Municipals Posted Positive Returns During the Week

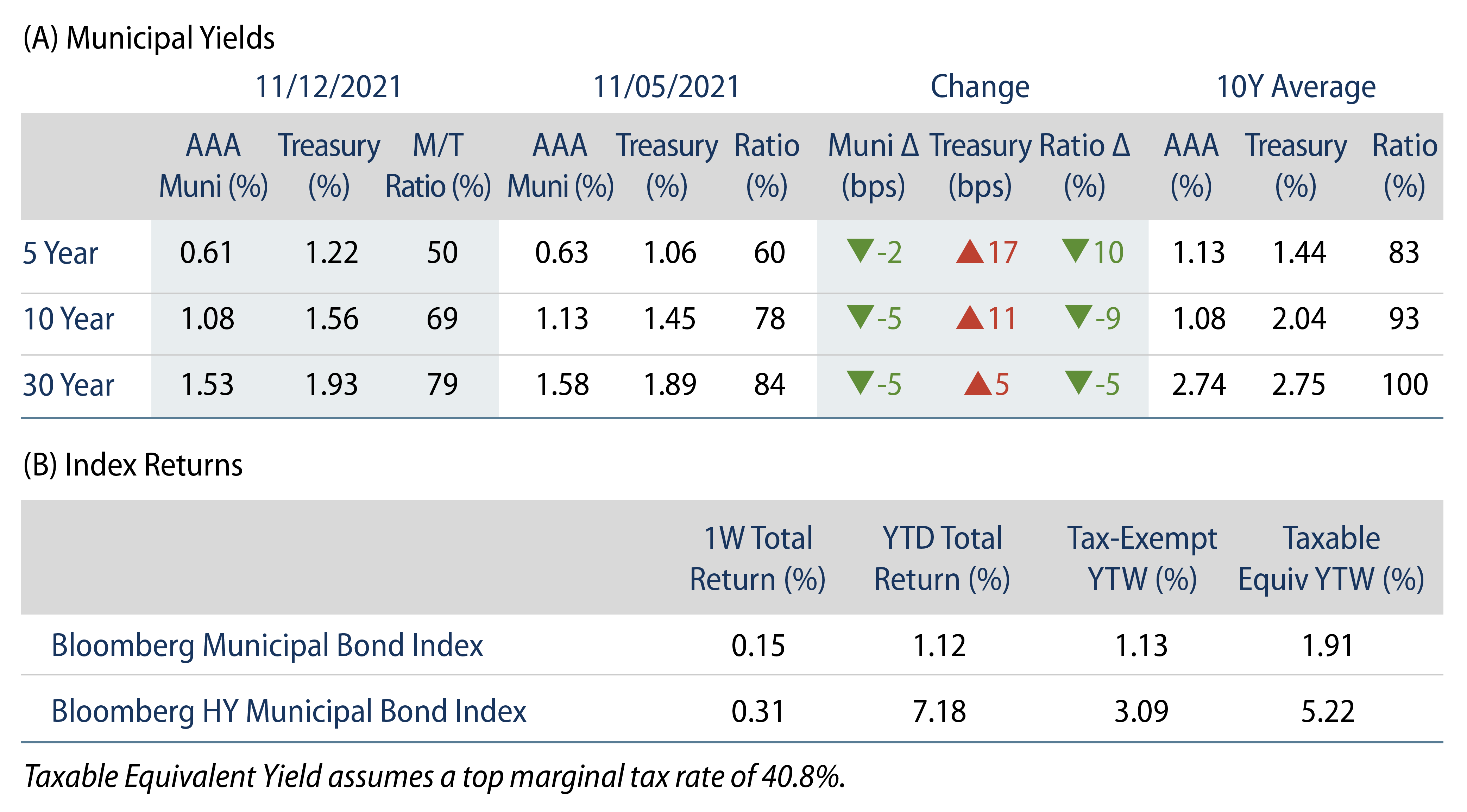

The US muni yield curve moved 2-5 bps lower during the week. Municipals shrugged off the Treasury rate selloff and outperformed across all maturities. Technicals strengthened as fund flows accelerated. The Bloomberg Municipal Index returned 0.15%, while the HY Muni Index returned 0.31%. This week we highlight the passage of the Infrastructure Investment and Jobs Act and look at the latest draft of Biden’s Build Back Better spending plan.

Technicals Strengthen as Municipal Mutual Fund Inflows Accelerate

Fund Flows: During the week ending November 10, municipal mutual funds recorded $1.9 billion of net inflows. Long-term funds recorded $1.8 billion of inflows, high-yield funds recorded $1.2 billion of inflows and intermediate funds recorded $163 million of inflows. Municipal mutual funds have now recorded inflows 77 of the last 78 weeks, extending the record inflow cycle to $156 billion, with year-to-date (YTD) net inflows surpassing a record calendar-year pace at $95 billion.

Supply: The muni market recorded $11 billion of new-issue volume during the week, up 53% from the prior week. Total YTD issuance of $407 billion is 2% lower from last year’s levels, with tax-exempt issuance trending 7% higher year-over-year (YoY) and taxable issuance trending 23% lower YoY. This week’s new-issue calendar is expected to decline to $9.1 billion of new issuance. The largest deals include $1.2 billion state of Mississippi and $1.2 billion Grand Canyon University transactions.

This Week in Munis—Infrastructure Passes

Earlier this month, Congress passed the Infrastructure Investment and Jobs Act (IIJA), which was signed into law by President Biden yesterday on November 15. The law includes a modest expansion of tax-exempt private activity bonds, but major bond incentives of tax-exempt advance refunding bonds and federally subsidized direct pay bonds (akin to the Build America Bond program) were excluded.

As highlighted in our last blog related to infrastructure policy, IIJA includes a reauthorization of existing federal spending on highways and transit. It also includes new spending on highways, transit, electric vehicles, airports, ports, clean water, clean energy and broadband. We anticipate the sheer dollar amounts allocated to the various transportation sectors will be an incremental positive for certain credits but we expect the overall market effect of the spending will be muted.

With the bipartisan infrastructure bill behind us, all eyes are looking forward to the proposed $1.75 trillion Build Back Better bill currently being debated by Congress. As the current draft stands, municipal supply incentives of tax-exempt advance refunding bonds and taxable direct-pay bonds are also not included within this legislation. While most muni bond buyers will be disappointed by an ongoing restriction of tax-exempt bond refinancings, the absence of a taxable direct-pay bond solution ensures that the traditional tax-exempt muni bond will remain the cornerstone of domestic infrastructure financing.

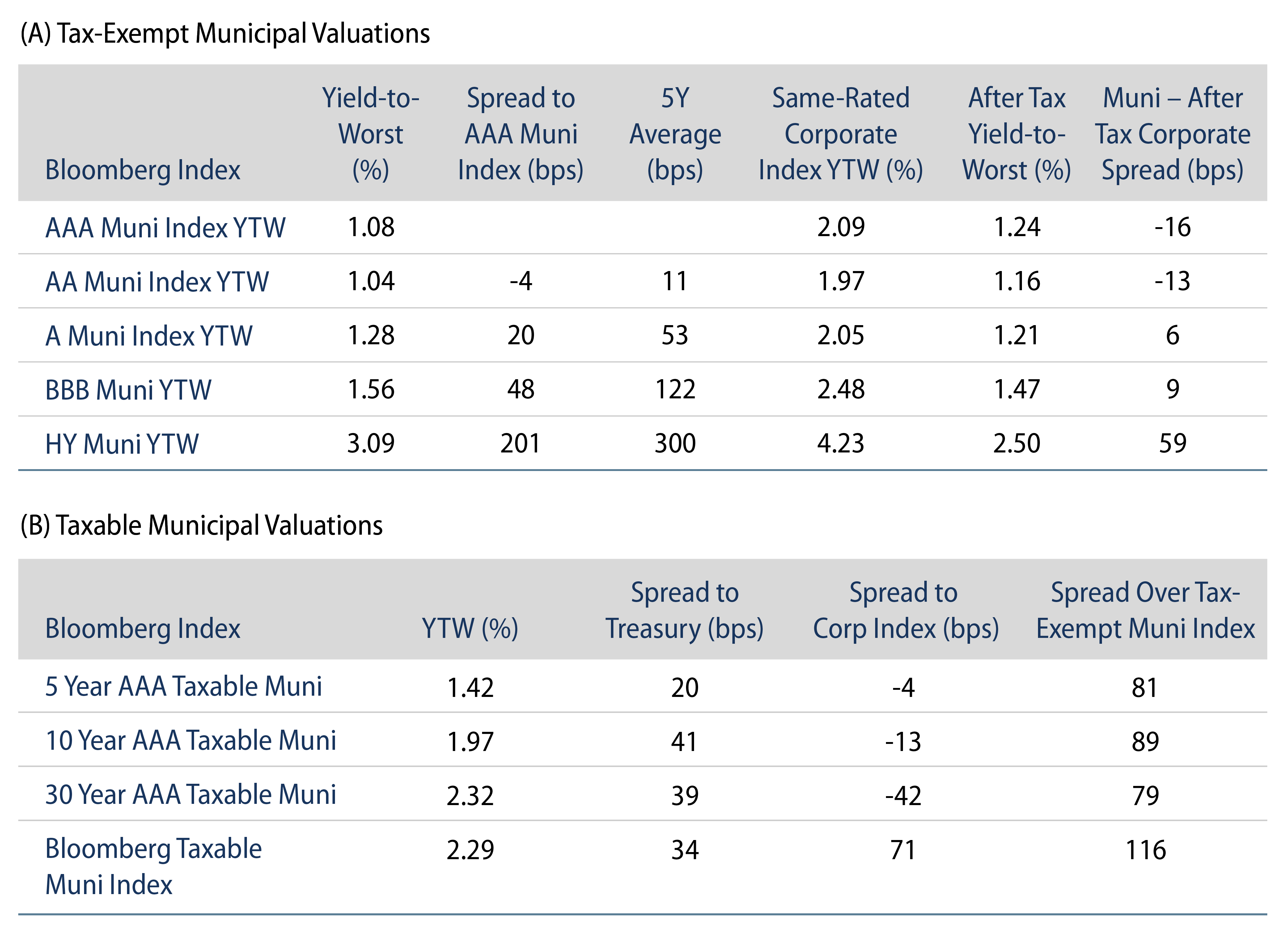

Build Back Better also includes a few notable tax provisions. The most recent draft does not increase the top marginal tax rate of 37%, but it does include a surcharge of up to 8% on incomes over $25 million, increasing the top potential federal effective tax rate from 40.8% to 48.8%. Meanwhile, the bill lifts the state and local tax (SALT) deduction to $80,000 from its current level of $10,000. The bill also includes a proposed minimum corporate income tax of 15%, impacting the potential value of tax-exempt muni bonds for insurance companies.

We would expect the combined effect of these provisions on the muni market to be marginally positive. Any tax increase on ultra-high net worth individuals should spur incremental demand, but we believe the prospect of tax increases was at least partially reflected in current market valuations. An expansion of the SALT tax-deduction could reduce all-in effective tax rates in high tax states, but we do not anticipate a SALT expansion would significantly curtail the marginal demand for municipal bonds. Lastly, while insurance companies facing a minimum tax rate may be incentivized to trim tax-exempt holdings, it is important to realize that they hold less than 15% of outstanding municipal bonds. While Build Back Better is still fluid and politically fraught, we continue to monitor developments but anticipate the ultimate impact on the municipal market will be more subdued than headlines may suggest.