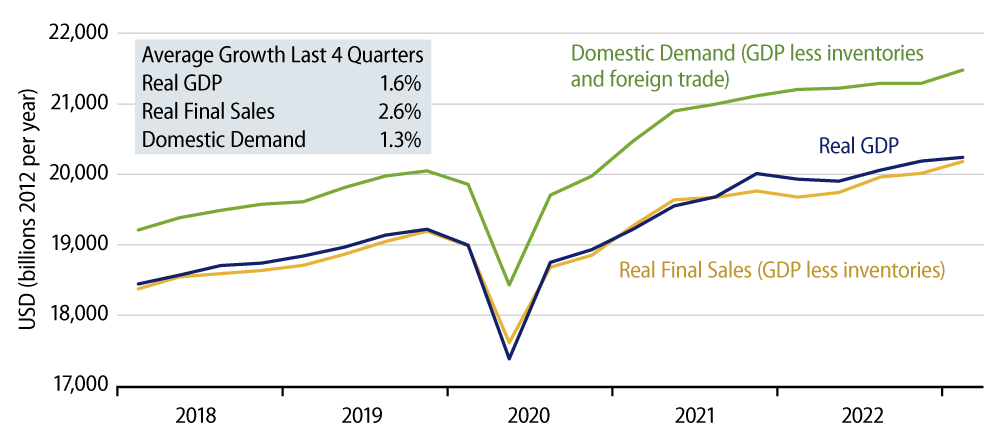

Real GDP grew in 1Q23 at a 1.1% annualized rate according to data released today by the Bureau of Economic Analysis. GDP price index inflation occurred at a 4.0% annualized rate, so that nominal GDP grew at a 5.1% annualized rate.

The 5.1% 1Q growth in nominal GDP was the slowest since the lockdown days of the pandemic and was about equal to what we were typically seeing prior to the pandemic. Nominal GDP growth is the best ultimate measure of the impact of Federal Reserve (Fed) policy, and we take the steady deceleration there as an indication that Fed policy is indeed reining in spending in the economy such that inflation will eventually—and soon—fall to within the Fed’s target range. Granted, we weren’t there in 1Q, but we are getting there.

The real GDP growth rate was below market expectations, which were clustered around 2% or higher, but above our own forecast of -0.4%. We were looking for a big drag on growth from nonfarm inventories, and these indeed came in slightly below our expectations.

Based on revisions to retail sales data released early this week, we also thought that 1Q consumer growth, while decent, would come in below expectations, and this was indeed the case. Real consumption grew at a 3.7% annualized pace in 1Q, but prior to the retail revisions, a number near 8% looked likely.

The bulk of the 1Q consumption gains came from outsized spending increases in January. We thought all along that those January gains were a seasonal blip, an offset of understated holiday spending in late-2022. This week’s retail revisions pushed up 4Q sales slightly, while reducing the size of the January gain and pulling down sales estimates in February and March.

The net result, again, was a decent 1Q gain, but much less of an increase than previously expected. Furthermore, with real consumption of goods presumably declining in February and March and with similar swings in restaurant sales—which are counted within services—consumer spending is starting “in a hole” in 2Q (i.e., with March spending levels below the 1Q average).

As for inventories, these had boosted 4Q growth substantially, so the 1Q declines were mostly payback. Note also that it was the rate of increase in inventories that declined in 1Q. The level of inventories still grew in 1Q (but at a much slower rate than in 4Q). So, if merchants are concerned about weakening sales and want to reduce inventories to get them under control, there is still work for them to do in 2Q and beyond.

Finally, real business equipment investment declined at a -7.4% annualized rate in 1Q, while growth in investment in intellectual property slowed to a 3.8% rate, down from 8.2% growth in 2022.

What came in above our forecast? Government purchases of services grew rapidly in 1Q. Motor vehicle output also showed a nice increase, belying Fed data that indicated a 1Q decline in vehicle output. Similarly, farm sector output showed a sharp increase, driven largely by inventory accumulation there.