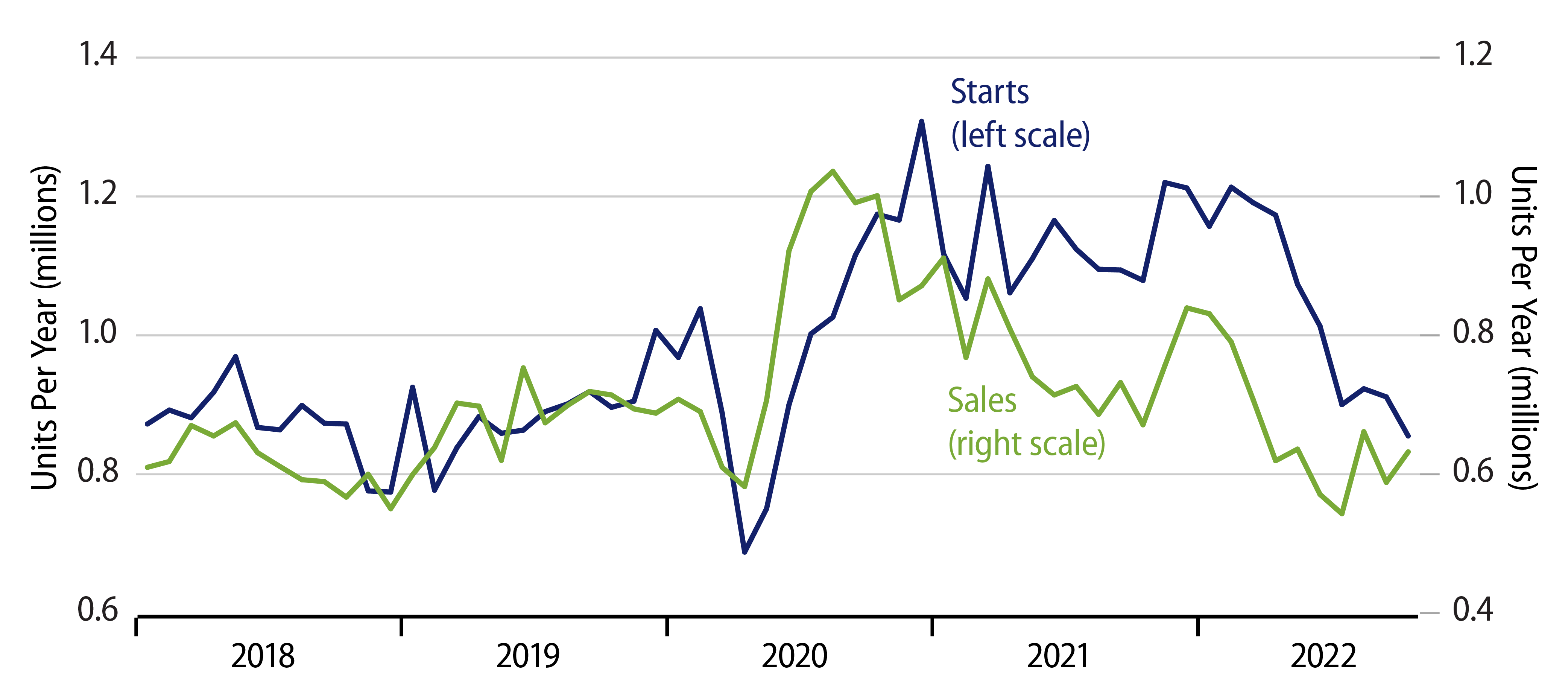

New-home sales rose 7.7% on a seasonally adjusted annual rate basis in October, though more than half of that gain was offset by downward revisions to August and September. Today’s new-home sales release from the Census Bureau completes October homebuilding data, after last week’s housing starts release showed single-family starts declining 6.1%. As you can see in the chart, the October data did little to intensify or arrest the sharp downtrends in both series occurring over the last year or two, though maybe new-home sales are trying to find a bottom.

The respective scales on our chart are adjusted to account for owner-builds, which are reflected in starts but not in sales. Based on that adjustment, it looks as though starts are still proceeding at a faster rate than new-home sales. In line with this, inventories of unsold new homes climbed further in October to 463,000 units.

This is not as high as the 572,000 peak inventory level seen at the bottom of the housing crash of 2005-2010, but it is up there. Unsold inventories are about nine months’ worth of sales. We take this as indicating that housing starts and residential construction spending are going to have to fall sharply further before the current glut of new homes is fully worked off. If, indeed, new-home sales are bottoming, that would reduce the further downside potential for starts, but not eliminate it.

Meanwhile, builders were able to step up sales a bit in October without having to make concessions on price. Our seasonal adjustment of Census sales price data shows the average sale price of a new home rising by 3% in October, reversing about half of the decline from April to September. This was a better performance than in the resale market, where sales prices of existing single-family homes dropped in October for the fifth straight month. Home sales prices are not plunging at present, and new-home sales prices have been especially volatile over recent months, but generally, the uptrend in prices seen from mid-2020 into mid-2022 looks to be over.