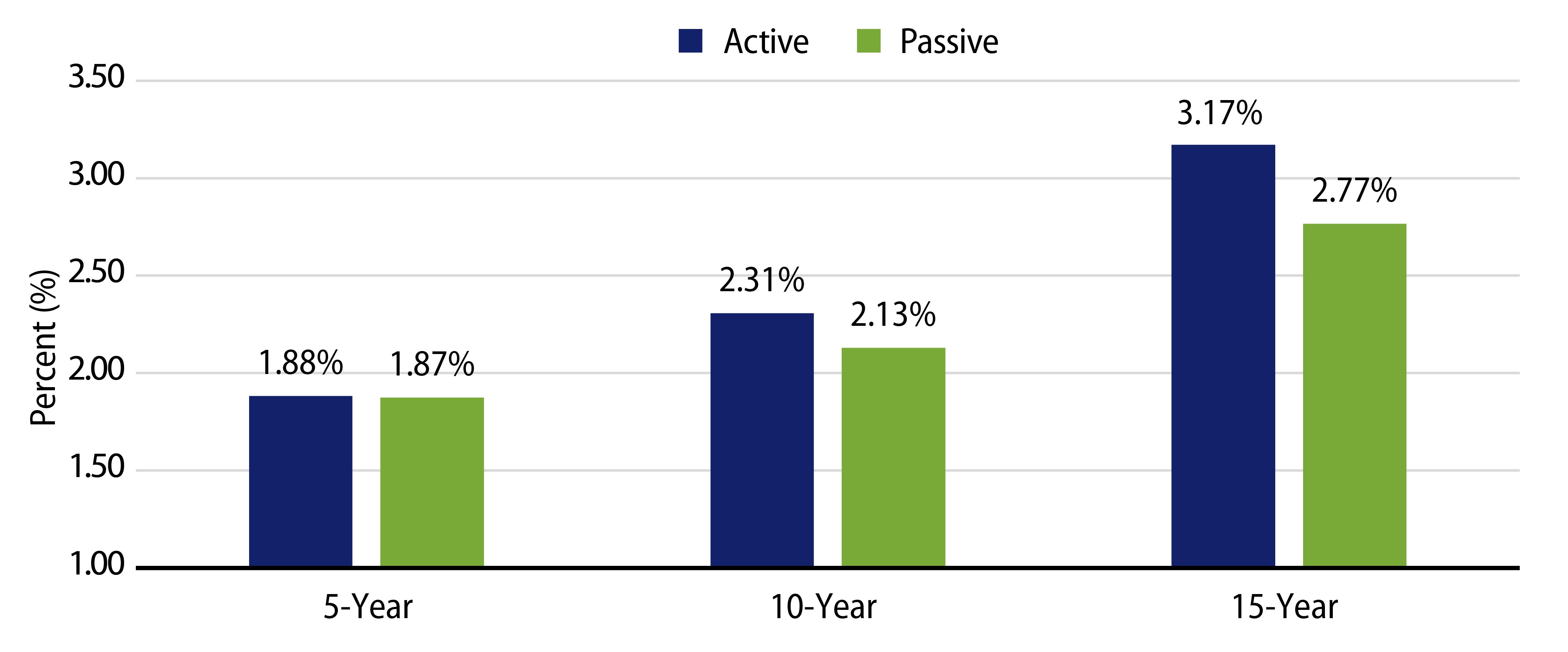

While passive investment solutions have proven advantageous in equity markets, active management offers structural advantages in fixed-income markets, particularly within the fragmented muni market. Considering the largest Morningstar municipal fund category (Muni Intermediate), over the past 15 years (2008-2023), actively managed funds have outperformed passive vehicles by 0.43%, after fees. We believe there are several structural advantages to an active approach within the muni market:

2. Volatile Liquidity Conditions Could Challenge Passive Vehicles. Considering their rules-based allocation approach, passive funds tend to be fully vested at all times and could be vulnerable to the challenging municipal supply and demand dynamics. During inflow cycles, passive vehicles could be forced to allocate at the time of potentially rich valuations in order to achieve index-like exposure. Similarly, during outflow cycles, fully vested vehicles can be subject to redemptions and forced to raise cash during weak market conditions. Active strategies that can navigate market liquidity, seasonal supply and demand dynamics and relative value independent of an index can stand to benefit from investing into overbought and selling into oversold conditions.

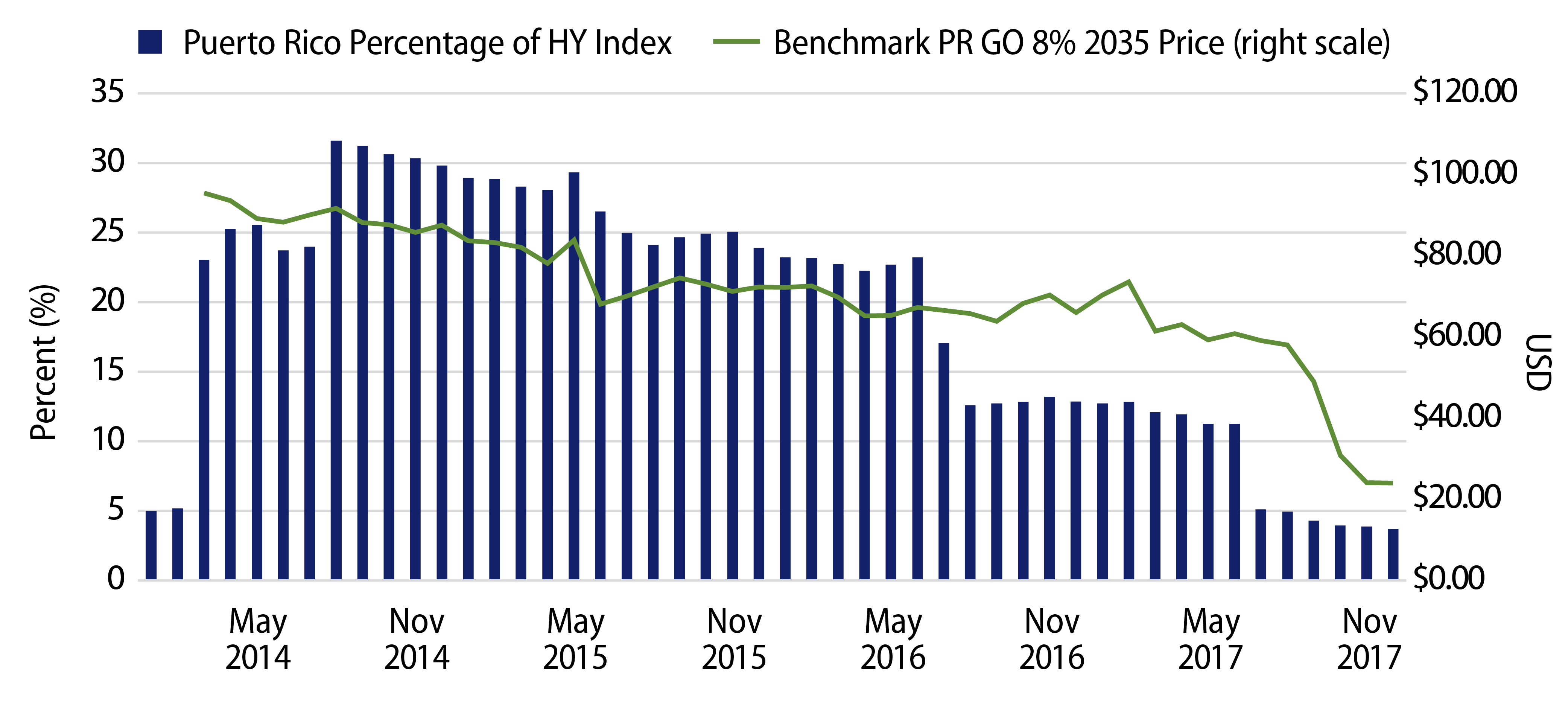

3. Greater Exposure to Indebted Issuers Could Challenge Risk-Adjusted Returns. While equity benchmark constituents are typically weighted by market capitalization, fixed-income benchmarks are weighted by the amount of debt outstanding in the marketplace. This distinction can lead more levered and potentially lower quality issuers to comprise a greater share of the overall index and passive portfolios that track the index. This dynamic is perhaps best illustrated by Puerto Rico, which comprised over 30% of the Bloomberg High Yield Municipal Bond Index in 2014 ahead of the island’s bankruptcy process that led to the defaults and removal of these bonds from the index. While an index can seamlessly rebalance out of defaulted securities following a default without consequence, a fund vehicle could be challenged to source liquidity for these securities. The benchmark Puerto Rico GO 8% of 2035 observed its steepest price decline after the removal from the index, falling to as low as $21.18 in 2017 following the initial issue price of $93 in 2014.

Western Asset believes that expenses will impact total returns and should be considered as part of an asset allocation. However, passive “set it and forget it” frameworks in the inefficient municipal market can lead to less optimal outcomes. With fewer liquidity providers in the muni market and the greater potential for market volatility, we expect active management solutions will continue to deliver better value versus passive counterparts.

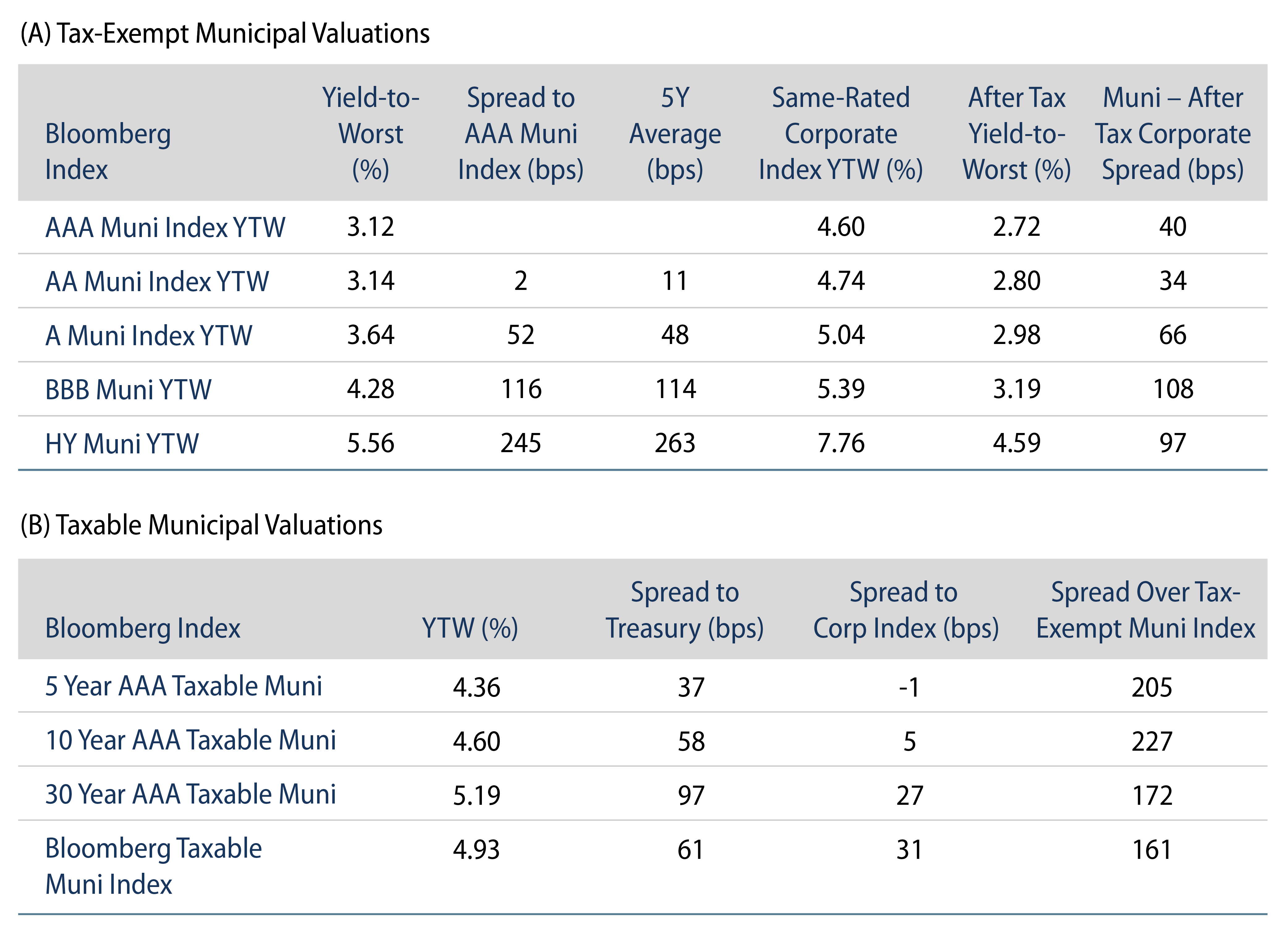

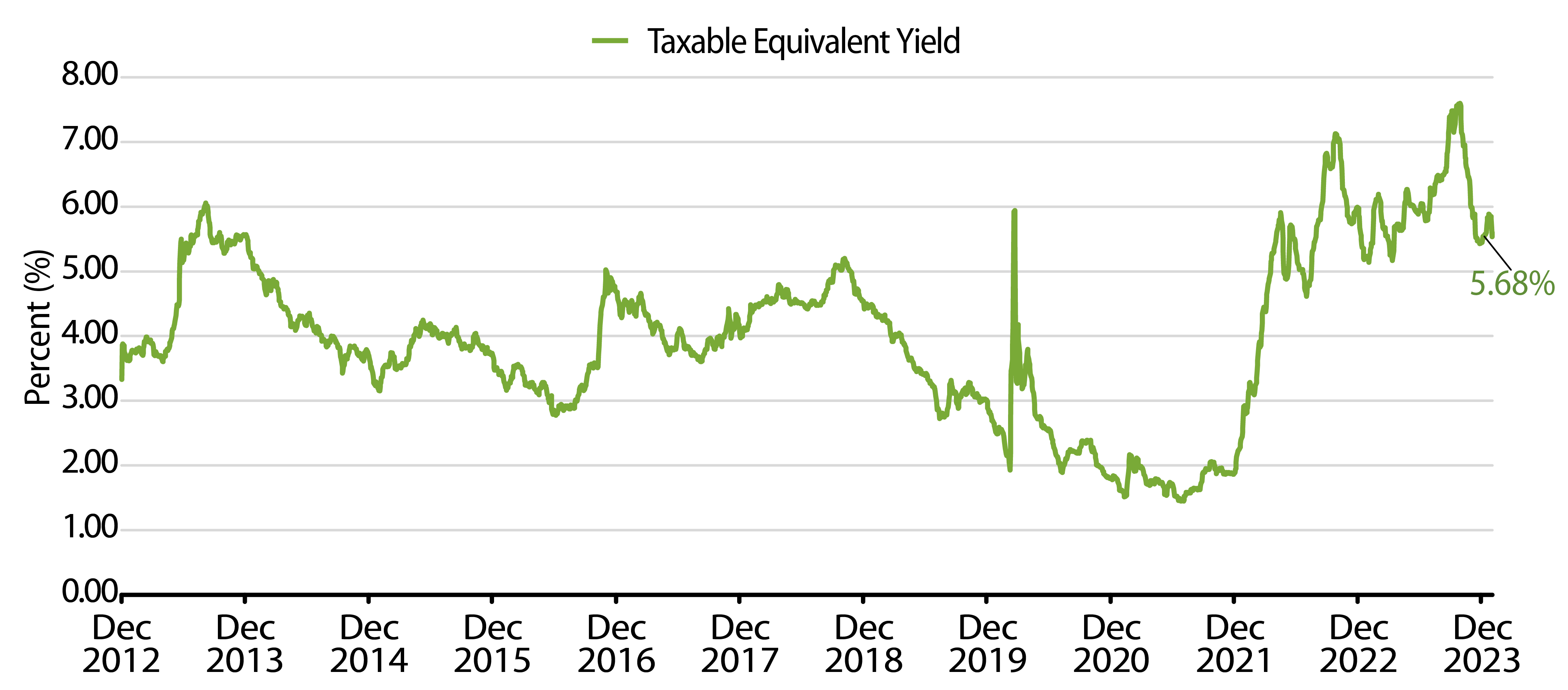

Theme #1: Municipal taxable-equivalent yields are above decade averages.

Theme #2: Recent yield curve steepening has highlighted value in longer maturities.

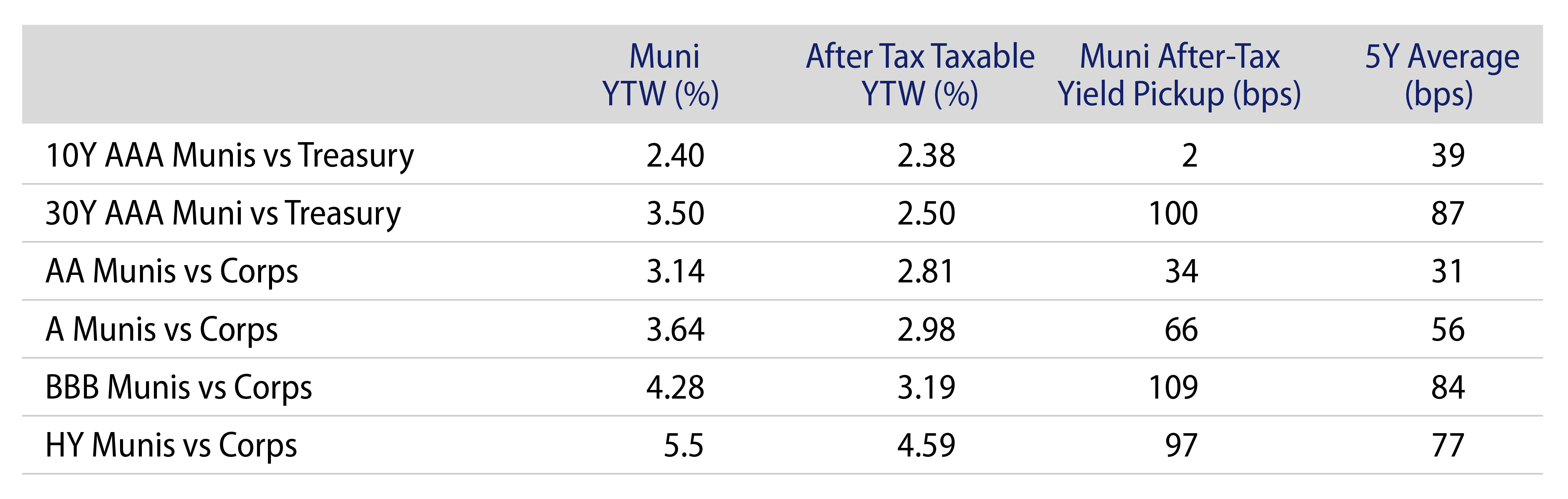

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.