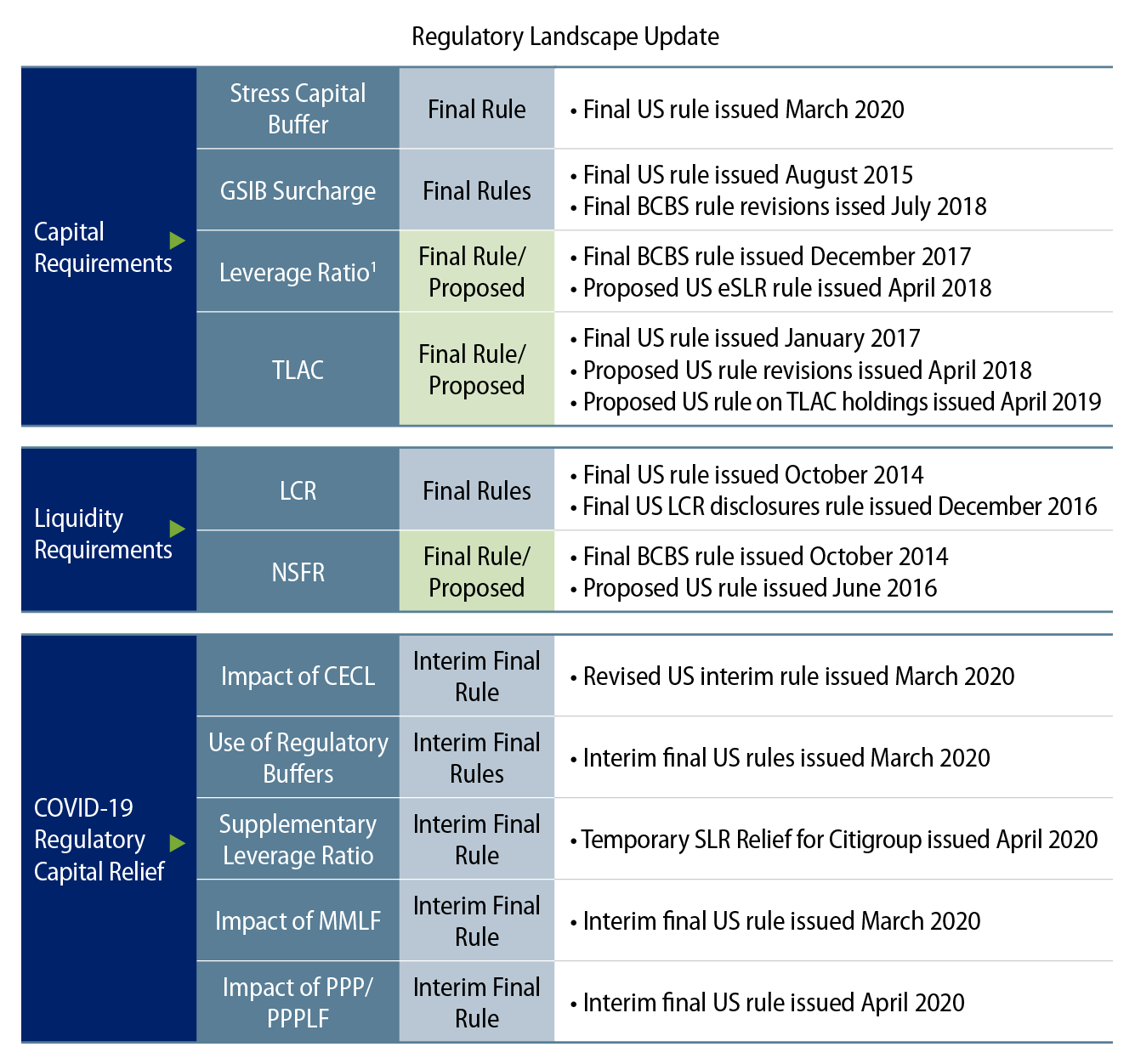

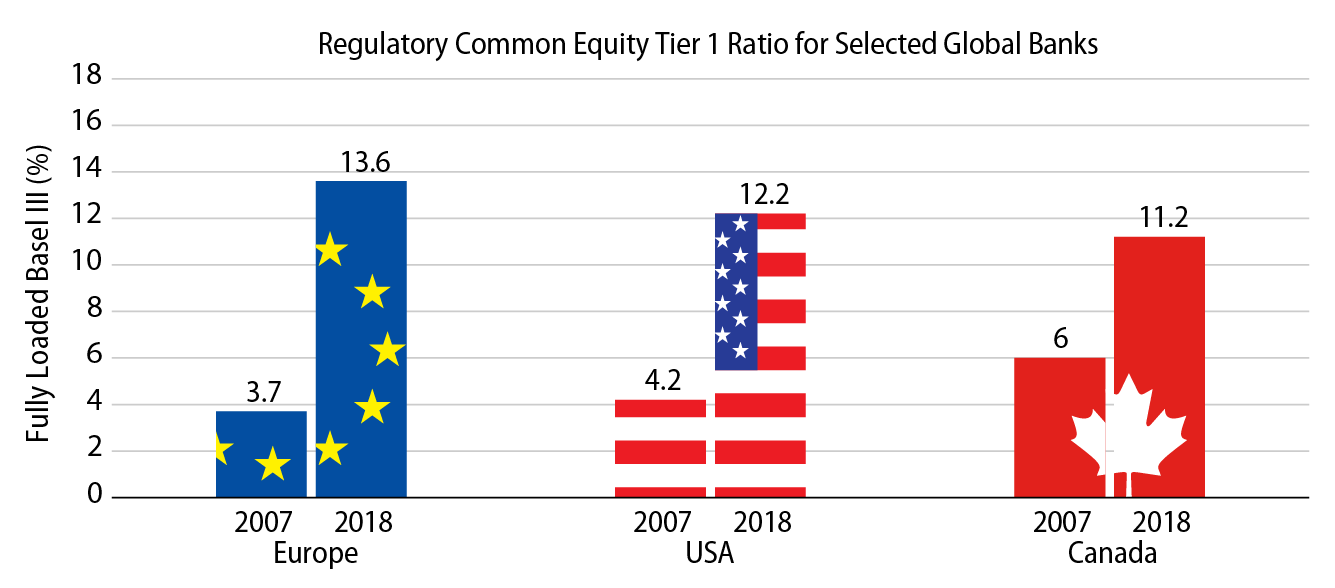

Our constructive secular view on major US banks is based on the following: (1) simpler, safer and stronger banks; (2) well-entrenched, lower-risk banking business models, and (3) a robust regulatory framework driven by Dodd-Frank in 2010. In contrast to being public enemy number one during the global financial crisis (GFC) in 2008/2009, banks have generally acted responsibly and have been transformed from being a problem to being part of the solution in dealing with the dire economic consequences of the current public health crisis. Despite considerable political noise by Trump to dismantle Dodd-Frank, the major US banks have been tightly regulated by the Fed with Dodd-Frank largely intact. Dodd-Frank as a response to the GFC has been the most meaningful enhancement to US bank regulation since the Great Depression and after more than a decade the regulatory jigsaw puzzle has largely been completed.

We believe that both Democratic and Republican policymakers will want to take a pragmatic approach toward the banks, ensuring that banks remain “safe,” but at the same time “confident to lend,” which requires a predictable and pragmatic regulatory outlook. This means we see little appetite for wholesale changes to the regulatory framework that would make us reconsider our constructive credit view on the sector. Instead, we think it’s more likely we’ll see politicians use their political capital to drive changes in sectors such as tech, health insurance and pharma/healthcare, which are much more at the center of the public debate.

Republicans and Democrats Share Overarching Goals When It Comes to Banking Regulation

As seen in almost all developed countries, we believe that both Democrats and Republicans share two overarching goals when it comes to bank regulation:

- Avoiding another (politically dangerous and costly) financial crisis

- Shifting losses in the event of a financial crisis from depositors and taxpayers to investors

Democratic and Republican policies toward the industry certainly differ below the headline policy level, with the gradual deregulation trend under the Trump administration slowing further if the Democrats win. Under a Biden presidency we also would expect higher corporate tax rates for banks and a somewhat tougher enforcement of existing rules and regulations. Joe Biden has not made financial regulation a cornerstone of his campaign. A Biden-led government could theoretically replace the regulatory heads of the Fed, FDIC, OCC and CFPB, but the current chairs have terms ending two to 12 years after the 2020 election. Clearly the most dramatic risks for bank investors would be an extremely progressive Treasury Secretary such as Elizabeth Warren and/or unlikely efforts to cap credit card interest rates or break up the major banks. That said, Biden was part of the administration that implemented the far-reaching and largely successful banking regulatory reform and as such, we do not expect dramatic changes to the rulebook if Biden wins.

Similarly, we don’t expect major changes to bank regulation if Trump is re-elected, either. Despite the Trump administration’s policy focus on deregulation, the relaxations to the rulebook have actually been quite modest for the biggest banks since his election given that the Fed held the line. In the case of a Republican win, we expect banking regulation to continue with a slight deregulation bias but we wouldn’t expect any major changes as policy focus will likely lie elsewhere.

Banks: From Casinos to Utilities

The journey from “casino to utility” banking business model has benefited most stakeholders, further reducing the desire for an overhaul of the regulatory framework. We view politically driven regulatory risks as relatively benign regardless of the election outcome, and believe the major banks are more concerned with the overall strength of the economy and level of interest rates than the winner of the upcoming election. The GFC exposed the new high-growth banking business model as high risk and unsustainable. This was evident after ambivalent regulation and light-touch oversight allowed banking to morph from a relatively simple industry into a casino-like business that emphasized size, scale, growth and diversification, along with opportunistic and transformational acquisitions. In the end this transformation ended very badly. Thus, investors, rating agencies, regulators, politicians, bank CEOs and taxpayers all have good reasons to support the less-risky banking business models.

New Banking Model Shines Amid COVID-19

We believe that this new and tougher global regulatory regime has proven to be successful during the coronavirus crisis. Regulators across the world have shifted their energy from over-regulation to a more pragmatic approach, with a focus on banks supporting economic growth. This time the banks are part of the solution and not part of the problem—this is also thanks to the dramatic changes in the regulatory framework that have led banks on a decade-long back-to-basics journey. We see limited incentive and appetite for either Republicans or Democrats to meaningfully change this well-functioning regulatory framework.