Municipals Posted Negative Returns

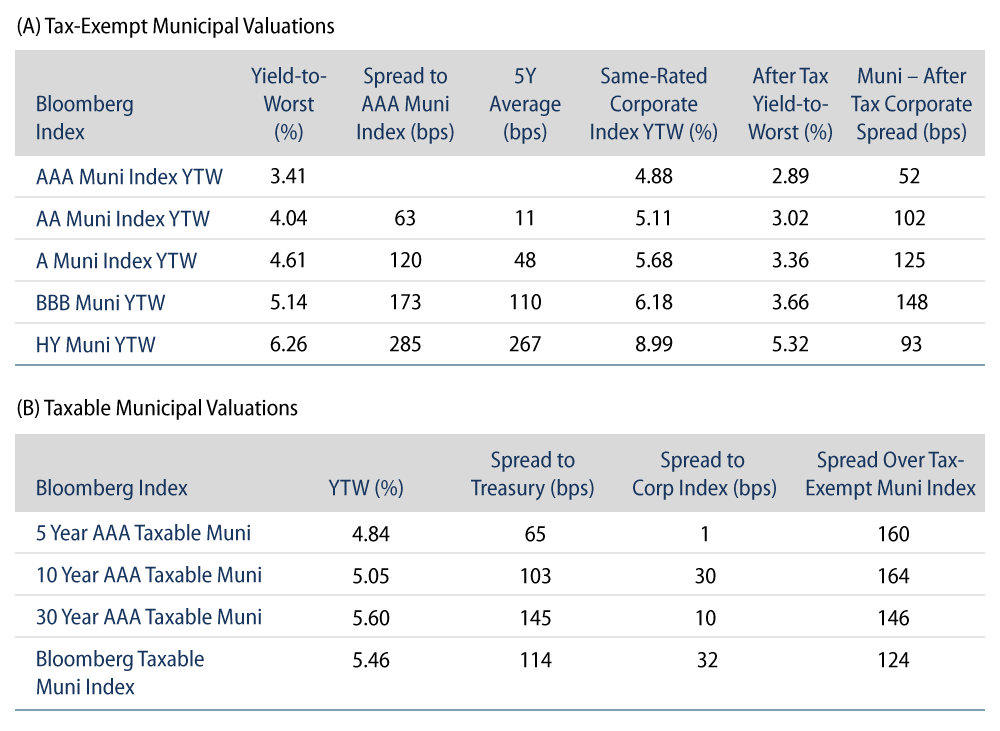

Municipals posted negative returns last week as they shrugged off the Treasury rally. Muni/Treasury ratios moved 4% to 8% higher across the curve and high-grade munis moved 5-20 bps higher. Meanwhile, technicals remained weak as outflows extended at a record place. The Bloomberg Municipal Index returned -1.20%, the HY Muni Index returned -1.89% and taxable munis posted positive returns of 1.37% with the broader rate rally. This week we highlight the scope of muni bond ballot initiatives in the upcoming midterm election.

Technicals Remained Weak as Outflows Continued Record Pace

Fund Flows: During the week ending October 26, weekly reporting municipal mutual funds recorded $1.8 billion of net outflows, according to Lipper. Long-term funds recorded $1.2 billion of outflows, high-yield funds recorded $594 million of outflows and intermediate funds recorded $297 million of outflows. This marks the 12th consecutive week of outflows and extends year-to-date (YTD) outflows to $105 billion.

Supply: The muni market recorded $9.1 billion of new-issue volume last week, down 8.5% from the prior week. Total YTD issuance of $320 billion remains 16% lower than last year’s levels, with tax-exempt issuance trending 4% lower year-over-year (YoY) and taxable issuance trending 51% lower YoY. This week’s new-issue calendar is expected to decline to $3 billion. Larger deals include $323 million New York Environmental Facilities Corporation and $267 million Los Angeles Department of Water and Power transactions.

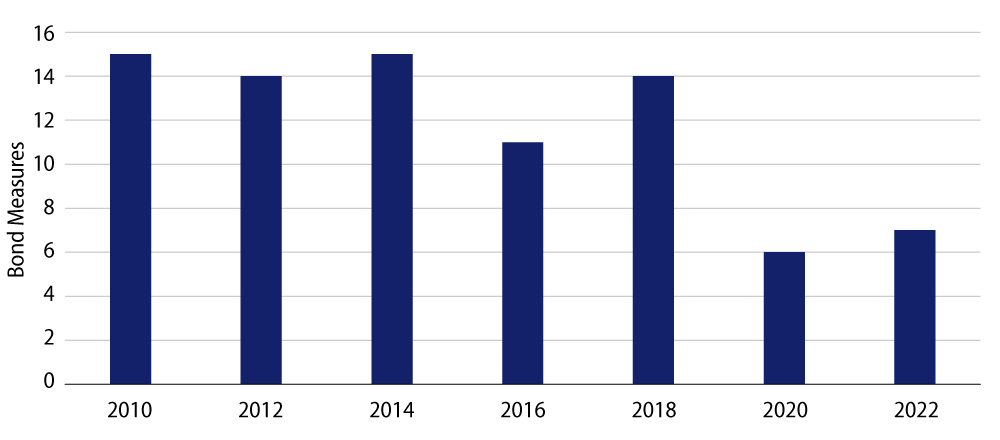

This Week in Munis: 2022 Ballot Box

Midterm elections present an opportunity for voters to be heard on a wide range of ballot initiatives. Of potential interest to municipal market participants are bonding initiatives and tax policy initiatives, including supplemental tax measures (e.g., gaming expansion, marijuana legalization). According to Ballotpedia, four states (New York, Rhode Island, New Mexico and Alabama) are seeking voter approval across seven bond measures for the issuance of up to $4.9 billion of debt. The seven bond measures are just one measure higher than what was observed in the 2020 election, but represent just half of the 14 bond measures observed in the 2018 midterms.

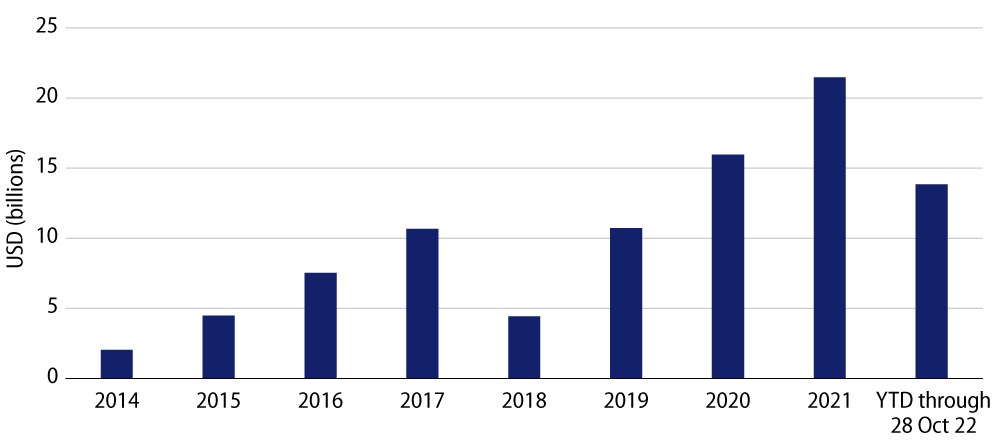

The vast majority of bond measures by volume (85%) reside in the state of New York, via the Clean Water, Clean Air and Green Jobs Environmental Bond Act of 2022. The proposal calls for the sale of up to $4.2 billion of state general obligation bonds to provide capital for a broad range of environmentally focused projects. The initiatives range from air and water pollution-reduction projects; wetland protections; green building projects; solar arrays, heat pumps and wind turbines in public low-income housing areas; zero-emission school buses; street trees and urban forest programs; green roofs and reflective roofs; land conservation measures, and efficient wastewater programs. The Act requires that at least 35% of bond proceeds benefit disadvantaged communities. We believe there is a high likelihood this measure will succeed considering the most recent Siena College poll, which highlighted strong support for the initiative.

Western Asset believes that the low number of bond initiatives on ballots this cycle could contribute to the relatively limited overall supply trends we have observed in recent years. However, the Clean Water, Clean Air and Green Jobs Environmental Bond Act of 2022 represents the value the municipal market could provide for investors seeking ESG-oriented issuance. So far this year, we have observed $14 billion of Green Bond issuance, on track to be down 23% from the prior year’s level. A successful undertaking of these initiatives by a leading issuer such as the State of New York could promote further sustainability-linked issuance in the future. In the coming weeks, we will highlight the tax initiatives on the ballot in California and Massachusetts, as well as the impact of specialty tax legislation.

Western Asset believes that isolating how investors can be compensated for the variety of risk factors that exist in the municipal market can lead to better risk-adjusted outcomes, particularly in volatile market conditions. In the current environment where sector-level relative valuations can be less apparent, individual security selection and independent credit risk assessment can be paramount.