Headline retail sales rose by 0.6% in May, but after a -0.4% revision to the May estimate, leaving a slight change on net over what sales were estimated to be one month ago. Lately, we have been focusing on a measure of sales that abstracts from vehicle dealers, service stations, building materials stores and restaurants, excluding the first three sectors because businesses frequent them as much as consumers and the last sector because of its suppression during the Covid shutdown and after. That “underlying” sales measure rose by 0.8% in June, with a -0.5% revision to the May estimate, also showing only a slight gain on net.

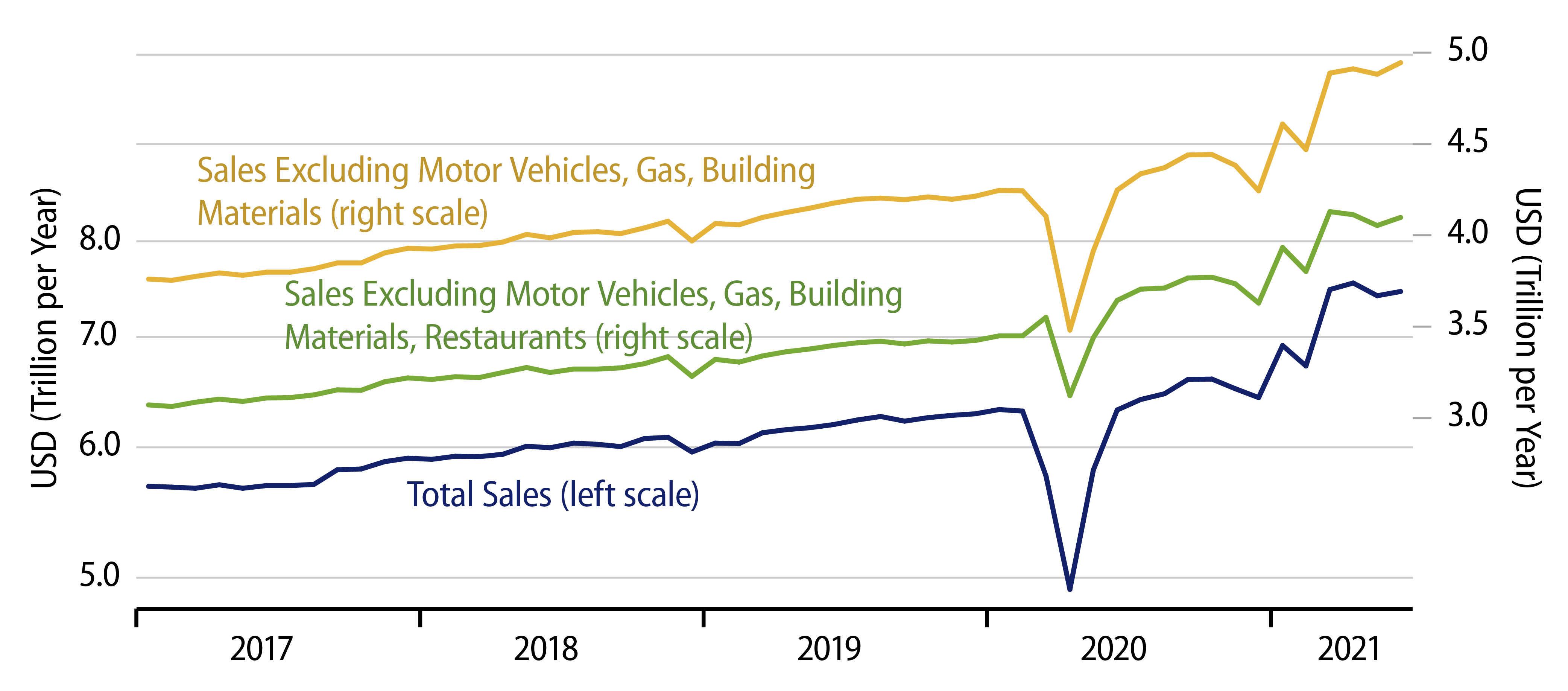

These sales aggregates are depicted in the accompanying chart. Our take on this picture is that the data lie right in between the market consensus story and ours. That is, retail sales have clearly failed to sustain the strong growth that they exhibited early this year, through March. This conflicts with the consensus line that the combination of reopenings and various government stimulus efforts would drive further, strong growth in consumption.

Our take, meanwhile, was that the strong sales growth from June 2020 through March 2021 reflected consumers catching up on purchases not accomplished during the shutdown. With that unmet demand sated by March, we thought sales levels would move back toward the growth trends that were in place prior to the Covid shutdown. It is hard to stridently push that story line as well in the light of the current data. Sales have pulled back (or at least stopped growing) but at the recent pace of possible decline, sales levels would remain above pre-Covid trends for another year or so—not quite what we had in mind.

We can say this. There is still no evidence that any of the government stimulus has been spent. That is, in every month where stimulus payments were remitted, personal saving rose by more than the amount of the stimulus payment, which is to say, consumer spending—on goods and services—rose by less than the increase in income from work.

While retail sales growth has not slowed as much or as quickly as we had expected, it clearly has been softer than market expectations. Long bond yields have dropped 45 bps since sales growth crested in March, and some commentators have expressed fear of a growth fizzle. We think those fears are just as misplaced, as were the expectations of explosive growth circulating this past spring. The post-shutdown recovery will continue, but not at the pace most foresaw just a few months ago.

Meanwhile, the recent months’ “softness” in sales is reflected in most store types, especially building material stores, furniture stores, book and sporting goods stores, and department stores, and even in a flattening in online sales. Vehicle dealer sales have also declined, but that clearly reflects supply-chain problems for carmakers more than any sating of consumer demand. Sales are continuing to move up at grocery stores, restaurants and apparel stores. Again, no real softness in any of these store types, just not the explosive growth expected a few months ago.