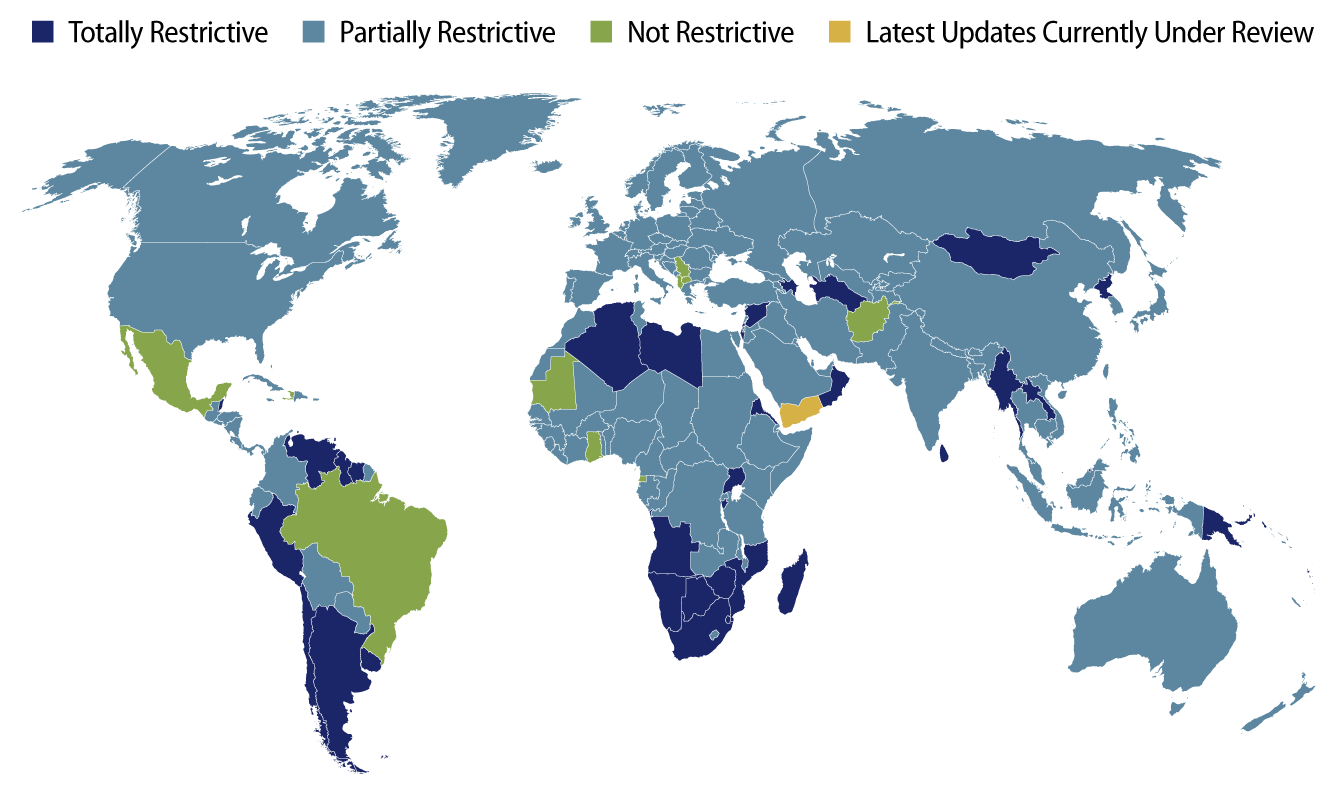

Almost exactly six months ago, air travel as the public knew it changed forever due to the outbreak of COVID-19. The unprecedented closing of international borders, as well as quarantines and other “shelter-in-place” restrictions, caused global air travel demand to decline more than 90% at its nadir in April 2020. Since then, demand for air travel in the US has slowly begun to take off thanks to a resilient appetite for leisure travel to domestic vacation destinations and “visiting friends and relatives” traffic. Currently, international travel remains weak and down more than 85% from 2019 levels as air travel restrictions remain intact, with 85 countries still completely closed. Hence, more than 65% of the global wide-body fleet, including almost the entire commercial fleet of double-decker A380 aircraft, is parked either temporarily or, potentially, permanently.

In early March 2020 as the pandemic began to spread around the world, the market began to reprice every investment security related to an airline or aircraft financing. In January and February 2020, prior to the pandemic outbreak, the spread relationship between unsecured and secured airline bonds had tightened to less than 150 bps, which is well inside of the historical average spread of more than 300 bps. For example, in mid-February 2020 (aka the “pre-pandemic era”), American Airlines issued a $500 million senior unsecured bond due in 2025 with a coupon of 3.75% at a spread of +239 bps over Treasuries—this was less than 150 bps wide of the most senior secured tranche of a 5-year equivalent American Airlines secured EETC bond. By the latter half of March 2020, the aforementioned American Airlines 3.75% unsecured bond was trading at distressed levels well in excess of 3,200 bps, or 32 cents on the dollar, as the market priced in a complete collapse of the global airline industry.

Western Asset has been an active investor in the airline sector for more than two decades with a seasoned team of analysts who have endured multiple market cycles, including 9/11 and SARS. As a result, we have developed robust financial models and excellent relationships with the various airline management teams. Because we consider the airline sector to be highly cyclical, in early 2020 we fundamentally viewed valuations on both secured and unsecured airline bonds to be very rich on an absolute and relative basis. Given that assessment, we were underweight the airline sector heading into the current pandemic crisis. As you can see in Exhibit 2, both the investment-grade and high-yield rated airline sectors are some of the worst performers in the Bloomberg Barclays High Yield Index on a YTD basis due to the significant underperformance in March and April 2020.

Beginning in late April 2020, some of the US legacy carriers, such as Delta Airlines, were able to issue secured debt backed by mission-critical intangible assets, such as routes, slots and gates. This was necessary to bolster their overall liquidity given the uncertainty and potential turbulence ahead. Hence, over the past six months, our team of tenured analysts has carefully analyzed each airline deal from both a fundamental and structural perspective to select the best performing deals issued by the fundamentally strongest airlines that have the longest liquidity runways, including unencumbered assets.

Our decision to selectively invest in the highly cyclical airline sector in the middle of a pandemic was further bolstered by the fact that the US airline industry is essential and critical to domestic infrastructure for the movement of people and goods. In fact, the CARES Act passed in late March 2020 provided the US airlines with $50 billion of financial assistance that consisted of $25 billion of grants and 5-year unsecured loans at a rate of L+100 bps until April 2025, as well as $25 billion of secured loans at favorable interest rates in the range of L+300 to L+350 bps. The CARES Act financial assistance prevented the industry from laying off hundreds of thousands of employees through September 30, 2020, when the layoff restrictions will expire. However, the government financial assistance program also contained certain stipulations, such as no forced layoffs, no dividends or share buybacks, as well as limits on executive compensation and minimum service levels to certain cities. In addition, the Treasury required each airline to issue equity warrants that could potentially provide the Treasury with some equity upside. Earlier this summer, the US airlines received the grants and unsecured loans from the Treasury Department, although each airline is still negotiating the terms of the secured loan program with Treasury Secretary Steven Mnuchin and his team. However, very few airlines are expected to accept the terms of the secured loans as most of them, including Southwest, Delta and Spirit, that are able to access the public markets with terms that are less onerous, although at a slightly higher cost of capital. Since March 2020, the US airlines, including Alaska, American, Delta, Hawaiian, JetBlue, Southwest, Spirit and United, have opportunistically issued more than $50 billion of mostly secured debt. The debt includes EETCs, secured bonds and secured bank debt, which have effectively extended those airlines’ liquidity runways by 12 to 24 months.

Looking ahead, the aviation industry still faces a number of headwinds as a result of low demand that we believe will not change in a significant manner until an effective therapeutic or widely distributed vaccine is available. Therefore, Western Asset is selectively overweight certain secured airline bonds issued by the fundamentally strongest US airlines that possess the longest liquidity runways. We strongly believe that there is tremendous pent-up demand for air travel and, from an ESG perspective, the surviving airlines will exit the crisis with a lower cost structure, including a younger fleet of aircraft, which will also accelerate their emission-reduction targets.